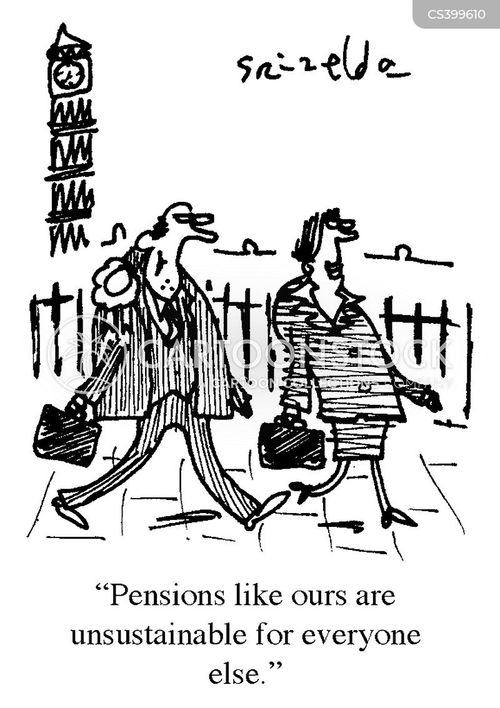

The Unsustainable Costs Of Public Sector Pensions: A Taxpayer Perspective

Table of Contents

The Growing Liability of Public Sector Pension Schemes

The core problem lies in the ballooning liability of public sector pension schemes. This escalating cost is a significant concern for taxpayers, threatening essential public services and potentially leading to increased taxation.

Unfunded Liabilities and Future Projections

A key driver of this financial strain is the existence of significant unfunded liabilities. Simply put, unfunded liabilities represent the difference between the promised pension benefits and the assets available to pay them. These liabilities are growing at an alarming rate, threatening the long-term financial stability of many schemes.

- What are unfunded liabilities? These are essentially promises made to pensioners that the government may not have the funds to fulfill. Think of it as a massive IOU to future retirees.

- Examples of schemes with significant unfunded liabilities: [Insert specific examples and links to relevant reports, e.g., specific state or local government pension plans facing large unfunded liabilities. Cite official government data sources.]

- Projected growth: Experts project a [Insert percentage]% increase in unfunded liabilities over the next 10-20 years. [Link to reputable source supporting this projection.] This unsustainable growth puts immense pressure on taxpayers.

- Data Sources: [Include hyperlinks to government reports, statistical agencies, and reputable financial news sources providing data on public sector pension liabilities.]

Generous Benefit Packages and Early Retirement

Further contributing to the rising costs are generous benefit packages and early retirement options offered to public sector employees. These benefits, while attractive to employees, place a considerable strain on public finances.

- Comparison to private sector: Public sector pensions often offer significantly higher benefits and earlier retirement ages compared to their private sector counterparts.

- Cost of early retirement: Early retirement schemes, while intended to benefit employees, substantially increase the overall cost of pension provision. The longer retirees receive payments, the higher the overall cost.

- Impact of increasing life expectancy: As life expectancy increases, the cost of pension payouts rises proportionally, further exacerbating the existing financial pressure.

The Taxpayer's Burden: Increased Taxation and Reduced Services

The consequences of unsustainable public sector pension costs are felt directly by taxpayers through increased taxation and cuts to essential public services.

The Impact on Tax Rates

The need to fund these growing liabilities often necessitates increases in various taxes. This places a significant burden on taxpayers, potentially impacting household budgets and economic growth.

- Examples of tax increases: [Cite specific examples of tax increases directly or indirectly linked to pension funding, e.g., increases in income tax, sales tax, or property tax.]

- Regressive nature: Often, tax increases to fund pensions disproportionately affect lower-income households, making them a regressive form of taxation.

- Opportunity cost: The funds used to cover pension liabilities could be invested in other vital areas like healthcare, education, and infrastructure, improving the quality of life for all citizens.

Cutbacks in Essential Public Services

To offset rising pension costs, governments often resort to drastic cuts in crucial public services, impacting the quality of life for all citizens.

- Examples of service cuts: [Provide concrete examples of cuts to healthcare, education, infrastructure, or other essential public services, citing specific instances and linking to credible sources.]

- Quantifying the impact: These cuts often result in job losses, reduced service quality, longer waiting times, and overall diminished public services.

- Negative consequences: The consequences are far-reaching, affecting access to healthcare, educational opportunities, and overall quality of life.

Potential Solutions and Reforms for Public Sector Pensions

Addressing the unsustainable costs of public sector pensions requires comprehensive reforms and innovative solutions.

Pension Reform Strategies

Several reform strategies could help alleviate the burden on taxpayers while ensuring fair treatment for public sector employees.

- Increasing contribution rates: Increasing employee and/or employer contributions can help close the funding gap.

- Adjusting benefit formulas: Modifying benefit calculation formulas to reflect changing demographics and economic realities can reduce long-term liabilities.

- Raising the retirement age: Gradually increasing the retirement age can align with increasing life expectancy and reduce the overall payout period.

- Pros and cons: Each strategy has its own advantages and disadvantages, needing careful consideration of the potential impact on both employees and taxpayers.

- International examples: [Provide examples of successful pension reforms implemented in other countries, highlighting their effectiveness and challenges.]

The Role of Transparency and Accountability

Improving transparency and accountability in the management of public sector pension funds is crucial.

- Increased public access: Greater public access to pension fund information is vital to ensure responsible management.

- Improved oversight: Implementing robust oversight mechanisms and independent audits can help prevent mismanagement and cost overruns.

- Preventing future overruns: Stronger accountability measures can discourage unsustainable practices and promote responsible financial planning.

Conclusion

The unsustainable cost of public sector pensions presents a significant challenge to taxpayers. The growing unfunded liabilities, generous benefit packages, and increasing life expectancy contribute to this escalating financial burden. This leads to increased taxation and cuts in essential public services. To address this, comprehensive pension reforms, including adjusting benefit formulas, increasing contribution rates, raising the retirement age, and improving transparency and accountability are necessary.

Demand change! Contact your representatives and advocate for sustainable solutions to the escalating costs of public sector pensions. Your voice matters in shaping a fairer and more fiscally responsible future. The future of public sector pensions requires your active participation to ensure a sustainable and equitable system for all.

Featured Posts

-

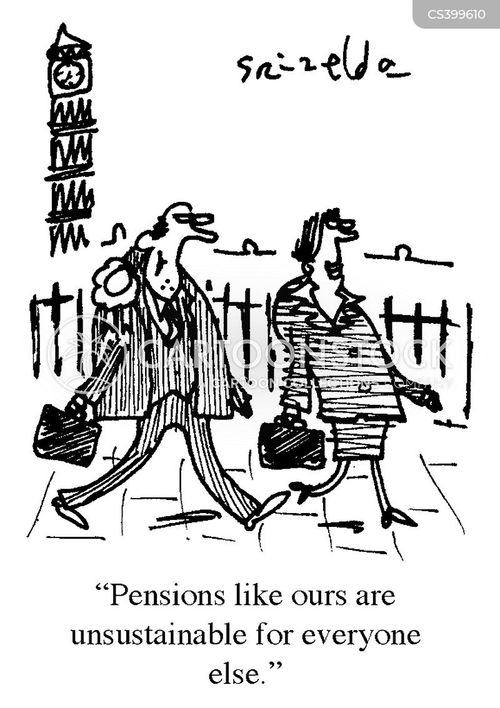

Black Hawk Crash Pilots Pre Crash Actions Under Scrutiny

Apr 29, 2025

Black Hawk Crash Pilots Pre Crash Actions Under Scrutiny

Apr 29, 2025 -

160km H Mlb

Apr 29, 2025

160km H Mlb

Apr 29, 2025 -

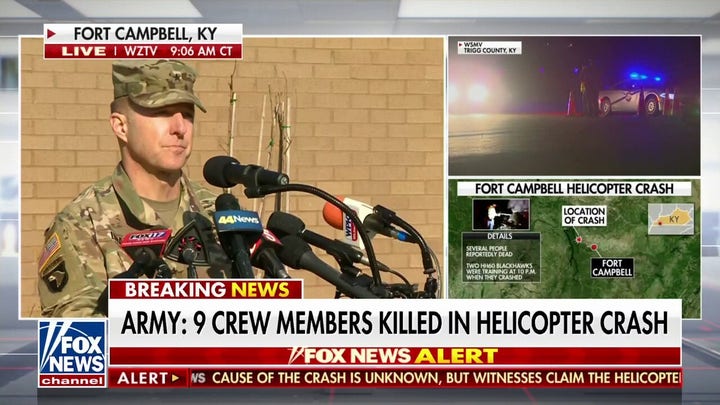

Behind The Scenes Jeff Goldblum And The Flys Ending

Apr 29, 2025

Behind The Scenes Jeff Goldblum And The Flys Ending

Apr 29, 2025 -

2024 Metais Porsche Pardavimu Augimas Lietuvoje

Apr 29, 2025

2024 Metais Porsche Pardavimu Augimas Lietuvoje

Apr 29, 2025 -

January 29th Dc Air Disaster Uncovering The Untold Story From Ny Times Reporting

Apr 29, 2025

January 29th Dc Air Disaster Uncovering The Untold Story From Ny Times Reporting

Apr 29, 2025

Latest Posts

-

Our Farm Next Door A Familys Story Of Farming And Community

Apr 30, 2025

Our Farm Next Door A Familys Story Of Farming And Community

Apr 30, 2025 -

Meet Amanda Clive And The Kids A Day In The Life Of Our Farm Next Door

Apr 30, 2025

Meet Amanda Clive And The Kids A Day In The Life Of Our Farm Next Door

Apr 30, 2025 -

Life On Our Farm Next Door Amanda Clive And Their Family

Apr 30, 2025

Life On Our Farm Next Door Amanda Clive And Their Family

Apr 30, 2025 -

Meet Amanda Clive And Kids A Day In The Life Of Our Farm Next Door

Apr 30, 2025

Meet Amanda Clive And Kids A Day In The Life Of Our Farm Next Door

Apr 30, 2025 -

Our Farm Next Door Amanda Clive And The Kids Country Life

Apr 30, 2025

Our Farm Next Door Amanda Clive And The Kids Country Life

Apr 30, 2025