This Week's Bitcoin Mining Boom: A Detailed Analysis

Table of Contents

The Surge in Bitcoin's Hash Rate: A Deep Dive

Defining Hash Rate and its Significance

Hash rate, in simple terms, represents the computational power dedicated to solving complex cryptographic puzzles to validate Bitcoin transactions and add new blocks to the blockchain. It's a crucial metric for assessing the security and stability of the Bitcoin network.

- Enhanced Network Security: A higher hash rate makes it exponentially more difficult for malicious actors to launch a 51% attack, where they control more than half of the network's computing power to manipulate the blockchain.

- Mining Difficulty Adjustment: The Bitcoin protocol automatically adjusts the mining difficulty every 2016 blocks (approximately two weeks) to maintain a consistent block generation time of around 10 minutes. A higher hash rate generally leads to an increase in mining difficulty.

Analyzing This Week's Hash Rate Increase

This week has seen a dramatic spike in Bitcoin's hash rate, exceeding [Insert actual data and percentage increase here, e.g., 200 EH/s, a 15% increase from last week]. This surge follows a period of [mention previous trend, e.g., relatively stable hash rate or a slight decline].

- Specific Numbers: [Include a chart or graph visually representing the hash rate increase. Cite specific dates and numbers for clarity, e.g., "On October 26th, the hash rate reached X EH/s, a Y% increase compared to October 19th."]

- Comparison to Previous Peaks: [Compare the current increase to previous hash rate peaks and troughs. Provide context by mentioning any significant events that coincided with past changes.]

Correlation with Bitcoin Price

The recent Bitcoin mining boom appears to be closely correlated with a rise in Bitcoin's price. While a higher price directly increases mining profitability, the relationship isn't purely causal.

- Price Fluctuations: [Analyze the price movements during the period of increased mining activity. Provide a chart showing the correlation between price and hash rate.]

- Other Influencing Factors: Other factors like regulatory developments, technological advancements, and market sentiment also play a role in influencing both Bitcoin price and mining activity.

Factors Contributing to the Bitcoin Mining Boom

Increased Mining Profitability

The recent surge in Bitcoin mining activity can be largely attributed to increased profitability for miners.

- Rising Bitcoin Price: The most significant factor is the recent increase in Bitcoin's price, making the reward for successfully mining a block significantly more lucrative.

- Reduced Energy Costs: In some regions, decreased energy costs have further enhanced mining profitability, making it more attractive to operate mining farms.

- Technological Advancements: New, more efficient mining hardware has reduced operational costs, improving overall profitability.

New Mining Hardware and Technological Advancements

The development of increasingly powerful and energy-efficient ASIC (Application-Specific Integrated Circuit) miners has played a critical role in the boom.

- ASIC Manufacturers: Companies like Bitmain and MicroBT continue to release more advanced ASIC miners, pushing the technological boundaries of Bitcoin mining.

- Improved Energy Efficiency: Newer ASICs boast significantly improved energy efficiency, lowering operational costs and making mining more profitable even with fluctuating energy prices.

Expansion of Mining Farms

The growth of large-scale Bitcoin mining operations, often located in regions with favorable energy prices and regulatory environments, has contributed significantly to the increased hash rate.

- Geographical Locations: [Mention specific regions known for their large mining farms, e.g., Kazakhstan, Texas, etc., highlighting factors such as low electricity costs and supportive regulations.]

- Institutional Investors: The involvement of institutional investors in Bitcoin mining has also fueled this expansion, providing substantial capital for the establishment of large-scale mining facilities.

Potential Implications and Future Outlook

Impact on Network Security and Decentralization

The increased hash rate undeniably strengthens Bitcoin's network security, making it more resistant to attacks. However, it also raises concerns about decentralization.

- Increased Security: The higher computational power makes it incredibly difficult for attackers to compromise the network.

- Potential Centralization: If a few large mining pools control a disproportionately large share of the hash rate, it could lead to concerns about network centralization and potential vulnerabilities.

Environmental Concerns and Energy Consumption

The increased energy consumption associated with Bitcoin mining remains a significant environmental concern.

- Renewable Energy Sources: The industry is increasingly adopting renewable energy sources like hydropower and solar power to mitigate its environmental footprint.

- Energy Efficiency Improvements: Technological advancements in mining hardware are constantly improving energy efficiency, reducing the overall energy consumption per unit of hash rate.

Long-Term Sustainability of the Bitcoin Mining Boom

The sustainability of this Bitcoin mining boom hinges on several factors.

- Future Price Corrections: A significant drop in Bitcoin's price could significantly impact mining profitability, potentially leading to a decline in hash rate.

- Regulatory Changes: Government regulations regarding cryptocurrency mining could also impact the industry's growth and profitability.

- Technological Advancements: Continued technological advancements in mining hardware and renewable energy sources will play a crucial role in determining the long-term sustainability of Bitcoin mining.

Conclusion

This week's Bitcoin mining boom highlights the dynamic nature of the Bitcoin network and its sensitivity to market forces and technological advancements. While the surge in hash rate significantly strengthens network security, it also raises important questions about decentralization and environmental impact. Understanding the factors driving this boom – from increased profitability to technological innovation – is crucial for assessing its long-term sustainability and impact on the future of Bitcoin. Staying informed about the latest trends in Bitcoin mining, including analysis of the hash rate and mining difficulty, is vital for navigating this evolving landscape. Continue to follow our updates for further insights into the ongoing developments in the exciting world of Bitcoin mining.

Featured Posts

-

Tang Cuong Giam Sat Ngan Chan Bao Hanh Tre Em Tai Cac Co So Giu Tre Tu Nhan

May 09, 2025

Tang Cuong Giam Sat Ngan Chan Bao Hanh Tre Em Tai Cac Co So Giu Tre Tu Nhan

May 09, 2025 -

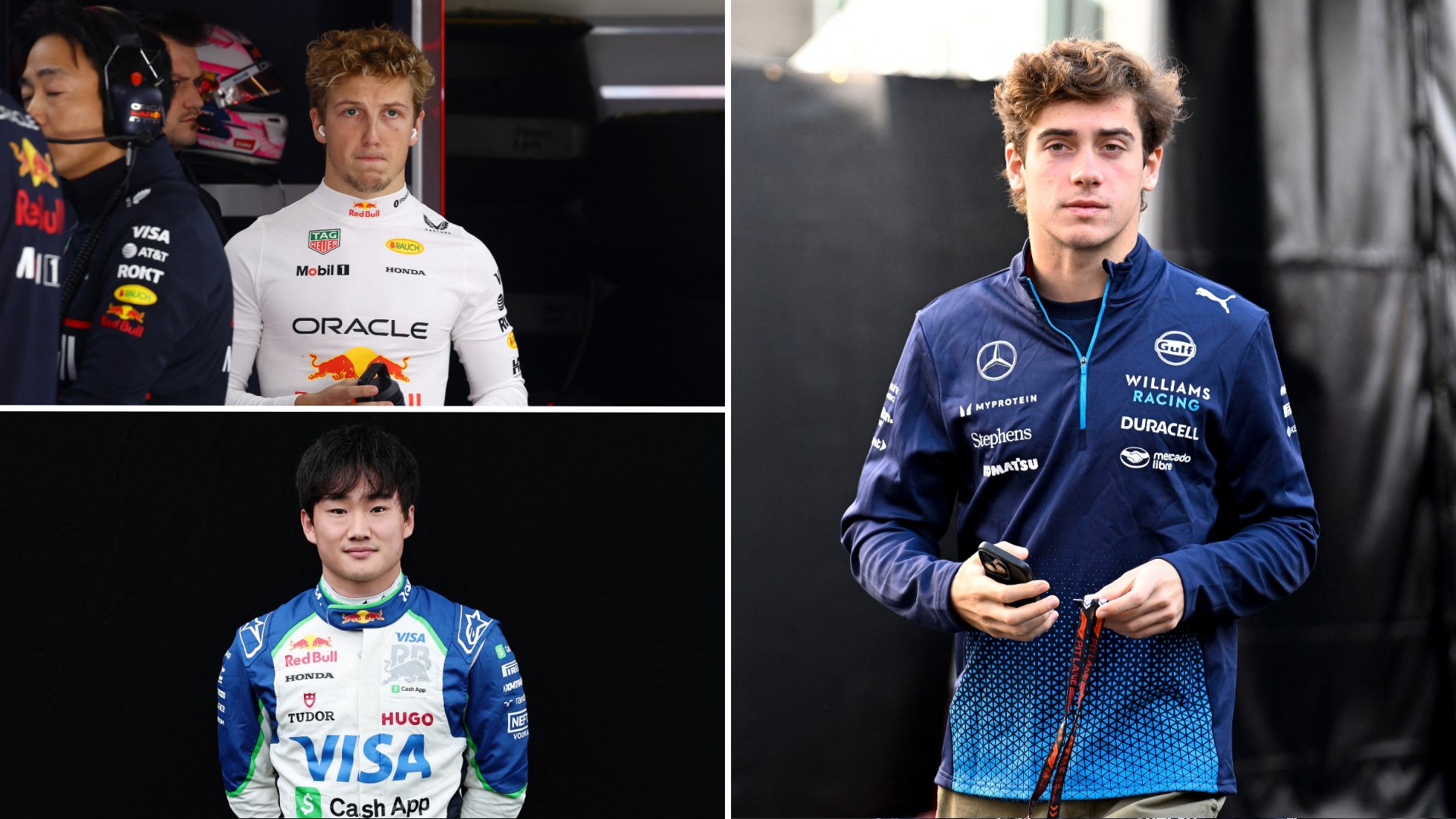

Red Bulls Driver Dilemma Colapinto Vs Lawson

May 09, 2025

Red Bulls Driver Dilemma Colapinto Vs Lawson

May 09, 2025 -

What Did Franco Colapinto Say In His Deleted Drive To Survive Message

May 09, 2025

What Did Franco Colapinto Say In His Deleted Drive To Survive Message

May 09, 2025 -

Warren Buffetts Canadian Successor A Billionaire Without Many Berkshire Hathaway Shares

May 09, 2025

Warren Buffetts Canadian Successor A Billionaire Without Many Berkshire Hathaway Shares

May 09, 2025 -

Us Uk Trade Deal Trumps Announcement And Its Implications For Businesses

May 09, 2025

Us Uk Trade Deal Trumps Announcement And Its Implications For Businesses

May 09, 2025

Latest Posts

-

Examining The Epstein Case Ag Pam Bondis Decision And Transparency

May 09, 2025

Examining The Epstein Case Ag Pam Bondis Decision And Transparency

May 09, 2025 -

Assessing Ag Pam Bondis Decision The Publics Right To Know Regarding The Epstein Files

May 09, 2025

Assessing Ag Pam Bondis Decision The Publics Right To Know Regarding The Epstein Files

May 09, 2025 -

Public Access To Jeffrey Epstein Files Evaluating Ag Pam Bondis Choice

May 09, 2025

Public Access To Jeffrey Epstein Files Evaluating Ag Pam Bondis Choice

May 09, 2025 -

Pam Bondi And James Comer Clash Over Epstein Files

May 09, 2025

Pam Bondi And James Comer Clash Over Epstein Files

May 09, 2025 -

Should We See The Epstein Files Examining Ag Pam Bondis Decision

May 09, 2025

Should We See The Epstein Files Examining Ag Pam Bondis Decision

May 09, 2025