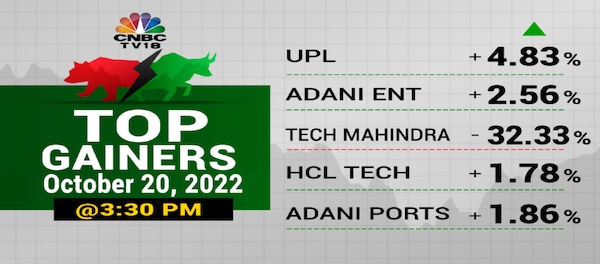

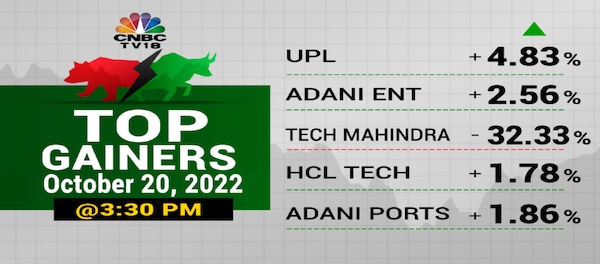

Today's Sensex: Significant Gains Across All Sectors

Table of Contents

Banking Sector Booms: Driving Today's Sensex Surge

The banking sector played a pivotal role in driving Today's Sensex surge. Significant gains in this sector contributed substantially to the overall positive market performance. This robust performance can be attributed to a confluence of factors, indicating a healthy and expanding financial landscape.

- Exceptional Stock Performance: HDFC Bank, ICICI Bank, and SBI witnessed impressive gains, significantly boosting the Sensex. These leading players' strong performance reflects investor confidence in the sector's future prospects.

- Positive Economic Indicators: Positive economic indicators, such as improved credit growth and reduced NPAs (Non-Performing Assets), fueled investor optimism and propelled the banking stocks higher. The government's focus on financial inclusion and infrastructure development has also played a significant role.

- Government Policies and Announcements: Recent government announcements regarding reforms in the banking sector and supportive monetary policies have further boosted investor sentiment and contributed to the sector's impressive performance in Today's Sensex.

IT Sector Shows Resilience: Contributing to Today's Sensex Gains

The IT sector displayed remarkable resilience, contributing significantly to Today's Sensex gains. Despite global uncertainties, the sector showcased its strength, indicating a healthy and stable growth trajectory.

- Leading IT Stocks: TCS, Infosys, and Wipro saw notable increases, reflecting the sector's continued strength in the global market. Their consistent performance underlines investor confidence in their long-term growth potential.

- Global Demand and New Contracts: Strong global demand for IT services and the signing of substantial new contracts have fueled the sector's growth. Technological advancements and the increasing reliance on digital solutions further contribute to the positive outlook.

- Future Outlook: The IT sector's positive trajectory is expected to continue, driven by consistent demand and the ongoing digital transformation across various industries. This sustained growth will likely continue to contribute positively to the Sensex in the coming periods.

FMCG Sector Holds Steady: Supporting Today's Sensex Positive Trend

The Fast-Moving Consumer Goods (FMCG) sector demonstrated remarkable stability, providing a crucial support to Today's Sensex positive trend. This sector's resilience reflects the underlying strength of the Indian consumer market.

- Key FMCG Stocks: Hindustan Unilever, Nestle India, and ITC showed steady performance, indicating consistent demand for their products. This reflects the sector's inherent resilience to market fluctuations.

- Consumer Spending and Inflation: Despite inflationary pressures, consumer spending remained relatively robust, contributing to the FMCG sector's steady performance. The sector’s ability to manage pricing and maintain market share amidst inflationary challenges is a key factor in its stability.

- Supporting the Positive Trend: The FMCG sector's consistent performance acted as a stabilizing force, ensuring a broader positive trend in Today's Sensex. Its inherent resilience contributes to the overall market stability and positive sentiment.

Analyzing the Impact of Global Factors on Today's Sensex

Global market trends played a role in shaping Today's Sensex performance. Positive sentiments in international markets, coupled with certain global events, influenced the Indian stock market's positive trajectory.

- Global Market Sentiment: Positive global market sentiment, driven by factors such as easing inflation concerns in some major economies, had a positive spillover effect on the Indian market.

- Correlation with International Markets: The Indian stock market showed a positive correlation with major global indices, reflecting the interconnected nature of global financial markets.

- Implications for Future Performance: The impact of global factors on future Sensex performance will depend on the evolving global economic landscape and geopolitical developments. Maintaining a keen eye on these factors is crucial for understanding future market trends.

Understanding the Implications of Today's Sensex Performance

Today's Sensex showcased significant gains across all sectors, with the banking, IT, and FMCG sectors playing prominent roles. The positive performance reflects a positive outlook for the Indian economy and indicates a robust market sentiment. While global factors played a part, the inherent strength of the Indian markets is evident.

The future outlook for the Sensex remains cautiously optimistic. While sustained growth is anticipated, investors should remain aware of potential global uncertainties. Continuous monitoring of market trends and economic indicators is crucial for informed investment decisions.

Stay updated on the daily performance of Today's Sensex and keep track of the significant gains and shifts across various sectors for informed investment decisions. Regularly reviewing market analyses and staying informed about economic news will enhance your understanding of the dynamic Sensex and allow for better strategic planning.

Featured Posts

-

Florida Jogsertes Miatt Letartoztattak Egy Transznemu Not A Noi Mosdo Hasznalataert

May 10, 2025

Florida Jogsertes Miatt Letartoztattak Egy Transznemu Not A Noi Mosdo Hasznalataert

May 10, 2025 -

Europa League Preview Brobbeys Strength A Decisive Factor

May 10, 2025

Europa League Preview Brobbeys Strength A Decisive Factor

May 10, 2025 -

Multiple Car Break Ins Reported At Elizabeth City Apartment Complexes

May 10, 2025

Multiple Car Break Ins Reported At Elizabeth City Apartment Complexes

May 10, 2025 -

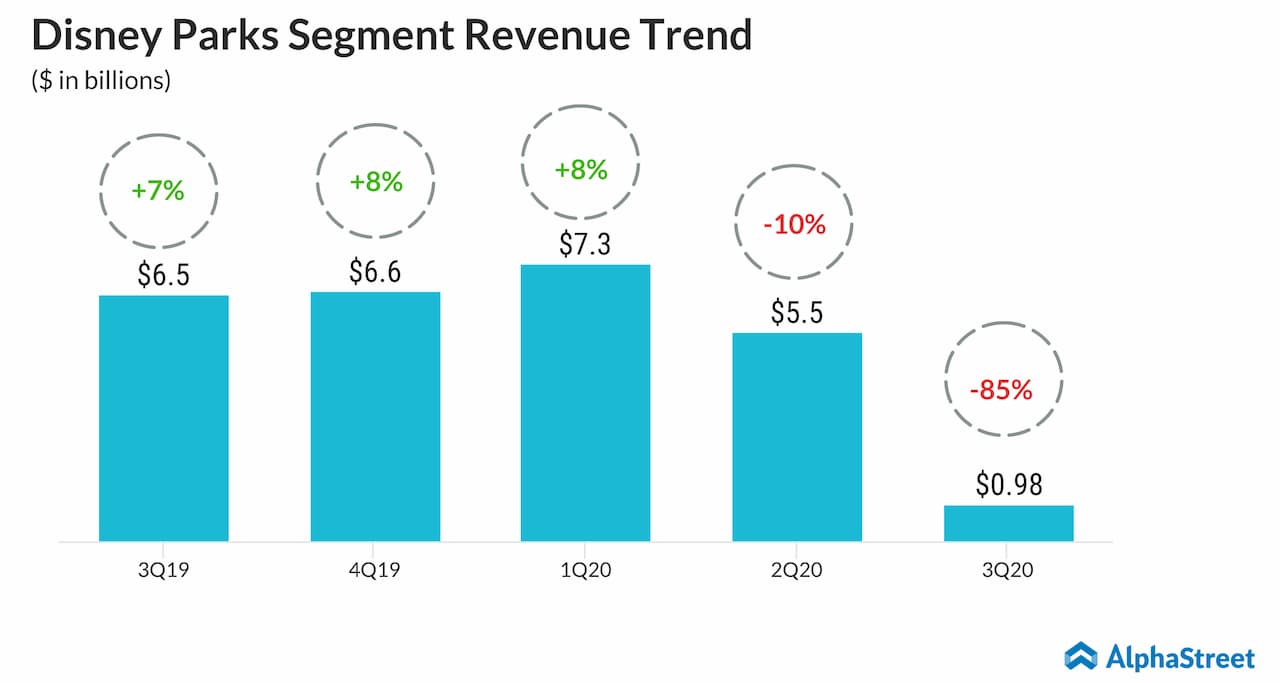

Disney Parks And Streaming Fuel Increased Profit Projections

May 10, 2025

Disney Parks And Streaming Fuel Increased Profit Projections

May 10, 2025 -

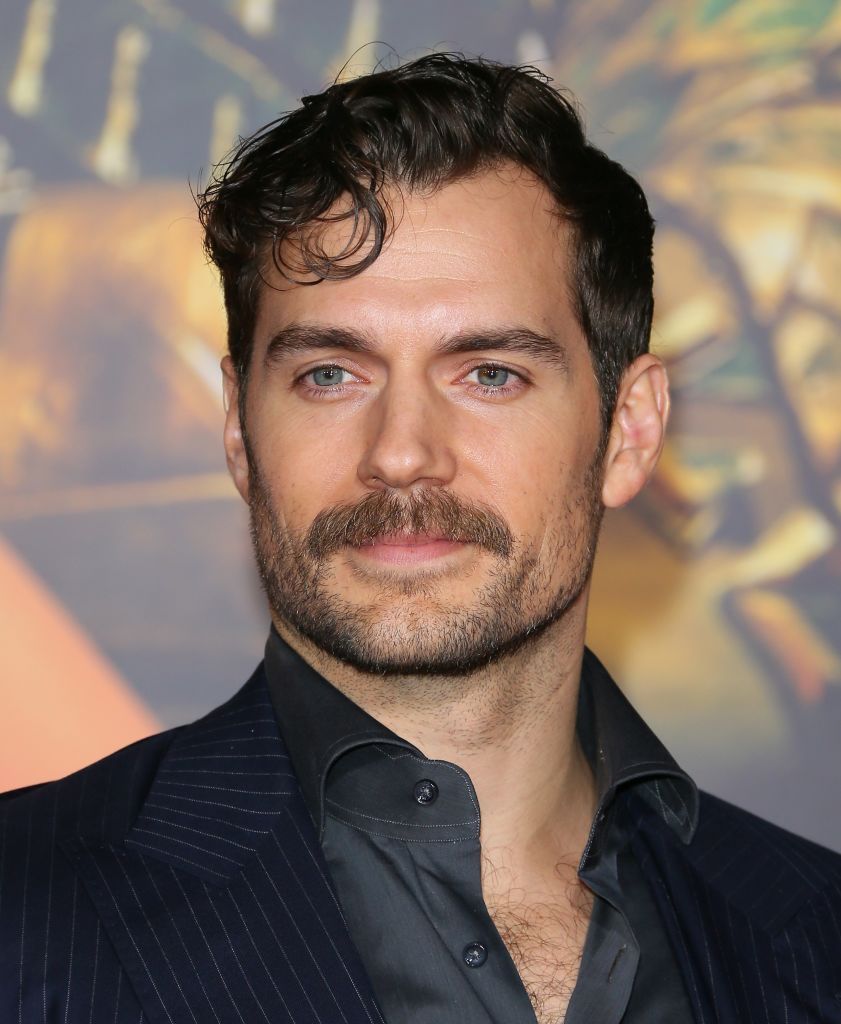

Harry Styles 70s Inspired Mustache A London Look

May 10, 2025

Harry Styles 70s Inspired Mustache A London Look

May 10, 2025