The Night Of April 8th: What Happened In The Treasury Market?

Table of Contents

The Sudden Surge in Treasury Yields

The night of April 8th saw a significant and unexpected increase in Treasury yields across the board. This sharp rise represented a dramatic shift in market sentiment and underscored underlying vulnerabilities within the financial system. The speed and magnitude of the moves were particularly striking.

- Specific yield changes: The 2-year Treasury yield spiked by approximately X%, the 10-year yield jumped by Y%, and the 30-year yield increased by Z%. (Note: Replace X, Y, and Z with actual percentage increases from April 8th, 2023 data. Include a chart or graph visually representing these changes.)

- Percentage increases and historical context: These percentage increases were historically significant, exceeding typical daily fluctuations by a considerable margin. The last time such a dramatic shift was observed was [insert relevant historical comparison, if any].

- Trading hours and time frames: The most significant moves occurred between [specific time range] during the late afternoon and evening trading sessions in the US. This timing suggests potential factors beyond regular market forces at play.

Underlying Factors Contributing to the Volatility

Several factors contributed to the dramatic volatility observed in the Treasury market on April 8th. The confluence of these events created a perfect storm, leading to the sharp increase in yields.

- Bank failures and liquidity concerns: The recent failures of several regional banks, particularly [mention specific banks if relevant], fueled concerns about the overall health of the banking sector and its liquidity. This triggered a flight to safety, driving up demand for U.S. Treasury securities, considered the safest assets.

- Increased demand for safe-haven assets: As investors sought refuge from perceived risks in the banking sector and broader economy, the demand for U.S. Treasury bonds – seen as a safe-haven asset – increased significantly. This surge in demand put upward pressure on prices and, consequently, pushed yields higher.

- Impact of quantitative tightening (QT): The Federal Reserve's ongoing quantitative tightening (QT) program, which involves reducing its balance sheet by allowing Treasury securities to mature without reinvestment, contributed to reduced liquidity in the market. This made the market more susceptible to sharp price swings.

- Role of algorithmic trading and high-frequency trading: The speed and scale of the yield movements suggest a significant role played by algorithmic and high-frequency trading strategies. These automated trading systems can amplify market fluctuations, especially in times of uncertainty.

- Potential impact of geopolitical factors: While not the primary driver, ongoing geopolitical tensions could have exacerbated market anxieties, further contributing to the demand for safe-haven assets like Treasuries.

The Role of Repo Markets

The repo market, where banks and other financial institutions borrow and lend short-term funds using Treasury securities as collateral, plays a critical role in the functioning of the Treasury market. Disruptions in this market can have significant spillover effects.

- Repo transactions explained: Repo transactions involve selling securities with an agreement to repurchase them at a later date at a slightly higher price, effectively a short-term loan.

- Strains in the repo market: Concerns about the stability of some banks likely led to increased strain in the repo market, as institutions became more hesitant to lend, driving up repo rates.

- Relationship between repo rates and Treasury yields: Higher repo rates can indirectly influence Treasury yields, as they reflect the cost of borrowing funds to invest in Treasuries.

Implications for the Broader Financial System

The events of April 8th had significant implications for the broader financial system and the global economy.

- Impact on other asset classes: The surge in Treasury yields influenced other asset classes, particularly stocks and corporate bonds. Increased borrowing costs put downward pressure on these markets.

- Effect on borrowing costs: Higher Treasury yields generally translate to higher borrowing costs for businesses and consumers, potentially impacting economic growth.

- Potential implications for monetary policy: The events of April 8th might influence the Federal Reserve's monetary policy decisions, potentially affecting future interest rate hikes or the pace of QT.

- Global market reactions: The turmoil in the U.S. Treasury market had ripple effects across global markets, impacting investor sentiment and exchange rates worldwide.

Regulatory Response and Market Stabilization

Following the market turmoil, central banks and regulators took steps to address the situation and stabilize the Treasury market.

- Federal Reserve actions: The Federal Reserve [describe specific actions taken by the Fed, e.g., increased liquidity injections, communication efforts to calm markets].

- Actions by other central banks: [Mention actions taken by other relevant central banks or regulatory bodies].

- Effectiveness of interventions: The effectiveness of these interventions in stabilizing the Treasury market remains a subject of ongoing analysis and debate.

Conclusion

The night of April 8th, 2023, marked a significant event in the U.S. Treasury market. The dramatic surge in Treasury yields underscored underlying vulnerabilities within the banking system and highlighted the interconnectedness of various financial markets. Factors including bank failures, increased demand for safe-haven assets, quantitative tightening, and the role of algorithmic trading all contributed to the volatility. The events had significant implications for the broader financial system and global economy, leading to regulatory responses aimed at market stabilization.

Understanding the intricacies of the Treasury market and events like the one on April 8th is crucial for investors and financial professionals alike. To stay informed on future developments in the Treasury market, subscribe to our newsletter and follow our blog for regular updates on Treasury yields and bond market analysis. Learn more about navigating the complexities of the Treasury market with our comprehensive resources.

Featured Posts

-

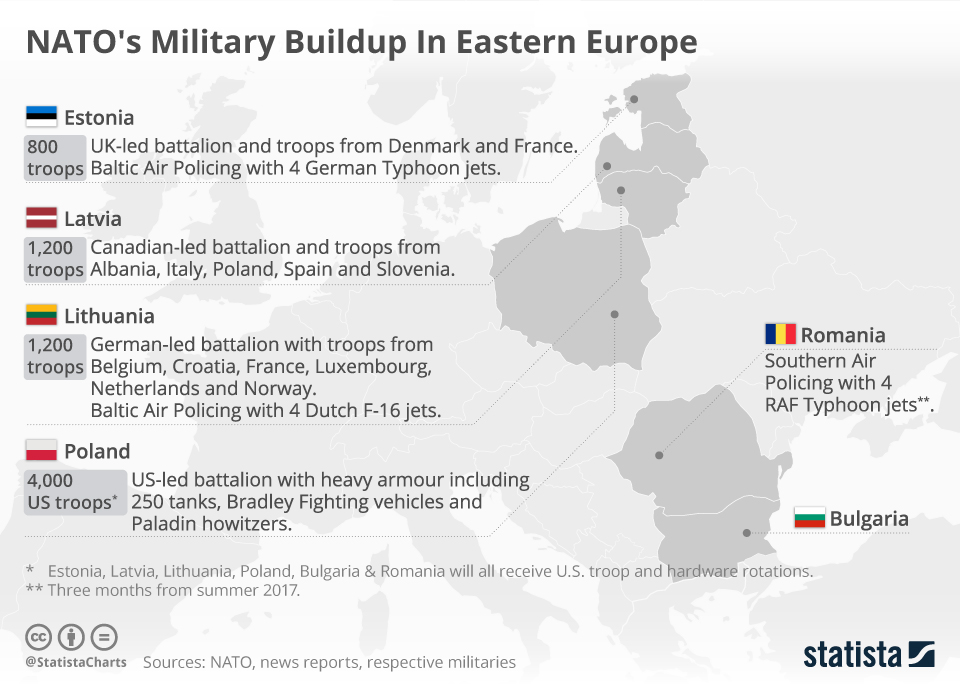

Russias Military Buildup Keeping Europe On High Alert

Apr 29, 2025

Russias Military Buildup Keeping Europe On High Alert

Apr 29, 2025 -

Historic Promotion For Wrexham Ryan Reynolds Involvement

Apr 29, 2025

Historic Promotion For Wrexham Ryan Reynolds Involvement

Apr 29, 2025 -

Nyt Strands March 15 2025 Clues Answers And Spangram Solution

Apr 29, 2025

Nyt Strands March 15 2025 Clues Answers And Spangram Solution

Apr 29, 2025 -

China Greenlights 10 New Nuclear Reactors Fueling Energy Growth

Apr 29, 2025

China Greenlights 10 New Nuclear Reactors Fueling Energy Growth

Apr 29, 2025 -

European Power Prices Plunge Solar Surge Sends Prices Below Zero

Apr 29, 2025

European Power Prices Plunge Solar Surge Sends Prices Below Zero

Apr 29, 2025

Latest Posts

-

8 Mart Onkokhirurg I Fitnes Trenor Obedinyavat Sili Za Borba S Raka Na Grdata

Apr 30, 2025

8 Mart Onkokhirurg I Fitnes Trenor Obedinyavat Sili Za Borba S Raka Na Grdata

Apr 30, 2025 -

I Ekseliksi Ton Ypologiston Inon Kai I Efarmogi Toys Stin Ygeia

Apr 30, 2025

I Ekseliksi Ton Ypologiston Inon Kai I Efarmogi Toys Stin Ygeia

Apr 30, 2025 -

Iva I Siyana Uspekht Prodlzhava

Apr 30, 2025

Iva I Siyana Uspekht Prodlzhava

Apr 30, 2025 -

Grip Prof Iva Khristova Oprovergava Opaseniyata Za Nova Vlna

Apr 30, 2025

Grip Prof Iva Khristova Oprovergava Opaseniyata Za Nova Vlna

Apr 30, 2025 -

Obnova Konania V Unose Studentky Sony Stredajsie Sudne Pojednavanie

Apr 30, 2025

Obnova Konania V Unose Studentky Sony Stredajsie Sudne Pojednavanie

Apr 30, 2025