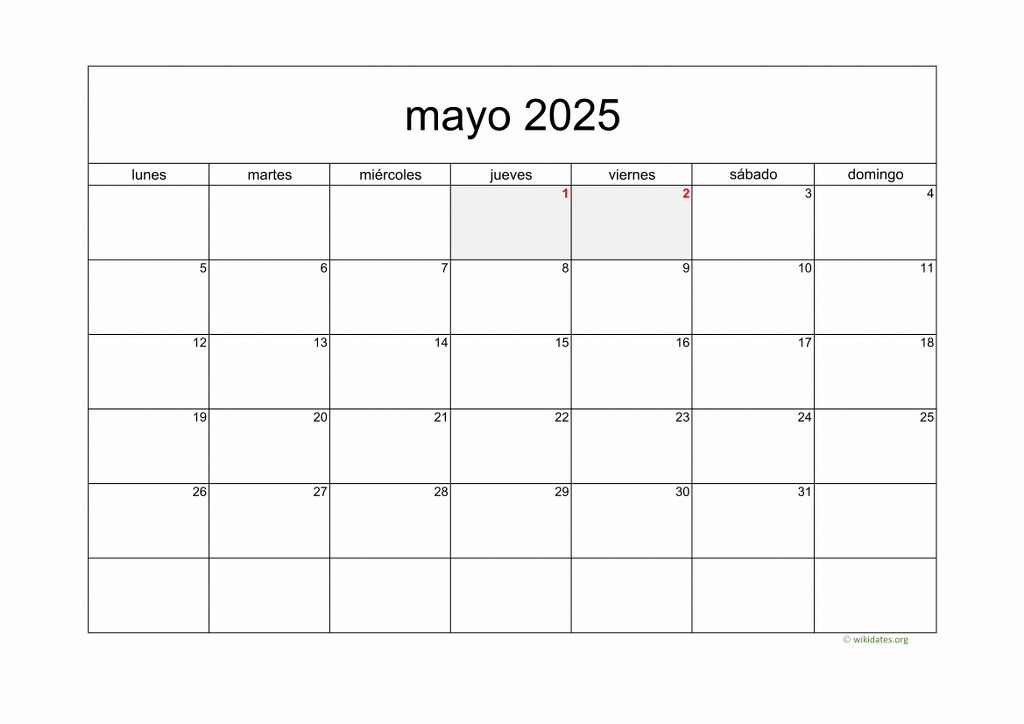

Top Company News: Friday Evening Update (7 PM ET)

Table of Contents

This Friday evening update brings you a quick summary of the most significant company news stories impacting markets and businesses as of 7 PM ET. We've compiled the key developments to keep you informed and ahead of the curve. Get caught up on the latest happenings and stay informed on all the crucial business news.

Tech Sector Shake-up: Big Tech Earnings and Stock Performance

The tech sector experienced significant volatility today, driven largely by the release of Q3 earnings reports from major players. Let's delve into the key developments:

Apple's Q3 Results Exceed Expectations:

Apple announced Q3 earnings that surpassed analyst predictions, sending its stock price soaring. The strong performance was attributed to robust iPhone sales and growth in its services sector. This positive news boosted investor confidence and contributed to a positive overall market sentiment for tech stocks. Key highlights include:

- Apple Stock: Experienced a [Insert Percentage]% increase following the earnings announcement.

- Q3 Earnings: Surpassed expectations by [Insert Percentage]%, exceeding the projected [Insert Amount] billion to reach [Insert Amount] billion.

- Market Capitalization: Reached a new high of [Insert Amount], solidifying its position as the world's most valuable company. This strong performance in the face of broader economic uncertainty is a sign of resilience within the tech sector.

Meta's Advertising Revenue Growth Slowdown:

In contrast to Apple's success, Meta's Q3 earnings revealed a slowdown in advertising revenue growth. This reflects broader concerns about the digital advertising market and the impact of economic headwinds on advertiser spending. While the company still reported substantial revenue, the slower-than-expected growth led to a dip in Meta stock price. Key takeaways include:

- Meta Stock: Experienced a [Insert Percentage]% decrease following the earnings report.

- Advertising Revenue: Grew by [Insert Percentage]%, a significant slowdown compared to previous quarters.

- Social Media Marketing: The slowing growth highlights challenges in the social media marketing landscape, potentially signaling a need for diversification in Meta's revenue streams. Analysts are closely watching for signs of a recovery in advertising spending.

Energy Sector Volatility: Oil Prices and Global Supply Concerns

The energy sector continues to experience significant volatility, driven by geopolitical factors and ongoing concerns about global energy supply.

OPEC+ Decision Impacts Global Oil Prices:

The recent OPEC+ meeting resulted in a decision to [Insert OPEC+ Decision, e.g., maintain current production levels]. This decision [Explain the impact of the decision on oil prices – e.g., sent oil prices higher/lower]. The resulting price fluctuation significantly impacts the energy sector and has ripple effects across various industries. Key factors include:

- Oil Prices: Crude oil prices are currently trading at [Insert Price] per barrel, a [Insert Percentage]% change from yesterday's close.

- OPEC+: The cartel's decisions continue to be a major driver of global oil price movements.

- Global Energy: The energy sector's volatility directly impacts global economic growth and inflation.

Renewable Energy Investments Surge:

Despite oil price fluctuations, investments in renewable energy continue to surge. Several major projects have been announced this week, showcasing the growing commitment to sustainable energy sources. This positive trend indicates a long-term shift towards cleaner energy solutions. For instance:

- Renewable Energy: Investments in solar and wind energy projects totaled [Insert Amount] this week.

- Solar Energy: [Mention specific company and project] is set to expand its solar energy production capacity.

- ESG Investing: The increasing focus on Environmental, Social, and Governance (ESG) factors is driving investment in sustainable energy solutions.

Economic Indicators and Market Sentiment

Economic indicators released today painted a mixed picture, influencing market sentiment and investor expectations.

Inflation Data Released: Implications for Interest Rates:

The latest inflation data revealed a [Insert Inflation Rate]% increase in [Insert Time Period]. This [Explain if it's higher or lower than expected and the implications for interest rates – e.g., higher-than-expected inflation is likely to lead to further interest rate hikes by the Federal Reserve]. This has significant implications for borrowing costs, investment decisions, and overall economic growth. Key points include:

- Inflation Rate: The current inflation rate stands at [Insert Percentage]%, compared to [Insert Percentage]% last month.

- Interest Rates: The Federal Reserve is expected to [Insert Expected Action regarding interest rates].

- Market Volatility: The uncertainty surrounding future inflation and interest rate decisions is contributing to market volatility.

Consumer Confidence Index Shows Mixed Signals:

The consumer confidence index showed [Insert whether it increased or decreased] this month. This indicates a [Explain what the change in consumer confidence means for the economy – e.g., cautious/optimistic outlook] among consumers. This mixed signal reflects the ongoing uncertainty surrounding the economy. Key factors include:

- Consumer Confidence: The index currently stands at [Insert Number], compared to [Insert Number] last month.

- Consumer Spending: Consumer spending is expected to [Insert Prediction based on consumer confidence].

- Economic Growth: The outlook for economic growth remains [Insert Outlook – e.g., uncertain/positive].

Conclusion:

This Friday evening update provided a snapshot of crucial company news across key sectors, including technology, energy, and the broader economic landscape. We covered significant earnings reports, market movements, and important global developments that are shaping the business world. The interplay between tech earnings, energy prices, and economic indicators continues to drive market volatility.

Call to Action: Stay updated on the latest company news and market trends. Subscribe to our newsletter for daily updates and in-depth analysis, so you never miss another critical development in the world of Top Company News. Check back tomorrow for another comprehensive update!

Featured Posts

-

Eurovision 2024 Could Celine Dion Make A Stunning Return

May 14, 2025

Eurovision 2024 Could Celine Dion Make A Stunning Return

May 14, 2025 -

Sevilla Hoy Miercoles 7 De Mayo De 2025 Eventos Y Actividades

May 14, 2025

Sevilla Hoy Miercoles 7 De Mayo De 2025 Eventos Y Actividades

May 14, 2025 -

Dresden Wahl 2024 Deutliche Ablehnung Von Cdu Und Spd

May 14, 2025

Dresden Wahl 2024 Deutliche Ablehnung Von Cdu Und Spd

May 14, 2025 -

Former Uruguayan President Mujica In Palliative Care Latest News And Family Updates

May 14, 2025

Former Uruguayan President Mujica In Palliative Care Latest News And Family Updates

May 14, 2025 -

Oqtf La Riposte Humoristique De Saint Pierre Et Miquelon

May 14, 2025

Oqtf La Riposte Humoristique De Saint Pierre Et Miquelon

May 14, 2025