The Impact Of Tariffs: Understanding The Bond Market's Vulnerability

Table of Contents

The global economy is increasingly interconnected, making it susceptible to shocks originating from various sources. One such significant source of economic instability is the implementation of tariffs. While often intended to protect domestic industries, tariffs can have unforeseen and far-reaching consequences, significantly impacting the bond market's stability and the overall fixed-income investment landscape. This article will explore the complex relationship between tariffs and bond market vulnerability, examining the mechanisms through which tariffs affect interest rates, inflation, and investor confidence. We will delve into how tariffs impact various aspects of the bond market, from interest rate fluctuations to investor sentiment and overall economic growth.

<h2>How Tariffs Increase Inflationary Pressures</h2>

Tariffs, essentially taxes on imported goods, directly contribute to inflationary pressures within an economy. This impact stems from two primary mechanisms: reduced supply and increased prices, and their subsequent effects on key economic indicators.

<h3>Reduced Supply and Increased Prices:</h3>

Tariffs raise the cost of imported goods, directly impacting consumer prices. This leads to increased inflation.

- Higher import costs translate to higher prices for consumers. The increased cost of imported raw materials or finished goods is often passed down the supply chain, leading to higher prices at the retail level.

- Reduced availability of imported goods can lead to shortages and further price increases. Tariffs can restrict the supply of certain goods, creating shortages and driving prices even higher due to increased demand relative to supply.

- Businesses may pass increased costs onto consumers, fueling inflation. Businesses facing higher input costs due to tariffs may raise prices to maintain profit margins, further contributing to inflationary pressure. This cost-push inflation is a direct result of tariff implementation.

<h3>Impact on the Consumer Price Index (CPI):</h3>

Increased inflation, driven by tariffs, directly affects the Consumer Price Index (CPI), a key indicator used by central banks to set monetary policy.

- A higher CPI can prompt central banks to raise interest rates. Central banks aim to maintain price stability, and a rising CPI signals inflationary pressures. To combat this, they typically raise interest rates.

- Rising interest rates can negatively impact bond prices. Higher interest rates make newly issued bonds more attractive, leading to a decline in the value of existing bonds with lower yields. This inverse relationship between interest rates and bond prices is a fundamental principle of fixed-income investing.

- Investors may seek higher yields in other asset classes, reducing demand for bonds. When interest rates rise, investors might shift their investments to assets offering higher returns, thereby reducing demand for bonds and potentially impacting their prices further.

<h2>Tariffs and Their Effect on Interest Rates</h2>

The impact of tariffs extends beyond inflation to significantly influence interest rates, creating a ripple effect throughout the bond market.

<h3>Central Bank Response to Inflation:</h3>

As mentioned previously, central banks often respond to inflation caused by tariffs by increasing interest rates. This is a crucial mechanism in managing macroeconomic stability.

- Higher interest rates make borrowing more expensive for businesses and consumers. Increased borrowing costs can stifle economic activity, as businesses may postpone investment and consumers reduce spending.

- This can slow economic growth and potentially lead to a recession. The dampening effect of higher interest rates on economic activity can lead to slower growth or even a recession, further impacting the bond market.

- Bond yields typically rise with interest rate increases. Investors demand higher returns on bonds to compensate for the increased risk and opportunity cost of holding bonds in a high-interest-rate environment.

<h3>Investor Sentiment and Flight to Safety:</h3>

Uncertainty caused by trade wars and tariff implementations can lead investors to seek "safe haven" assets.

- This increased demand for safe assets (like government bonds) can temporarily push bond prices up. During times of economic uncertainty, investors often flock to government bonds, perceiving them as relatively low-risk investments.

- However, long-term effects are typically negative due to the broader economic consequences. The initial flight to safety is often temporary, and the long-term negative effects of tariffs on economic growth and inflation usually outweigh the short-term positive impact on bond prices.

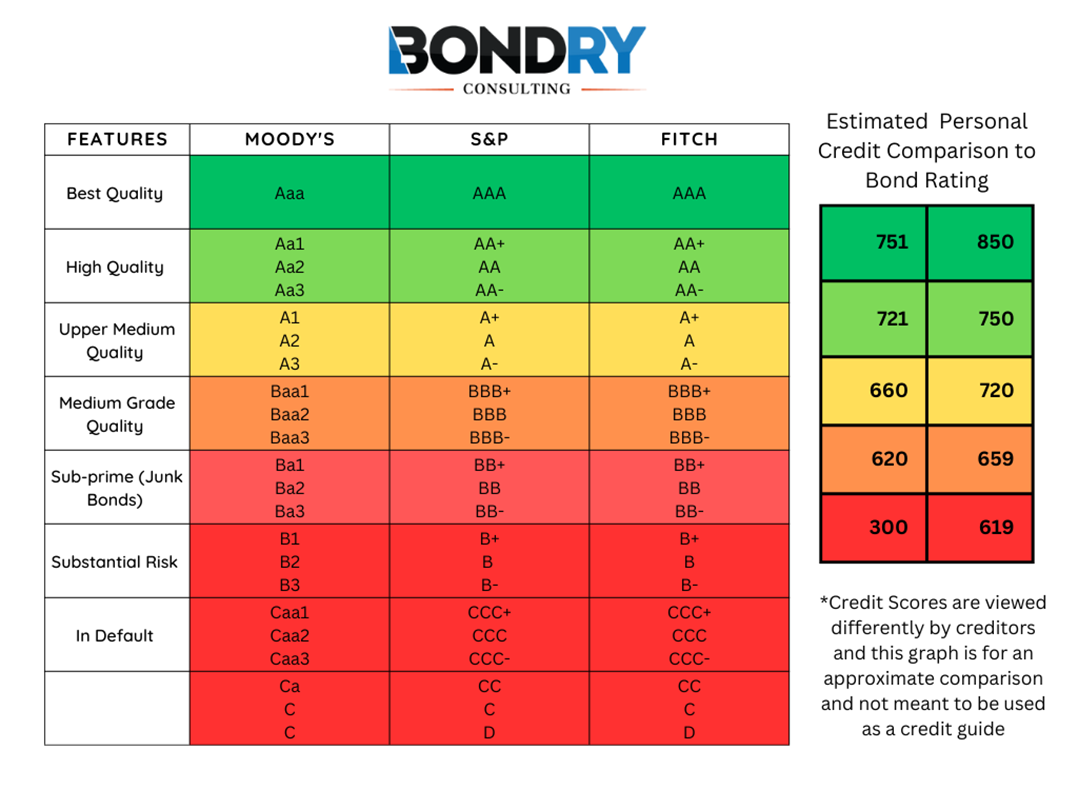

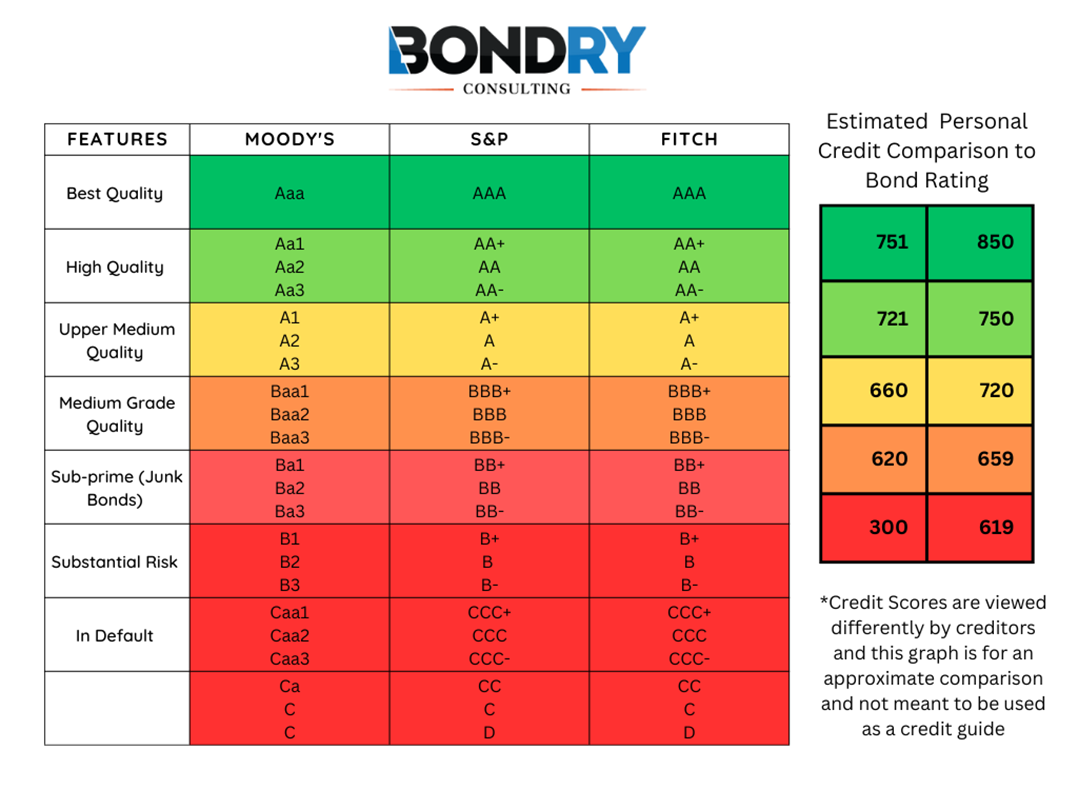

- Investors may shift away from riskier bonds, impacting their prices. The increased uncertainty associated with tariffs can lead investors to avoid riskier bonds, such as corporate bonds with lower credit ratings, driving down their prices.

<h2>The Impact of Tariffs on Economic Growth and Bond Yields</h2>

Tariffs' detrimental effects on economic growth directly influence bond yields and overall market performance.

<h3>Reduced Global Trade and Economic Slowdown:</h3>

Tariffs disrupt global trade flows, leading to reduced economic activity.

- Reduced economic growth can lower demand for bonds. Slower economic growth translates to reduced demand for capital, including reduced demand for bonds to finance business activities.

- Lower demand can lead to lower bond prices. Reduced demand, in the absence of other significant factors, generally leads to a decrease in asset prices, including bond prices.

- Businesses may postpone investment plans, reducing demand for capital and impacting bond markets. Businesses facing uncertainty due to tariffs may postpone investment decisions, further lowering demand for credit and impacting the bond market.

<h3>Uncertainty and Investor Risk Aversion:</h3>

The uncertainty associated with trade wars and tariffs increases investor risk aversion.

- Investors may demand higher yields on bonds to compensate for increased risk. To offset the increased risk, investors demand higher returns on their bond investments, resulting in higher yields.

- This can lead to lower bond prices. Higher yields typically imply lower bond prices, as the price is inversely related to yield.

- Risk-averse investors might move to less risky assets, decreasing demand for bonds. Investors might shift their investments towards assets perceived as safer, such as cash or government securities, reducing demand for riskier bonds.

<h2>Conclusion: Navigating the Bond Market in a Tariff-Affected World</h2>

Tariffs present a significant challenge to the bond market's stability. The inflationary pressures, interest rate adjustments, and dampened economic growth associated with tariffs can all negatively impact bond prices and yields. Understanding the complex interplay between tariffs, inflation, interest rates, and investor sentiment is crucial for navigating the fixed-income market effectively. Investors need to carefully assess the potential impact of tariffs on their bond portfolios and diversify their investments to mitigate the risks associated with tariff-induced economic uncertainty. By staying informed about the ongoing effects of tariffs and understanding their vulnerability, investors can make better-informed decisions in the bond market. Careful analysis of macroeconomic indicators and a well-diversified approach to bond investments are crucial for mitigating the risks associated with tariffs.

Featured Posts

-

Positive Developments In Us China Trade Discussions Bessents Assessment

May 12, 2025

Positive Developments In Us China Trade Discussions Bessents Assessment

May 12, 2025 -

The Most Sentimental Rocky Film According To Sylvester Stallone

May 12, 2025

The Most Sentimental Rocky Film According To Sylvester Stallone

May 12, 2025 -

Andrea Love And Neal Mc Clellands Ill House U House Music At Its Finest

May 12, 2025

Andrea Love And Neal Mc Clellands Ill House U House Music At Its Finest

May 12, 2025 -

Martinelli Encuentra Refugio En Colombia Analisis Del Asilo Otorgado

May 12, 2025

Martinelli Encuentra Refugio En Colombia Analisis Del Asilo Otorgado

May 12, 2025 -

Analyzing Ufc 315 Early Predictions And Key Matchups

May 12, 2025

Analyzing Ufc 315 Early Predictions And Key Matchups

May 12, 2025