The Stark Math On The GOP Tax Plan: Deficit Impact Analysis

Table of Contents

Projected Revenue Losses under the GOP Tax Plan

The GOP tax plan projects substantial revenue losses, a key concern for fiscal analysts and policymakers alike. Several sources, including the Congressional Budget Office (CBO) reports and independent analyses from organizations like the Tax Policy Center, have offered projections on the potential impact. These analyses vary slightly in their methodologies, but they consistently point towards significant revenue shortfalls.

-

Breakdown of revenue losses by tax bracket: Projections indicate disproportionate benefits for higher-income earners, leading to a larger percentage of revenue loss from the top tax brackets. Lower and middle-income brackets will also experience tax cuts, but the overall effect on revenue is dominated by the reductions at the higher end.

-

Impact on corporate tax revenue: The proposed cuts to the corporate tax rate are projected to significantly reduce corporate tax revenue. The extent of this reduction depends heavily on assumptions about corporate behavior, such as investment and repatriation of foreign earnings.

-

Analysis of dynamic scoring vs. static scoring methodologies and their differences in projected revenue loss: The debate surrounding dynamic scoring versus static scoring is crucial. Static scoring assumes no behavioral change in response to the tax cuts, while dynamic scoring incorporates the potential for increased economic activity. Proponents of the GOP plan often cite dynamic scoring to suggest the revenue losses will be offset by economic growth. However, the magnitude of this effect is highly debated, and critics argue that the assumptions underpinning dynamic scoring are overly optimistic.

-

Specific tax cuts contributing most significantly to revenue loss: The individual income tax rate cuts and the corporate tax rate reduction are the most significant contributors to the projected revenue losses. These cuts represent a large-scale reduction in the tax base, leading to a substantial shortfall in government revenue. The elimination or reduction of certain deductions and credits may partially offset some of these losses, but the net effect is still projected to be negative. Keywords: Revenue Loss, Tax Revenue, Corporate Tax, Income Tax, Dynamic Scoring, Static Scoring, CBO Report

Increased National Debt and its Consequences

The projected revenue losses under the GOP tax plan translate directly into a significant increase in the national debt. This increase raises serious concerns about the nation's long-term fiscal health.

-

Potential long-term consequences of a larger national debt: A larger national debt can lead to several negative consequences. Higher interest rates become necessary to attract investors, increasing the cost of borrowing for the government and potentially crowding out private investment. This can also lead to reduced government spending in other crucial areas like education, infrastructure, and healthcare, as more resources are diverted towards debt servicing.

-

Analysis of debt-to-GDP ratio projections: The debt-to-GDP ratio is a key indicator of a nation's fiscal health. The projected increase in the national debt under the GOP tax plan is expected to significantly raise this ratio, potentially exceeding levels seen in previous periods of fiscal stress.

-

Comparison to historical debt levels: Comparing the projected debt levels under the GOP plan to historical data provides valuable context. Analyzing previous periods of high national debt and their subsequent impacts can offer valuable insights into the potential consequences.

-

Potential impacts on future generations: The increased national debt will ultimately be borne by future generations, who will inherit a larger burden of government debt and potentially face reduced opportunities as a result. This intergenerational equity concern is a significant factor in the broader debate around the fiscal sustainability of the plan. Keywords: National Debt, Debt to GDP Ratio, Interest Rates, Government Spending, Fiscal Sustainability, Long-term Debt

Economic Growth Projections and their Validity

Proponents of the GOP tax plan argue that the projected economic growth spurred by the tax cuts will offset the revenue losses. This argument relies heavily on supply-side economics, suggesting that lower taxes incentivize investment and increased economic activity.

-

Discussion of supply-side economics and its role in the plan's justification: Supply-side economics is a cornerstone of the GOP tax plan's justification. The theory suggests that tax cuts, especially for businesses and high-income earners, stimulate economic growth by encouraging investment and entrepreneurship.

-

Evaluation of the assumptions underpinning the growth projections: The reliability of the projected economic growth is highly dependent on several key assumptions. These include the responsiveness of investment to tax cuts, the impact on labor supply, and the overall effect on aggregate demand. Critics point out that these assumptions are often overly optimistic and not well-supported by empirical evidence.

-

Counterarguments and alternative economic forecasts: Many independent economic analyses challenge the optimistic growth projections used to justify the GOP tax plan. These alternative forecasts often suggest much lower growth rates, leading to significantly larger increases in the national debt.

-

Independent economic analyses that challenge the proposed growth projections: Several respected organizations and economists have published analyses that challenge the rosy economic growth projections of the GOP tax plan. These analyses often point to factors such as the current level of economic capacity and the relatively low impact of past tax cuts on economic growth. Keywords: Economic Growth, Supply-Side Economics, Economic Forecast, GDP Growth, Tax Multiplier

Alternative Policy Options for Fiscal Responsibility

Instead of large, across-the-board tax cuts, alternative policies could achieve similar economic goals while minimizing the deficit impact.

-

Targeted tax cuts for specific demographics or sectors: Targeted tax cuts, focused on specific groups or industries deemed crucial for economic growth, may be more effective and fiscally responsible. This approach avoids the broad-based revenue losses associated with universal tax cuts.

-

Investment in infrastructure or education: Investing in infrastructure and education can stimulate long-term economic growth while simultaneously addressing national needs. These investments generate returns through increased productivity and human capital development.

-

Spending cuts in other areas of the budget: Spending cuts in less effective or less crucial areas of the budget could also help to offset the revenue losses from tax cuts, maintaining fiscal responsibility. This requires a careful analysis of the effectiveness and priorities of government spending. Keywords: Fiscal Responsibility, Alternative Policies, Targeted Tax Cuts, Infrastructure Investment, Budget Cuts

Conclusion

This analysis reveals the potentially significant impact of the GOP tax plan on the national deficit. Projected revenue losses, coupled with uncertain economic growth projections, point towards a substantial increase in the national debt with potentially serious long-term consequences. A careful consideration of alternative policy options that promote both economic growth and fiscal responsibility is crucial. Keywords: GOP Tax Plan, National Deficit, Fiscal Responsibility, National Debt, Tax Cuts.

Understanding the stark math behind the GOP tax plan is vital for informed civic engagement. Continue researching the deficit impact of proposed tax plans to make educated decisions about our nation's fiscal future. Learn more about the effects of the GOP tax plan on the national deficit and advocate for responsible fiscal policies.

Featured Posts

-

Understanding The Billionaire Boy Phenomenon Exploring The Dynamics Of Extreme Wealth

May 20, 2025

Understanding The Billionaire Boy Phenomenon Exploring The Dynamics Of Extreme Wealth

May 20, 2025 -

Germanys 5 4 Aggregate Victory Sends Them To Uefa Nations League Final Four

May 20, 2025

Germanys 5 4 Aggregate Victory Sends Them To Uefa Nations League Final Four

May 20, 2025 -

Filmo Bado Zaidynes Zvaigzde Jennifer Lawrence Ir Jos Antras Vaikas Vardo Atskleidimas

May 20, 2025

Filmo Bado Zaidynes Zvaigzde Jennifer Lawrence Ir Jos Antras Vaikas Vardo Atskleidimas

May 20, 2025 -

Us Army Bolsters Pacific Defense With Second Typhon Battery Deployment

May 20, 2025

Us Army Bolsters Pacific Defense With Second Typhon Battery Deployment

May 20, 2025 -

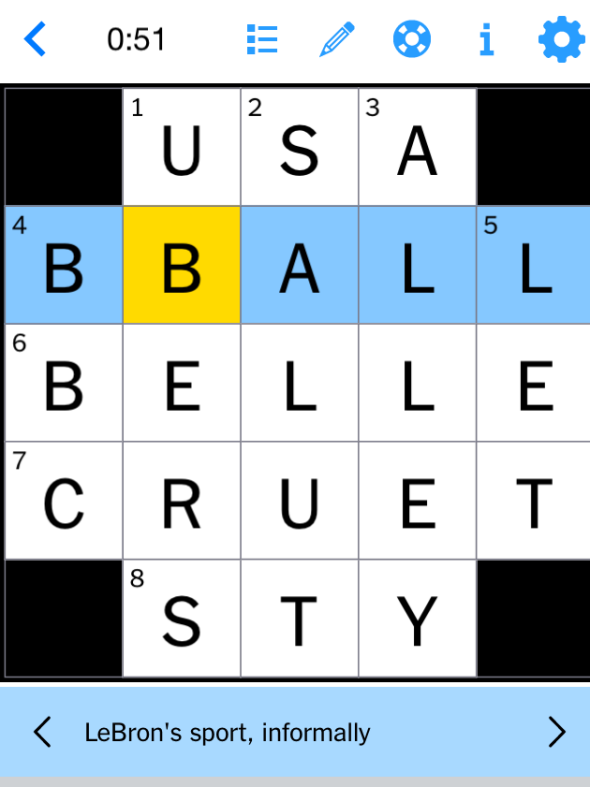

Complete Answers Nyt Mini Crossword March 31

May 20, 2025

Complete Answers Nyt Mini Crossword March 31

May 20, 2025