Toronto Home Sales And Prices: A 23% And 4% Decline, Respectively

Table of Contents

Significant Drop in Toronto Home Sales: Analyzing the 23% Decline

The 23% plunge in Toronto home sales represents a considerable downturn compared to previous years. Understanding the contributing factors is crucial for grasping the current market dynamics.

Factors Contributing to Reduced Sales:

Several interconnected factors have contributed to this significant decline in Toronto home sales:

-

Increased Interest Rates and Affordability: The Bank of Canada's interest rate hikes have substantially increased borrowing costs, making mortgages more expensive and impacting affordability for many prospective homebuyers in Toronto. This has led to reduced purchasing power, especially among first-time homebuyers.

-

Economic Uncertainty and Buyer Confidence: Economic uncertainty, including inflation and potential recessionary pressures, has dampened buyer confidence. Hesitancy to make large financial commitments in an unpredictable economic climate has contributed to lower sales volumes in the Toronto housing market.

-

Reduced Inventory in Specific Toronto Neighbourhoods: While overall inventory might have increased in some areas, specific desirable neighborhoods within Toronto still experience limited supply, affecting sales figures. This scarcity continues to drive competition, but the overall sales volume is still down.

-

Impact of Government Policies and Regulations: Government policies and regulations aimed at cooling the Toronto real estate market, such as stricter mortgage qualification rules, also played a role in curbing sales activity.

-

Sales Figures from TRREB: According to the Toronto Regional Real Estate Board (TRREB), sales in Q3 2023 (example data - replace with actual figures) decreased by X% compared to the same period last year. This reflects the overall trend of reduced sales activity across various segments of the Toronto real estate market.

Impact on Different Market Segments:

The decline in sales hasn't impacted all segments equally.

-

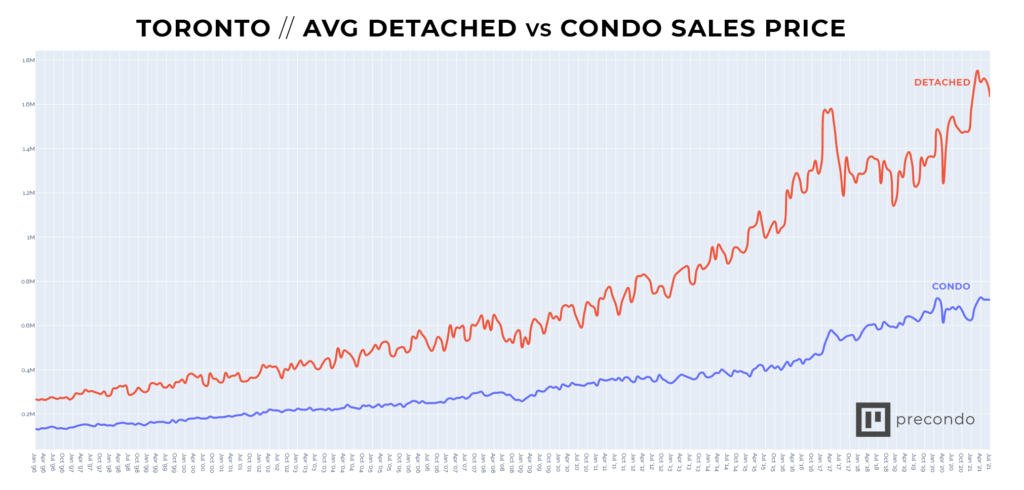

Property Types: The decrease in sales has been observed across various property types in Toronto, including condominiums, townhouses, and detached homes. However, the percentage change might vary across these segments. Detached homes might see a steeper drop than condos.

-

Buyer Demographics: First-time homebuyers, particularly sensitive to interest rate changes, have been significantly affected. Investors, facing higher borrowing costs and potentially reduced rental income, have also scaled back their activity in the Toronto market.

-

Specific Toronto Areas: While city-wide sales are down, some areas of Toronto might show more pronounced declines than others. For example, traditionally high-demand areas could experience a more significant drop than more peripheral neighborhoods.

Moderate Decrease in Toronto Home Prices: Understanding the 4% Dip

While the drop in sales is dramatic, the 4% decrease in average home prices in Toronto is a more moderate adjustment.

Factors Influencing Price Reductions:

The price reduction is closely linked to the reduced sales volume.

-

Reduced Sales and Price Adjustments: The lower demand has given buyers more leverage to negotiate, leading to price reductions. Sellers are often adjusting their asking prices to attract buyers in a less competitive market.

-

Increased Housing Supply (in some areas): While still limited in certain neighbourhoods, the overall inventory in some parts of Toronto has increased, lessening the pressure on prices. This increased supply provides buyers with more choices.

-

Buyer Negotiation Power: The shift in market dynamics has given buyers more negotiating power, enabling them to secure better deals and potentially lower prices.

-

Price Changes Across Toronto Neighbourhoods: Price reductions vary across different neighborhoods within Toronto. Some high-demand areas might see less price correction than others.

-

Price Data from Reliable Sources: Data from TRREB and other reputable sources show a moderate average price decrease of approximately 4% (replace with actual figures) in Q3 2023 compared to the previous year (example data – replace with actual figures).

Predicting Future Price Trends:

Predicting future price trends is challenging, but several factors suggest potential scenarios.

-

Expert Opinions: Real estate experts offer differing opinions, with some predicting further price adjustments and others anticipating market stabilization in the near future. This uncertainty reflects the complexity of the market.

-

Long-Term Trends: The long-term outlook for the Toronto real estate market remains positive, driven by population growth and limited land availability. However, short-term fluctuations are expected.

-

Potential Market Stabilization or Further Corrections: Whether the market stabilizes or experiences further price corrections depends on several factors, including interest rate movements and overall economic conditions.

Navigating the Changing Toronto Real Estate Landscape

The current market requires strategic adjustments for both buyers and sellers.

Strategies for Buyers in the Current Market:

Buyers can leverage the current situation to their advantage:

-

Negotiate Better Deals: The current buyer's market provides opportunities for negotiation. Buyers can confidently seek lower prices and favorable terms.

-

Mortgage Pre-Approval: Securing pre-approval for a mortgage demonstrates financial readiness and strengthens a buyer's position during negotiations.

-

Choose the Right Real Estate Agent: A knowledgeable agent experienced in navigating slower markets can provide invaluable insights and support.

Advice for Sellers in a Slower Market:

Sellers need to adapt their strategies:

-

Competitive Pricing: Accurately pricing a property is crucial. Overpricing can lead to extended listing times and potential price reductions later.

-

Effective Marketing and Staging: Presenting a property attractively through effective marketing and staging is more important than ever in a less competitive market.

-

Smooth Sales Process: Focusing on a smooth and efficient sales process, emphasizing clear communication and responsiveness, can be critical.

Conclusion

The 23% decline in Toronto home sales and the 4% dip in prices signify a significant shift in the Toronto real estate market. Both buyers and sellers must adapt their strategies to navigate this evolving landscape successfully. Understanding the factors driving these changes—interest rates, economic conditions, and government policies—is crucial for making informed decisions. To stay updated on Toronto home sales and learn more about Toronto real estate trends, explore additional resources, and consider contacting a qualified real estate professional for personalized advice tailored to your specific needs in Toronto's evolving housing market.

Featured Posts

-

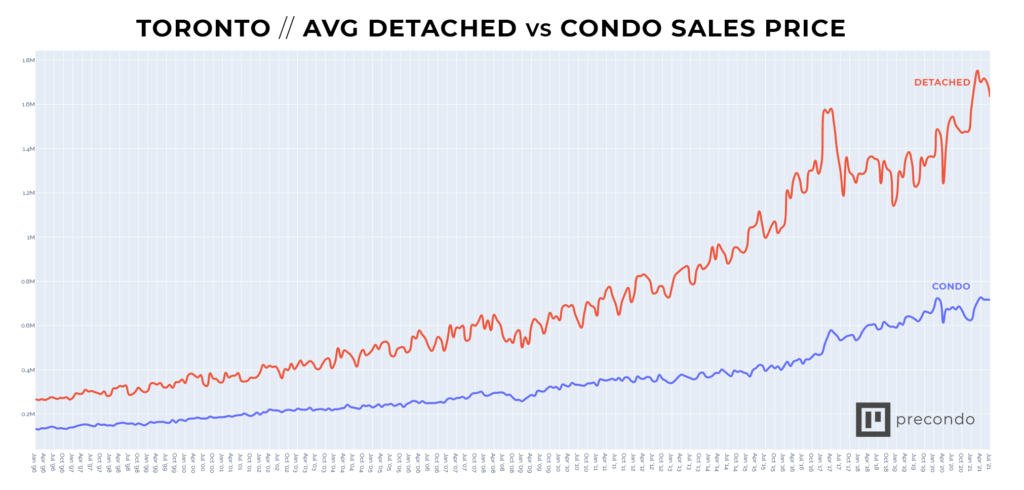

Piotr Zielinskis Calf Injury Expected Absence For Inter Milan

May 08, 2025

Piotr Zielinskis Calf Injury Expected Absence For Inter Milan

May 08, 2025 -

Andor Season 2 Rewriting Star Wars Canon Insights From A Rogue One Actor

May 08, 2025

Andor Season 2 Rewriting Star Wars Canon Insights From A Rogue One Actor

May 08, 2025 -

Nc State Faces Recruiting Challenge After Raphaels Exit

May 08, 2025

Nc State Faces Recruiting Challenge After Raphaels Exit

May 08, 2025 -

Okc Thunder Vs Indiana Pacers Complete Injury Report March 29

May 08, 2025

Okc Thunder Vs Indiana Pacers Complete Injury Report March 29

May 08, 2025 -

Inter Milan Vs Fc Barcelona Watch The Champions League Live

May 08, 2025

Inter Milan Vs Fc Barcelona Watch The Champions League Live

May 08, 2025

Latest Posts

-

Kripto Varliklarda Miras Sifresiz Kalanlar Ne Yapmali

May 08, 2025

Kripto Varliklarda Miras Sifresiz Kalanlar Ne Yapmali

May 08, 2025 -

Brezilya Nin Bitcoin Maas Oedemelerine Iliskin Yeni Yasasi

May 08, 2025

Brezilya Nin Bitcoin Maas Oedemelerine Iliskin Yeni Yasasi

May 08, 2025 -

Tuerkiye Deki Kripto Piyasasi Bakan Simsek In Goeruesleri Ve Etkileri

May 08, 2025

Tuerkiye Deki Kripto Piyasasi Bakan Simsek In Goeruesleri Ve Etkileri

May 08, 2025 -

Brezilya Da Bitcoin Maaslari Avantajlar Dezavantajlar Ve Gelecek

May 08, 2025

Brezilya Da Bitcoin Maaslari Avantajlar Dezavantajlar Ve Gelecek

May 08, 2025 -

Kripto Para Duezenlemesi Bakan Simsek In Uyarilari Ve Sektoeruen Gelecegi

May 08, 2025

Kripto Para Duezenlemesi Bakan Simsek In Uyarilari Ve Sektoeruen Gelecegi

May 08, 2025