The Impact Of The US-Dutch Trade War On Stock Performance

Table of Contents

A hypothetical trade war between the United States and the Netherlands could have far-reaching consequences for global markets. This article delves into the potential impact of such a conflict on stock performance, examining various sectors and offering insights for investors concerned about this geopolitical risk. The analysis will explore potential winners and losers, offering a comprehensive view of the potential ramifications of this significant trade dispute.

Impact on Technology Stocks

Semiconductor Sector Vulnerability

The Netherlands houses major semiconductor manufacturers, most notably ASML, a critical supplier of lithography systems crucial for chip production. This makes the semiconductor sector highly susceptible to trade restrictions between the US and the Netherlands. A trade war could severely impact this sector.

- Potential Tariffs: Imposition of significant tariffs on Dutch-made semiconductor equipment could drastically increase the cost of chip production for US companies, decreasing their profitability.

- Supply Chain Disruptions: Trade restrictions could disrupt the delicate global supply chain, leading to shortages of essential components and impacting production timelines for US chipmakers like Intel and Qualcomm.

- Decreased Profitability: Increased costs and supply chain disruptions would inevitably lead to decreased profitability for US companies heavily reliant on Dutch technology. This could negatively impact their stock prices. The impact on ASML stock itself would also be significant, as a major portion of its revenue comes from US customers. Tracking "ASML stock impact" will be critical in such a scenario.

Keyword Integration: Dutch semiconductor stocks, ASML stock impact, US chipmakers

Software and Data Storage Impacts

While not directly involved in the manufacturing of semiconductors, the software and data storage industries would feel the ripple effects of a US-Dutch trade war. The increased cost and potential scarcity of hardware components would impact these sectors in several ways:

- Delays in Product Launches: Shortages of key components could delay product launches for software companies, impacting revenue streams and potentially hindering innovation.

- Increased Prices for Consumers: Increased production costs would be passed on to consumers, leading to higher prices for computers, smartphones, and other electronic devices.

- Reduced Competitiveness for US Tech Firms: Higher production costs could diminish the competitiveness of US tech firms in the global market, especially against those relying less on Dutch technology.

Keyword Integration: Cloud computing stocks, data storage industry, software sector vulnerability

Impact on Agricultural and Food Stocks

Agricultural Exports and Imports

The Netherlands is a significant exporter of agricultural products, making this sector particularly vulnerable in a trade war with the US. Conversely, the US also exports agricultural goods to the Netherlands.

- Tariffs on Dutch Agricultural Goods: The US could impose tariffs on Dutch agricultural imports, increasing prices for US consumers and negatively impacting the profitability of Dutch agricultural companies. Monitoring "Dutch agricultural exports" would be crucial.

- Tariffs on US Agricultural Goods: Conversely, Dutch tariffs on US agricultural exports would harm US farmers and related businesses. The effects on "US food imports" would be noteworthy.

- Disrupted Trade Flows: Overall, trade restrictions would significantly disrupt agricultural trade flows between the two countries, affecting farming communities and potentially leading to food price increases.

Keyword Integration: Dutch agricultural exports, US food imports, agricultural stock market

Impact on Financial and Banking Stocks

Global Market Instability

A US-Dutch trade war would create significant global market instability, impacting investor confidence and potentially leading to capital flight. This would directly influence financial and banking stocks.

- Decreased Investor Confidence: Increased uncertainty stemming from the trade conflict would lead to decreased investor confidence, causing stock valuations to decline across various sectors. Watching "investor sentiment" would be key.

- Increased Market Volatility: The stock market would likely experience increased volatility as investors react to the unfolding events and try to assess the long-term economic consequences.

- Potential Capital Flight: Investors might move their capital to safer havens, reducing investment in both US and Dutch financial markets, impacting bank performance and financial institutions' stock prices.

Keyword Integration: global stock market, investor sentiment, financial market volatility

Potential Winners and Losers

Identifying Sectors Likely to Benefit

While many sectors would suffer from a US-Dutch trade war, some might benefit from shifts in trade flows.

- Domestic Production Increase: US companies producing alternatives to Dutch technology or agricultural goods could see increased demand, leading to higher profits. Focusing on "domestic production" would provide insights.

- Alternative Suppliers: Companies finding alternative suppliers outside the Netherlands could gain a competitive advantage, reducing their dependence on Dutch technology and mitigating supply chain risks.

- Regional Economic Shifts: This trade conflict could accelerate shifts in global supply chains. Understanding how "trade war beneficiaries" emerge is critical.

Keyword Integration: trade war beneficiaries, alternative suppliers, domestic production

Strategies for Investors

Diversification and Risk Management

In the face of geopolitical uncertainty created by a potential US-Dutch trade war, investors need to implement effective risk management strategies.

- Portfolio Diversification: Diversifying investments across different sectors and asset classes is crucial to mitigate the impact of a potential downturn in specific sectors. Emphasizing "portfolio diversification" is essential.

- Hedging Strategies: Hedging techniques can help protect portfolios against potential losses. Investors could consider options or other hedging instruments to mitigate risks.

- Sector-Specific Analysis: Investors should perform in-depth analysis of individual sectors and companies to identify those less exposed to the potential impacts of the trade war. Following relevant "investment strategies" becomes imperative.

Keyword Integration: portfolio diversification, risk management strategies, investment strategies

Conclusion

A hypothetical US-Dutch trade war presents significant challenges and uncertainties for investors. Understanding the potential impact on various sectors, particularly technology and agriculture, is crucial for informed decision-making. Careful consideration of risk management strategies, including diversification and hedging, is essential during periods of geopolitical instability.

Call to Action: Stay informed about the evolving situation and the impact of any potential US-Dutch trade war on stock performance. Regularly review your investment strategy and consult with a financial advisor to navigate this complex economic landscape. Understanding the potential ramifications of a US-Dutch trade war is critical for sound investment decisions.

Featured Posts

-

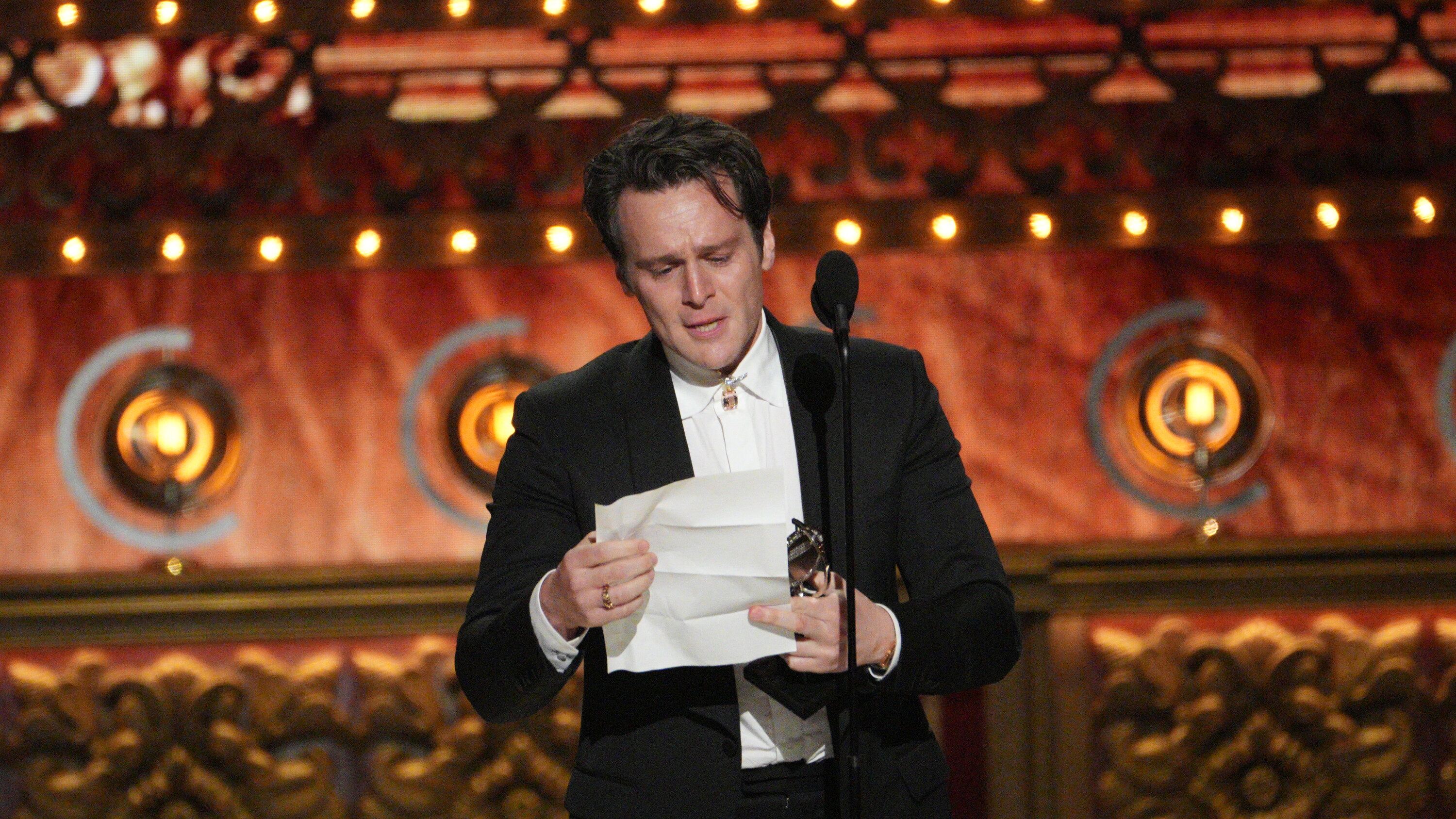

Will Jonathan Groffs Just In Time Performance Earn A Tony

May 24, 2025

Will Jonathan Groffs Just In Time Performance Earn A Tony

May 24, 2025 -

Amundi Msci World Ii Ucits Etf Usd Hedged Dist A Guide To Its Net Asset Value

May 24, 2025

Amundi Msci World Ii Ucits Etf Usd Hedged Dist A Guide To Its Net Asset Value

May 24, 2025 -

Astrologia Semanal Horoscopo Del 4 Al 10 De Marzo De 2025 Para Todos Los Signos

May 24, 2025

Astrologia Semanal Horoscopo Del 4 Al 10 De Marzo De 2025 Para Todos Los Signos

May 24, 2025 -

New 2026 Porsche Cayenne Ev What Spy Photos Tell Us

May 24, 2025

New 2026 Porsche Cayenne Ev What Spy Photos Tell Us

May 24, 2025 -

Escape To The Country Your Guide To A Peaceful Rural Retreat

May 24, 2025

Escape To The Country Your Guide To A Peaceful Rural Retreat

May 24, 2025