The Unforeseen Consequences Of ‘Liberation Day’ Tariffs On Stock Investments

Table of Contents

Impact on Specific Sectors

The ‘Liberation Day’ tariffs have created ripples across various economic sectors, impacting stock valuations and investor confidence. Let's analyze the most affected industries:

Manufacturing and Export-Oriented Industries

The manufacturing sector, particularly those heavily reliant on exports, is feeling the immediate brunt of these tariffs. Increased import duties and export tariffs directly impact production costs and international competitiveness.

- Increased production costs: Higher costs for imported raw materials and components translate to higher prices for finished goods, reducing profit margins.

- Decreased export volume: Increased prices make domestically produced goods less attractive in international markets, leading to a decline in export volume.

- Potential job losses: Reduced competitiveness and shrinking export markets can lead to factory closures and job losses within the manufacturing sector.

- Impact on supply chains: Disruptions in global supply chains due to tariffs can further complicate production and increase costs. For example, the automotive sector, heavily reliant on imported parts, saw a 15% drop in stock prices following the tariff announcement, highlighting the vulnerability of manufacturing stocks to these trade policies.

Consumer Goods and Retail

Increased import costs associated with the ‘Liberation Day’ tariffs are inevitably passed on to consumers, leading to higher prices for everyday goods. This impacts consumer spending and the profitability of retail companies.

- Higher prices for consumers: Inflationary pressures driven by tariffs squeeze household budgets, leading to reduced discretionary spending.

- Reduced consumer spending: Higher prices for consumer staples reduce consumer confidence and purchasing power, impacting overall demand.

- Impact on retail margins: Retailers face the challenge of absorbing increased costs or passing them on to consumers, affecting their profit margins and stock valuations.

- Potential stock price declines: Reduced consumer spending and squeezed retail margins can translate to declining stock prices for companies in the consumer goods and retail sectors. This underscores the importance of carefully evaluating retail stocks in the current market climate.

Technology and International Trade

The technology sector, heavily reliant on global supply chains for components and expertise, is also vulnerable to the impact of ‘Liberation Day’ tariffs.

- Disruptions to component sourcing: Tariffs on imported components can disrupt production schedules and increase manufacturing costs for tech devices.

- Increased production costs for tech devices: Higher component costs translate to higher prices for consumers, affecting demand and profitability.

- Impact on software companies reliant on international markets: Tariffs can hinder the expansion of software companies into international markets, limiting their growth potential. The interconnected nature of the global tech industry means that even seemingly minor tariffs can have far-reaching consequences for tech stocks and semiconductor stocks.

Macroeconomic Consequences and Market Volatility

The ‘Liberation Day’ tariffs have broader macroeconomic consequences that contribute to market instability and uncertainty.

Inflationary Pressures

Tariffs contribute to inflationary pressures by increasing the cost of imported goods and services. This negatively affects investor sentiment and stock valuations.

- Rising prices for goods and services: Increased import costs are passed on to consumers, leading to higher prices across the economy.

- Decreased purchasing power: Inflation erodes the purchasing power of consumers, impacting overall economic growth.

- Potential for interest rate hikes: To combat inflation, central banks may raise interest rates, increasing borrowing costs for businesses and individuals.

- Impact on market sentiment: Increased inflation and uncertainty can negatively impact investor confidence, leading to market volatility. Investors need to carefully consider inflation hedge strategies in the current environment.

Currency Fluctuations

The ‘Liberation Day’ tariffs can also lead to currency fluctuations, impacting multinational corporations and their stock performance.

- Changes in currency values: Tariffs can influence exchange rates, impacting the profitability of foreign earnings for multinational corporations.

- Impact on profitability of foreign earnings: Currency fluctuations can reduce the value of foreign earnings when converted back to the domestic currency.

- Potential for currency risk: Multinational corporations face increased currency risk due to fluctuating exchange rates.

- Hedging strategies: Companies can employ hedging strategies, such as foreign exchange options, to mitigate currency risk. Understanding currency exchange rates is vital for investors exposed to multinational corporations.

Strategies for Mitigating Investment Risks

Investors can take proactive steps to protect their portfolios from the negative impacts of the ‘Liberation Day’ tariffs.

Diversification

Diversification remains a cornerstone of effective risk management. Spreading investments across different sectors and asset classes reduces exposure to the negative impacts of tariffs on any specific sector.

- Spreading investments across different sectors and asset classes: A diversified portfolio mitigates the risk associated with sector-specific downturns.

- Reducing exposure to specific risks: Diversification minimizes the impact of adverse events affecting a single sector or asset class. Effective portfolio diversification is crucial for navigating the uncertainties created by the ‘Liberation Day’ tariffs.

Hedging Strategies

Hedging strategies can help protect against potential losses due to tariff-related market volatility.

- Options trading: Options contracts can be used to hedge against potential price declines in specific stocks or sectors.

- Futures contracts: Futures contracts can be used to lock in prices for commodities or other assets, mitigating the impact of price fluctuations.

- Currency hedging: Currency hedging strategies can protect against losses due to currency fluctuations.

- Inverse ETFs: Inverse exchange-traded funds (ETFs) can provide downside protection in a declining market. Thorough understanding of derivative instruments is vital when employing these hedging strategies. Risk mitigation is key.

Seeking Professional Advice

Navigating the complex landscape of ‘Liberation Day’ tariffs and their impact on investments requires expertise. Consulting with a financial advisor is crucial.

- Importance of personalized advice: A financial advisor can provide personalized advice based on your individual risk tolerance and investment goals.

- Tailored investment strategies: A financial advisor can help you develop a tailored investment strategy to address the challenges posed by the tariffs.

- Risk tolerance assessment: A financial advisor can assess your risk tolerance and recommend appropriate investment strategies accordingly. Investment planning and wealth management become increasingly important in this environment.

Conclusion

The ‘Liberation Day’ tariffs present significant challenges for investors. Understanding their multifaceted impact on various sectors and the broader economy is crucial for making informed investment decisions. By diversifying your portfolio, employing appropriate hedging strategies, and seeking professional financial advice, you can mitigate risks and navigate the complexities of this changing market landscape. Don't underestimate the impact of the ‘Liberation Day’ tariffs on your stock investments; take proactive steps today to protect your portfolio. Consult a financial advisor to develop a robust investment strategy to address the challenges posed by these new ‘Liberation Day’ tariffs.

Featured Posts

-

Psl 10 Tickets Official Sale Commences Today

May 08, 2025

Psl 10 Tickets Official Sale Commences Today

May 08, 2025 -

Consumer Organisation Takes Lidl To Court Over Plus App

May 08, 2025

Consumer Organisation Takes Lidl To Court Over Plus App

May 08, 2025 -

Psl 10 Ticket Sales Starting Today

May 08, 2025

Psl 10 Ticket Sales Starting Today

May 08, 2025 -

Xrp Futures And Options Impact On Price Recovery

May 08, 2025

Xrp Futures And Options Impact On Price Recovery

May 08, 2025 -

Andor Showrunner Tony Gilroy Reflects On Production

May 08, 2025

Andor Showrunner Tony Gilroy Reflects On Production

May 08, 2025

Latest Posts

-

Kenya Uber Update Cashback Offers And Increased Delivery Ride Opportunities

May 08, 2025

Kenya Uber Update Cashback Offers And Increased Delivery Ride Opportunities

May 08, 2025 -

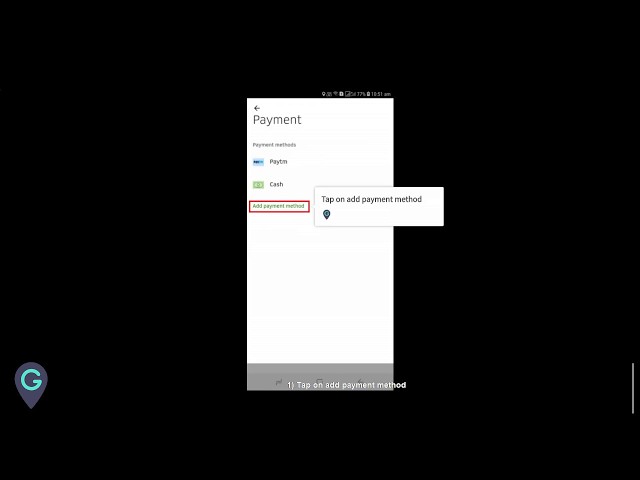

How To Pay For Uber Auto Rides A Guide To Upi And Alternatives

May 08, 2025

How To Pay For Uber Auto Rides A Guide To Upi And Alternatives

May 08, 2025 -

Ubers Kalanick Admits Abandoning Product Strategy Was A Mistake

May 08, 2025

Ubers Kalanick Admits Abandoning Product Strategy Was A Mistake

May 08, 2025 -

Get Cashback With Uber Kenya Good News For Drivers And Couriers Too

May 08, 2025

Get Cashback With Uber Kenya Good News For Drivers And Couriers Too

May 08, 2025 -

Uber Auto Understanding Payment Methods After Cash Removal

May 08, 2025

Uber Auto Understanding Payment Methods After Cash Removal

May 08, 2025