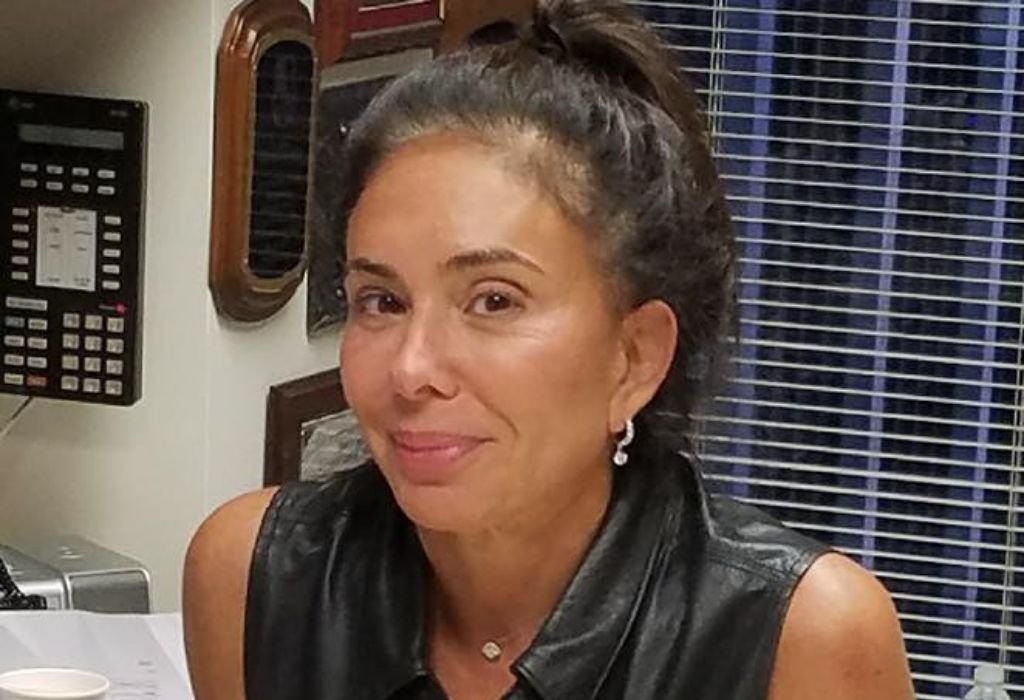

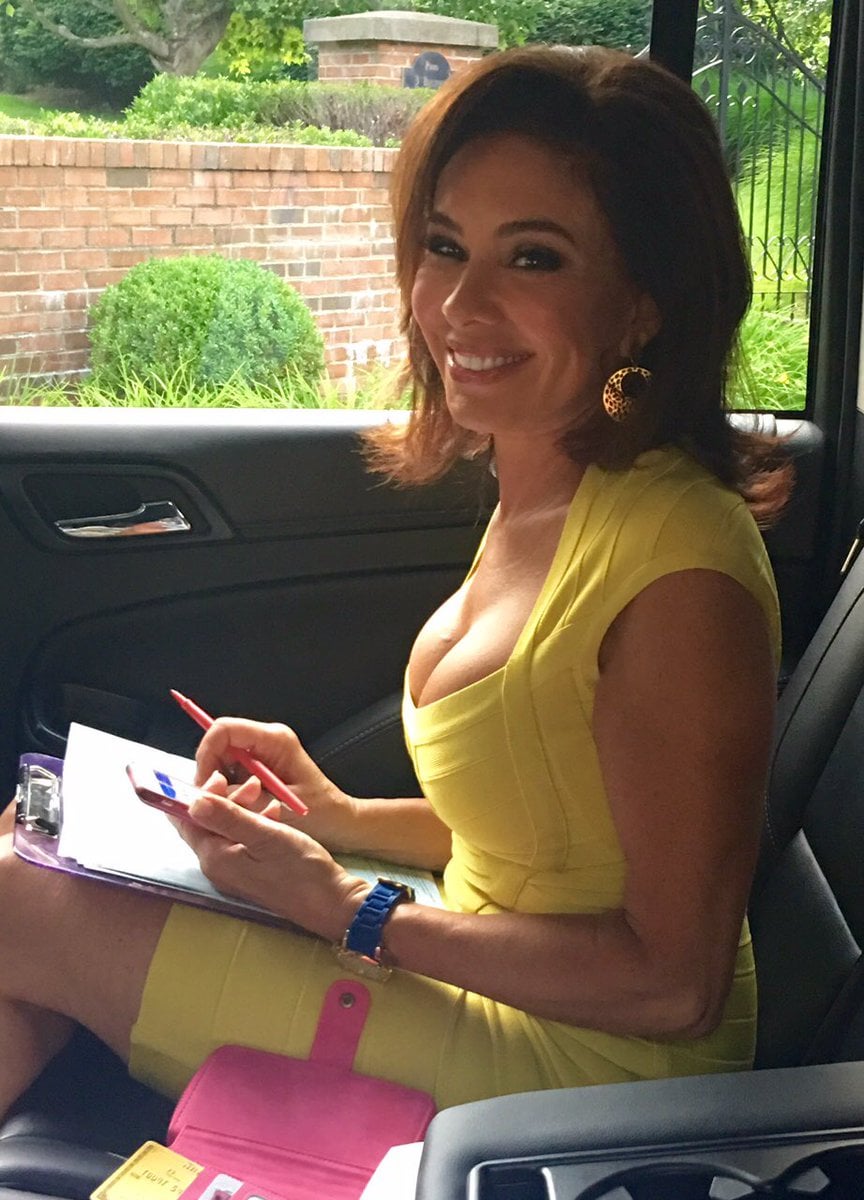

The Jeanine Pirro Effect: Should You Pause Your Stock Market Activity?

Table of Contents

Understanding the "Jeanine Pirro Effect" on Investor Sentiment

The "Jeanine Pirro Effect" refers to the potential influence of Jeanine Pirro's public statements on investor behavior and market sentiment. Understanding this effect requires a careful analysis of her commentary and the broader impact of media personalities on investment decisions.

Analyzing Jeanine Pirro's Public Statements

To understand the Jeanine Pirro effect, we need to examine her recent pronouncements on the economy and the stock market. (Note: This section would ideally include specific examples of her statements, linked to reliable news sources. Due to the dynamic nature of news, providing specific examples here is not feasible. Replace this with actual quotes and links when writing the final article.)

- Key phrases used: (Insert specific phrases from her commentary)

- Target audience: Generally, her audience tends to be conservative and politically engaged, which might influence their interpretation of her economic pronouncements.

- Overall tone: (Assess whether her commentary is generally optimistic, pessimistic, or neutral towards the market)

Her statements, regardless of their accuracy, can significantly impact investor confidence. Pessimistic commentary can lead to selling pressure, while overly optimistic statements could fuel irrational exuberance.

The Influence of Media Personalities on Market Behavior

The influence of media personalities on market behavior is a well-documented phenomenon. Commentators, through their platforms, can shape public perception and influence investment decisions, sometimes irrespective of the underlying economic fundamentals.

- Examples of other commentators impacting market sentiment: (List examples of other prominent financial commentators and their influence)

- Psychological factors at play: Fear, greed, and herd mentality are powerful psychological forces that amplify the impact of media commentary on investor behavior.

- Discerning credible information from opinion: It’s crucial to remember that many commentators offer opinions rather than objective, data-driven analysis. Investors should critically evaluate information and rely on credible sources.

Assessing Current Market Conditions and Volatility

Understanding the broader market context is vital before deciding whether to pause stock market activity. Analyzing macroeconomic factors and geopolitical risks provides crucial context.

Macroeconomic Factors

Several key macroeconomic indicators significantly impact stock market performance.

- Key economic indicators: Inflation, interest rates, and unemployment rates are crucial factors.

- Current state: (Describe the current state of these indicators, citing reliable sources)

- Potential future trends: (Analyze potential future trends based on expert forecasts and economic models)

High inflation, rising interest rates, and high unemployment often correlate with decreased market performance, while the opposite tends to be true.

Geopolitical Risks

Global events can introduce significant uncertainty and volatility into the market.

- Specific geopolitical events: (List current geopolitical events that might impact market stability)

- Potential impact on stock prices: (Explain how these events could influence stock prices)

- Risk assessment: Carefully assess the potential risks associated with these events and their impact on your investments.

Developing a Personalized Investment Strategy

Regardless of Jeanine Pirro's comments or broader market conditions, developing a sound, personalized investment strategy is paramount.

The Importance of Diversification

Diversification is a cornerstone of risk management. Spreading investments across different asset classes reduces the impact of poor performance in any single asset.

- Asset classes: Consider stocks, bonds, real estate, and alternative investments.

- Diversification techniques: Implement strategies like asset allocation and international diversification.

Risk Tolerance Assessment

Understanding your own risk tolerance is critical. This determines the appropriate investment strategy for your circumstances.

- Questions to ask oneself: How much risk are you comfortable taking? What is your investment time horizon? What is your financial situation?

- Different investment strategies for various risk levels: Conservative investors may favor low-risk investments, while more aggressive investors might allocate a larger portion to higher-growth assets.

Seeking Professional Financial Advice

Consulting a qualified financial advisor provides invaluable guidance tailored to your specific needs and risk profile.

- Benefits of professional financial advice: Advisors provide personalized strategies, diversification guidance, and ongoing support.

- Identifying a qualified advisor: Choose a registered financial advisor with a proven track record and a fiduciary duty to act in your best interest.

Conclusion: Making Informed Decisions in the Face of the Jeanine Pirro Effect

While the "Jeanine Pirro Effect" highlights the potential influence of media personalities on investor sentiment, remember that individual investment decisions should be based on thorough research, professional advice, and a personal risk assessment. Market conditions, including macroeconomic factors and geopolitical risks, should also be considered. Don't let impulsive reactions to single commentators dictate your financial future.

Key Takeaway: Avoid making rash decisions based solely on a single commentator's opinion. Market fluctuations are normal, and a well-diversified, long-term strategy is key to navigating them successfully.

Call to Action: Don't let the Jeanine Pirro effect dictate your financial future. Take control of your investments by conducting thorough research, consulting a financial advisor, and developing a personalized investment strategy that aligns with your risk tolerance and long-term goals. Make informed decisions and build a resilient financial portfolio.

Featured Posts

-

Davids Potential Uncovering Morgans Critical Flaw

May 10, 2025

Davids Potential Uncovering Morgans Critical Flaw

May 10, 2025 -

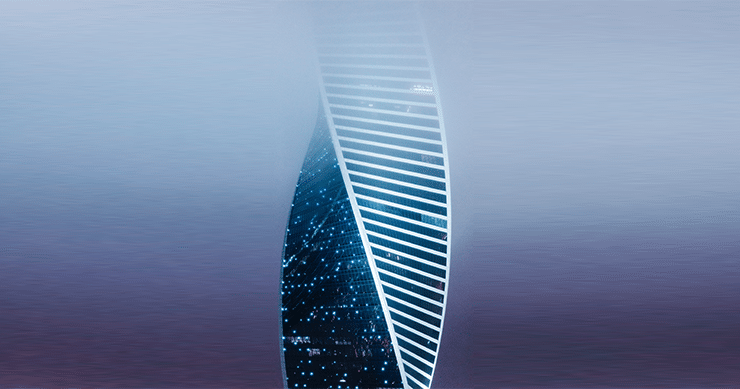

Uk Immigration New Visa Policies Target Overstay Rates From Nigeria And Elsewhere

May 10, 2025

Uk Immigration New Visa Policies Target Overstay Rates From Nigeria And Elsewhere

May 10, 2025 -

Trumps Transgender Military Ban Unpacking The Controversy

May 10, 2025

Trumps Transgender Military Ban Unpacking The Controversy

May 10, 2025 -

The Economic Impact Of Trumps Tariffs On His Billionaire Network

May 10, 2025

The Economic Impact Of Trumps Tariffs On His Billionaire Network

May 10, 2025 -

Fact Checking Jeanine Pirro Aocs Response To Fox News Commentary

May 10, 2025

Fact Checking Jeanine Pirro Aocs Response To Fox News Commentary

May 10, 2025