The Inside Story: Shorting $TRUMP Coin And Winning A White House Dinner

Table of Contents

Understanding the $TRUMP Coin Phenomenon

What is $TRUMP Coin?

$TRUMP Coin is a cryptocurrency allegedly associated with Donald Trump, capitalizing on his name and political influence. It's a prime example of a meme coin, meaning its value is largely driven by internet hype and speculation, rather than any underlying technological innovation or utility. This inherent volatility makes it incredibly susceptible to market manipulation and rapid price swings. Its appeal lies in its association with a prominent political figure, attracting both fervent supporters and those looking to profit from its unpredictable behavior. However, it's crucial to note that its legitimacy and connection to Trump himself are often debated and unsubstantiated. For more information, you can consult resources like [insert link to reputable news source about $TRUMP coin] and [insert link to another reputable source].

- High Volatility: Expect extreme price fluctuations within short periods.

- Lack of Intrinsic Value: The coin’s value isn't tied to any tangible asset or project.

- Speculative Trading: The primary activity involves buying and selling based on predicted price changes.

- Regulatory Uncertainty: The lack of clear regulatory oversight increases the risk of scams.

The Risks of Investing in Political Cryptocurrencies

Investing in political cryptocurrencies, like $TRUMP Coin, carries significant risks. The inherent volatility of meme coins makes them highly speculative investments, prone to dramatic price drops. The lack of regulatory oversight leaves investors vulnerable to scams and pump-and-dump schemes, where prices are artificially inflated before being crashed, leaving investors holding worthless assets.

- Pump-and-Dump Schemes: Be aware of coordinated efforts to inflate prices artificially.

- Market Manipulation: Prices can be easily influenced by social media trends and news events.

- Regulatory Uncertainty: Lack of regulation increases investor vulnerability.

- Illiquidity Risk: Difficulty selling your holdings quickly at a favorable price.

- Examples: Many other politically themed cryptocurrencies have experienced similar volatility and risk.

The Strategy: Shorting $TRUMP Coin

Short Selling Explained

Short selling involves borrowing an asset (in this case, $TRUMP Coin), selling it at the current market price, and hoping to buy it back later at a lower price. The difference between the selling price and the repurchase price is your profit. However, if the price rises instead of falling, your losses can be potentially unlimited. In the cryptocurrency market, short selling often involves using derivatives like futures contracts or through cryptocurrency exchanges that offer shorting functionalities.

- Borrowing: You borrow the asset from a broker or lender.

- Selling: You sell the borrowed asset at the current market price.

- Repurchasing: You buy back the asset to return it to the lender.

- Profit/Loss: Profit is realized if the price falls, while losses can be substantial if it rises.

Market Analysis and Timing

Before shorting $TRUMP Coin, the investor conducted thorough market research, analyzing factors such as historical price movements, trading volume, social media sentiment, and news related to Donald Trump and the cryptocurrency market. They utilized technical analysis tools to identify potential price reversal points. The timing of the short was crucial; they likely initiated their position when the coin's price showed signs of overvaluation or unsustainable growth.

- Technical Analysis: Charts and indicators to predict price trends.

- Fundamental Analysis: Understanding the underlying factors affecting the coin’s price.

- News Sentiment: Monitoring news and social media for market-moving events.

- Market Timing: Identifying optimal entry and exit points.

Risk Management Techniques

The investor implemented a robust risk management strategy, employing stop-loss orders to limit potential losses. This involves setting a price point at which the short position is automatically closed, preventing catastrophic losses if the price unexpectedly surges. Diversification across different assets helped mitigate overall portfolio risk, limiting the impact of any single investment, including the $TRUMP Coin short.

- Stop-Loss Orders: Automatic mechanisms to limit potential losses.

- Position Sizing: Controlling the amount invested in the short position.

- Diversification: Spreading investments across different asset classes.

The Payoff: A White House Dinner Invitation

The Unexpected Reward

The successful shorting of $TRUMP Coin resulted in a substantial profit for the investor. This unexpectedly led to an invitation to a White House dinner, allegedly through connections made within the political circles influenced by the market's reaction to the coin's price fluctuations. The precise details remain unclear, but the story highlights the sometimes unpredictable connections between seemingly disparate events.

- Profit from Short: The successful trade generated significant financial gains.

- Unconventional Reward: The White House invitation was a highly unusual and unexpected outcome.

- Ethical Considerations: The situation raises ethical questions about the interplay between finance and politics.

Lessons Learned

This remarkable story offers several key takeaways. Investing in highly speculative assets like $TRUMP Coin demands a comprehensive understanding of risk and reward. Thorough research, careful planning, and effective risk management techniques are essential for success. While high profits are possible, losses can be devastating, emphasizing the importance of responsible investment practices.

- Risk Assessment: Thoroughly evaluate the risks before any investment.

- Market Knowledge: Develop expertise in the specific market sector.

- Risk Management: Employ strategies to protect capital from significant loss.

- Diversification: Avoid overexposure to any single asset.

Conclusion

Shorting $TRUMP Coin proved to be a high-risk, high-reward venture for one astute investor, culminating in an unexpected invitation to a White House dinner. This case study illustrates the potential – and peril – of investing in volatile political cryptocurrencies like $TRUMP Coin. While lucrative, success demands a deep understanding of market dynamics, risk management, and the unpredictable nature of meme coins. Before you consider any investment in $TRUMP Coin or similar speculative cryptocurrencies, carefully research market conditions and consult with a financial advisor. Remember, understanding the risks involved is crucial before entering the world of shorting crypto, and success is rarely guaranteed. Learn more about responsible cryptocurrency investment and explore alternative strategies to protect your capital.

Featured Posts

-

Testing Crash Results In Marinis Hospitalization

May 29, 2025

Testing Crash Results In Marinis Hospitalization

May 29, 2025 -

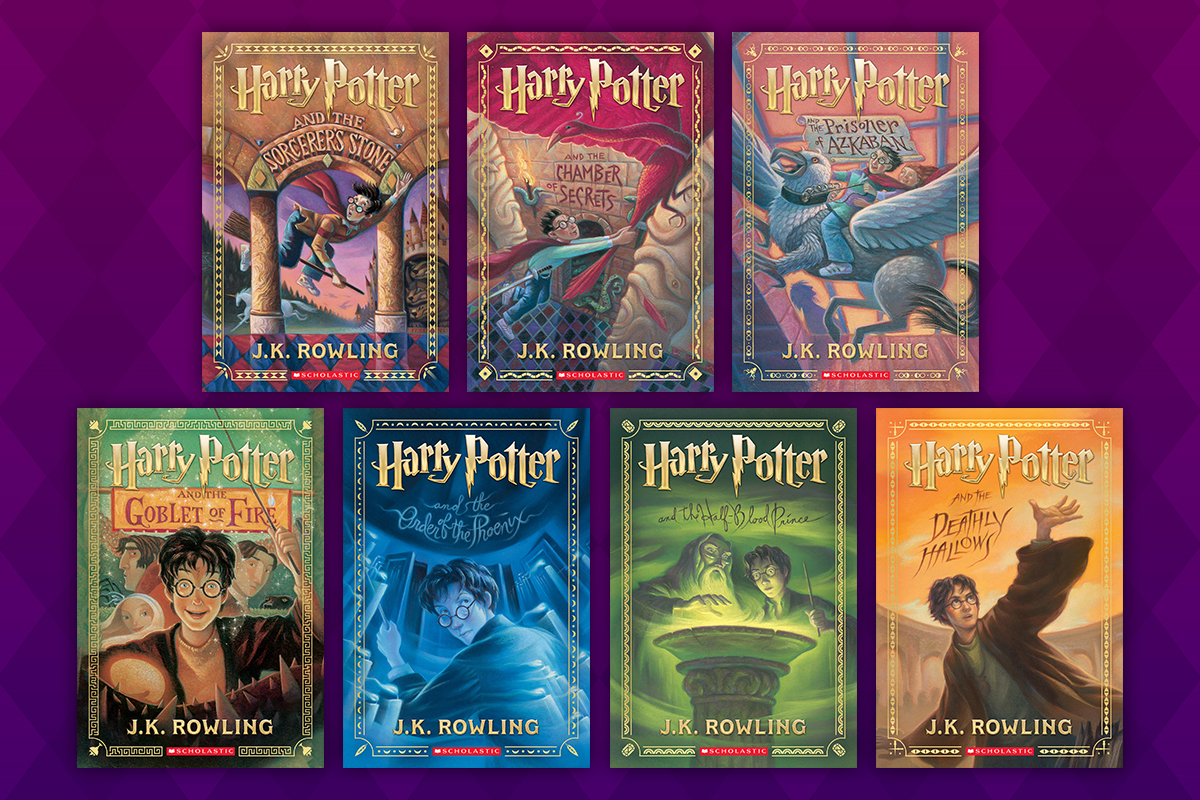

Hbo Reassures Fans Harry Potter Series Will Exclude J K Rowlings Controversial Opinions

May 29, 2025

Hbo Reassures Fans Harry Potter Series Will Exclude J K Rowlings Controversial Opinions

May 29, 2025 -

Grab A Bargain Nike Sneakers On Sale 39 At Revolve

May 29, 2025

Grab A Bargain Nike Sneakers On Sale 39 At Revolve

May 29, 2025 -

Stranger Things Comics A Perfect Companion While Waiting For Season 5

May 29, 2025

Stranger Things Comics A Perfect Companion While Waiting For Season 5

May 29, 2025 -

League Of Legends Arcane 50 Off 4 K Blu Ray Steelbook On Amazon

May 29, 2025

League Of Legends Arcane 50 Off 4 K Blu Ray Steelbook On Amazon

May 29, 2025