This Week's Commodity Market Outlook: 5 Essential Charts

Table of Contents

Chart 1: Crude Oil Price Movements and Geopolitical Influences

Crude oil prices remain a focal point in the commodity market outlook. Recent price fluctuations are largely driven by the ongoing geopolitical tensions in Eastern Europe, impacting global supply chains and energy security. OPEC+ decisions also play a significant role, with any changes in production quotas immediately reverberating through the market. Global demand, particularly from recovering economies in Asia, adds another layer of complexity.

- Key Price Levels: Support currently sits around $75 per barrel, while resistance hovers near $85. A breach of either level could significantly influence the short-term trend.

- Technical Indicators: Moving averages suggest a potential short-term upward trend, while the RSI (Relative Strength Index) indicates the market is approaching overbought territory, hinting at potential price correction.

- Potential Impact of Sanctions: Further sanctions on oil-producing nations could lead to supply disruptions, potentially driving prices higher. Conversely, a de-escalation of geopolitical tensions could trigger a price decline.

Chart 2: Natural Gas Prices and Weather Patterns

Natural gas prices show a strong correlation with weather patterns. The current outlook reflects a balance between seasonal demand (higher in winter months) and storage levels. Extreme weather events, such as prolonged heatwaves or unexpectedly harsh winters, can significantly impact prices by influencing both supply and demand.

- Correlation Between Weather Forecasts and Price Volatility: Accurately forecasting weather patterns is crucial for predicting natural gas price volatility. Unusually hot or cold spells can dramatically shift the market.

- Inventory Levels: Currently, storage levels are [insert current data on storage levels]. Low inventory levels typically indicate higher price potential due to tighter supply.

- Government Policies: Government regulations and incentives related to natural gas production and the transition to cleaner energy sources can also influence price trends.

Chart 3: Precious Metals Performance and Safe-Haven Demand

Precious metals, such as gold, silver, and platinum, are often seen as safe-haven assets. Their price movements are highly sensitive to inflation, interest rate changes, and overall investor sentiment. During times of economic uncertainty, investors often flock to precious metals, increasing demand and driving prices up.

- Correlation Between Precious Metal Prices and the US Dollar: Precious metals prices typically have an inverse relationship with the US dollar. A stronger dollar often leads to lower precious metal prices, and vice versa.

- Impact of Central Bank Policies: Central bank decisions on interest rates and monetary policy significantly influence investor sentiment and the demand for precious metals.

- Analysis of Investment Flows into Gold ETFs: Monitoring investment flows into Gold Exchange-Traded Funds (ETFs) provides valuable insights into investor confidence and market sentiment.

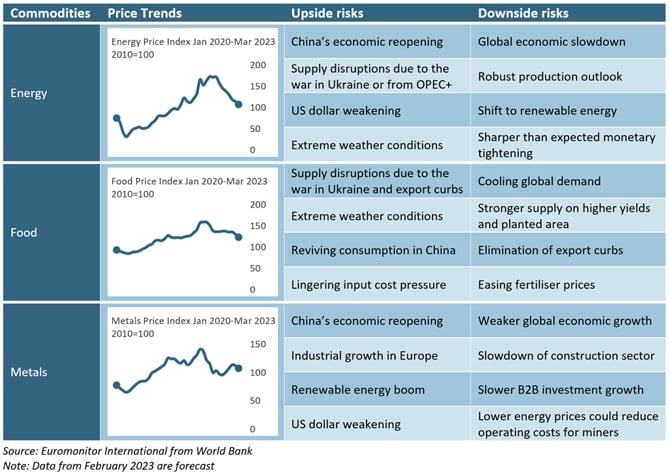

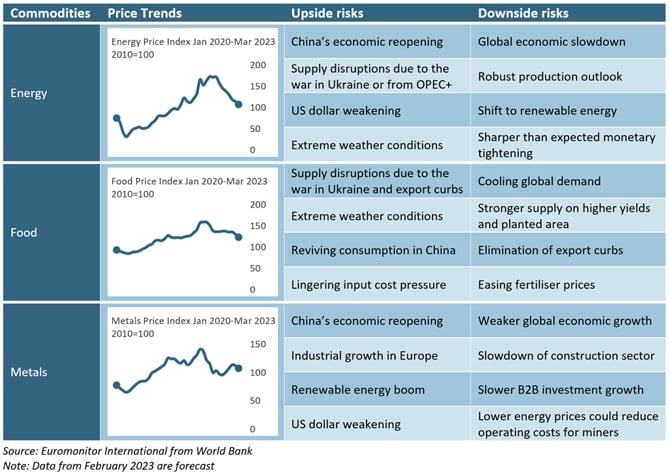

Chart 4: Agricultural Commodity Prices and Global Food Security

Agricultural commodity prices (e.g., corn, wheat, soybeans) are heavily impacted by weather conditions, global supply chains, and geopolitical factors. These commodities are essential for global food security, making their price fluctuations a matter of significant concern.

- Impact of Climate Change: Climate change is increasingly affecting crop yields, leading to supply uncertainties and price volatility.

- Global Trade Policies: Trade disputes, tariffs, and export restrictions can significantly influence the availability and price of agricultural commodities.

- Crop Production Forecasts: Analyzing crop production forecasts from major agricultural producers is essential for predicting future price trends.

Chart 5: Industrial Metal Prices and Manufacturing Activity

Industrial metal prices (copper, aluminum, iron ore) are closely linked to global manufacturing activity and infrastructure spending. Strong industrial demand generally translates to higher metal prices, while economic slowdowns or supply chain disruptions can lead to price declines.

- Correlation Between Metal Prices and Economic Growth Indicators: Key economic indicators, such as industrial production indices and PMI (Purchasing Managers' Index), provide valuable insights into future metal demand.

- Impact of Supply Chain Disruptions: Supply chain bottlenecks and logistical challenges can significantly affect the availability and price of industrial metals.

- Analysis of Future Demand: Government investments in infrastructure projects and the growth of renewable energy sectors can drive future demand for industrial metals.

Conclusion: Making Informed Decisions with This Week's Commodity Market Outlook

This week's commodity market outlook reveals a complex interplay of geopolitical events, weather patterns, economic indicators, and investor sentiment. Analyzing these factors through the lens of the five key charts presented provides valuable insights for making informed decisions in commodity trading and investment. While opportunities exist, it's crucial to acknowledge potential risks associated with market volatility. Stay informed on the ever-changing landscape of the commodity market with our weekly commodity market outlook and insightful charts. Check back next week for a fresh analysis of the commodity market outlook!

Featured Posts

-

5 Times Stephen King Clashed With Other Celebrities

May 06, 2025

5 Times Stephen King Clashed With Other Celebrities

May 06, 2025 -

Dont Miss Out Hot Tickets For Oh Mary Stranger Things And More

May 06, 2025

Dont Miss Out Hot Tickets For Oh Mary Stranger Things And More

May 06, 2025 -

Miley Cyrusin Plagiointisyytteet Tuomioistuin Ei Hylaennyt Syytteitae

May 06, 2025

Miley Cyrusin Plagiointisyytteet Tuomioistuin Ei Hylaennyt Syytteitae

May 06, 2025 -

Jangan Lewatkan Jadwal Dan Link Live Streaming Indonesia Vs Yaman Piala Asia U20 2025

May 06, 2025

Jangan Lewatkan Jadwal Dan Link Live Streaming Indonesia Vs Yaman Piala Asia U20 2025

May 06, 2025 -

Guelsen Bubikoglu Nun Son Hali Yesilcam Guezeli Hayranlarini Sasirtti Mine Tugay Dan Da Tepki Geldi

May 06, 2025

Guelsen Bubikoglu Nun Son Hali Yesilcam Guezeli Hayranlarini Sasirtti Mine Tugay Dan Da Tepki Geldi

May 06, 2025