The Ripple Effect: Oil Supply Shocks And The Airline Industry's Future

Table of Contents

The Direct Impact of Increased Fuel Costs

Increased jet fuel prices directly translate to higher operating costs for airlines. This is a primary concern when considering the relationship between oil supply shocks and the airline industry. This direct impact manifests in several critical ways:

Rising Operational Expenses

Increased jet fuel prices directly translate to higher operating costs for airlines. This can force carriers to make difficult choices:

- Reduce flight frequencies on less profitable routes: Airlines may cut back on less lucrative routes to minimize fuel expenses, potentially impacting connectivity for certain regions.

- Increase ticket prices to offset increased fuel costs, potentially impacting demand: Passing increased fuel costs onto passengers through higher fares risks reducing demand, especially among price-sensitive travelers. This delicate balance between profitability and affordability is a constant challenge.

- Delay or cancel planned aircraft acquisitions: The financial burden of high fuel prices can delay or prevent airlines from investing in new, more fuel-efficient aircraft, hindering long-term efficiency improvements.

- Explore fuel-efficient technologies and operational strategies (e.g., optimized flight paths): Airlines are actively seeking ways to improve fuel efficiency, from investing in new technologies to optimizing flight paths and reducing weight.

Impact on Profit Margins

Higher fuel costs significantly squeeze airline profit margins, potentially leading to reduced profitability or even losses. Airlines might need to consider:

- Implementing cost-cutting measures across various departments: This could involve streamlining operations, reducing staff, or negotiating better deals with suppliers.

- Seeking government subsidies or financial assistance: In severe cases, airlines may require government intervention to alleviate financial strain.

- Renegotiating contracts with suppliers and service providers: Airlines may attempt to renegotiate contracts to reduce costs in areas other than fuel.

- Focus on ancillary revenue streams (e.g., baggage fees, in-flight purchases): Airlines increasingly rely on additional revenue sources to offset rising fuel costs.

Indirect Impacts on the Airline Industry

The impact of oil supply shocks on the airline industry extends beyond direct fuel costs, creating indirect challenges that ripple through the entire ecosystem.

Impact on Passenger Demand

Increased ticket prices due to higher fuel costs can lead to decreased passenger demand, particularly for price-sensitive travelers. Airlines must develop strategies to mitigate this:

- Implement dynamic pricing strategies to manage demand fluctuations: Adjusting ticket prices based on demand allows airlines to optimize revenue.

- Offer promotional fares and discounts to stimulate demand: Promotional offers can attract price-sensitive passengers and maintain occupancy rates.

- Focus on marketing campaigns highlighting value and customer loyalty programs: Building customer loyalty can create a more stable demand base, less susceptible to price fluctuations.

Supply Chain Disruptions

Oil supply shocks can also disrupt the supply chain for aircraft maintenance, parts, and even ground handling services, leading to:

- Delays in aircraft maintenance and repairs: Supply chain issues can delay essential maintenance, impacting flight schedules and safety.

- Increased costs for spare parts and other supplies: Shortages can inflate the price of necessary parts, adding to operational expenses.

- Potential operational disruptions and flight cancellations: Delays and shortages can cause ripple effects leading to operational disruptions and flight cancellations.

Impact on Investment and Innovation

Uncertainty created by volatile fuel prices can discourage investment in new aircraft, technologies, and expansion plans, hindering industry growth and innovation. This can lead to:

- Delayed fleet modernization and upgrades: Airlines may postpone upgrading their fleets, hindering fuel efficiency and operational efficiency.

- Reduced investment in research and development for fuel-efficient technologies: Uncertainty can make companies hesitant to invest in long-term R&D projects.

- Slower adoption of sustainable aviation fuels (SAFs): The high upfront costs of SAFs can be a barrier to adoption, especially during periods of economic uncertainty.

Strategies for Mitigating the Impact of Oil Supply Shocks

Airlines need to proactively manage the risk of oil supply shocks and the airline industry's future. Several strategies can be employed:

Fuel Hedging

Airlines can utilize financial instruments like fuel hedging to protect themselves against price volatility. This involves locking in future fuel prices to mitigate the risk of unexpected spikes.

Fuel Efficiency Improvements

Investing in more fuel-efficient aircraft and implementing optimized flight operations (e.g., continuous descent approaches) can significantly reduce fuel consumption and lower operational costs.

Diversification of Fuel Sources

Exploring alternative sustainable aviation fuels (SAFs) can reduce reliance on traditional jet fuel and enhance resilience against price shocks. This involves exploring biofuels and other renewable sources.

Strategic Partnerships

Collaboration with other airlines and fuel suppliers can enhance resilience and access to resources during periods of supply disruption. This can involve joint purchasing agreements or fuel supply contracts.

Conclusion

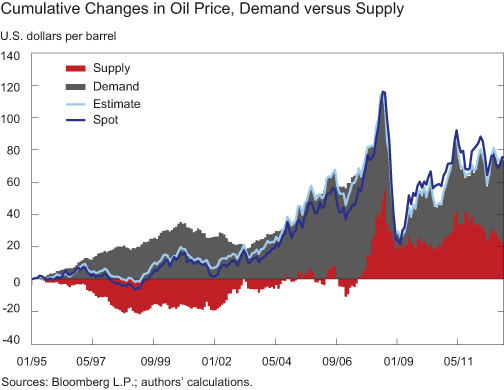

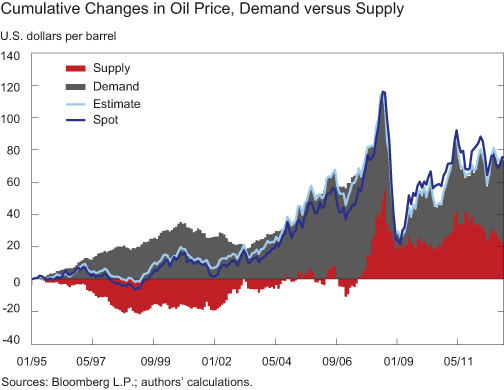

Oil supply shocks pose a significant threat to the airline industry's financial stability and future growth. The direct impact on operating costs, coupled with the indirect effects on passenger demand and supply chains, requires proactive and multifaceted strategies. Airlines must adopt a combination of fuel hedging, fuel efficiency improvements, exploration of alternative fuels, and strategic partnerships to navigate the challenges presented by volatile oil prices. Understanding the complex ripple effect of oil supply shocks and airline industry dynamics is crucial for the long-term sustainability and resilience of air travel. Proactive planning and adaptation to these inevitable fluctuations are key to ensuring a secure future for the industry. Investing in resilience strategies is paramount for navigating the unpredictable nature of global energy markets and securing the future of air travel.

Featured Posts

-

300 5

May 03, 2025

300 5

May 03, 2025 -

Lionesses Vs Spain Tv Coverage Kick Off Time And Live Streaming Details

May 03, 2025

Lionesses Vs Spain Tv Coverage Kick Off Time And Live Streaming Details

May 03, 2025 -

Ongoing Swiss Support For Ukraine Presidential Affirmation

May 03, 2025

Ongoing Swiss Support For Ukraine Presidential Affirmation

May 03, 2025 -

Les Tuche 5 Un Film Dedie A Qui

May 03, 2025

Les Tuche 5 Un Film Dedie A Qui

May 03, 2025 -

Lucien Jean Baptiste Dans Joseph Analyse De La Nouvelle Serie Tf 1

May 03, 2025

Lucien Jean Baptiste Dans Joseph Analyse De La Nouvelle Serie Tf 1

May 03, 2025