To Buy Or Not To Buy Palantir Stock Before May 5th? Wall Street's Answer

Table of Contents

Wall Street's Sentiment Towards Palantir

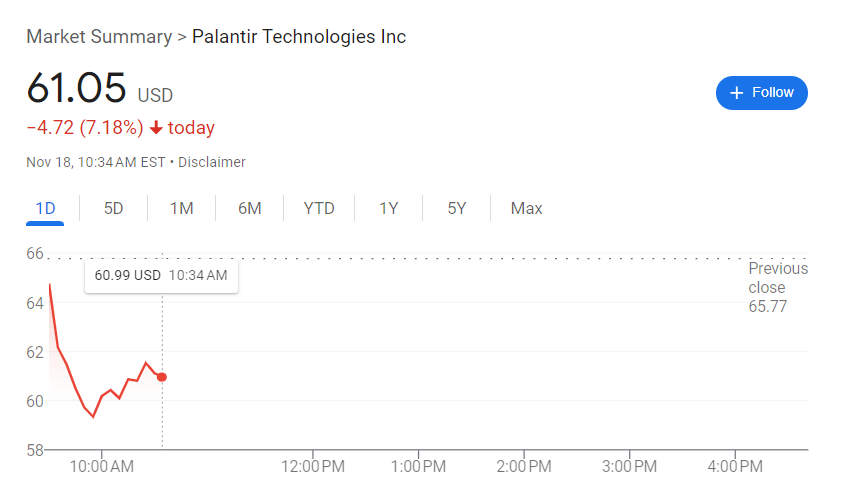

Understanding Wall Street's overall sentiment towards Palantir is crucial before considering any investment. Recent analyst ratings paint a mixed picture. While some analysts maintain a bullish outlook on Palantir stock, citing its strong growth potential and significant government contracts, others express concerns about its high valuation and profitability.

For instance, Bloomberg reports a range of price targets, with some analysts predicting significant upside potential, while others suggest a more conservative approach. Reuters, on the other hand, highlights the fluctuating nature of Palantir's stock price, influenced by both positive and negative news cycles.

- Bullish Arguments:

- Significant growth potential in the burgeoning big data analytics market.

- Strong and growing relationship with government agencies, securing substantial contracts.

- Continuous technological advancements and expansion into new sectors.

- Bearish Arguments:

- High valuation compared to its current revenue and profitability.

- Intense competition in the data analytics sector from established players.

- Concerns about long-term profitability and sustainable growth.

- Recent Rating Changes: Leading up to May 5th, we've seen some analysts adjust their ratings, reflecting the evolving market conditions and Palantir's performance. Monitoring these changes is key to understanding the shifting consensus.

Palantir's Upcoming Financial Performance and May 5th

May 5th may hold significant importance for Palantir investors. The company is expected to release its Q1 2024 earnings report around that time, potentially impacting Palantir stock prices significantly. This earnings call will provide crucial insights into the company's financial performance and future outlook. Furthermore, any announcements regarding new contracts, partnerships, or product launches around this date could influence investor sentiment and the Palantir stock price.

- Expected Revenue Growth (Q1/Q2 2024): Analysts project varying levels of revenue growth, influenced by factors such as contract wins and the overall market demand for Palantir's services.

- Profitability Projections: While Palantir is making strides towards profitability, the pace and sustainability of this progress remain a point of discussion among analysts.

- Impact of New Contracts/Partnerships: Securing new contracts, particularly large government contracts, could significantly boost Palantir's revenue and stock price. Conversely, delays or setbacks could negatively affect investor confidence.

Key Factors Influencing Palantir Stock Price

Several external factors beyond Palantir's direct control can influence its stock price. Macroeconomic conditions play a substantial role. Interest rate hikes, for example, generally impact growth stocks like Palantir more severely than others. Inflation and recession fears also add to the uncertainty.

The competitive landscape is another key factor. Palantir faces competition from established players in the big data analytics market, and its ability to maintain a competitive edge is critical to its long-term success. Geopolitical events, such as the war in Ukraine, can also indirectly impact Palantir's business, depending on its government contracts and international operations.

- Impact of Interest Rate Hikes: Higher interest rates typically lead to lower valuations for growth stocks, potentially depressing Palantir stock prices.

- Competitive Threats: Palantir needs to continually innovate and adapt to maintain its market share amidst increasing competition.

- Geopolitical Risks/Opportunities: Global events can create both opportunities (increased demand for its services) and risks (supply chain disruptions or geopolitical instability) for Palantir.

Risk Assessment for Investing in Palantir Stock

Investing in Palantir stock carries inherent risks. The stock price is known for its volatility, influenced by market sentiment and news cycles. Competition within the data analytics market is fierce, and Palantir’s ability to maintain its competitive advantage is a key risk factor. Furthermore, macroeconomic factors and geopolitical uncertainty further add to the complexity of the investment.

Diversification is crucial when considering Palantir as part of a portfolio. Never put all your eggs in one basket.

- Potential Downsides: The potential for losses, particularly in a volatile market, should be carefully considered.

- Risk Mitigation Strategies: Diversifying your portfolio, setting stop-loss orders, and conducting thorough due diligence are crucial for mitigating risk.

- Due Diligence: Before investing in Palantir stock, it’s essential to conduct comprehensive research, understanding the company's financials, business model, and the broader market conditions.

Conclusion: The Verdict – Should You Buy Palantir Stock Before May 5th?

Based on the analysis of Wall Street's sentiment, Palantir's upcoming financial performance, and the various factors influencing its stock price, investing in Palantir stock before May 5th presents both significant opportunities and considerable risks. The upcoming earnings report and any announcements surrounding May 5th will likely play a crucial role in shaping investor sentiment. Investors should carefully weigh the potential rewards against the inherent risks and consider their own risk tolerance and investment goals before making any investment decisions. Remember to conduct thorough due diligence and diversify your portfolio to mitigate potential losses. Learn more about Palantir's investment potential to make informed decisions regarding Palantir stock.

Featured Posts

-

Have Trumps Executive Orders Impacted Your Life As A Transgender Person We Want To Hear From You

May 10, 2025

Have Trumps Executive Orders Impacted Your Life As A Transgender Person We Want To Hear From You

May 10, 2025 -

Blue Origins Rocket Launch Cancelled Vehicle Subsystem Problem

May 10, 2025

Blue Origins Rocket Launch Cancelled Vehicle Subsystem Problem

May 10, 2025 -

Solutions For Nyt Strands Saturday April 12th Game 405

May 10, 2025

Solutions For Nyt Strands Saturday April 12th Game 405

May 10, 2025 -

London Spotting Harry Styles And His Seventies Stache

May 10, 2025

London Spotting Harry Styles And His Seventies Stache

May 10, 2025 -

Renaissance Et Modem Vers Une Fusion Pour Renforcer La Majorite Presidentielle

May 10, 2025

Renaissance Et Modem Vers Une Fusion Pour Renforcer La Majorite Presidentielle

May 10, 2025