The Most Effective Dividend Strategy: Simplicity Itself

Table of Contents

Are you looking to generate passive income and build long-term wealth? Many investors get bogged down in complex dividend strategies, chasing the next hot tip or trying to time the market. The truth is, the most effective dividend strategy is often the simplest. This article will unveil the secrets to building a robust and sustainable dividend income stream with minimal complexity. We'll explore a straightforward approach that focuses on quality, diversification, and long-term growth, allowing you to achieve financial freedom with ease.

Focus on High-Quality Dividend Aristocrats

Understanding Dividend Aristocrats

Dividend Aristocrats are companies with a remarkable track record: a long history of consistently increasing their dividends year after year. This sustained commitment to shareholder returns demonstrates financial strength, stability, and a dedication to long-term growth. Investing in Dividend Aristocrats significantly reduces risk compared to companies with erratic or non-existent dividend payouts. The consistency of these dividend increases contributes to substantial long-term income generation and capital appreciation.

- Reduced risk: Established, financially stable companies are less vulnerable to market downturns.

- Increased likelihood of continued dividend growth: A history of dividend increases signals a commitment to shareholder value.

- Examples of well-known Dividend Aristocrats: Johnson & Johnson, Coca-Cola, 3M, Procter & Gamble – these are just a few examples of blue-chip companies known for their reliable dividend payouts.

- Resources for finding Dividend Aristocrats: Many financial websites and stock screeners allow you to filter for companies with long dividend growth streaks. Utilize these tools to identify potential additions to your portfolio.

Diversification is Key

Spreading Your Risk

Diversification is paramount in any investment strategy, and dividend investing is no exception. Spreading your investments across different sectors and industries significantly mitigates risk. If one sector underperforms, the others can potentially offset those losses.

- Don't put all your eggs in one basket: Avoid over-concentration in a single company or sector. A diversified portfolio protects against significant losses from a single poor performer.

- Target 10-20 different dividend-paying stocks: This number provides a good balance between diversification and management complexity.

- Utilize ETFs or mutual funds: These offer broad market exposure, simplifying diversification and reducing research time.

- Consider geographic diversification: Investing in international dividend-paying companies can further reduce risk and potentially boost returns.

Reinvest Dividends for Compounding Growth

The Power of Compounding

Reinvesting your dividends to buy more shares is the key to unlocking the power of compounding. This snowball effect allows your returns to generate even more returns over time, significantly accelerating your wealth-building journey.

- DRIPs (Dividend Reinvestment Plans): Many companies offer DRIPs, which automatically reinvest your dividends, simplifying the process.

- Long-term benefits of compounding: The longer you reinvest your dividends, the more dramatic the effect of compounding becomes.

- Illustrative example: Investing $10,000 annually with a 7% average annual return and dividend reinvestment could grow to over $500,000 in 30 years – a testament to the power of compounding.

Regularly Review and Rebalance Your Portfolio

Maintaining a Healthy Portfolio

Regular review and rebalancing are crucial to maintaining a healthy dividend portfolio. Market conditions change, and your portfolio needs to adapt to ensure it remains aligned with your financial goals and risk tolerance.

- Annual portfolio review: Assess the performance of your individual holdings and the overall portfolio. Identify any underperformers and consider adjustments.

- Rebalancing: Selling overperforming assets and buying underperforming ones helps maintain your target asset allocation and manage risk.

- Consider professional financial advice: For complex portfolios or if you lack the time or expertise, consulting a financial advisor can provide valuable guidance.

Avoid Chasing High Yields

Understanding the Risks of High-Yield Traps

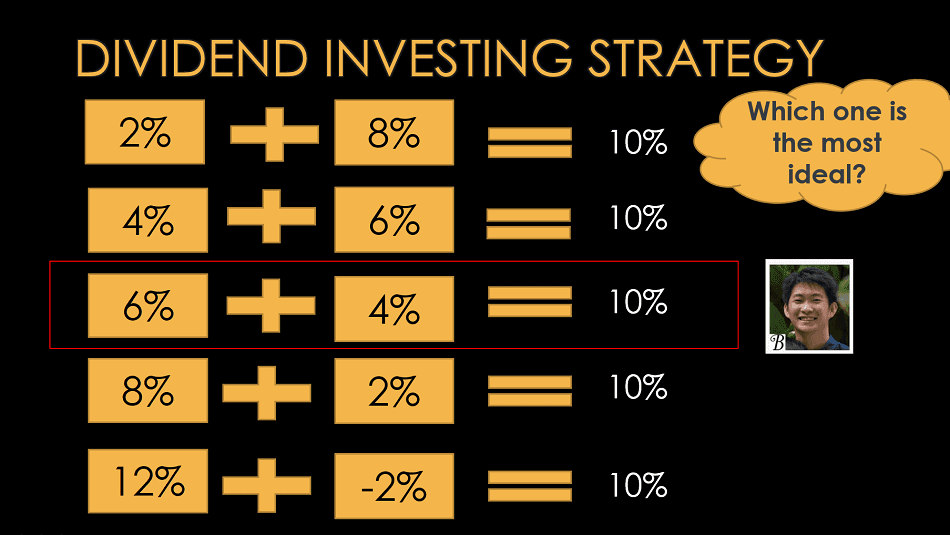

While high dividend yields are tempting, it’s crucial to focus on sustainable dividend growth rather than simply chasing the highest yield. Unusually high yields often signal underlying financial problems that could jeopardize your investment.

- High-yield stocks may be unsustainable: Companies struggling financially might offer high yields to attract investors, but these payouts might not last.

- Focus on the company's financial health: Analyze key financial metrics like the dividend payout ratio and debt levels before investing.

- Research the reason behind high yields: Understand why a company offers such a high yield. Is it a temporary measure, or are there serious underlying issues?

Conclusion:

The most effective dividend strategy is surprisingly simple: focus on high-quality dividend aristocrats, diversify your portfolio, reinvest dividends for compounding growth, regularly review and rebalance, and avoid chasing unsustainable high yields. By following these straightforward steps, you can build a solid foundation for long-term wealth and generate a consistent stream of passive income. Start building your portfolio today with a simple, yet effective dividend strategy! Learn more about selecting the right high-yield dividend stocks and achieving your financial goals through consistent, sustainable dividend investing.

Featured Posts

-

The Next Pope Examining 9 Possible Candidates For The Papacy

May 11, 2025

The Next Pope Examining 9 Possible Candidates For The Papacy

May 11, 2025 -

Grand Slam Track A Bold New League For Track And Field

May 11, 2025

Grand Slam Track A Bold New League For Track And Field

May 11, 2025 -

Crazy Rich Asians Tv Series Jon M Chus Update

May 11, 2025

Crazy Rich Asians Tv Series Jon M Chus Update

May 11, 2025 -

Keanu Reeves John Wick 5 Everything We Know So Far

May 11, 2025

Keanu Reeves John Wick 5 Everything We Know So Far

May 11, 2025 -

Bayern Munichs Thomas Mueller A Heartfelt Farewell After 25 Years

May 11, 2025

Bayern Munichs Thomas Mueller A Heartfelt Farewell After 25 Years

May 11, 2025