The Real Safe Bet: Investing Strategies For Secure Returns

Table of Contents

Diversification: Spreading Your Risk Across Asset Classes

A core principle of successful investing is diversification. This involves spreading your investments across different asset classes to minimize the impact of poor performance in any single area. If one investment underperforms, others may offset those losses, protecting your overall portfolio value. Effective investment diversification is key to mitigating risk. A well-diversified portfolio should include:

- Stocks: Investing in stocks from various sectors (technology, healthcare, consumer goods, etc.) and market capitalizations (large-cap, mid-cap, small-cap) provides broader exposure and reduces reliance on any single company's performance.

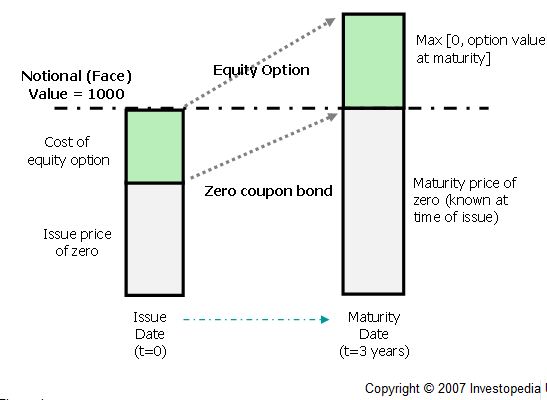

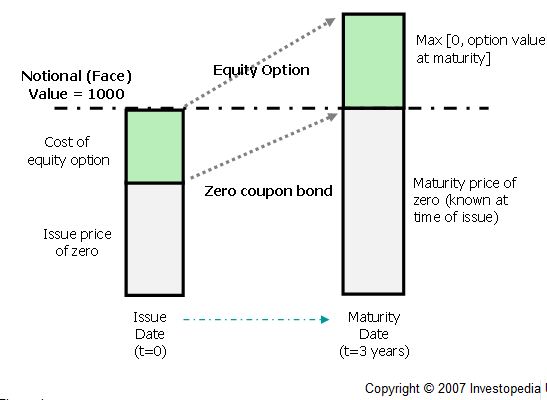

- Bonds: Bonds, representing loans to governments or corporations, offer a relatively lower-risk, fixed-income component to your portfolio. Consider diversifying across government bonds, corporate bonds, and municipal bonds to spread your risk further.

- Real Estate: Real estate, including rental properties or Real Estate Investment Trusts (REITs), can provide diversification and potential for rental income or capital appreciation.

- Commodities: Commodities like gold and oil can act as a hedge against inflation and offer diversification benefits.

- Alternative Investments: While higher risk, alternative investments such as hedge funds and private equity can potentially offer higher returns, but should be considered cautiously and only as a part of a well-diversified strategy.

Example: A simple diversified portfolio might allocate 40% to stocks, 30% to bonds, 20% to real estate, and 10% to commodities. This is just an example; the optimal asset allocation depends on individual circumstances and risk tolerance. Careful consideration of your portfolio diversification is crucial for long-term success. Proper asset allocation is paramount for mitigating risk effectively.

Value Investing: Finding Undervalued Gems

Value investing is a long-term strategy focused on identifying companies trading below their intrinsic value. This involves thorough fundamental analysis to uncover opportunities where the market has mispriced a company's true worth. Value investors like Warren Buffett have built immense wealth through this approach. Key principles of value investing include:

- Fundamental Analysis: Analyzing a company's financial statements (balance sheets, income statements, cash flow statements) to assess its financial health and profitability.

- Understanding Valuation Metrics: Using metrics like the Price-to-Earnings (P/E) ratio to determine whether a stock is undervalued compared to its peers and its own historical performance.

- Long-Term Investment Horizon: Value investing requires patience; undervalued companies may take time to reach their true potential.

- Patience and Discipline: Resisting the urge to sell during market downturns is crucial for long-term success in value investing. Sticking to a well-researched strategy is key.

Successful value investors, such as Warren Buffett, exemplify the power of this approach, demonstrating how identifying undervalued stocks can lead to substantial long-term gains. This strategy of value investing requires significant research and a long-term outlook, but it can be very rewarding.

Index Fund Investing: The Power of Passive Investing

Index fund investing offers a simple, cost-effective way to participate in market growth. Index funds passively track a specific market index (like the S&P 500), providing instant diversification across a wide range of companies.

- Lower Expense Ratios: Index funds typically have much lower expense ratios than actively managed funds, resulting in higher returns over time.

- Built-in Diversification: By tracking an index, you automatically gain diversification across many different companies, reducing your risk.

- Long-Term Growth Potential: Index funds aim to mirror the market's overall performance, providing the potential for long-term growth.

- Beginner-Friendly: Index funds are an excellent entry point for beginners due to their simplicity and low management fees. They represent a simple yet effective way to participate in market growth.

Example: Over the long term, index funds have historically outperformed many actively managed funds due to their lower fees and inherent diversification. Consider comparing the returns of a broad market index fund like the S&P 500 to actively managed funds over a 10-20 year period to see the difference. Investing in ETFs (Exchange Traded Funds) is another efficient way to implement this strategy.

Dollar-Cost Averaging (DCA): Reducing Market Timing Risk

Dollar-cost averaging (DCA) involves investing a fixed amount of money at regular intervals (e.g., monthly), regardless of market fluctuations. This strategy mitigates the risk of investing a lump sum at a market peak.

- Reduced Emotional Decision-Making: DCA removes the pressure of trying to time the market, reducing emotional investment decisions.

- Averaging Out Purchase Price: By investing consistently, you average out your purchase price, minimizing the impact of market volatility.

- Beginner-Friendly: DCA is particularly suitable for beginners due to its simplicity and risk-reducing nature.

- Less Susceptible to Market Timing Errors: DCA significantly reduces the risk associated with trying to predict market tops and bottoms.

Example: A chart comparing lump-sum investing versus DCA during a period of market volatility would clearly show how DCA can smooth out returns and reduce the impact of market downturns. The power of DCA lies in its consistent nature, smoothing out investment returns over time.

The Importance of Professional Advice

While these strategies offer effective approaches to building a secure investment portfolio, seeking personalized guidance from a qualified financial advisor is crucial. A financial advisor can help you develop an investment plan aligned with your individual financial goals, risk tolerance, and time horizon. They can provide valuable insights tailored to your circumstances, offering personalized investment advice and helping you navigate complex financial decisions. A comprehensive financial plan is invaluable for long-term success. Consider consulting a financial planner to help create a truly personalized plan.

Securing Your Financial Future with Proven Investing Strategies

In conclusion, diversification, value investing, index fund investing, and dollar-cost averaging are powerful investing strategies for secure returns. By combining these approaches and considering your individual risk tolerance, you can significantly enhance your chances of achieving your financial goals. Remember to always consider your risk tolerance and seek professional financial advice to build a personalized investment plan. Start building your secure financial future today by exploring these investing strategies for secure returns. Learn more about creating your secure financial future by [link to relevant resource, e.g., financial planning tools or advisor directory].

Featured Posts

-

Melanie Griffith And Siblings Support Dakota Johnson At Materialist Premiere

May 09, 2025

Melanie Griffith And Siblings Support Dakota Johnson At Materialist Premiere

May 09, 2025 -

Changes To Uk Visa System Increased Scrutiny For Work And Student Applications

May 09, 2025

Changes To Uk Visa System Increased Scrutiny For Work And Student Applications

May 09, 2025 -

Ocasio Cortezs Strong Words For Trump And Fox News

May 09, 2025

Ocasio Cortezs Strong Words For Trump And Fox News

May 09, 2025 -

Weight Watchers Bankruptcy Filing Impact Of Weight Loss Drugs

May 09, 2025

Weight Watchers Bankruptcy Filing Impact Of Weight Loss Drugs

May 09, 2025 -

Beyonces Concert Fuels Cowboy Carters Streaming Numbers

May 09, 2025

Beyonces Concert Fuels Cowboy Carters Streaming Numbers

May 09, 2025

Latest Posts

-

Match Dijon Concarneau Score Final Et Resume De La 28e Journee De National 2 2024 2025

May 09, 2025

Match Dijon Concarneau Score Final Et Resume De La 28e Journee De National 2 2024 2025

May 09, 2025 -

Defaite De Dijon Face A Concarneau 0 1 En National 2 04 04 2025

May 09, 2025

Defaite De Dijon Face A Concarneau 0 1 En National 2 04 04 2025

May 09, 2025 -

National 2 Dijon Concede La Defaite Face A Concarneau 0 1

May 09, 2025

National 2 Dijon Concede La Defaite Face A Concarneau 0 1

May 09, 2025 -

Resultat Dijon Concarneau 0 1 National 2 2024 2025 Journee 28

May 09, 2025

Resultat Dijon Concarneau 0 1 National 2 2024 2025 Journee 28

May 09, 2025 -

Uk Immigration Policy Update Restrictions On Visa Applications

May 09, 2025

Uk Immigration Policy Update Restrictions On Visa Applications

May 09, 2025