The Maluf Factor: How BYD's Strategy Impacts Ford's Future In Brazil's EV Sector

Table of Contents

BYD's Aggressive Market Penetration in Brazil

The "Maluf Factor": BYD's Rapid Market Share Growth

BYD's entrance into the Brazilian EV market has been nothing short of meteoric. The "Maluf Factor" perfectly encapsulates their astonishingly rapid growth, quickly dominating sales charts and leaving competitors scrambling to catch up. This explosive growth is a direct result of a multi-pronged strategy focusing on competitive pricing, attractive models, and a vertically integrated supply chain.

- Sales Figures: BYD's market share in Brazil jumped from near zero to [Insert Specific Percentage]% in [Insert Time Period], exceeding expectations and outpacing established brands. [Insert data source citation].

- Popular Models: The BYD Tang, Yuan Plus, and Han EVs have proven particularly popular with Brazilian consumers, appealing to a wide range of buyers with their style, features, and competitive pricing.

- Pricing Strategy: BYD's aggressive pricing strategy, undercuttings competitors, has been a key driver of their success. This has allowed them to capture significant market share, particularly among price-sensitive consumers.

BYD's Vertically Integrated Supply Chain Advantage

BYD's control over its entire supply chain, from battery production to manufacturing, provides a crucial competitive advantage. This vertical integration allows for cost optimization, greater control over quality, and faster response to market demands.

- Cost Advantages: By manufacturing its own batteries and key components, BYD significantly reduces its production costs compared to competitors reliant on external suppliers. This translates to lower prices for consumers and higher profit margins for BYD.

- Price Competitiveness: This cost advantage directly fuels BYD's aggressive pricing strategy, making their EVs more attractive to Brazilian buyers.

- Supply Chain Resilience: BYD's vertically integrated model also offers resilience against supply chain disruptions, a critical factor in the current global economic climate. This contrasts sharply with Ford's reliance on external suppliers, leaving them potentially vulnerable to disruptions.

Ford's Current Position and Challenges in the Brazilian EV Market

Ford's EV Portfolio and Market Share in Brazil

Ford's presence in the Brazilian EV market is currently significantly smaller than BYD's. The company's EV portfolio in Brazil is [Describe Ford's current EV offerings in Brazil]. This limited range and lower market share compared to BYD highlight the challenges the company faces.

- Sales Comparison: A direct comparison of Ford's EV sales figures with BYD's reveals a stark contrast, showcasing BYD's market dominance. [Insert data source citation for Ford's sales].

- Reasons for Slow Adoption: Ford's relatively slow adoption of EVs in Brazil may be attributed to factors such as late market entry, limited model availability, and a less aggressive pricing strategy compared to BYD.

Challenges Faced by Ford: Competition and Infrastructure

Ford faces numerous challenges in competing with BYD in the Brazilian EV market. These include intense competition, the limitations of Brazil's charging infrastructure, and regulatory hurdles.

- Competition: BYD's aggressive marketing, competitive pricing, and wide range of models pose a significant threat to Ford's market share.

- Charging Infrastructure: Brazil's EV charging infrastructure is still underdeveloped compared to more mature markets. This lack of widespread charging availability hinders EV adoption.

- Import Tariffs and Regulations: Import tariffs and regulations can significantly impact the pricing and availability of imported EVs, giving a potential advantage to locally produced vehicles like those from BYD.

Strategic Implications for Ford's Future in Brazil

Potential Responses from Ford to BYD's Success

To regain competitiveness, Ford needs to adopt a proactive and multi-faceted strategy. Several options are available, including increased investment in the Brazilian EV market and strategic partnerships.

- Increased Investment: Ford might consider substantially increasing its investment in developing and manufacturing EVs specifically tailored to the Brazilian market.

- Partnerships and Joint Ventures: Collaborating with local companies or other automotive manufacturers could help Ford access existing infrastructure and expertise.

- Localization: Adapting Ford's EV models to better suit Brazilian consumer preferences, including features specific to the region's climate and infrastructure, will be vital.

Long-Term Outlook for Ford and the Brazilian EV Market

The long-term outlook for Ford in Brazil's EV market depends heavily on its ability to adapt to the challenges posed by BYD. The Brazilian EV market is poised for significant growth, but the competition will be fierce.

- Future Market Share Dynamics: The coming years will likely see continued growth in the Brazilian EV market, but the exact market share distribution between BYD and Ford remains uncertain.

- Growth and Challenges: Despite the potential for considerable expansion, challenges such as infrastructure limitations and government policies will continue to shape the Brazilian EV sector's growth trajectory.

Conclusion

BYD's impact on the Brazilian EV market, embodied by "The Maluf Factor," is undeniable. Its rapid growth presents a significant challenge to established players like Ford, forcing them to reassess their strategies for success in this burgeoning sector. To remain competitive, Ford must address the challenges posed by BYD’s aggressive approach and leverage its strengths to carve out a significant portion of the Brazilian EV market. Understanding "The Maluf Factor" and its implications is crucial for navigating the complexities of Brazil’s evolving electric vehicle landscape. Therefore, a thorough analysis of BYD's success and the resulting impact on Ford's future in Brazil is essential for investors and industry experts alike. Learn more about the implications of "The Maluf Factor" and its effect on the future of EV adoption in Brazil.

Featured Posts

-

October 7th Gaza Kidnapping Updates On Edan Alexanders Case

May 13, 2025

October 7th Gaza Kidnapping Updates On Edan Alexanders Case

May 13, 2025 -

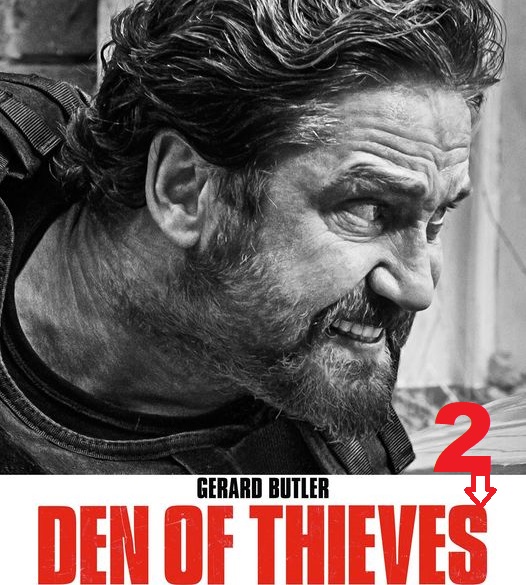

Gerard Butler And Den Of Thieves 2 A 523 Million Franchise Continues

May 13, 2025

Gerard Butler And Den Of Thieves 2 A 523 Million Franchise Continues

May 13, 2025 -

Dzherard Btlr Praznuva 8 Godini S Osinoveno Blgarsko Kuche Snimka

May 13, 2025

Dzherard Btlr Praznuva 8 Godini S Osinoveno Blgarsko Kuche Snimka

May 13, 2025 -

Lookman Transfer Liverpool Face Chelsea Competition

May 13, 2025

Lookman Transfer Liverpool Face Chelsea Competition

May 13, 2025 -

Evaluating Andrew Chafins Impact On The 2024 Texas Rangers Season

May 13, 2025

Evaluating Andrew Chafins Impact On The 2024 Texas Rangers Season

May 13, 2025