Top 5 Commodity Market Charts To Watch Closely This Week

Table of Contents

1. Crude Oil Price Chart: Assessing Geopolitical Risk and Demand

The crude oil price chart remains a cornerstone of commodity market analysis. Fluctuations in oil prices significantly impact global economies and energy markets. This week, several factors warrant close monitoring.

Global Supply Chain Disruptions and their Impact

- OPEC+ Production Cuts: The decisions made by OPEC+ regarding oil production significantly influence global supply and, consequently, crude oil prices. Any changes to their quotas will be reflected in the oil market outlook.

- Sanctions on Russian Oil: Ongoing sanctions on Russian oil exports continue to create volatility in the market, impacting global supply chains and energy commodities.

- The War in Ukraine: The ongoing conflict in Ukraine continues to exert pressure on global energy markets, adding to uncertainty surrounding crude oil prices.

- Growing Global Demand: Increased global demand, particularly from emerging economies, puts upward pressure on crude oil prices.

- Refinery Capacity Constraints: Limited refinery capacity in certain regions can lead to supply bottlenecks, influencing oil prices and the overall energy market.

Analyzing Technical Indicators for Potential Price Movements

Technical analysis plays a vital role in predicting potential price movements in the crude oil market. Key indicators include:

- Moving Averages: Tracking moving averages (e.g., 50-day, 200-day) helps identify trends and potential support/resistance levels.

- RSI (Relative Strength Index): The RSI helps gauge the momentum of price movements, signaling potential overbought or oversold conditions.

- MACD (Moving Average Convergence Divergence): The MACD helps identify changes in momentum and potential trend reversals.

- Support/Resistance Levels: Identifying these levels on the chart can help predict potential price targets and trading strategies. Analyzing chart patterns, such as head and shoulders or double tops/bottoms, can also provide valuable insights. This detailed technical analysis helps in oil price prediction and formulating effective trading strategies.

2. Natural Gas Price Chart: Monitoring Weather Patterns and Storage Levels

The natural gas price chart is highly sensitive to weather patterns and storage levels. Understanding these factors is crucial for predicting price movements in the energy markets.

The Influence of Seasonal Demand and Weather Forecasts

- Winter Weather: Harsh winter weather significantly increases natural gas consumption for heating, impacting gas prices and storage levels. Forecasts become incredibly important.

- Storage Levels: Monitoring storage levels in key regions (e.g., the US) provides insights into supply availability and potential price fluctuations. Low storage levels can lead to price spikes.

- Weather Forecasts: Accurate weather forecasts play a critical role in anticipating seasonal demand and its influence on natural gas prices.

Evaluating the Transition to Renewable Energy Sources

The ongoing transition to renewable energy sources is gradually impacting natural gas demand. While natural gas remains a significant energy source, its role is evolving. This transition influences both the gas market and long-term price projections. The impact of renewable energy adoption on natural gas demand and prices is a key factor to watch in the coming years.

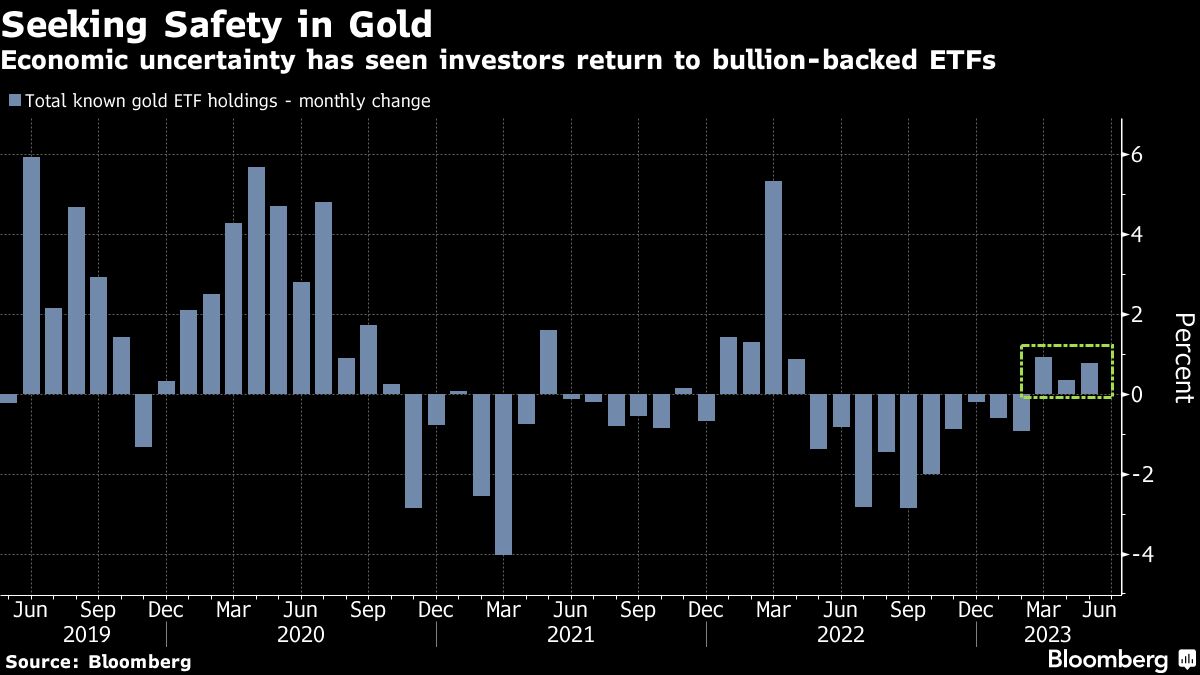

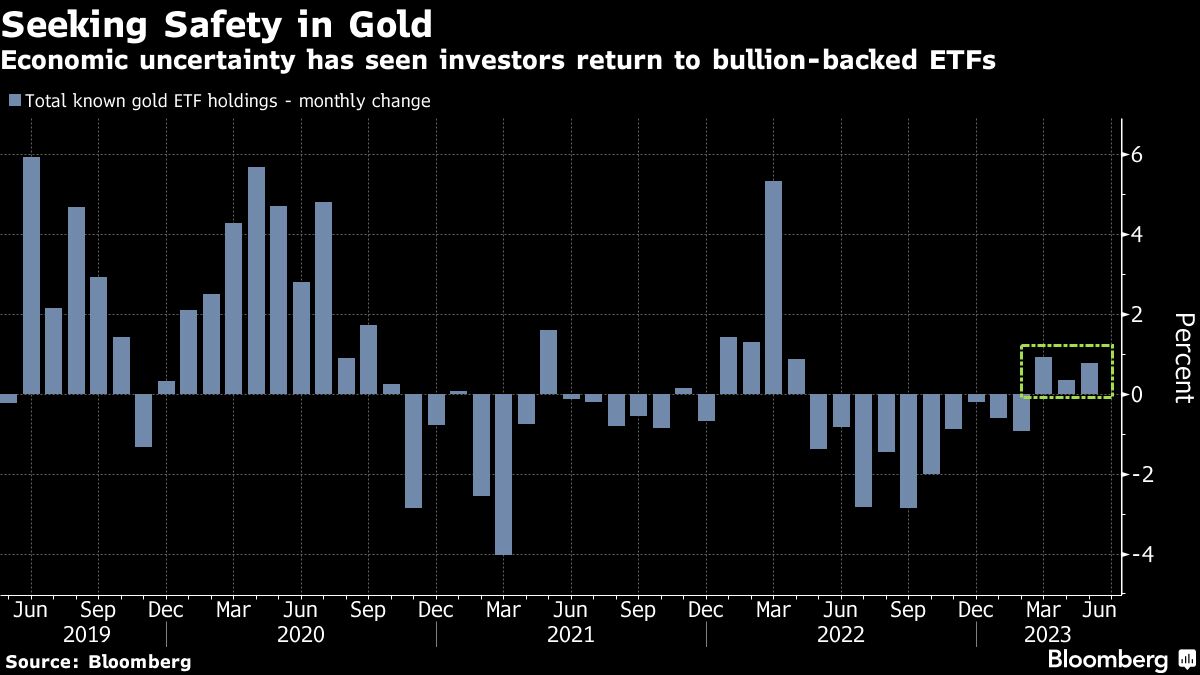

3. Gold Price Chart: A Safe Haven Asset in Times of Uncertainty

Gold often serves as a safe haven asset during times of economic uncertainty. Its price is influenced by various macroeconomic factors.

Inflationary Pressures and their Effect on Gold

- Inflation Hedge: Gold is often seen as an inflation hedge. Rising inflation rates tend to increase the demand for gold, driving up its price. Analyzing inflation rates is therefore crucial for understanding gold price forecasts.

- Purchasing Power: As inflation erodes purchasing power, investors often turn to gold as a store of value, boosting its demand.

Interest Rate Hikes and their Impact on Gold Demand

- Opportunity Cost: Higher interest rates can increase the opportunity cost of holding gold (which doesn't pay interest), potentially reducing demand and impacting its price.

- Monetary Policy: Central bank monetary policies, including interest rate hikes, significantly influence the gold market trends and investment strategies surrounding the precious metal.

4. Agricultural Commodity Charts (Corn, Soybeans, Wheat): Assessing Crop Yields and Global Food Security

Agricultural commodity prices are influenced by a complex interplay of weather patterns, geopolitical factors, and global food security concerns.

Weather Conditions and their Impact on Crop Production

- Drought and Floods: Extreme weather events like droughts and floods can severely impact crop yields, leading to price volatility in agricultural commodities such as wheat, corn, and soybeans.

- Climate Change: The long-term effects of climate change on crop production pose significant challenges to global food security and agricultural markets.

Geopolitical Factors and Supply Chain Disruptions

- War in Ukraine: The war in Ukraine, a major exporter of wheat and other agricultural products, has created significant disruptions to global food supply chains, impacting agricultural commodities prices.

- Trade Wars and Sanctions: Trade disputes and sanctions can also restrict the flow of agricultural products, affecting global food prices and creating volatility in agricultural markets.

5. Industrial Metal Price Charts (Copper, Aluminum): Gauging Economic Growth and Infrastructure Spending

Industrial metal prices, such as copper and aluminum, are closely tied to global economic growth and infrastructure spending.

Analyzing Demand from Construction and Manufacturing Sectors

- Economic Growth: Strong economic growth generally translates into increased demand for industrial metals from the construction and manufacturing sectors. Economic indicators are therefore key to monitoring.

- Infrastructure Projects: Large-scale infrastructure projects significantly boost demand for copper and aluminum, driving their prices upward.

Supply Chain Bottlenecks and their Influence on Prices

- Supply Chain Disruptions: Supply chain bottlenecks caused by various factors, including geopolitical events and logistical issues, can restrict the availability of industrial metals, impacting their prices.

- Global Trade: Global trade flows and disruptions significantly influence the supply and prices of industrial metals.

Conclusion

Monitoring these top 5 commodity market charts provides invaluable insights into global economic trends and potential investment opportunities. Understanding the factors influencing these commodities – from geopolitical risks to weather patterns and economic growth – is crucial for successful commodity market trading and investment strategies. Stay ahead of the curve by closely monitoring these top 5 commodity market charts this week and beyond. Regularly checking for updates on these key indicators will allow you to make more informed decisions in the dynamic world of commodity markets.

Featured Posts

-

Podrobnosti O Roli Aliny Voskresenskoy V Novom Sezone Univer Na Tnt

May 06, 2025

Podrobnosti O Roli Aliny Voskresenskoy V Novom Sezone Univer Na Tnt

May 06, 2025 -

Guelsen Bubikoglu Nun 71 Yasina Oezel Sosyal Medya Yayini

May 06, 2025

Guelsen Bubikoglu Nun 71 Yasina Oezel Sosyal Medya Yayini

May 06, 2025 -

Us Israel Azerbaijan Cooperation Benefits Challenges And Future Prospects

May 06, 2025

Us Israel Azerbaijan Cooperation Benefits Challenges And Future Prospects

May 06, 2025 -

Demi Moores Daughters Cryptic Ashton Kutcher Comment Regret And Fallout

May 06, 2025

Demi Moores Daughters Cryptic Ashton Kutcher Comment Regret And Fallout

May 06, 2025 -

Smokey Robinson Addresses Rumors Was That Song About Diana Ross

May 06, 2025

Smokey Robinson Addresses Rumors Was That Song About Diana Ross

May 06, 2025