The Private Credit Hiring Process: 5 Essential Do's And Don'ts

Table of Contents

Do's of the Private Credit Hiring Process

Do Your Research:

Thorough research is paramount. Understanding the specific firm's investment strategy, recent deals, and key personnel demonstrates genuine interest and sets you apart from other candidates in the competitive private credit jobs market. This shows you're not just applying for any Private Credit job, but specifically this one.

- Analyze the firm's website: Look beyond the homepage; delve into their investment philosophy, portfolio companies, and team biographies.

- LinkedIn is your friend: Research the LinkedIn profiles of key employees, including managing directors and partners. Look for commonalities in their backgrounds and experience to highlight in your application. Understanding their career paths within private credit can provide valuable insights.

- Stay up-to-date: Read recent news articles and press releases about the firm's activities. Knowing about recent deals or investments shows you're actively following the industry and the firm's trajectory within the broader world of alternative investments.

- Identify specific deals: Identify specific deals or portfolio companies that resonate with your interests and highlight your knowledge in your application materials and during interviews. This demonstrates a proactive approach and deeper understanding beyond surface-level knowledge.

Network Strategically:

Networking within the private credit industry is vital. It's not just about who you know, but also how you leverage those connections.

- Attend industry events: Conferences and workshops are excellent opportunities to meet professionals and learn about the latest trends in private credit and alternative investments.

- Leverage your network: Reach out to your existing network—former professors, classmates, or mentors—for introductions and insights into private credit roles and firms.

- Utilize LinkedIn effectively: Engage meaningfully with recruiters and hiring managers on LinkedIn. Don't just send generic connection requests; personalize your message showing you've researched their background.

Tailor Your Resume and Cover Letter:

Generic applications won't cut it. Private credit firms receive many applications for Credit Analyst jobs and other positions. Show them you're a perfect fit.

- Quantify your accomplishments: Instead of simply stating your responsibilities, quantify your achievements whenever possible (e.g., "Increased efficiency by 15%," "Managed a portfolio of $X million").

- Keyword optimization is key: Use keywords from the job description in your resume and cover letter. This helps Applicant Tracking Systems (ATS) identify your application as a potential match.

- Showcase your understanding: Demonstrate your understanding of private credit concepts and terminology, such as direct lending, mezzanine financing, distressed debt, and other relevant investment strategies. This indicates your preparation and genuine interest.

Prepare for Behavioral and Technical Interviews:

Private credit interviews often involve a rigorous process encompassing both behavioral and technical questions. Preparation is key.

- Practice behavioral questions: Practice answering common behavioral interview questions (e.g., "Tell me about a time you failed," "Describe a challenging situation and how you overcame it"). Focus on showcasing your problem-solving skills and teamwork abilities.

- Master the technical side: Be prepared to discuss your understanding of financial statements, credit analysis, valuation methodologies (DCF, LBO), and financial modeling skills. Practice creating and interpreting these models.

- Case studies are crucial: Be ready for case study questions that test your analytical and problem-solving skills within the context of private credit investing.

Follow Up Professionally:

After each interview, a thoughtful follow-up demonstrates professionalism and reinforces your candidacy.

- Personalize your thank-you note: Don't send generic emails. Tailor your thank-you note to each interviewer, mentioning specific points discussed during the conversation.

- Reinforce your interest: Reiterate your enthusiasm for the opportunity and highlight your key qualifications that align with the firm's needs and the specific role.

- Timely follow-up: Send your thank-you note within 24 hours of the interview.

Don'ts of the Private Credit Hiring Process

Don't Neglect the Fundamentals:

A strong foundation in finance is non-negotiable. Don't underestimate the importance of mastering core concepts.

- Brush up on financial modeling: Ensure your skills in financial modeling, particularly in Excel, are sharp.

- Review accounting principles: A solid understanding of accounting principles (GAAP) is crucial for analyzing financial statements.

- Understand credit risk: Demonstrate a comprehensive understanding of credit risk assessment methodologies and various credit scoring models.

Don't Be Unprepared:

Lack of preparation is a significant red flag. Thorough preparation demonstrates your commitment and seriousness.

- Understand the firm's investment strategy: Don't go into an interview without a clear understanding of the firm's investment thesis, target sectors, and recent transactions.

- Practice technical questions: Anticipate technical questions and practice your responses until you can explain complex concepts concisely and clearly.

- Prepare questions to ask: Asking thoughtful questions showcases your interest and engagement.

Don't Be Overconfident or Arrogant:

Humility and a willingness to learn are essential qualities in the private credit industry.

- Listen actively: Listen attentively to the interviewer's questions and avoid interrupting.

- Maintain a respectful attitude: Approach the interview with respect and a collaborative spirit.

- Show eagerness to learn: Demonstrate a genuine interest in learning and growing within the firm.

Don't Rush the Process:

The private credit hiring process can be lengthy. Maintain patience and professionalism.

- Follow up appropriately: Follow up politely, but avoid excessive contact.

- Be prepared for multiple rounds: Understand that the process often involves multiple rounds of interviews with different team members.

- Stay positive: Don't get discouraged if you don't hear back immediately.

Don’t Underestimate the Importance of Culture Fit:

Private credit firms value cultural fit highly. Research the firm's culture and align your responses accordingly.

- Research employee reviews: Utilize sites like Glassdoor to understand the firm's work environment and culture.

- Ask about company culture: Ask thoughtful questions during the interview process to demonstrate your interest in understanding the firm’s culture.

- Demonstrate alignment: Try to show that your work style and values align with the firm's culture.

Conclusion:

Securing a position in private credit requires diligent preparation and a strategic approach. By following these do's and don'ts, you can significantly improve your chances of success in navigating the rigorous private credit hiring process. Remember to thoroughly research firms, network effectively, and showcase your skills and knowledge of alternative investments. Don't be discouraged by the competitive landscape; with dedication and the right approach, you can land your dream job in private credit. Start your journey to a successful private credit career today!

Featured Posts

-

Eurovisions Most Controversial Acts A Look Back As The Uk Unveils 2025 Entry

May 18, 2025

Eurovisions Most Controversial Acts A Look Back As The Uk Unveils 2025 Entry

May 18, 2025 -

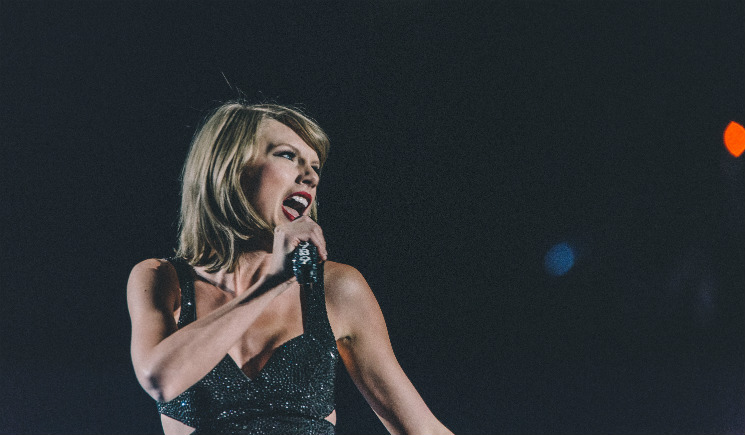

Taylor Swifts Legal Battle Against Kanye Wests Explicit Lyrics

May 18, 2025

Taylor Swifts Legal Battle Against Kanye Wests Explicit Lyrics

May 18, 2025 -

A Comprehensive Guide To The Countrys Emerging Business Hot Spots

May 18, 2025

A Comprehensive Guide To The Countrys Emerging Business Hot Spots

May 18, 2025 -

Taylor Swift Taylors Version Albums Ranked From Worst To Best So Far

May 18, 2025

Taylor Swift Taylors Version Albums Ranked From Worst To Best So Far

May 18, 2025 -

Damiano David Di Maneskin Annuncia Il Suo Album Solista Funny Little Fears

May 18, 2025

Damiano David Di Maneskin Annuncia Il Suo Album Solista Funny Little Fears

May 18, 2025

Latest Posts

-

Assessing Carneys Cabinet A Call For Responsible Governance

May 18, 2025

Assessing Carneys Cabinet A Call For Responsible Governance

May 18, 2025 -

Will Canadian Tires Acquisition Of Hudsons Bay Pay Off A Comprehensive Analysis

May 18, 2025

Will Canadian Tires Acquisition Of Hudsons Bay Pay Off A Comprehensive Analysis

May 18, 2025 -

Analyzing The Canadian Tire Hudsons Bay Merger Opportunities And Challenges

May 18, 2025

Analyzing The Canadian Tire Hudsons Bay Merger Opportunities And Challenges

May 18, 2025 -

Amazon Faces Quebec Labour Tribunal Over Warehouse Closings And Union Disputes

May 18, 2025

Amazon Faces Quebec Labour Tribunal Over Warehouse Closings And Union Disputes

May 18, 2025 -

Kahnawake Casino Dispute 220 Million Lawsuit Shakes Mohawk Council

May 18, 2025

Kahnawake Casino Dispute 220 Million Lawsuit Shakes Mohawk Council

May 18, 2025