The Numbers Don't Lie: Evaluating The GOP Tax Plan's Deficit Claims

Table of Contents

Examining the GOP Tax Plan's Projected Revenue

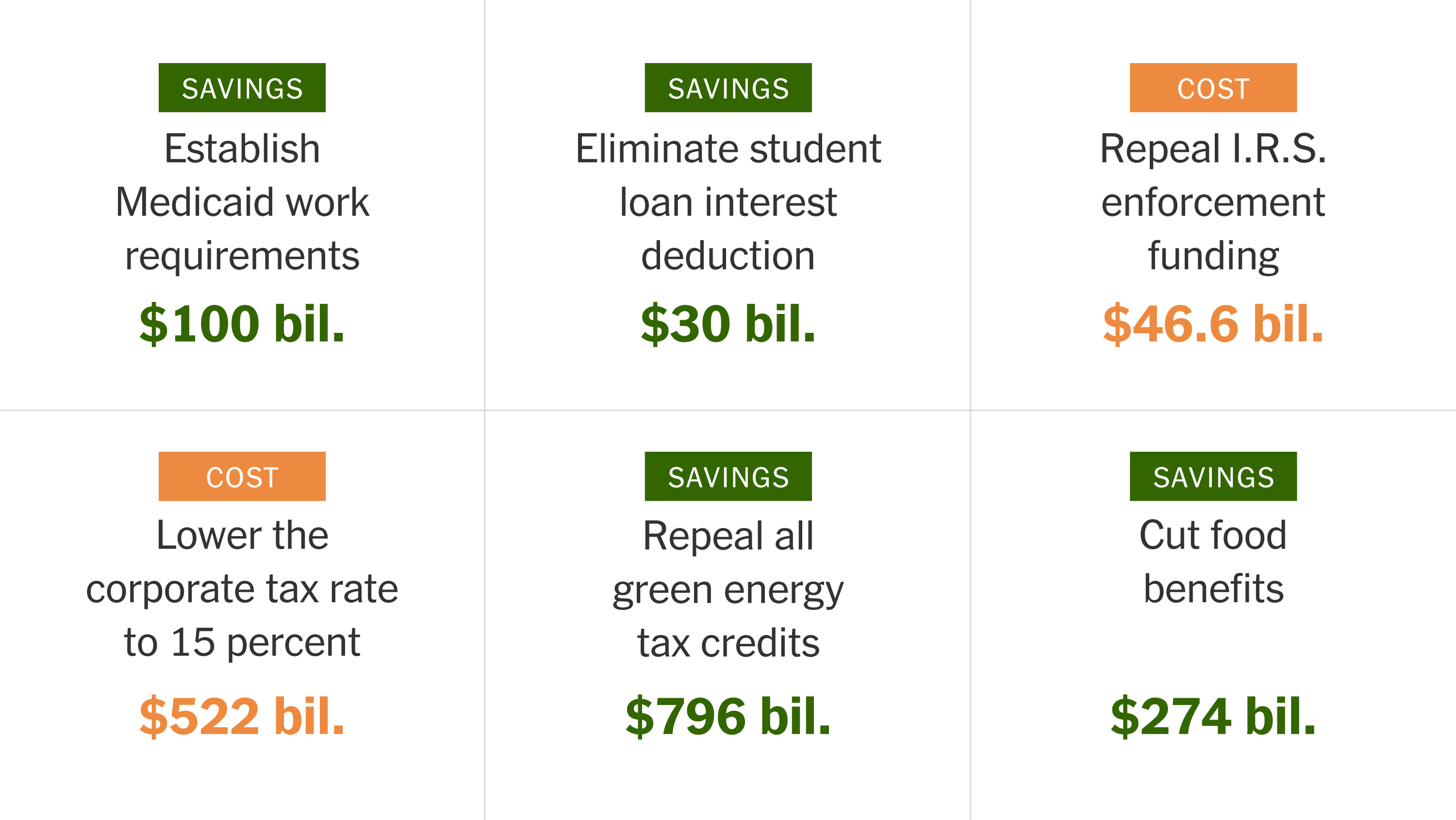

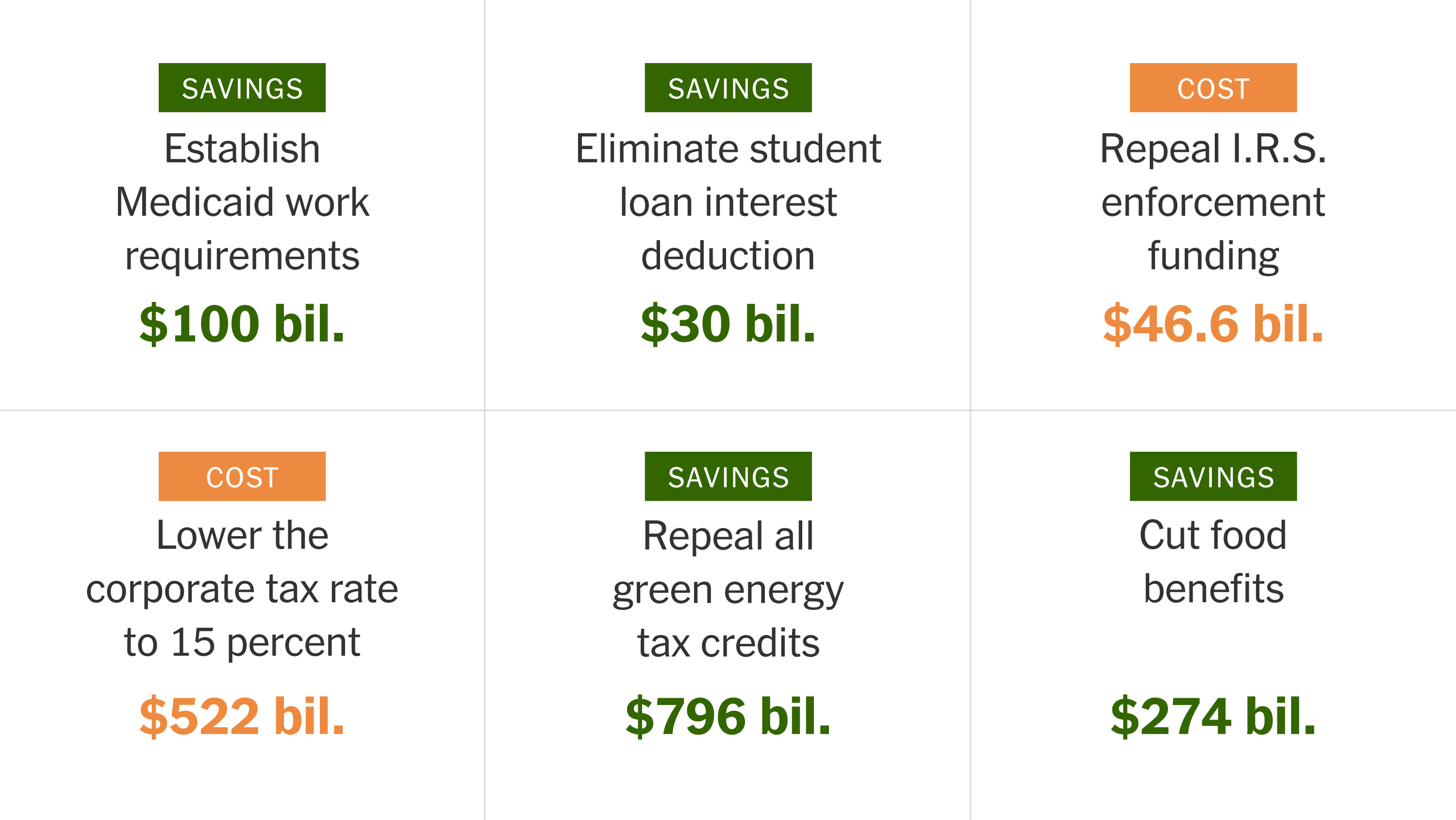

The core of the debate surrounding the GOP tax plan centers on its projected impact on federal revenue. Accurately predicting this impact requires careful consideration of the methodologies used.

Static vs. Dynamic Scoring

Estimating the revenue effects of tax changes involves two primary approaches: static and dynamic scoring. Understanding the difference between these methods is crucial to interpreting the often-conflicting projections surrounding the GOP tax plan.

-

Static Scoring: This method assumes that taxpayer behavior remains unchanged following a tax cut. It simply calculates the direct revenue loss from the lower tax rates.

- Example: A 10% tax cut on corporate income is assumed to directly reduce government revenue by 10% of the existing corporate income tax base.

- Criticism: Static scoring ignores the potential for behavioral changes, such as increased investment or altered business decisions, that might offset some of the revenue loss.

-

Dynamic Scoring: This approach incorporates the anticipated behavioral responses of taxpayers to the tax changes. It attempts to model how individuals and businesses will adjust their economic activity in response to the new tax rates.

- Example: A dynamic model might predict increased investment spurred by a corporate tax cut, leading to higher economic growth and ultimately, increased tax revenue from other sources.

- Criticism: Dynamic scoring relies on complex economic models and assumptions that can be difficult to validate and are prone to uncertainty. The projections are highly sensitive to the specific parameters used in the model.

The choice between static and dynamic scoring significantly influences the predicted revenue impact of the GOP tax plan. The inherent limitations and biases of each method necessitate careful consideration of the underlying assumptions when evaluating the GOP tax revenue projections. Understanding the "static scoring methodology" and the "dynamic scoring model limitations" is essential for critical analysis.

Analyzing Tax Cut Impacts on Specific Income Brackets

The GOP tax plan typically proposes tax cuts across different income brackets. Analyzing the effects on each bracket is crucial for a complete understanding of the plan’s impact.

-

Breakdown of Tax Cuts by Income Bracket: Past GOP tax plans have often included disproportionate tax cuts for higher-income individuals and corporations. A detailed analysis needs to examine the proposed changes to tax rates, deductions, and credits for each bracket.

-

Projected Revenue Changes for Each Bracket: Examining the projected revenue changes for each income bracket helps determine if the tax cuts are self-financing. This requires analyzing the interplay between the reduced tax rates and any potential behavioral responses.

-

Consideration of Potential Behavioral Responses: A thorough analysis should account for potential behavioral changes, such as increased savings or investment by higher-income individuals, which may or may not offset the direct revenue losses. The "GOP tax cuts impact" on different income brackets and the resulting "tax revenue projections by income" are key components in a comprehensive assessment.

Assessing the GOP Tax Plan's Spending Projections

Beyond revenue projections, assessing the GOP tax plan’s impact on the deficit requires examining the plan’s assumptions about government spending.

Evaluating the Assumptions Underlying Spending Forecasts

The accuracy of the GOP tax plan's deficit projections hinges critically on the underlying assumptions about future government spending.

-

Examples of Assumptions: These often include projected economic growth rates, future healthcare costs, and anticipated defense spending. These assumptions are not always explicitly stated and can vary significantly depending on the source.

-

Potential Sources of Error: These assumptions are inherently uncertain and prone to error. Unforeseen economic downturns, unexpected healthcare cost increases, or changes in geopolitical situations could significantly alter actual spending levels. Accurate assessment of the "GOP spending projections" and "government spending forecasts" are key in evaluating the plan's credibility. The accuracy of "deficit projections accuracy" is directly related to the quality of these assumptions.

Considering the Impact of Economic Growth on the Deficit

The relationship between economic growth and the deficit is crucial to analyzing the GOP tax plan's claims.

-

How Economic Growth Affects Tax Revenue and Government Spending: Faster economic growth generally leads to higher tax revenue and lower government spending on social programs (due to reduced demand). Conversely, slower growth can lead to lower tax revenue and higher spending.

-

The Plan's Reliance on Growth: Many GOP tax plans rely heavily on anticipated economic growth to offset revenue losses from tax cuts. This often requires a higher-than-average growth rate, potentially making the projections optimistic.

-

Analysis of the Plausibility of Projected Growth Rates: Critically examining whether the projected growth rates are realistic is essential. This involves comparing the projected rates to historical trends, expert forecasts, and independent economic models. Analyzing the "economic growth impact" and the "GOP tax plan economic growth assumptions" is critical to determining the feasibility of the plan's deficit claims. The plan's success depends largely on the "deficit reduction strategies" it employs and their effectiveness.

Comparing the GOP Tax Plan to Independent Analyses

To obtain a more objective evaluation, it's vital to compare the GOP's projections with those of independent organizations.

Reviewing the Findings of Independent Economic Organizations

Several non-partisan organizations, such as the Congressional Budget Office (CBO) and the Tax Policy Center, provide independent analyses of proposed tax plans.

-

Specific Findings from Various Organizations: These organizations use different methodologies and assumptions, but their findings often provide a valuable counterpoint to the GOP's own projections.

-

Comparison of Their Analyses with the GOP's Own Projections: A side-by-side comparison of these analyses highlights areas of agreement and disagreement, helping to identify potential biases and limitations in the various projections. Examining the "independent analysis GOP tax plan," "CBO deficit projections," and "Tax Policy Center findings" offers a balanced perspective. Obtaining a "third-party analysis" from multiple independent sources strengthens the objectivity of the overall assessment.

Highlighting Discrepancies and Explaining Potential Causes

Significant discrepancies often arise between the GOP's claims and independent analyses.

-

Examples of Discrepancies: These may involve differences in projected revenue increases, the predicted impact on the deficit, or the estimated economic effects of the tax cuts.

-

Explanations for the Differences: These differences often stem from variations in methodological approaches, differing assumptions about economic growth, or the incorporation of various behavioral responses. Investigating the "GOP tax plan discrepancies" and the "deficit projection differences" helps determine the reliability of each projection. A thorough "analysis comparison" reveals the strengths and weaknesses of each approach.

Conclusion

This analysis of the GOP tax plan's deficit claims reveals a significant gap between the party's projections and those of independent economic organizations. The discrepancies highlight the importance of critically evaluating the methodologies and assumptions used to predict the plan’s fiscal impact. By understanding the complexities of static vs. dynamic scoring, the impact of economic growth projections, and the potential biases inherent in different analyses, we can form a more informed opinion on the long-term fiscal consequences of the GOP Tax Plan. Further research into the specific details and independent analyses of future GOP tax plans is crucial for responsible engagement with the ongoing debate around the GOP Tax Plan Deficit.

Featured Posts

-

Switzerlands Response To Chinas Increased Military Activity

May 21, 2025

Switzerlands Response To Chinas Increased Military Activity

May 21, 2025 -

To Buy Or Not To Buy Big Bear Ai Stock A Data Driven Approach

May 21, 2025

To Buy Or Not To Buy Big Bear Ai Stock A Data Driven Approach

May 21, 2025 -

Hypotheken Intermediair Karin Polman Neemt Directie Abn Amro Florius En Moneyou Over

May 21, 2025

Hypotheken Intermediair Karin Polman Neemt Directie Abn Amro Florius En Moneyou Over

May 21, 2025 -

Building Bridges The Sound Perimeter Effect Of Shared Musical Experiences

May 21, 2025

Building Bridges The Sound Perimeter Effect Of Shared Musical Experiences

May 21, 2025 -

Amazon Workers Union Fights Warehouse Shutdowns In Quebec

May 21, 2025

Amazon Workers Union Fights Warehouse Shutdowns In Quebec

May 21, 2025