The Ultimate Guide To Federal Student Loan Refinancing

Table of Contents

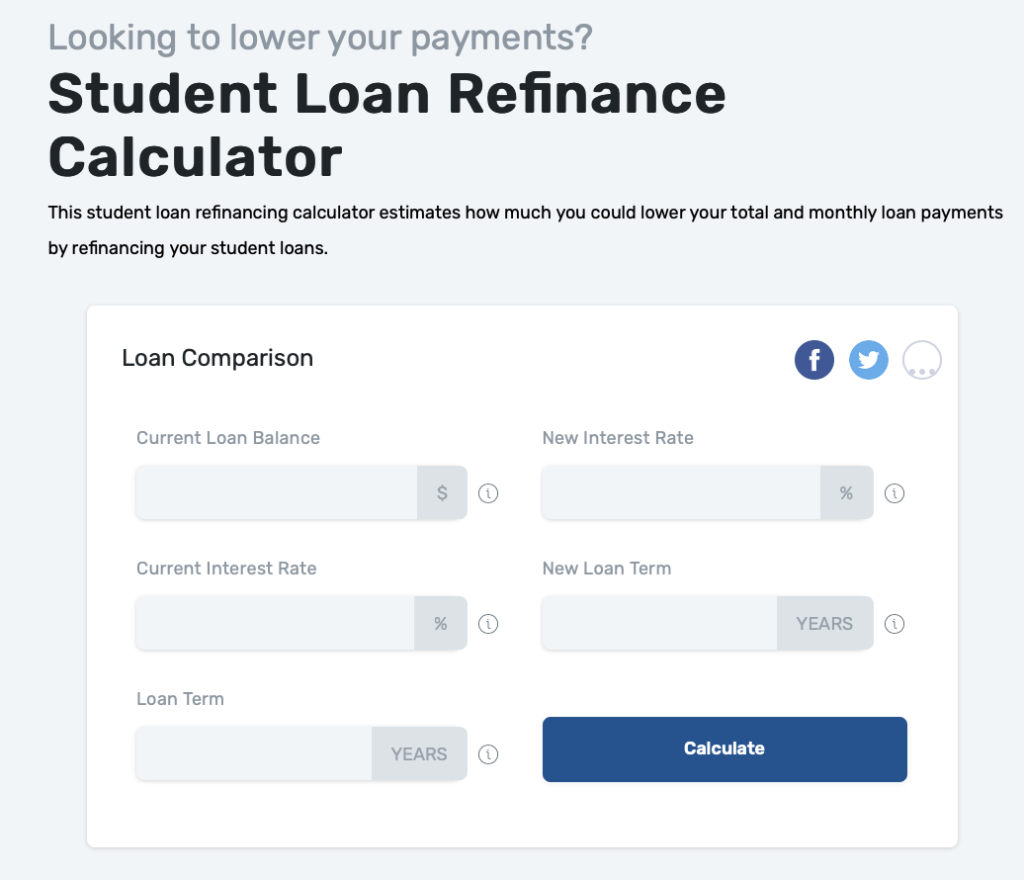

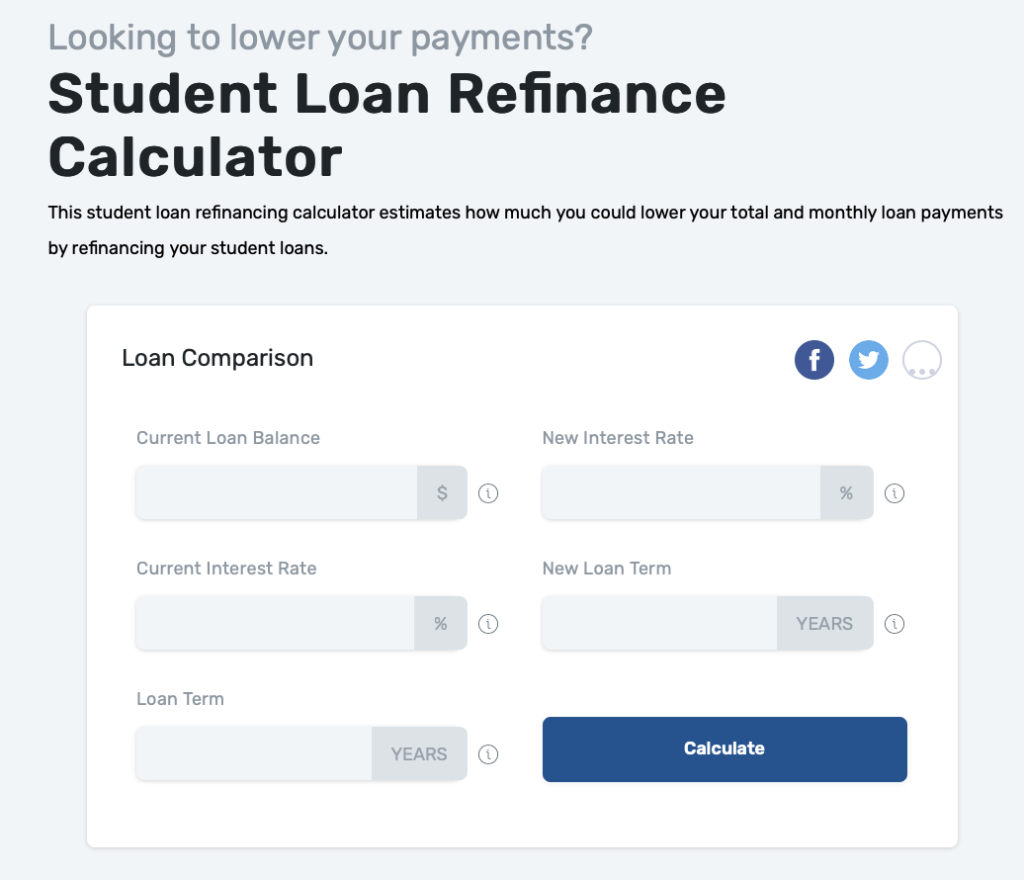

Understanding Federal Student Loan Refinancing

What is Federal Student Loan Refinancing?

Federal student loan refinancing involves replacing your existing federal student loans with a new private loan from a private lender. This process essentially means you're paying off your federal loans and taking out a new loan with a private institution. The key difference lies in the protections afforded. Federal student loans often come with government-backed benefits like income-driven repayment plans, deferment options, and potential forgiveness programs. Private student loans, however, typically do not offer these same protections. Understanding this distinction is crucial before proceeding with refinancing. Losing these federal benefits is a significant drawback to consider.

Who is a Good Candidate for Refinancing?

Refinancing your student loans is not a one-size-fits-all solution. You're generally a good candidate if you meet several criteria:

-

Excellent or Good Credit Score: Lenders typically require a good to excellent credit score (generally 680 or higher) to qualify for the most favorable interest rates. A higher score demonstrates your creditworthiness and reduces the lender's risk.

-

Stable Income and Employment History: Lenders want assurance you can consistently make your monthly payments. A stable job history and steady income are essential for approval.

-

Low Debt-to-Income Ratio: A low debt-to-income ratio (DTI) shows you have the financial capacity to manage additional debt. The lower your DTI, the better your chances of approval and securing a better interest rate.

Refinancing might be especially beneficial if:

- You qualify for a significantly lower interest rate than your current federal loans.

- You want to switch from a variable interest rate to a fixed interest rate, protecting yourself from future rate increases.

- You have multiple student loans and want to consolidate them into a single, easier-to-manage payment.

Types of Refinancing Options:

Several options exist when refinancing your federal student loans:

- Single-loan refinancing: This involves refinancing a single student loan.

- Multi-loan refinancing: This allows you to refinance multiple federal student loans into one new loan. This simplifies your payments and potentially reduces your overall interest rate.

- Refinancing with a co-signer: If you have a low credit score or limited income, a co-signer with good credit can significantly increase your chances of approval and potentially secure a lower interest rate. However, remember the co-signer shares the responsibility for repayment.

- Repayment terms: You can choose different repayment terms (e.g., 5-year, 10-year, 15-year loan terms). Shorter terms lead to higher monthly payments but lower overall interest paid. Longer terms result in lower monthly payments but higher total interest paid.

The Benefits and Drawbacks of Refinancing Federal Student Loans

Potential Benefits:

- Lower Monthly Payments: Refinancing can significantly reduce your monthly student loan payments, making budgeting easier.

- Lower Interest Rate: Securing a lower interest rate can save you thousands of dollars in interest over the life of your loan.

- Shorter Repayment Term: A shorter repayment term can help you pay off your loans faster, though this will increase your monthly payments.

- Fixed Interest Rate: Switching to a fixed interest rate protects you from fluctuating interest rates, offering predictability and financial stability.

- Streamlined Payments: Consolidating multiple loans simplifies your finances and reduces the hassle of managing several different payments.

Potential Drawbacks:

- Loss of Federal Student Loan Benefits: This is a crucial consideration. Refinancing means losing access to income-driven repayment plans, potential loan forgiveness programs, and other federal protections.

- Higher Interest Rates for Lower Credit Scores: Borrowers with less-than-stellar credit scores may face higher interest rates than those with excellent credit.

- Increased Monthly Payments (Shorter Term): Opting for a shorter repayment term will increase your monthly payments, even if the interest rate is lower.

- Increased Total Interest Paid (Longer Term): Extending your repayment term lowers monthly payments but increases the total interest you'll pay over the life of the loan.

How to Choose the Right Refinancing Lender

Comparing Lenders and Interest Rates:

Shopping around is crucial. Compare offers from multiple lenders to secure the best interest rate and terms. Consider these factors:

- Interest rates: This is the most crucial factor. Aim for the lowest possible interest rate.

- Fees: Be aware of origination fees, prepayment penalties, and other potential charges.

- Customer service: Read reviews to gauge the lender's reputation for customer service and responsiveness.

- Repayment options: Consider the different repayment plans available to find one that best suits your financial situation.

Understanding the Fine Print:

Carefully read the loan agreement before signing. Pay close attention to:

- Interest rates (fixed vs. variable): Understand the implications of each.

- Fees: Ensure you understand all fees and charges.

- Repayment terms: Choose a repayment term that aligns with your budget and financial goals.

- Prepayment penalties: Some lenders charge penalties for paying off your loan early.

The Refinancing Process: A Step-by-Step Guide

Step 1: Check Your Credit Score:

Before applying, check your credit score. A higher score improves your chances of securing a favorable interest rate.

Step 2: Shop Around for Lenders:

Compare interest rates and terms from multiple lenders to find the best deal. Use online comparison tools to streamline this process.

Step 3: Complete the Application:

Fill out the application accurately and completely. Provide all necessary documentation to speed up the process.

Step 4: Review and Accept the Offer:

Carefully review the loan terms before accepting the offer. Ensure you fully understand the terms and conditions before signing.

Conclusion

Refinancing your federal student loans can offer significant benefits, potentially leading to lower monthly payments and less overall interest paid. However, it's crucial to carefully weigh the pros and cons and understand the implications of losing federal loan benefits. By thoroughly researching lenders, comparing offers, and understanding the process, you can make an informed decision about whether federal student loan refinancing is the right choice for you. Start exploring your options today and take control of your student loan debt! Don't delay – begin your federal student loan refinancing journey now!

Featured Posts

-

Canadas New Tariffs On Us Goods Plummet Near Zero Rates And Key Exemptions

May 17, 2025

Canadas New Tariffs On Us Goods Plummet Near Zero Rates And Key Exemptions

May 17, 2025 -

Yankees Vs Mariners Mlb Game Expert Prediction Picks And Betting Odds

May 17, 2025

Yankees Vs Mariners Mlb Game Expert Prediction Picks And Betting Odds

May 17, 2025 -

Apple Tv 3 Month Subscription 3 Offer Ending Soon

May 17, 2025

Apple Tv 3 Month Subscription 3 Offer Ending Soon

May 17, 2025 -

New Zealands Top Online Casinos For Real Money Gambling

May 17, 2025

New Zealands Top Online Casinos For Real Money Gambling

May 17, 2025 -

Unexpected Leader After A Difficult Opening Round At The Pga Championship

May 17, 2025

Unexpected Leader After A Difficult Opening Round At The Pga Championship

May 17, 2025

Latest Posts

-

Self Driving Cars Arrive In Austin Uber And Waymos Robotaxi Debut

May 17, 2025

Self Driving Cars Arrive In Austin Uber And Waymos Robotaxi Debut

May 17, 2025 -

Understanding Ubers April Performance A Double Digit Rally Explained

May 17, 2025

Understanding Ubers April Performance A Double Digit Rally Explained

May 17, 2025 -

Online Casino New Zealand Expert Recommendations And Comparisons

May 17, 2025

Online Casino New Zealand Expert Recommendations And Comparisons

May 17, 2025 -

Uber Stock Soars Analyzing Aprils Double Digit Gains

May 17, 2025

Uber Stock Soars Analyzing Aprils Double Digit Gains

May 17, 2025 -

Playing At The Best Online Casinos In New Zealand A Players Guide

May 17, 2025

Playing At The Best Online Casinos In New Zealand A Players Guide

May 17, 2025