The Winning Apple Investment: Lessons From Warren Buffett

Table of Contents

Understanding Buffett's Investment Philosophy

Warren Buffett's approach to investing is deeply rooted in the principles of value investing. This strategy emphasizes identifying undervalued companies with strong fundamentals and holding them for the long term. Let's explore the core tenets of his philosophy that contributed to the success of his Warren Buffett Apple Investment.

Focus on Value Investing

Buffett's core principle is identifying companies whose market price is significantly lower than their intrinsic value. This requires a deep understanding of the company's financials and long-term growth potential.

- Emphasis on long-term growth potential: Buffett isn't interested in short-term gains. He looks for companies with sustainable competitive advantages that can deliver consistent growth over many years. This long-term investment strategy is crucial for weathering market volatility.

- Analysis of financial statements: Thorough fundamental analysis is paramount. This involves meticulously examining a company's balance sheets, income statements, and cash flow statements to understand its financial health and profitability.

- Understanding intrinsic value vs. market price: The key to value investing is identifying the difference between a company's true worth (intrinsic value) and its current market price. Buying when the market price is significantly below intrinsic value is the cornerstone of Buffett's approach. This often requires patience and a contrarian perspective.

Keywords: Value investing, long-term investment strategy, intrinsic value, fundamental analysis, Warren Buffett Apple Investment.

The Importance of Management Quality

Beyond strong financials, Buffett places immense importance on the quality of a company's management team. He seeks out companies with competent, ethical, and forward-thinking leaders.

- Competent leadership: A skilled management team is crucial for navigating challenges, making sound strategic decisions, and driving long-term growth.

- Ethical practices: Buffett favors companies with a strong ethical foundation and a commitment to responsible business practices.

- Long-term vision: He seeks leaders who prioritize long-term value creation over short-term gains.

- Proven track record: A successful history of managing and growing a business is a key indicator of management quality.

Keywords: Strong management team, leadership quality, corporate governance, ethical business practices, Warren Buffett Apple Investment.

Analyzing Apple's Attractiveness to Buffett

Apple presented a compelling investment opportunity for Buffett, aligning perfectly with his investment philosophy. Several factors made Apple particularly attractive.

Strong Brand and Loyal Customer Base

Apple boasts an unparalleled brand reputation and fiercely loyal customer base. This translates into significant competitive advantages.

- Premium pricing power: Apple's strong brand allows it to command premium prices for its products, boosting profit margins.

- High customer retention: Apple users often remain loyal to the ecosystem, creating a recurring revenue stream.

- Strong brand affinity: The Apple brand resonates deeply with consumers, creating a powerful emotional connection.

- Consistent product innovation: Apple's continuous innovation keeps its products desirable and competitive, driving sales and growth.

Keywords: Brand loyalty, customer retention, strong brand, premium pricing, Warren Buffett Apple Investment.

Recurring Revenue Streams

Beyond hardware sales, Apple generates significant revenue from its services business, creating a robust and predictable income stream.

- App Store revenue: The App Store is a massive revenue generator, benefiting from a large and active user base.

- Subscription services (Apple Music, iCloud): Apple's subscription services provide recurring revenue and lock in customers to the Apple ecosystem.

- Strong ecosystem lock-in: The seamless integration of Apple's hardware and software creates a powerful ecosystem, making it difficult for customers to switch to competitors.

Keywords: Recurring revenue, subscription services, Apple ecosystem, App Store, Warren Buffett Apple Investment.

Undervalued Asset (at the time of investment)

When Buffett initially invested, many analysts viewed Apple as undervalued. This provided a significant opportunity for a value investor like Buffett.

- Market sentiment: Market sentiment towards Apple was somewhat negative at the time, creating a buying opportunity for contrarian investors.

- Comparison to intrinsic value: Buffett likely saw a significant gap between Apple's market price and its intrinsic value based on his assessment of its future earnings power and brand strength.

- Potential for future growth: Buffett recognized the enormous potential for growth in Apple's services business and international markets.

- Contrarian investment approach: Buffett's investment in Apple demonstrates his willingness to go against the prevailing market sentiment when he sees significant value.

Keywords: Undervalued stocks, contrarian investing, market mispricing, growth potential, Warren Buffett Apple Investment.

Lessons for Investors

Buffett's success with Apple offers invaluable lessons for all investors.

Patience and Long-Term Perspective

The Warren Buffett Apple Investment exemplifies the importance of patience and a long-term investment horizon.

- Ignoring short-term market fluctuations: Don't panic sell during market downturns. Focus on the long-term growth prospects of your investments.

- Focusing on long-term growth: Prioritize companies with sustainable competitive advantages and a proven track record of delivering long-term growth.

- Avoiding emotional decision-making: Make investment decisions based on rational analysis, not emotion.

Keywords: Long-term investment, patience in investing, market volatility, emotional investing, Warren Buffett Apple Investment.

Thorough Due Diligence

Before making any investment, comprehensive research is essential.

- Financial statement analysis: Analyze the company's financial health and profitability.

- Competitive analysis: Assess the company's competitive position within its industry.

- Industry analysis: Understand the industry trends and growth outlook.

- Understanding company strategy: Analyze the company's strategic direction and its ability to execute its plans.

Keywords: Due diligence, investment research, financial analysis, competitive landscape, Warren Buffett Apple Investment.

Conclusion

Warren Buffett's success with his Apple investment underscores the power of a value-driven, long-term investment strategy. By focusing on companies with strong fundamentals, exceptional management, and sustainable competitive advantages, investors can significantly enhance their chances of success. His Apple investment serves as a masterclass in identifying undervalued assets and recognizing the potential for substantial, long-term growth.

Call to Action: Learn from Warren Buffett's winning Apple investment strategy and start building your own portfolio of undervalued, high-growth companies. Begin your journey towards successful long-term investing by researching and understanding the principles of the Warren Buffett Apple Investment approach today!

Featured Posts

-

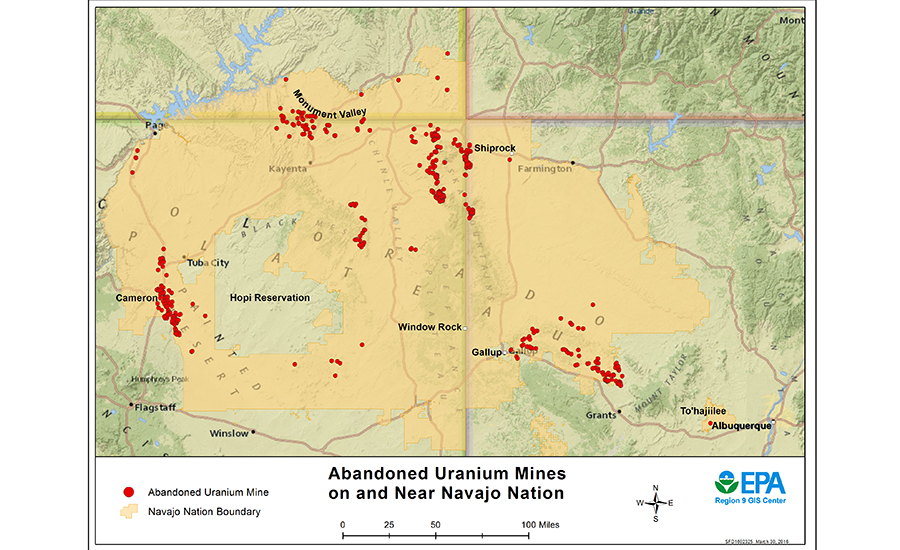

Abandoned Gold Mines Environmental Hazards And Remediation

May 06, 2025

Abandoned Gold Mines Environmental Hazards And Remediation

May 06, 2025 -

Top 5 Most Outrageous Celebrity Met Gala Moments

May 06, 2025

Top 5 Most Outrageous Celebrity Met Gala Moments

May 06, 2025 -

Humanitarian Crisis In Yemen The Untold Story Of Child Drivers

May 06, 2025

Humanitarian Crisis In Yemen The Untold Story Of Child Drivers

May 06, 2025 -

L Avenir Des Spurs Sans Gregg Popovich

May 06, 2025

L Avenir Des Spurs Sans Gregg Popovich

May 06, 2025 -

Dont Miss Out Hot Tickets For Oh Mary Stranger Things And More

May 06, 2025

Dont Miss Out Hot Tickets For Oh Mary Stranger Things And More

May 06, 2025