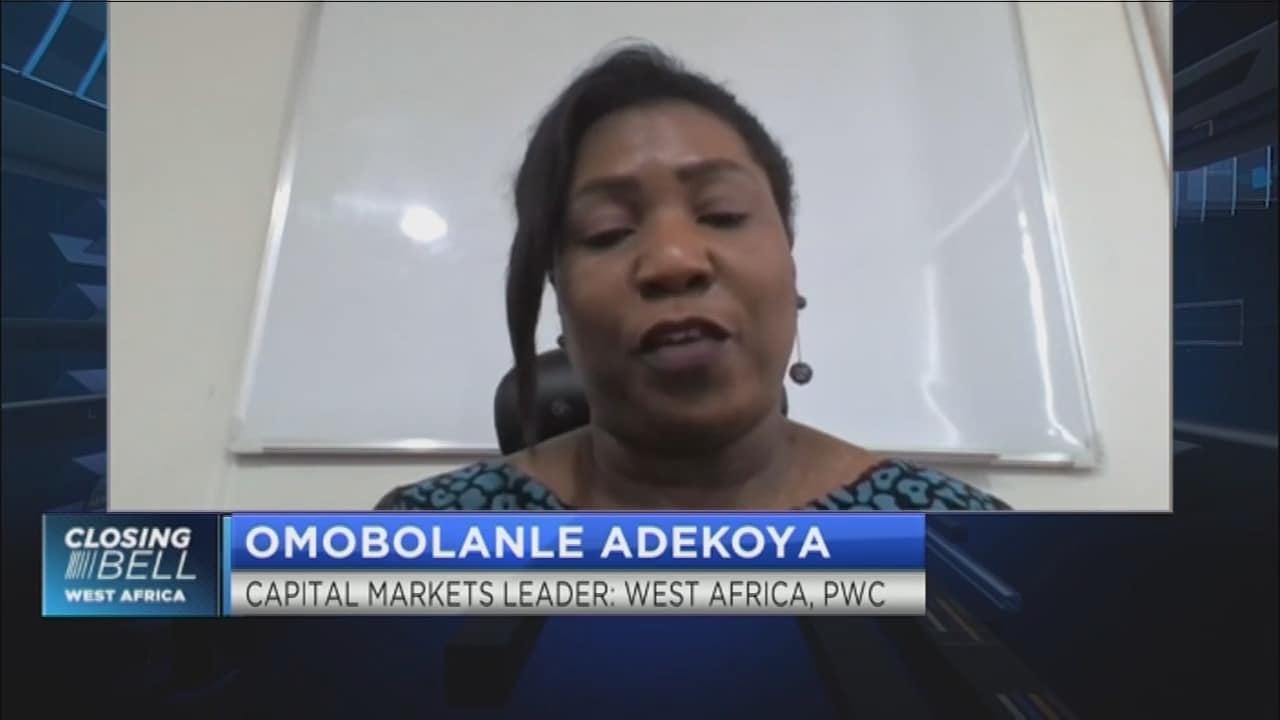

The Implications Of PwC's Exit From Nine African Countries

Table of Contents

H2: Impact on Auditing and Financial Services in Affected Countries

PwC's presence in Africa was substantial. Its departure creates a void in the audit firms Africa sector, raising concerns about the long-term health of financial reporting Africa. Key implications for accounting standards Africa and regulatory compliance Africa include:

- Reduced competition: The absence of PwC will likely reduce competition within the audit market, potentially leading to increased costs for businesses, especially smaller enterprises. This lack of competition could also impact the speed and efficiency of audit services.

- Maintaining auditing standards: Ensuring the maintenance of high accounting standards Africa and regulatory compliance Africa will be challenging. PwC's departure necessitates a greater focus on oversight by existing firms and regulatory bodies.

- Increased workload: Remaining audit firms will face a significantly increased workload, potentially compromising the quality of their services if they lack sufficient resources and personnel. This could further impact the accuracy and timeliness of financial reporting.

- Talent retention: Attracting and retaining skilled accounting professionals will become more difficult in these countries, as PwC was a major employer and training ground for many. This skills gap could exacerbate the challenges facing the sector.

The potential for monopolies to emerge, and the subsequent impact on smaller businesses' access to fair and competitive audit services, needs careful consideration. Maintaining international accounting standards is crucial to ensuring trust and transparency in the financial markets of these African nations.

H2: Effects on Foreign Direct Investment (FDI) and Business Confidence

PwC played a significant role in attracting foreign investment Africa. Its withdrawal could negatively impact investor sentiment Africa, leading to several consequences:

- Decreased investor confidence: The exit signals increased risk and uncertainty, potentially deterring future foreign investment Africa. Investors may perceive a higher risk profile in these countries, impacting their willingness to invest.

- Decline in FDI: A reduction in foreign direct investment (FDI) is highly probable, hindering economic growth and development. This decrease will particularly affect sectors heavily reliant on foreign investment.

- Negative impact on economic growth: The decline in FDI will directly affect economic growth Africa, impacting job creation and overall economic development. This slowdown could further destabilize these already-developing economies.

- Increased scrutiny: The PwC withdrawal will undoubtedly lead to increased scrutiny of the business environment in Africa by international investors, who may demand greater transparency and accountability from African governments and businesses.

The impact on business confidence Africa could ripple outwards, impacting sectors beyond direct clients of PwC. The government's response will be crucial in reassuring investors and restoring confidence.

H2: The Role of Regulatory Bodies and Government Response

The responsibility now falls heavily on African regulators and governments to mitigate the negative impacts of this PwC impact Africa. Their response will be critical:

- Strengthening oversight: African regulators must strengthen their oversight of the accounting profession to maintain high standards and ensure accountability. Increased scrutiny and stricter enforcement are required.

- Government policies: Governments need to implement supportive economic policies to attract other accounting firms Africa and stimulate investment in the sector. This could include tax incentives and training programs.

- Regional collaboration: Collaboration between African nations to develop stronger regional accounting standards and regulatory frameworks is crucial to creating a more robust and resilient financial environment.

- Transparency and accountability: Increased transparency and accountability within the financial sector will be essential to restore and maintain investor confidence. This includes strengthening anti-corruption measures.

Effective governmental and regulatory action is paramount to minimizing the negative effects of the PwC withdrawal and ensuring a stable financial sector.

H2: Opportunities for Other Accounting Firms and Local Players

While the PwC withdrawal presents challenges, it also presents significant opportunities for other players in the accounting firms Africa landscape:

- Increased market share: Existing international and local African accounting firms can expect increased market share and a chance to expand their client base significantly.

- Local firm expansion: Local firms can leverage this opportunity to expand their service offerings and build greater capacity to meet the growing demand for accounting services.

- Demand for skilled professionals: A surge in demand for skilled accounting professionals will create employment opportunities and stimulate growth within the sector.

- Specialized services: Local firms can specialize in niche services to cater to the specific needs of businesses in their regions, developing a competitive advantage.

This shift presents a crucial opportunity for the growth and development of local talent and businesses. However, they must adequately prepare themselves to meet the increased demands and expectations.

3. Conclusion

The PwC Africa withdrawal from nine African countries presents a complex situation with both challenges and opportunities. The short-term impact is likely negative, affecting auditing standards, investor confidence, and economic growth Africa. However, it also opens doors for other firms and could stimulate growth of local capabilities. The response of governments and African regulators will be crucial in mitigating the negative consequences and ensuring the long-term health of the financial sector. Understanding the implications of this PwC's exit from nine African countries is crucial for businesses operating on the continent. Stay informed about the evolving landscape and adapt your strategies accordingly. Further research into the impact of this decision is needed to fully understand the long-term implications of PwC's withdrawal from Africa.

Featured Posts

-

Watch Lionel Messis Inter Miami Mls Matches Live Stream Guide Schedule And Betting

Apr 29, 2025

Watch Lionel Messis Inter Miami Mls Matches Live Stream Guide Schedule And Betting

Apr 29, 2025 -

Capital Summertime Ball 2025 Ticket Information And Purchase Guide

Apr 29, 2025

Capital Summertime Ball 2025 Ticket Information And Purchase Guide

Apr 29, 2025 -

Neuer Job Fuer Ex Leoben Trainer Carsten Jancker

Apr 29, 2025

Neuer Job Fuer Ex Leoben Trainer Carsten Jancker

Apr 29, 2025 -

Concern Grows For Missing British Paralympian In Las Vegas

Apr 29, 2025

Concern Grows For Missing British Paralympian In Las Vegas

Apr 29, 2025 -

One Dead Several Injured In Clearwater Ferry Boat Collision

Apr 29, 2025

One Dead Several Injured In Clearwater Ferry Boat Collision

Apr 29, 2025

Latest Posts

-

Free Streaming Of Ru Pauls Drag Race Season 17 Episode 9

Apr 30, 2025

Free Streaming Of Ru Pauls Drag Race Season 17 Episode 9

Apr 30, 2025 -

How To Watch Ru Pauls Drag Race Season 17 Episode 9 For Free

Apr 30, 2025

How To Watch Ru Pauls Drag Race Season 17 Episode 9 For Free

Apr 30, 2025 -

Watch Ru Pauls Drag Race Season 17 Episode 8 Online Free No Cable Needed

Apr 30, 2025

Watch Ru Pauls Drag Race Season 17 Episode 8 Online Free No Cable Needed

Apr 30, 2025 -

How To Watch Ru Pauls Drag Race Season 17 Episode 8 For Free

Apr 30, 2025

How To Watch Ru Pauls Drag Race Season 17 Episode 8 For Free

Apr 30, 2025 -

Unexpected Family Ties Nba Legend And Ru Pauls Drag Race Contestant

Apr 30, 2025

Unexpected Family Ties Nba Legend And Ru Pauls Drag Race Contestant

Apr 30, 2025