Tracking The Net Asset Value (NAV) Of Amundi MSCI World Catholic Principles UCITS ETF Acc

Table of Contents

Understanding the Amundi MSCI World Catholic Principles UCITS ETF Acc NAV

The Net Asset Value (NAV) represents the net worth of an ETF's holdings per share. It's calculated by subtracting the fund's liabilities from the total market value of its assets, then dividing by the number of outstanding shares. For investors, the NAV provides a snapshot of the fund's intrinsic value, crucial for assessing its performance and making informed buy or sell decisions.

The Amundi MSCI World Catholic Principles UCITS ETF Acc, specifically, holds a unique position due to its adherence to both ESG (Environmental, Social, and Governance) and Catholic principles. This rigorous screening process impacts its composition, resulting in a portfolio of companies aligned with these ethical standards. This differs from broader market indices that don't incorporate such strict criteria.

- Unique Characteristics impacting NAV: The fund's focus on ethical investing might lead to a slightly different portfolio composition than a traditional global market index fund. This could result in both potential underperformance during periods of strong performance by companies excluded due to ethical considerations and potential outperformance when ethical investing trends become more prominent in the market.

- ESG and Catholic Principles Influence: The investment strategy, incorporating both ESG criteria and Catholic principles, actively excludes companies involved in activities deemed morally objectionable. This can affect the fund's performance relative to broader market indices, potentially leading to both periods of higher and lower returns depending on market trends and the performance of the excluded companies.

Where to Find the Amundi MSCI World Catholic Principles UCITS ETF Acc NAV

Reliable and up-to-date NAV information is essential for effective investment tracking. Several sources provide this data:

- Official Amundi Website: The official Amundi website is the primary source for accurate and timely NAV data for the Amundi MSCI World Catholic Principles UCITS ETF Acc. Look for dedicated fund fact sheets or performance sections.

- Major Financial Data Providers: Reputable financial data providers like Bloomberg Terminal, Refinitiv Eikon, and similar platforms offer real-time and historical NAV data for various ETFs, including the Amundi MSCI World Catholic Principles UCITS ETF Acc.

- Brokerage Platforms: Most online brokerage platforms display the NAV of ETFs held within client accounts. This is usually a convenient and readily accessible source of information.

It's crucial to note that slight discrepancies might exist between different sources due to timing differences and data processing variations. Always prioritize the official Amundi website for the most accurate data. The NAV is typically updated daily, usually at the market close.

Factors Influencing the Amundi MSCI World Catholic Principles UCITS ETF Acc NAV

Several factors interact to influence the daily and longer-term NAV of the Amundi MSCI World Catholic Principles UCITS ETF Acc:

-

Market Performance:

- Global Stock Market Fluctuations: The overall performance of global stock markets significantly impacts the NAV. Positive market trends generally lead to NAV increases, while negative trends cause decreases.

- Sector-Specific Performance: The fund's portfolio is diversified across various sectors. Strong performance in specific sectors (e.g., technology, healthcare) positively affects the NAV, while underperformance in others negatively impacts it.

- Currency Fluctuations: As a global fund, currency exchange rates influence the NAV. Changes in the value of the currencies in which the fund's holdings are denominated will impact the overall value in the investor's base currency.

-

ESG and Catholic Principles Screening: This core aspect of the fund's strategy directly affects its holdings and, consequently, its NAV. While this may lead to underperformance compared to non-ESG funds during periods favoring companies excluded by the screening process, it can also lead to outperformance when ethical investing gains traction. Benchmark comparisons are crucial for a comprehensive analysis.

-

Fund Expenses: Management fees and the Total Expense Ratio (TER) directly impact the NAV. These costs are deducted from the fund's assets, reducing the overall NAV. Higher expenses result in a smaller NAV growth for the same level of underlying asset growth.

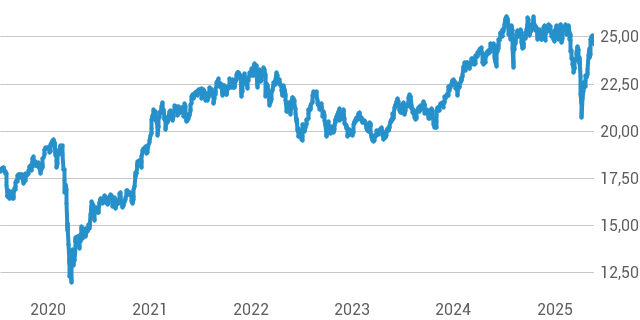

Analyzing Amundi MSCI World Catholic Principles UCITS ETF Acc NAV Trends

Analyzing NAV charts and graphs is crucial for understanding the fund's performance over time. Pay close attention to the following:

-

Benchmark Comparisons: Comparing the Amundi MSCI World Catholic Principles UCITS ETF Acc's NAV performance against a relevant benchmark index, such as the MSCI World Index, provides valuable context. This helps assess whether the fund's ethical investment approach leads to underperformance or outperformance.

-

Technical Analysis (Use with Caution): While technical analysis indicators like moving averages can help identify potential trends, they should be used cautiously and alongside a fundamental analysis of the fund's holdings and market conditions. Technical analysis alone is not a reliable predictor of future NAV movements.

-

Long-Term Perspective: It's essential to adopt a long-term perspective when tracking ETF NAVs. Short-term fluctuations are normal, and focusing on long-term trends offers a more accurate assessment of the fund's performance.

Conclusion: Making Informed Decisions with Amundi MSCI World Catholic Principles UCITS ETF Acc NAV Data

Tracking the Amundi MSCI World Catholic Principles UCITS ETF Acc NAV is vital for understanding the fund's performance and its suitability for your investment objectives. By understanding the factors influencing its NAV, utilizing reliable data sources, and adopting a long-term perspective, you can make better-informed investment decisions. Remember to always consult a financial advisor before making any investment choices. Stay informed about the Amundi MSCI World Catholic Principles UCITS ETF Acc NAV and its performance to effectively manage your investment in this ethically focused, globally diversified fund. Regularly monitor your Amundi MSCI World Catholic Principles UCITS ETF Acc NAV to ensure alignment with your financial goals.

Featured Posts

-

Shop Owner Stabbing Previously Bailed Teen Arrested Again

May 24, 2025

Shop Owner Stabbing Previously Bailed Teen Arrested Again

May 24, 2025 -

Inside Ferraris First Official Bengaluru Service Centre A Closer Look

May 24, 2025

Inside Ferraris First Official Bengaluru Service Centre A Closer Look

May 24, 2025 -

Escape To The Country Finding Your Perfect Countryside Home

May 24, 2025

Escape To The Country Finding Your Perfect Countryside Home

May 24, 2025 -

Amundi Msci World Ex Us Ucits Etf Acc Nav Calculation And Implications

May 24, 2025

Amundi Msci World Ex Us Ucits Etf Acc Nav Calculation And Implications

May 24, 2025 -

Glastonbury 2025 Lineup Announcement A Controversial Choice

May 24, 2025

Glastonbury 2025 Lineup Announcement A Controversial Choice

May 24, 2025

Latest Posts

-

Debate Intensifies Macrons En Marche Supports Restricting Hijabs For Girls Under 15

May 24, 2025

Debate Intensifies Macrons En Marche Supports Restricting Hijabs For Girls Under 15

May 24, 2025 -

Chine La Repression Des Dissidents Francais

May 24, 2025

Chine La Repression Des Dissidents Francais

May 24, 2025 -

French Presidents Party Pushes For Public Hijab Ban On Minors

May 24, 2025

French Presidents Party Pushes For Public Hijab Ban On Minors

May 24, 2025 -

Differences Between Macron And His Former Prime Minister Emerge

May 24, 2025

Differences Between Macron And His Former Prime Minister Emerge

May 24, 2025 -

France Revisits The Dreyfus Affair A Push For Recognition

May 24, 2025

France Revisits The Dreyfus Affair A Push For Recognition

May 24, 2025