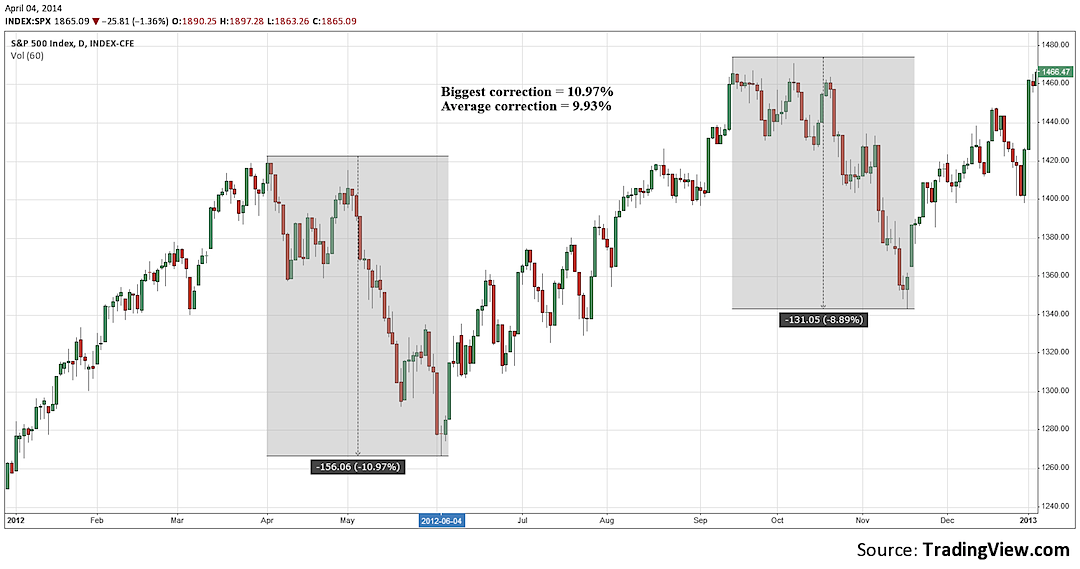

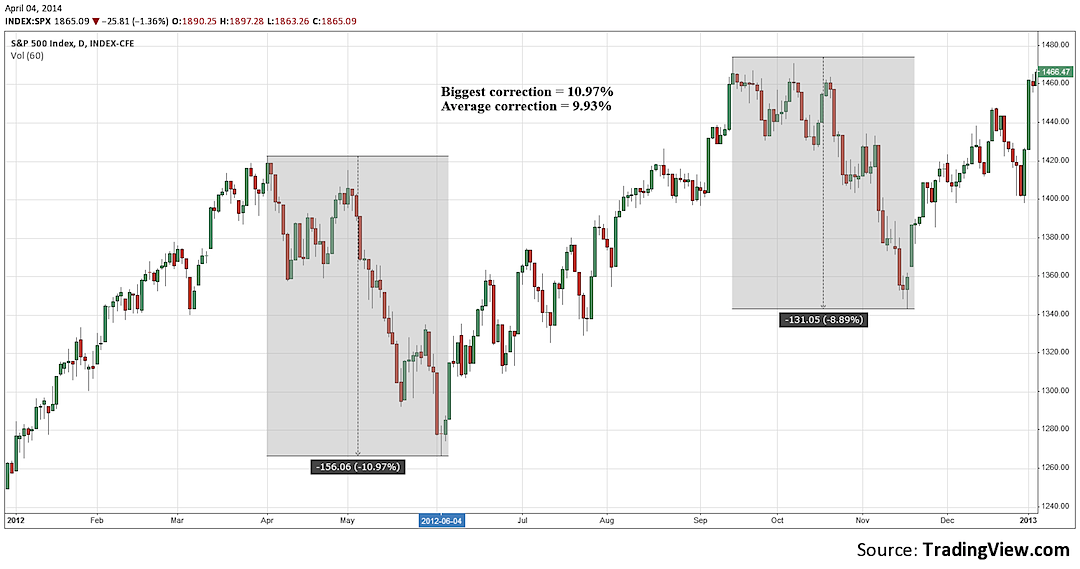

The Recent Market Correction: Who Sold And Who Bought?

Table of Contents

Identifying the Sellers During the Correction

The recent market correction saw a significant wave of selling pressure, driven by a variety of actors. Let's examine the key players:

Retail Investors: Panic Selling and Emotional Decisions

Individual investors, often driven by emotion and influenced by social media chatter, were significant sellers during the correction. Fear and uncertainty led to panic selling, exacerbating the downturn.

- Examples of retail investor selling trends: A surge in sell orders was observed across various asset classes, particularly in high-growth tech stocks, often mirroring the trends amplified on social media platforms.

- Analysis of their portfolio performance: Many retail investors experienced significant losses, often exceeding their risk tolerance levels due to impulsive reactions to market volatility.

- Average losses during the correction: Studies indicate that the average retail investor saw losses significantly higher than those of institutional investors during this period.

Related keywords: Panic selling, retail investor sentiment, social media trading, emotional investing, individual investor behavior.

Institutional Investors: Strategic Moves or Market Timing?

Institutional investors, including hedge funds, mutual funds, and pension funds, displayed a more nuanced response. While some engaged in strategic selling to rebalance portfolios or lock in profits, others saw the correction as a buying opportunity.

- Examples of institutional investor activity: Some large institutional funds reported net buying during the dip, capitalizing on discounted asset prices.

- Analysis of their trading strategies: Many institutions employed sophisticated algorithms and risk management models to navigate the volatile market conditions. Their strategies often involved selectively selling overvalued assets and purchasing undervalued ones.

- Comparison of their performance to retail investors: Generally, institutional investors fared better than retail investors due to their more disciplined approach and access to advanced market intelligence.

Related keywords: Hedge fund activity, institutional investor strategies, market timing, portfolio rebalancing, professional investor behavior.

Forced Selling: Margin Calls and Liquidity Crises

Some investors were forced to sell their assets due to unforeseen circumstances, including margin calls and liquidity issues.

- Examples of forced selling scenarios: Investors holding highly leveraged positions faced margin calls as asset prices plummeted, forcing them to liquidate holdings to meet their obligations.

- Explanation of the mechanisms behind it: Margin calls occur when the value of an investor's collateral falls below a certain threshold, requiring them to deposit more funds or sell assets to cover their losses.

- Impact on market dynamics: Forced selling can exacerbate market declines, creating a negative feedback loop where falling prices trigger further selling.

Related keywords: Margin calls, liquidity crisis, forced liquidation, deleveraging, market liquidity.

Pinpointing the Buyers During the Correction

While many were selling, a significant group of investors viewed the market correction as a chance to acquire assets at discounted prices.

Long-Term Investors: Embracing the "Buy the Dip" Strategy

Long-term investors, with a focus on fundamental analysis and a long investment horizon, often adhere to a "buy the dip" strategy. They see corrections as temporary setbacks and opportunities to accumulate assets at attractive valuations.

- Examples of successful long-term investment strategies: Data shows that consistently investing during market downturns often leads to superior long-term returns.

- Data supporting the benefits of long-term investing during corrections: Historical data consistently demonstrates that long-term investors who weather market corrections tend to achieve higher returns than those who react emotionally.

Related keywords: Long-term investing, value investing, buy-and-hold strategy, dollar-cost averaging, long-term investment returns.

Contrarian Investors: Capitalizing on Market Fear

Contrarian investors actively seek out opportunities during market downturns, recognizing that fear often creates irrational selling. They profit from identifying undervalued assets and capitalizing on the negative sentiment.

- Examples of successful contrarian investing strategies: Contrarian investors might focus on sectors or companies that are unfairly punished during a market correction.

- Analysis of their risk tolerance: Contrarian investors typically have a higher risk tolerance, understanding that their strategy involves greater potential for both gains and losses.

Related keywords: Contrarian investing, market timing, risk management, opportunity identification, contrarian investment strategies.

Corporate Buybacks: Supporting Stock Prices

Several companies utilized the correction to repurchase their own shares, thereby supporting stock prices and signaling confidence in their future prospects.

- Examples of companies conducting buybacks: Many companies with strong balance sheets took advantage of lower prices to increase shareholder value.

- The reasons behind these actions: Buybacks can be a strategic move to boost earnings per share, reduce outstanding shares, and signal confidence to investors.

Related keywords: Stock buybacks, corporate finance, share repurchases, investor confidence, corporate buyback programs.

Conclusion

The recent market correction revealed stark differences in investor behavior. Retail investors, often driven by emotion, experienced significant losses due to panic selling. In contrast, institutional investors and long-term investors, employing more disciplined strategies, frequently saw the correction as an opportunity. Contrarian investors also capitalized on the downturn, while corporate buybacks played a role in stabilizing certain sectors. Understanding the nuances of a market correction is crucial for making informed decisions. Learning to identify opportunities during periods of market volatility is key to developing a resilient investment strategy. Learn more about navigating future market corrections and building a resilient investment strategy today!

Featured Posts

-

1 050 Price Hike On V Mware At And T Challenges Broadcoms Proposed Acquisition

Apr 28, 2025

1 050 Price Hike On V Mware At And T Challenges Broadcoms Proposed Acquisition

Apr 28, 2025 -

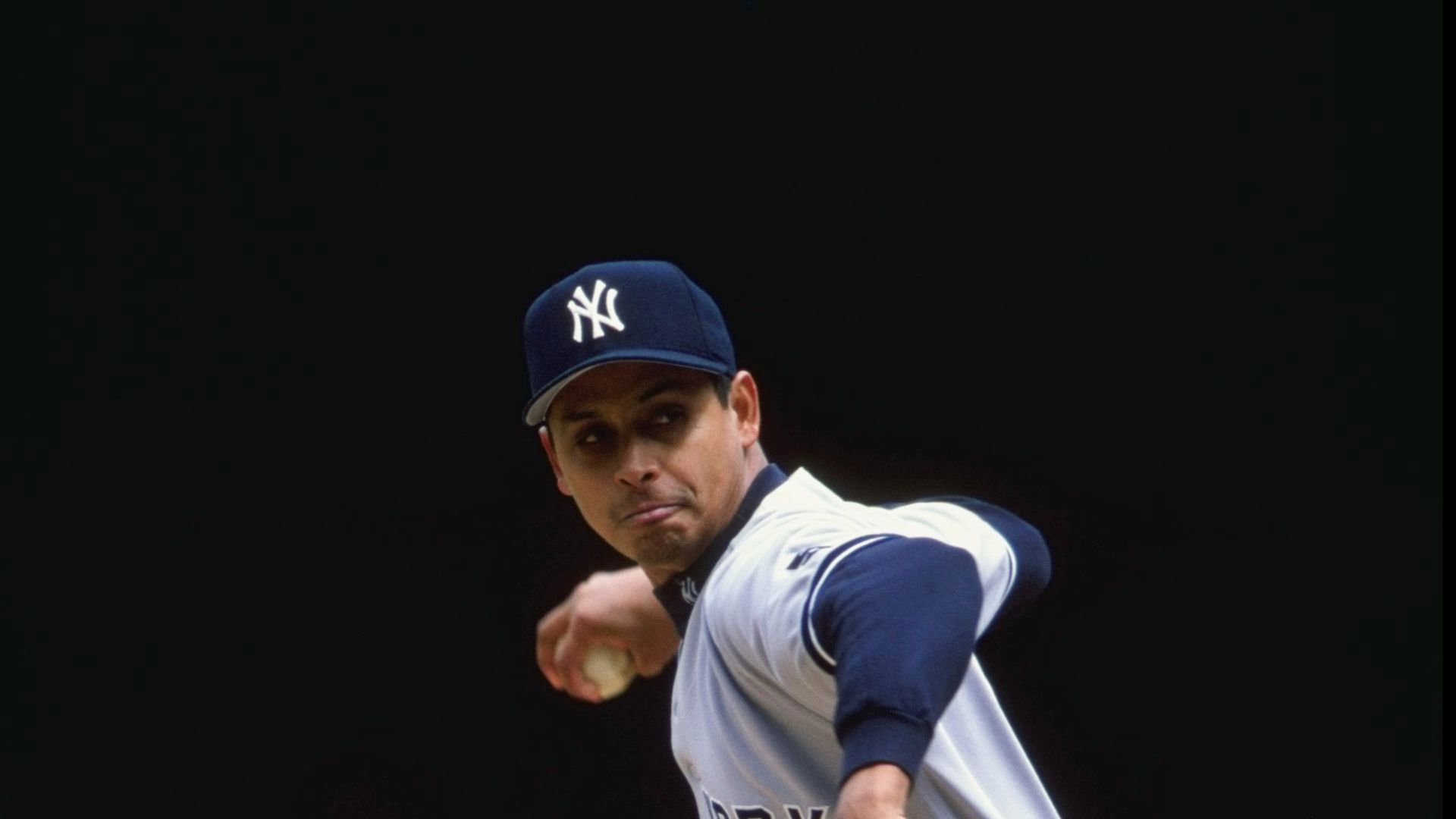

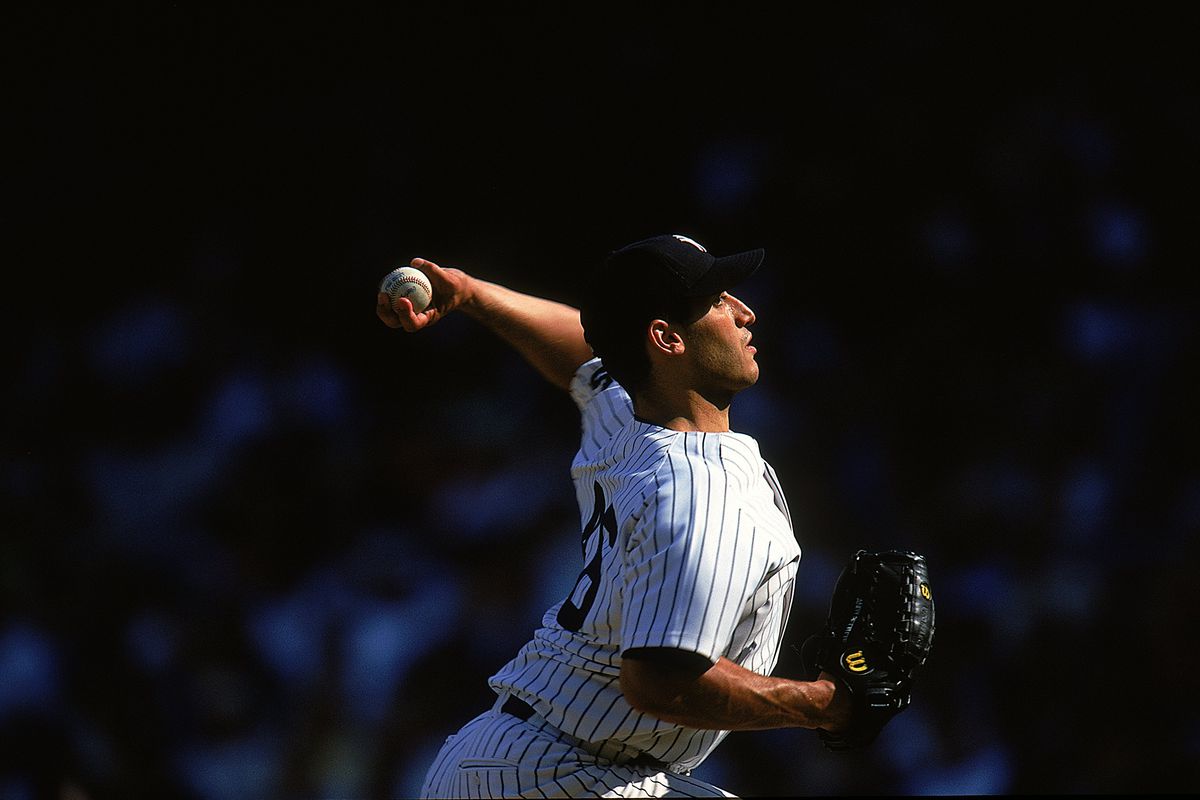

2000 Yankees Diary Bombers Defeat Royals In Thrilling Victory

Apr 28, 2025

2000 Yankees Diary Bombers Defeat Royals In Thrilling Victory

Apr 28, 2025 -

Eva Longorias Culinary Encounter A World Renowned Chefs Fishermans Stew

Apr 28, 2025

Eva Longorias Culinary Encounter A World Renowned Chefs Fishermans Stew

Apr 28, 2025 -

The Current Gpu Market High Prices And Limited Availability

Apr 28, 2025

The Current Gpu Market High Prices And Limited Availability

Apr 28, 2025 -

Shedeur Sanders Drafted By Cleveland Browns In 5th Round

Apr 28, 2025

Shedeur Sanders Drafted By Cleveland Browns In 5th Round

Apr 28, 2025

Latest Posts

-

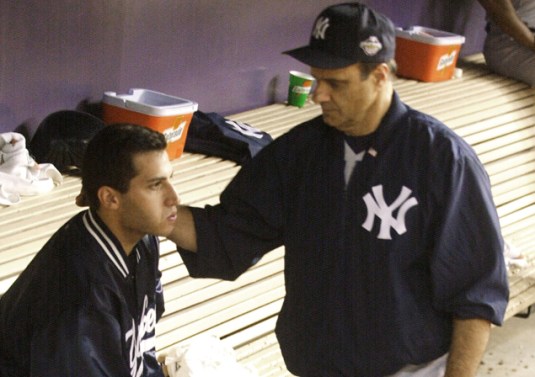

Remembering 2000 Joe Torres Leadership And Andy Pettittes Masterful Performance

Apr 28, 2025

Remembering 2000 Joe Torres Leadership And Andy Pettittes Masterful Performance

Apr 28, 2025 -

2000 Yankees Season Joe Torre Andy Pettitte And A Twin City Shutout

Apr 28, 2025

2000 Yankees Season Joe Torre Andy Pettitte And A Twin City Shutout

Apr 28, 2025 -

2000 Yankees Diary Joe Torres Meetings And Andy Pettittes Shutout Of The Twins

Apr 28, 2025

2000 Yankees Diary Joe Torres Meetings And Andy Pettittes Shutout Of The Twins

Apr 28, 2025 -

Yankees Avoid Historic Sweep With Offensive Explosion And Rodons Pitching Masterclass

Apr 28, 2025

Yankees Avoid Historic Sweep With Offensive Explosion And Rodons Pitching Masterclass

Apr 28, 2025 -

Williams Implosion Key Factor In Yankees Loss To Blue Jays

Apr 28, 2025

Williams Implosion Key Factor In Yankees Loss To Blue Jays

Apr 28, 2025