The Impact Of US Tariffs On Shein's London IPO

Table of Contents

Shein's Reliance on US Market & Potential Tariff Implications

Shein enjoys a substantial presence in the US market, representing a significant portion of its overall revenue. The company's success is intrinsically linked to its ability to offer trendy clothing at incredibly low prices to American consumers.

- Shein's US Sales: While precise figures remain confidential, numerous reports indicate that the US represents a major market share for Shein, potentially accounting for billions of dollars in annual revenue.

- Tariff-Sensitive Goods: Shein's product range, encompassing apparel, accessories, and home goods, includes many items subject to existing and potentially future US tariffs. These tariffs primarily target textiles and clothing imports from China, Shein's primary manufacturing base.

- Current Tariff Rates: Currently, various tariffs ranging from several percent to upwards of 25% are applied to numerous products similar to those offered by Shein. These rates can significantly increase the cost of goods sold.

- Impact on Profitability and Competitiveness: Increased tariffs directly impact Shein's profitability by raising the cost of importing goods into the US. This could force price increases, potentially diminishing its competitive edge against other fast-fashion brands and impacting its market share.

- Mitigation Strategies: To offset the impact of tariffs, Shein might explore several strategies, including shifting a portion of its production to countries with more favorable trade agreements (such as Vietnam or Bangladesh), adjusting pricing strategies, or absorbing some of the increased costs to maintain its price competitiveness.

Impact of Tariffs on Shein's Valuation and Investor Sentiment

The uncertainty surrounding US tariffs introduces significant risk for potential investors considering participation in Shein's London IPO. This uncertainty directly impacts the perceived value of the company and the confidence investors have in its long-term prospects.

- Impact on Projected Profits: Higher costs due to tariffs directly reduce Shein's projected profits, a critical factor for investors evaluating the IPO. Any significant increase in tariff rates could substantially alter the financial forecasts presented to potential investors.

- Decreased Investor Confidence: The potential for increased costs and reduced profitability due to tariffs can lead to decreased investor confidence, making them hesitant to invest at the expected valuation.

- Discount for Tariff Risk: Investors might demand a discount on Shein's valuation to account for the inherent risk associated with the ongoing uncertainty surrounding US tariffs. This discount could significantly impact the final IPO pricing and Shein's overall valuation.

- Negative News Coverage: Negative news coverage highlighting the potential impact of US tariffs on Shein's business can further erode investor confidence and negatively affect the IPO's success. Any perception of significant tariff-related risk can deter potential investors.

Alternative Sourcing and Supply Chain Diversification Strategies

To mitigate the impact of US tariffs, Shein is likely to explore several strategies to diversify its supply chain and reduce its reliance on manufacturing in China.

- Shifting Production: Relocating or diversifying its manufacturing base to countries with more favorable trade agreements with the US is a key consideration. This could involve establishing production facilities in countries like Vietnam, Bangladesh, or other Southeast Asian nations.

- Feasibility and Cost Implications: Such a shift involves substantial investment and logistical challenges. The cost of setting up new manufacturing facilities, training workers, and managing a more geographically dispersed supply chain could be significant.

- Impact on Production Timelines: Diversifying the supply chain may affect Shein's production timelines and lead times, potentially impacting its ability to keep up with rapid fashion trends. This could also impact inventory management and overall operational efficiency.

- Complexities and Challenges: The complexities of navigating different regulatory environments, labor laws, and infrastructure limitations in various countries present significant challenges to diversifying the supply chain.

Geopolitical Considerations and Trade War Implications

The broader geopolitical context of US-China relations significantly impacts Shein. The ongoing trade tensions between the two countries create a volatile environment that can influence tariff policies and potentially impact Shein's future growth.

- Further Escalation of Trade Tensions: Further escalation of trade tensions between the US and China could lead to the imposition of new or increased tariffs on a wider range of goods, impacting Shein more significantly.

- Further Tariffs or Trade Restrictions: The US government could impose new tariffs or trade restrictions targeting specific aspects of Shein's business model or supply chain, depending on evolving political and economic dynamics.

- Retaliatory Measures from China: China may also take retaliatory measures, potentially affecting Shein's operations or access to certain resources within China.

Conclusion

Shein's London IPO faces considerable challenges due to the uncertainty surrounding US tariffs. Increased tariffs could negatively impact profitability, valuation, and investor confidence. Mitigating these risks requires strategic supply chain adjustments and proactive engagement with evolving trade policies. The success of the Shein London IPO will largely depend on its ability to navigate these complexities effectively.

Stay informed about the evolving impact of US tariffs on Shein's London IPO and the broader fast-fashion industry. Follow our updates on the latest developments regarding Shein London IPO and the effects of US Tariffs Shein. Understanding these complexities is crucial for investors and industry stakeholders alike.

Featured Posts

-

Emma Stooyn Nea Fimi Gia Rimeik Tis Tainias Body Heat

May 04, 2025

Emma Stooyn Nea Fimi Gia Rimeik Tis Tainias Body Heat

May 04, 2025 -

Backlash Against Lizzo Comparing Britney Spears And Janet Jackson

May 04, 2025

Backlash Against Lizzo Comparing Britney Spears And Janet Jackson

May 04, 2025 -

Ufc Des Moines Predictions For Every Fight On The Card

May 04, 2025

Ufc Des Moines Predictions For Every Fight On The Card

May 04, 2025 -

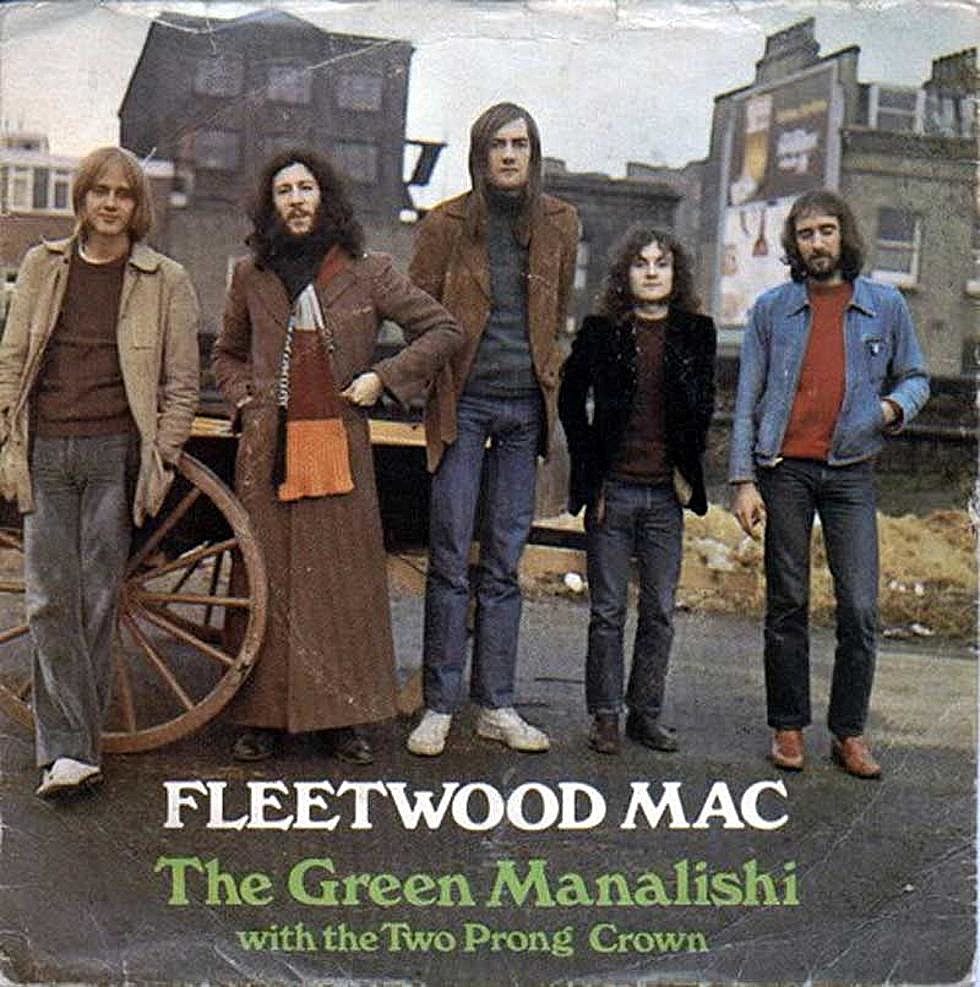

How Peter Green Shaped Fleetwood Macs Identity With 96 1 The Rocket

May 04, 2025

How Peter Green Shaped Fleetwood Macs Identity With 96 1 The Rocket

May 04, 2025 -

Carney Promises Biggest Economic Overhaul In A Generation

May 04, 2025

Carney Promises Biggest Economic Overhaul In A Generation

May 04, 2025