The Trump Presidency And Crypto: A Multi-Million Dollar Shift?

Table of Contents

Trump's Regulatory Approach and its Ripple Effect on Crypto

The Trump administration's approach to cryptocurrency regulation, or rather, the lack thereof, significantly impacted the market.

H3: The Absence of Clear Crypto Regulation under Trump

- Limited Federal Oversight: The Trump administration largely avoided establishing comprehensive federal regulations for cryptocurrencies. This contrasted sharply with the more proactive regulatory stances adopted by some other nations.

- Regulatory Ambiguity Fueled Growth: This lack of clear guidelines, while potentially risky, fostered an environment of innovation and rapid growth. Many viewed the regulatory uncertainty as an opportunity rather than a hindrance.

- Conflicting Statements: Different government agencies sometimes offered conflicting opinions on crypto, creating further confusion for investors and businesses operating in the space. For example, while some agencies warned of risks, others appeared more open to the potential benefits of blockchain technology.

H3: Impact of the "Executive Order on Financial Market Regulation" (and similar actions)

While no single executive order specifically targeted cryptocurrency, broader financial market regulations indirectly affected the crypto space.

- Focus on Anti-Money Laundering (AML) and Know Your Customer (KYC): Increased scrutiny on AML/KYC compliance within the financial system indirectly impacted cryptocurrency exchanges and businesses, leading to stricter verification processes.

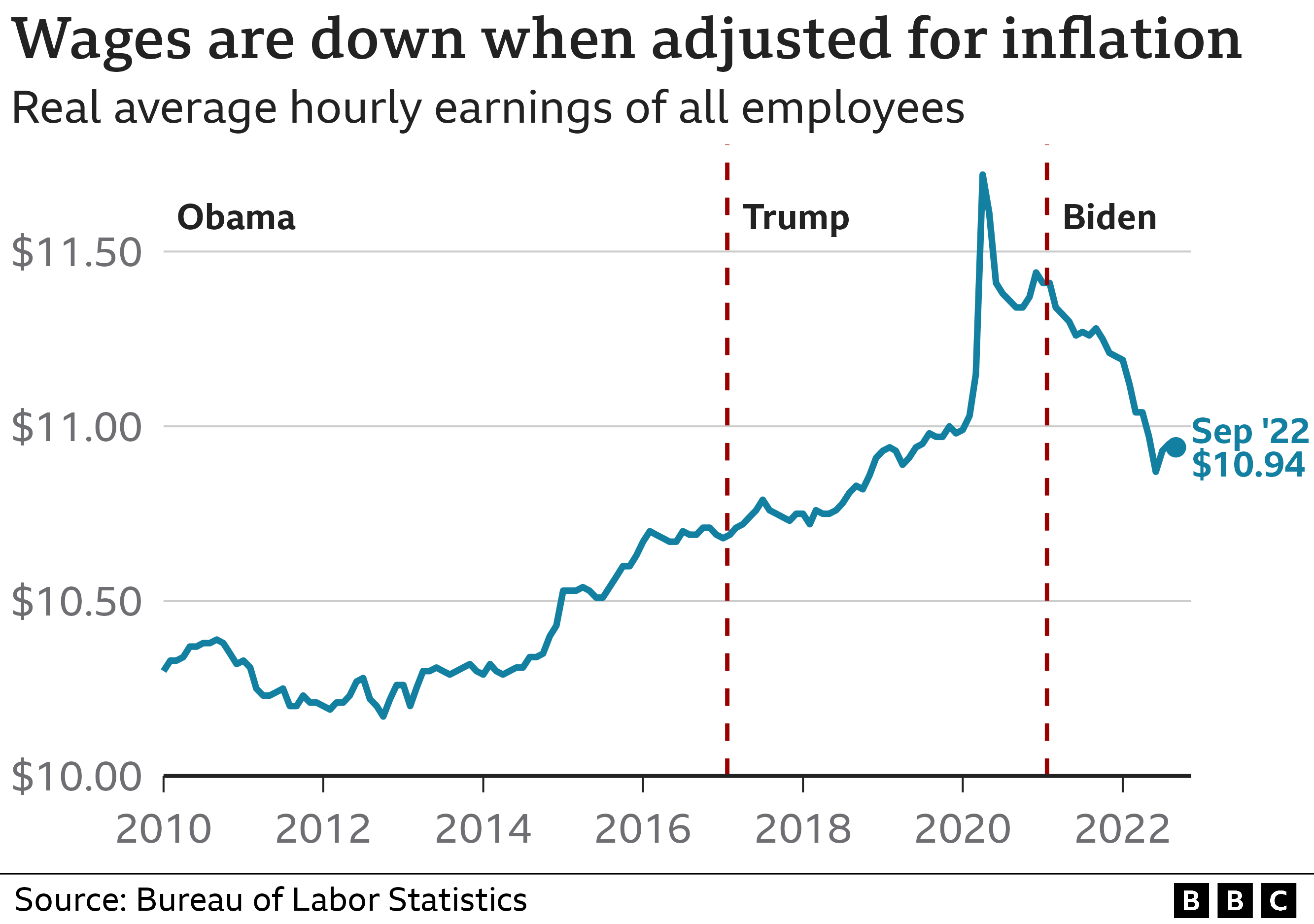

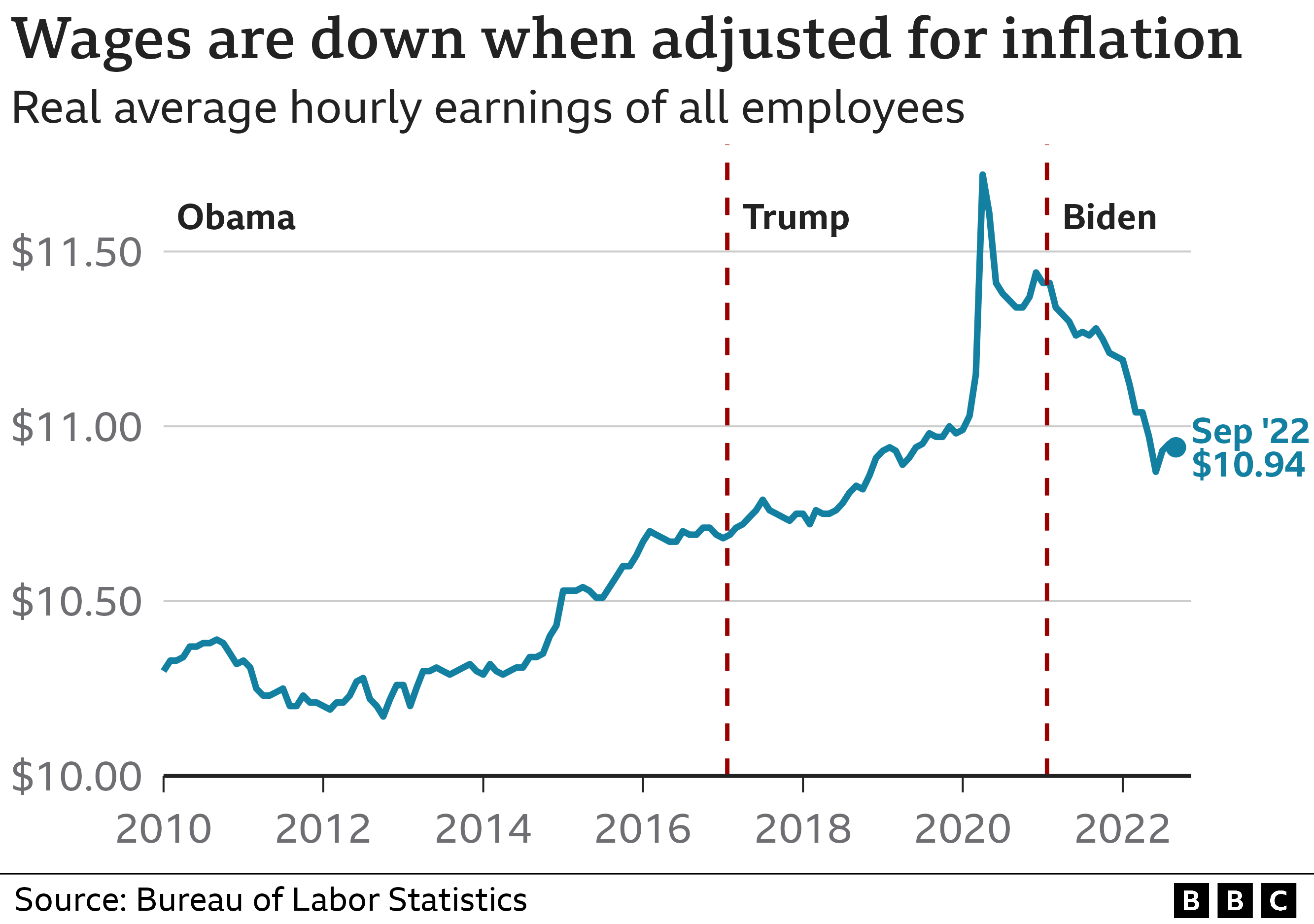

- Market Reaction to Regulatory Uncertainty: The overall regulatory uncertainty led to periods of both significant price increases and dramatic drops, reflecting the market's sensitivity to even hinted-at regulatory changes.

- Data Points: Analyzing Bitcoin's price movements alongside announcements regarding financial regulations during the Trump administration reveals periods of heightened volatility correlated with these events.

The Influence of Trump's Economic Policies on Crypto Adoption

Beyond direct regulation, Trump's broader economic policies also played a role in shaping the crypto landscape.

H3: Tax Implications and Crypto Investment

- Capital Gains Taxes: The existing capital gains tax structure applied to cryptocurrency profits, potentially incentivizing some investors to hold their assets longer to defer tax obligations.

- Tax Avoidance Concerns: The relative anonymity associated with certain cryptocurrencies raised concerns regarding tax avoidance, leading to increased calls for stricter regulations from some quarters.

- Tax Reform Act of 2017: While not directly addressing cryptocurrency, this act's impact on various tax brackets and investment strategies had indirect consequences for investors holding crypto assets.

H3: The Role of Economic Uncertainty and Crypto as a Safe Haven Asset

- Trade Wars and Economic Volatility: The trade wars initiated during the Trump administration created economic uncertainty, pushing some investors towards cryptocurrencies as a potential safe haven asset.

- Inflation Hedge: Some saw cryptocurrencies as a hedge against potential inflation, particularly given the expansionary monetary policies adopted during this period.

- Market Analyses: Many market analyses from the time show a correlation between increased economic uncertainty and capital flight into the cryptocurrency market.

Trump's Tweets and the Volatility of Crypto Markets

Perhaps the most immediate and visible connection between the Trump presidency and cryptocurrency lies in the impact of his tweets.

- Market Sensitivity to Presidential Statements: Trump's often unpredictable pronouncements on various economic and political issues sent ripples through the entire market, including cryptocurrency.

- Examples of Tweet-Driven Volatility: Several instances saw cryptocurrency prices sharply move following specific tweets by President Trump, showcasing the immediate and considerable influence of his statements.

- Psychological Impact: These tweets significantly impacted investor sentiment, leading to significant short-term volatility based primarily on emotional reactions rather than fundamental market changes.

Conclusion:

The relationship between the Trump Presidency and Crypto is complex and multifaceted. While no single policy directly caused the multi-million dollar shifts seen in the cryptocurrency market, the administration's regulatory ambiguity, broader economic policies, and the President's public statements all contributed to a volatile yet undeniably dynamic environment for cryptocurrencies. The lack of clear regulatory frameworks arguably fostered innovation and rapid growth, while simultaneously creating periods of extreme market volatility. Whether a direct causal link exists is difficult to definitively establish, but the influence of the Trump administration on the cryptocurrency market during this period is undeniably significant. Continue exploring the complex relationship between the Trump Presidency and Crypto by researching further into the specific regulatory actions and their market impact during this era. Dive deeper into the analysis of how the Trump administration shaped the cryptocurrency landscape and its long-term consequences.

Featured Posts

-

Las Vegas Aces Center Megan Gustafsons Leg Injury Out Indefinitely

May 07, 2025

Las Vegas Aces Center Megan Gustafsons Leg Injury Out Indefinitely

May 07, 2025 -

Ps 5 Vs Xbox Series S Which Console Is Right For You

May 07, 2025

Ps 5 Vs Xbox Series S Which Console Is Right For You

May 07, 2025 -

Warriors Coach Kerr Optimistic About Currys Return From Injury

May 07, 2025

Warriors Coach Kerr Optimistic About Currys Return From Injury

May 07, 2025 -

Watykan Ekspert Rzuca Swiatlo Na Tajne Obchody Konklawe

May 07, 2025

Watykan Ekspert Rzuca Swiatlo Na Tajne Obchody Konklawe

May 07, 2025 -

Ovechkin V Zale Slavy Iihf Podtverzhdenie Krikunova

May 07, 2025

Ovechkin V Zale Slavy Iihf Podtverzhdenie Krikunova

May 07, 2025