The Unexpected Link Between Climate Risk And Your Creditworthiness For A Mortgage

Table of Contents

How Climate Change Affects Property Values and Mortgage Risk

Climate change significantly impacts property values and the perceived risk associated with mortgage lending. Lenders are increasingly factoring climate-related hazards into their assessments, making it harder for some homeowners to qualify for loans.

Increased Risk of Natural Disasters

The frequency and intensity of natural disasters like floods, wildfires, and hurricanes are escalating due to climate change. These events directly impact property values, making them less attractive to lenders.

- Floods: A property significantly damaged by a flood can experience a dramatic decrease in value, sometimes making it difficult to secure a mortgage or even refinance.

- Wildfires: Properties in areas prone to wildfires face higher insurance premiums and decreased market value due to the increased risk of damage or destruction. Areas in California and Australia, for example, have seen significant impacts.

- Hurricanes: Coastal properties susceptible to hurricanes are increasingly facing stricter lending criteria and higher insurance costs, reflecting the elevated risk.

Lenders use sophisticated models that incorporate historical climate data, geographical location, and projected future risks to assess the vulnerability of a property. This assessment significantly influences their willingness to provide a mortgage.

The Growing Importance of Climate Risk Assessments

As the understanding of climate change's impact deepens, lenders are incorporating climate risk assessments into their mortgage underwriting processes.

- Climate risk assessment tools: Companies and organizations are developing tools to assess climate-related risks to properties, using factors such as flood plain mapping, wildfire risk models, and sea-level rise projections.

- Government regulations: Government regulations and initiatives, including climate-related disclosures, are pushing lenders to consider climate risk more comprehensively in their lending practices.

Accurately predicting future climate risks and their precise impact on property values remains a challenge, leading to a more cautious approach by lending institutions. This cautious approach can translate to stricter lending criteria and higher interest rates in high-risk areas.

The Impact of Climate Change on Home Insurance and Mortgage Approval

Climate change is significantly influencing home insurance costs and availability, directly impacting mortgage applications.

Rising Insurance Premiums and Unaffordability

Increased climate risk translates into higher home insurance premiums. In many high-risk areas, these premiums are becoming prohibitively expensive.

- Escalating premiums: Homeowners in flood-prone zones, wildfire-prone areas, and coastal regions are seeing dramatic increases in their insurance costs.

- Uninsurable properties: In some cases, properties become completely uninsurable, making it impossible to secure a mortgage.

From the lender's perspective, home insurance is a critical element of mortgage approval. It protects their investment in case of damage or destruction of the property.

Difficulty Securing Homeowners Insurance

The difficulty in securing affordable homeowners insurance can be a significant obstacle to mortgage approval.

- Lender requirements: Lenders often require specific types of insurance coverage, and if this insurance is unavailable or too expensive, the mortgage application may be denied.

- Implications for homeowners: This creates significant challenges for homeowners in climate-vulnerable areas, limiting their ability to purchase or refinance their homes.

Proactive Steps to Mitigate Climate Risk and Improve Your Creditworthiness

Taking proactive steps to reduce climate risk associated with your property can improve your creditworthiness and chances of mortgage approval.

Investing in Climate-Resilient Upgrades

Investing in home improvements that enhance climate resilience can positively influence your mortgage application.

- Flood barriers: Installing flood barriers can significantly reduce the risk of flood damage and lower insurance premiums.

- Fire-resistant roofing: Replacing a traditional roof with a fire-resistant option can minimize wildfire damage risks and potentially lead to lower insurance costs.

- Improved drainage: Enhancements to drainage systems can reduce the risk of water damage.

Lenders view these upgrades favorably as they demonstrate a commitment to mitigating risk, potentially leading to better loan terms and interest rates.

Transparency and Disclosure

Being completely transparent about potential climate-related risks associated with the property is crucial.

- Accurate property disclosures: Honest and comprehensive disclosures about past flood damage, wildfire proximity, or other climate-related risks build trust with lenders.

- Legal implications: Undisclosed climate risks can have significant legal ramifications, jeopardizing both the buyer and the lender.

Conclusion

The link between climate risk and your creditworthiness for a mortgage is undeniable. Climate change is impacting property values, insurance costs, and lender assessments. Understanding the increased role of climate risk assessments in underwriting is vital. By proactively investing in climate-resilient upgrades and maintaining transparency, you can significantly improve your chances of securing a mortgage. Understanding the link between climate risk and your creditworthiness for a mortgage is crucial for securing your future home. Begin your research today! Don't let climate risk affect your mortgage application. Learn more about mitigating these risks now.

Featured Posts

-

Colombian Models Murder Femicide Condemnation Mounts After Mexican Influencers Killing

May 21, 2025

Colombian Models Murder Femicide Condemnation Mounts After Mexican Influencers Killing

May 21, 2025 -

The David Walliams Simon Cowell Bgt Feud A Timeline Of Tension

May 21, 2025

The David Walliams Simon Cowell Bgt Feud A Timeline Of Tension

May 21, 2025 -

De Voordelen Van Tikkie Voor Nederlandse Bankklanten

May 21, 2025

De Voordelen Van Tikkie Voor Nederlandse Bankklanten

May 21, 2025 -

The Buy Canadian Beauty Movement A Tariff Focused Analysis

May 21, 2025

The Buy Canadian Beauty Movement A Tariff Focused Analysis

May 21, 2025 -

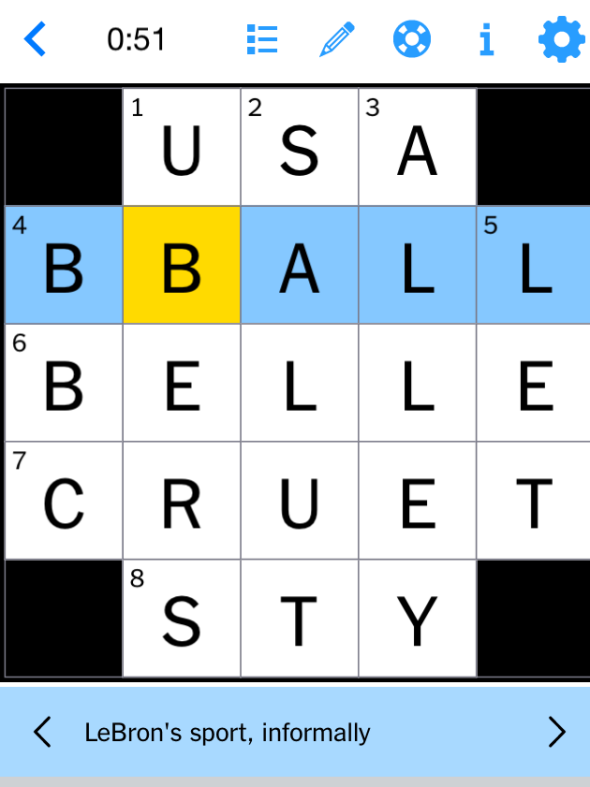

Todays Nyt Mini Crossword Answers March 13 2025

May 21, 2025

Todays Nyt Mini Crossword Answers March 13 2025

May 21, 2025