The Strengthening Taiwan Dollar And The Path To Economic Restructuring

Table of Contents

Factors Contributing to the Strengthening Taiwan Dollar

The appreciation of the Taiwan dollar is a multifaceted phenomenon driven by several key factors. Understanding these drivers is crucial for formulating effective policy responses.

Increased Foreign Investment: Taiwan's thriving tech sector, particularly its dominance in semiconductor manufacturing, has attracted substantial foreign investment. This influx of capital significantly increases the demand for the NTD.

- Increased demand for Taiwanese tech products: Global demand for high-tech components, particularly semiconductors, remains robust, fueling capital inflows into Taiwan.

- Growing global interest in Taiwan's semiconductor industry: Taiwan's technological prowess, particularly in advanced semiconductor manufacturing, attracts significant foreign direct investment (FDI).

- Foreign direct investment (FDI) flows into Taiwan: A significant portion of FDI flows into Taiwan are directly related to investment in the technology sector, further driving up demand for the NTD.

Robust Export Performance: Despite global economic headwinds, Taiwan's export performance has remained remarkably strong. This continued success contributes significantly to the NTD's strength.

- High demand for Taiwanese electronics and semiconductors globally: The global technological landscape remains reliant on Taiwanese technological expertise, underpinning strong export figures.

- Competitive advantage in specific technological niches: Taiwan’s specialized expertise in high-value-added manufacturing maintains its competitive edge in the global market.

- Growing global reliance on Taiwan's technological expertise: The strategic importance of Taiwan’s technological capabilities continues to support robust export performance and strengthen the NTD.

High Interest Rates (relative to other currencies): Comparatively higher interest rates in Taiwan, set by the Central Bank of the Republic of China (Taiwan), attract foreign capital seeking higher returns. This inflow of capital further strengthens the NTD.

- Monetary policy decisions of the Central Bank of the Republic of China (Taiwan): The Central Bank's monetary policy plays a significant role in influencing interest rates and attracting foreign investment.

- Comparison of interest rates with other major economies: Taiwan's interest rate environment, relative to other major economies, influences capital flows and impacts the NTD exchange rate.

- Impact of global interest rate environments on the NTD: Global interest rate trends also influence the attractiveness of investing in Taiwan and, consequently, the strength of the NTD.

Challenges Posed by a Strong Taiwan Dollar

While a strengthening NTD offers some advantages, it also presents significant challenges that need to be addressed proactively.

Reduced Export Competitiveness: The appreciation of the NTD makes Taiwanese exports more expensive in international markets, potentially impacting export volumes and revenue.

- Impact on the profitability of export-oriented businesses: Companies reliant on exports may face reduced profit margins due to increased production costs.

- Need for strategies to offset the effects of currency appreciation: Businesses need to adopt strategies to maintain competitiveness, such as improving efficiency or diversifying markets.

- Potential job losses in export-dependent industries: A decline in export competitiveness could lead to job losses in sectors heavily reliant on international trade.

Increased Import Costs: While benefiting consumers in terms of lower prices for imported goods, a stronger NTD also increases the cost of imports, potentially fueling inflation.

- Effect on the prices of imported goods and raw materials: Increased import costs can translate to higher prices for consumers and businesses.

- Impact on consumer spending and inflation rates: Rising import costs can lead to inflationary pressures and affect consumer spending patterns.

- Strategies to mitigate the impact of increased import costs: Strategies to mitigate the impact of increased import costs include diversification of supply chains and investment in domestic production.

Path to Economic Restructuring

To navigate the challenges posed by the strengthening Taiwan dollar and ensure sustainable economic growth, a comprehensive strategy focusing on economic restructuring is crucial.

Economic Diversification: Reducing over-reliance on export-oriented industries is paramount. This involves strategic investment and innovation in new sectors.

- Investment in research and development (R&D): Investing in R&D across diverse sectors will drive innovation and create new economic opportunities.

- Development of new industries and technologies: Nurturing growth in sectors like biotechnology, green energy, and advanced manufacturing will diversify the economy.

- Support for small and medium-sized enterprises (SMEs): SMEs are crucial drivers of innovation and economic diversification, and should receive targeted support.

Enhancing Domestic Demand: Boosting domestic consumption and investment can lessen the dependence on exports and create a more resilient economy.

- Policies to stimulate domestic consumption: Government policies can incentivize domestic spending and boost overall economic activity.

- Investments in infrastructure and public services: Investments in infrastructure and public services improve living standards and stimulate economic growth.

- Promotion of domestic tourism: Promoting domestic tourism can generate revenue and support related industries.

Investing in Human Capital: Upskilling the workforce is crucial for adapting to a changing economic landscape.

- Education and training programs for a knowledge-based economy: Investing in education and training programs ensures the workforce has the necessary skills for future jobs.

- Attracting and retaining skilled talent: Creating an environment that attracts and retains skilled workers is essential for long-term economic growth.

- Promoting innovation and entrepreneurship: Supporting a culture of innovation and entrepreneurship will foster the development of new industries and technologies.

Conclusion

The strengthening Taiwan dollar presents a complex economic challenge, but also an opportunity for strategic transformation. While the benefits of a stronger currency are undeniable, the risks to export competitiveness and the potential for inflationary pressures necessitate a proactive approach to economic restructuring. Successfully navigating this economic landscape requires a multifaceted strategy that encompasses economic diversification, the enhancement of domestic demand, and substantial investment in human capital. By proactively embracing these crucial elements, Taiwan can ensure sustainable and inclusive growth, even in the face of a strengthening NTD. Understanding the dynamics of the strengthening Taiwan dollar and implementing effective strategies are paramount for securing Taiwan’s economic future. Begin planning your approach to economic restructuring today to effectively manage the impact of a strengthening Taiwan dollar.

Featured Posts

-

Meaningful Dialogue Breaking Bread With Scholars In Academia

May 08, 2025

Meaningful Dialogue Breaking Bread With Scholars In Academia

May 08, 2025 -

Expected Lahore Weather Eid Ul Fitr And Following Day

May 08, 2025

Expected Lahore Weather Eid Ul Fitr And Following Day

May 08, 2025 -

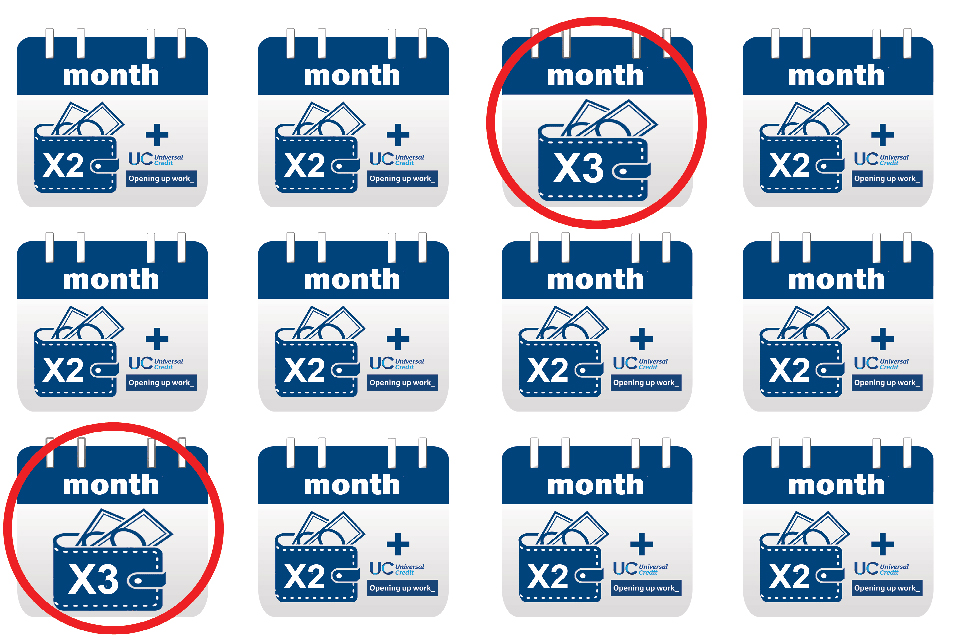

Universal Credit Back Payments Are You Eligible For A Refund

May 08, 2025

Universal Credit Back Payments Are You Eligible For A Refund

May 08, 2025 -

Aktuelle Lottozahlen 6aus49 12 April 2025

May 08, 2025

Aktuelle Lottozahlen 6aus49 12 April 2025

May 08, 2025 -

Pierce Countys 160 Year Old Home Demolition And Park Conversion

May 08, 2025

Pierce Countys 160 Year Old Home Demolition And Park Conversion

May 08, 2025

Latest Posts

-

Universal Credit Understanding And Reclaiming Hardship Payment Overpayments

May 08, 2025

Universal Credit Understanding And Reclaiming Hardship Payment Overpayments

May 08, 2025 -

Celtics Vs Nets Latest Injury Report And Tatums Playing Status

May 08, 2025

Celtics Vs Nets Latest Injury Report And Tatums Playing Status

May 08, 2025 -

Abc Promo Features Tnt Announcers Hilarious Take On Jayson Tatum

May 08, 2025

Abc Promo Features Tnt Announcers Hilarious Take On Jayson Tatum

May 08, 2025 -

Dwp Universal Credit Claiming Back Overpaid Hardship Payments

May 08, 2025

Dwp Universal Credit Claiming Back Overpaid Hardship Payments

May 08, 2025 -

Is Jayson Tatum Out Tonight Celtics Nets Injury News

May 08, 2025

Is Jayson Tatum Out Tonight Celtics Nets Injury News

May 08, 2025