The Real Safe Bet: Your Guide To Smart Investing

Table of Contents

Understanding Your Risk Tolerance

Before diving into specific investment strategies, it's crucial to understand your risk tolerance. This involves honestly assessing your comfort level with potential losses and aligning your investment approach with your financial goals.

Defining Your Investment Goals:

What are you saving for? Understanding your objectives is paramount in determining the appropriate level of risk you can comfortably take. Your goals can be categorized into:

-

Short-term goals: These typically involve needs within the next 1-3 years, such as:

- Creating an emergency fund (3-6 months of living expenses)

- Saving for a down payment on a house

- Funding a major purchase (car, home renovation)

-

Long-term goals: These are typically longer than 5 years, including:

- Retirement planning

- Funding your children's education

- Building long-term wealth

Your investment strategy must directly correlate to your timeline. Short-term goals require lower-risk investments, while long-term goals allow for potentially higher-risk, higher-reward options.

Assessing Your Risk Profile:

Are you a conservative, moderate, or aggressive investor? This isn't about guesswork; it’s about honest self-assessment. Ask yourself these questions:

- How comfortable are you with the possibility of losing some or all of your investment?

- What is your age and how close are you to retirement?

- What is your overall financial situation? Do you have significant savings beyond your investments?

Your age and financial situation heavily influence your risk tolerance. Younger investors generally have a longer time horizon to recover from potential losses, allowing for a more aggressive investment approach. Conversely, those nearing retirement may prefer a more conservative strategy to protect their accumulated savings.

Different asset classes carry different levels of risk:

- Stocks: Historically offer higher returns but also higher volatility.

- Bonds: Generally considered less risky than stocks, offering more stability.

- Real Estate: Can provide diversification and potential appreciation but involves higher initial investment and less liquidity.

Diversification: Spreading Your Investments

Diversification is a cornerstone of smart investing. It's the strategy of spreading your investments across various asset classes to reduce overall portfolio risk. Don't put all your eggs in one basket!

The Importance of Diversification:

Diversification helps mitigate losses. If one investment performs poorly, the others may offset those losses. For example:

- A portfolio heavily weighted in technology stocks could suffer significantly during a tech downturn.

- A diversified portfolio including stocks, bonds, and real estate is less vulnerable to such sector-specific downturns.

Asset Allocation Strategies:

Asset allocation refers to the proportion of your portfolio invested in different asset classes. This should align with your risk tolerance and goals:

- Conservative: A higher proportion of bonds and lower-risk investments.

- Moderate: A balanced mix of stocks and bonds.

- Aggressive: A larger allocation to stocks and potentially alternative investments.

A common strategy is the 60/40 portfolio: 60% stocks and 40% bonds. However, your ideal allocation will depend on your individual circumstances. Rebalancing your portfolio periodically – adjusting the proportions to maintain your target allocation – is also crucial to maintain your risk profile over time.

Long-Term Investing: The Power of Time

Patience is a virtue in investing. The longer you invest, the more time your money has to grow.

Compound Interest and its Benefits:

Compound interest is the magic of earning interest on your initial investment and on the accumulated interest. This snowball effect significantly accelerates wealth creation over the long term. For example:

- Investing $10,000 annually for 30 years at a 7% annual return will yield a significantly larger sum than investing the same amount lump-sum.

The importance of patience cannot be overstated. Market fluctuations are inevitable, but long-term investing allows you to ride out short-term volatility.

Dollar-Cost Averaging (DCA): A Strategy for Steady Growth:

Dollar-cost averaging involves investing a fixed amount of money at regular intervals, regardless of market fluctuations. This strategy helps mitigate the risk of investing a large sum at a market peak.

- By investing consistently, you buy more shares when prices are low and fewer when prices are high, averaging out your cost per share.

- This reduces the impact of market timing, a notoriously difficult task even for experienced professionals.

Seeking Professional Advice:

While this guide offers valuable insights, seeking professional advice can provide a significant advantage.

When to Consult a Financial Advisor:

Consider consulting a financial advisor if:

- You have a complex financial situation.

- You have significant assets to manage.

- You need help developing a comprehensive financial plan.

- You lack the time or expertise to manage your investments effectively.

Finding a Reputable Financial Advisor:

Finding the right advisor is crucial. Ask potential advisors about:

- Their fees and how they are structured.

- Their experience and qualifications.

- Their investment philosophy and approach.

- Whether they adhere to a fiduciary duty (acting in your best interest).

Be wary of advisors who guarantee high returns or pressure you into making quick decisions. A reputable advisor will take the time to understand your goals and risk tolerance before recommending any investment strategy.

Conclusion:

Smart investing isn't about gambling; it's about making informed decisions based on your individual needs and risk tolerance. By understanding your risk profile, diversifying your portfolio, embracing long-term strategies like dollar-cost averaging, and seeking professional advice when necessary, you can build a secure financial future and make the real safe bet. Start planning your smart investing strategy today – your future self will thank you!

Featured Posts

-

Ohio Derailment Investigation Into Lingering Toxic Chemicals In Buildings

May 10, 2025

Ohio Derailment Investigation Into Lingering Toxic Chemicals In Buildings

May 10, 2025 -

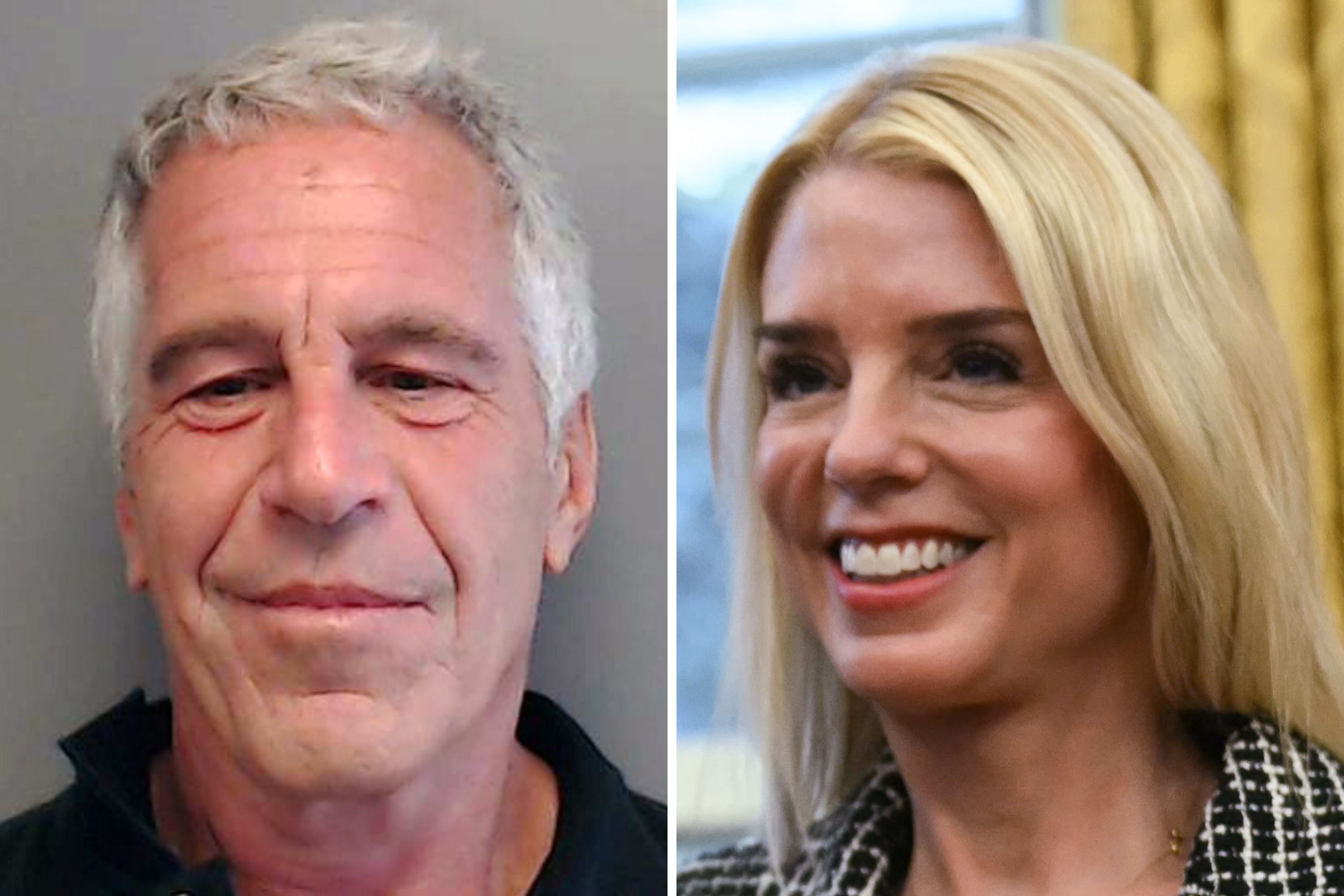

Pam Bondis Claims Documents On Epstein Diddy Jfk And Mlk To Be Released

May 10, 2025

Pam Bondis Claims Documents On Epstein Diddy Jfk And Mlk To Be Released

May 10, 2025 -

Toxic Chemical Residue From Ohio Train Disaster A Building By Building Assessment

May 10, 2025

Toxic Chemical Residue From Ohio Train Disaster A Building By Building Assessment

May 10, 2025 -

Nhls Hart Trophy Draisaitl Hellebuyck And Kucherov Vie For Top Honors

May 10, 2025

Nhls Hart Trophy Draisaitl Hellebuyck And Kucherov Vie For Top Honors

May 10, 2025 -

The Nottingham Attacks First Hand Accounts From Survivors

May 10, 2025

The Nottingham Attacks First Hand Accounts From Survivors

May 10, 2025