Top-Performing DSP India Fund Shifts To Cautious Stance, Increases Cash Reserves

Table of Contents

Reasons Behind the DSP India Fund's Shift to a Cautious Stance

The DSP India Fund's decision to adopt a more cautious stance and bolster its cash reserves is driven by a confluence of macroeconomic and domestic market factors, coupled with a proactive risk management strategy.

Macroeconomic Factors

Several global and regional economic headwinds have contributed to the fund's shift:

- Global Inflation and Rising Interest Rates: Persistent global inflation and aggressive interest rate hikes by central banks worldwide are dampening economic growth and increasing market volatility. This uncertainty significantly impacts emerging markets like India.

- Geopolitical Risks: The ongoing Russia-Ukraine conflict and escalating geopolitical tensions create further uncertainty, impacting global supply chains and commodity prices, which directly affect the Indian economy.

- Impact on Economic Indicators: Key economic indicators such as the Consumer Price Index (CPI) and Gross Domestic Product (GDP) growth forecasts are being revised downwards, reflecting the global economic slowdown and its ripple effect on India. These factors contribute to increased market volatility and uncertainty. Keywords: Indian economy, inflation, interest rates, geopolitical risks, market volatility.

Domestic Market Conditions

Concerns within the Indian market itself also played a role in the DSP India Fund's decision:

- High Valuations: Certain sectors within the Indian stock market are perceived to be overvalued, presenting a higher risk of correction.

- Regulatory Changes: Upcoming regulatory changes and their potential impact on specific industries introduce further uncertainty.

- Sector-Specific Risks: Concerns exist within specific sectors such as real estate and technology, which have experienced significant growth in recent years but face potential headwinds. Keywords: Indian stock market, valuations, regulatory changes, sector-specific risks.

Risk Management Strategy

The fund manager's decision to increase cash reserves is a key element of a proactive risk management strategy. This approach aims to:

- Mitigate Downside Risk: Holding a larger percentage of cash reduces the fund's exposure to market volatility, safeguarding against potential losses during periods of downturn.

- Enhance Portfolio Liquidity: Increased liquidity allows the fund to swiftly capitalize on attractive investment opportunities that may arise as the market corrects or presents better entry points. Keywords: risk management, portfolio diversification, cash reserves, liquidity.

Impact on Investors of the DSP India Fund's Strategy Change

The DSP India Fund's shift to a more conservative strategy has several implications for investors:

Potential Returns

- Lower Potential Gains: The more cautious approach may result in lower potential returns compared to a more aggressive investment strategy in a bullish market.

- Reduced Risk of Significant Losses: However, the strategy prioritizes capital preservation and reduces the risk of substantial losses during market corrections. Keywords: investment returns, risk-adjusted returns, capital preservation.

Investor Sentiment and Reactions

Investor reaction to the strategy change has been mixed. While some investors appreciate the fund manager's cautious approach and focus on risk mitigation, others may be concerned about the potential for lower returns. The fund may experience some outflows as investors seek higher-growth opportunities elsewhere, but this is balanced by the influx of investors looking for a more stable investment option in a volatile market. Keywords: investor sentiment, fund flows, investment strategy.

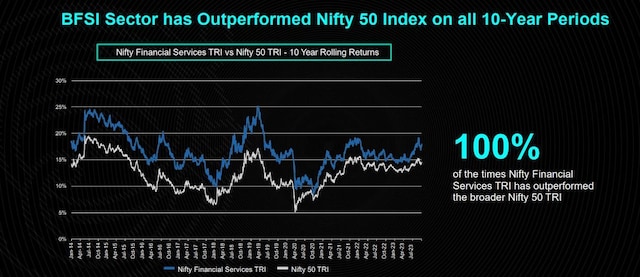

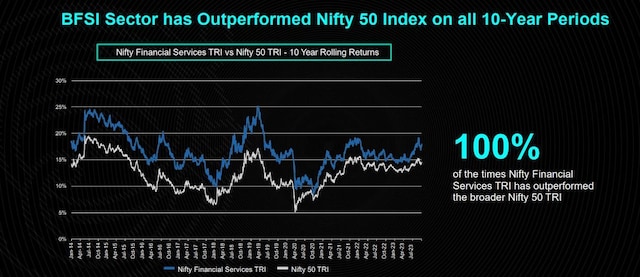

Comparison with Other Funds

The DSP India Fund's increased cash reserves and cautious approach differentiate it from some other actively managed funds in the Indian market, which may maintain a higher exposure to equities. However, the strategy aligns with a growing trend among certain fund managers who prioritize risk management in the face of global uncertainty. Keywords: peer comparison, mutual funds India, investment strategies.

Analyzing the Increased Cash Reserves of the DSP India Fund

The DSP India Fund's increase in cash reserves represents a significant strategic shift:

Strategic Allocation

The exact percentage of cash reserves held by the DSP India Fund hasn't been publicly specified, but it is considerably higher than previous levels. This demonstrates a clear commitment to a more conservative approach.

Opportunities for Deployment

The fund manager intends to deploy the cash reserves strategically when compelling investment opportunities emerge, particularly when market valuations become more attractive. The cash reserves provide a war chest for opportunistic purchases.

Transparency and Communication

The level of transparency regarding the fund's strategy and cash reserve management is crucial for maintaining investor confidence. Open communication helps to alleviate concerns and provides clarity regarding the fund's approach.

Conclusion: Top-Performing DSP India Fund's Cautious Approach – A Look Ahead

The DSP India Fund's shift to a more cautious stance, marked by a substantial increase in cash reserves, reflects a prudent response to both global and domestic economic uncertainties. While this may lead to lower potential gains in a booming market, it prioritizes capital preservation and reduces the risk of significant losses. Understanding the DSP India Fund's shift to a cautious stance and increased cash reserves is crucial for investors navigating the complexities of the Indian market. Conduct your own thorough research before making any investment decisions. Visit the DSP India Fund website for more details.

Featured Posts

-

Identifying The Countrys Next Big Business Centers

Apr 29, 2025

Identifying The Countrys Next Big Business Centers

Apr 29, 2025 -

Texas Woman Dies In Wrong Way Crash Near Minnesota North Dakota Border

Apr 29, 2025

Texas Woman Dies In Wrong Way Crash Near Minnesota North Dakota Border

Apr 29, 2025 -

Minnesota Snow Plow Naming Contest Winners Revealed

Apr 29, 2025

Minnesota Snow Plow Naming Contest Winners Revealed

Apr 29, 2025 -

Kl Ma Thtaj Merfth En Fn Abwzby Ybda 19 Nwfmbr

Apr 29, 2025

Kl Ma Thtaj Merfth En Fn Abwzby Ybda 19 Nwfmbr

Apr 29, 2025 -

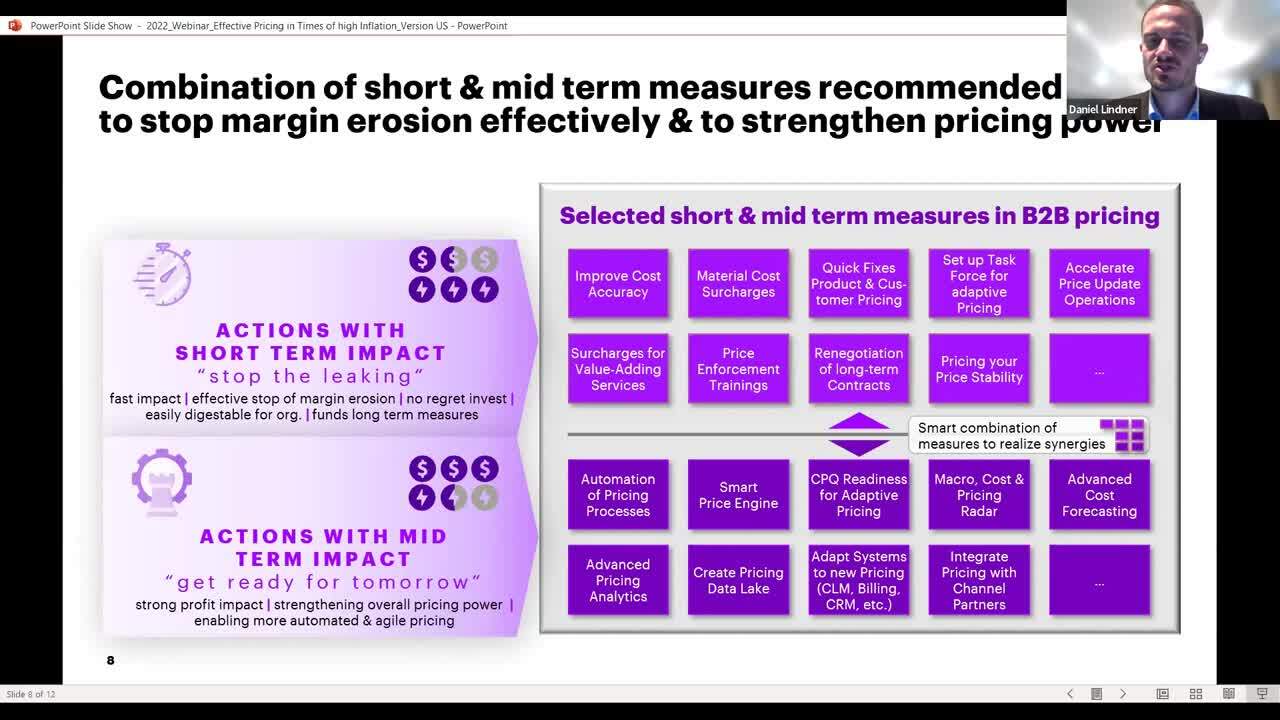

Tariff Uncertainty Drives U S Corporate Cost Cutting Strategies

Apr 29, 2025

Tariff Uncertainty Drives U S Corporate Cost Cutting Strategies

Apr 29, 2025

Latest Posts

-

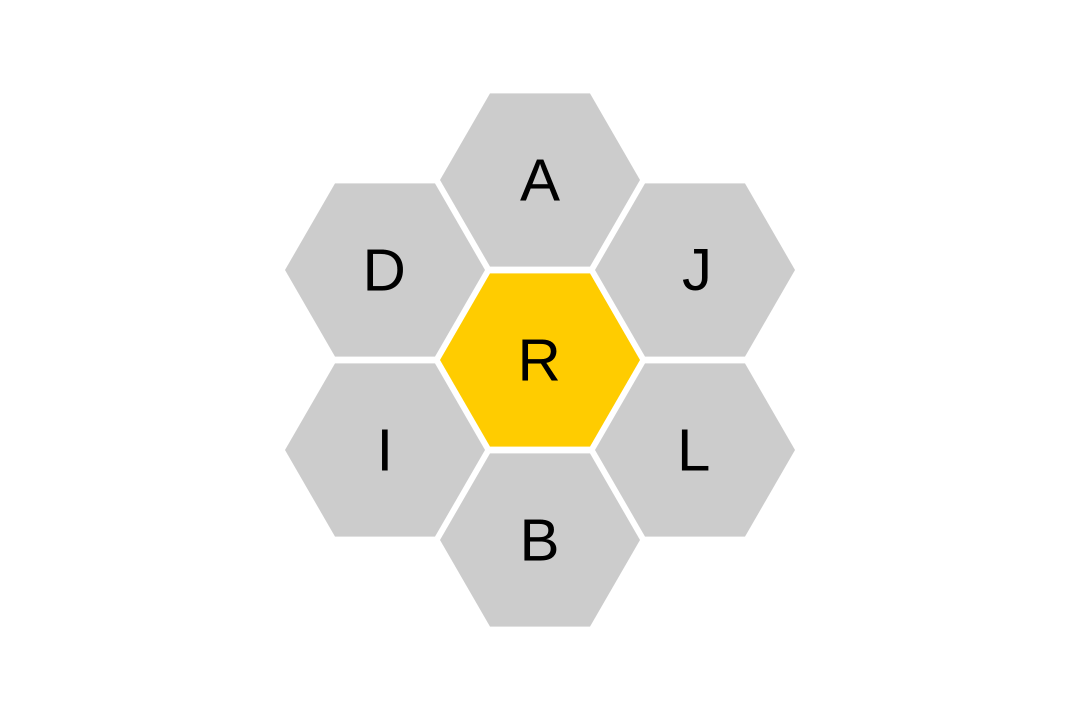

Conquer The Nyt Spelling Bee April 1 2025 Puzzle Solutions And Tips

Apr 29, 2025

Conquer The Nyt Spelling Bee April 1 2025 Puzzle Solutions And Tips

Apr 29, 2025 -

Nyt Spelling Bee April 1 2025 Pangram And Word List

Apr 29, 2025

Nyt Spelling Bee April 1 2025 Pangram And Word List

Apr 29, 2025 -

Solve The Nyt Spelling Bee April 1 2025 Hints And Strategies

Apr 29, 2025

Solve The Nyt Spelling Bee April 1 2025 Hints And Strategies

Apr 29, 2025 -

Nyt Spelling Bee Solution March 15 2025

Apr 29, 2025

Nyt Spelling Bee Solution March 15 2025

Apr 29, 2025 -

Complete Guide To The Nyt Spelling Bee For March 15 2025

Apr 29, 2025

Complete Guide To The Nyt Spelling Bee For March 15 2025

Apr 29, 2025