Tracking The Stock Market: Dow Futures, Earnings, And Current Market Trends

Table of Contents

Deciphering Dow Futures: A Window into Market Sentiment

What are Dow Futures?

Dow Jones Industrial Average futures contracts are derivative instruments whose price is tied to the expected future value of the Dow Jones Industrial Average (DJIA). They represent an agreement to buy or sell the DJIA at a predetermined price on a specific date. Dow futures essentially reflect the collective sentiment of investors regarding the anticipated performance of the 30 major companies comprising the index. The relationship between Dow futures and the cash market (the actual DJIA) is generally very close, often moving in tandem, providing valuable insights into short-term market direction.

Utilizing Dow Futures for Trading Strategies

Dow futures offer opportunities for both hedging and speculative trading. Hedging involves using futures contracts to mitigate potential losses in an existing stock portfolio. For example, an investor holding a large number of Dow stocks could buy Dow futures contracts to offset potential declines. Speculative trading, on the other hand, aims to profit from price movements in the Dow futures market itself. However, it's crucial to understand that futures trading involves significant risk, and losses can exceed initial investment.

Analyzing Dow futures charts effectively is paramount. Consider these techniques:

- Technical Analysis: Utilizing indicators like moving averages, Relative Strength Index (RSI), and candlestick patterns to identify potential buy/sell signals.

- Support and Resistance Levels: Identifying price levels where buying or selling pressure is expected to be strong.

Where to Find Reliable Dow Futures Data

Reliable real-time Dow futures quotes and charts are available from various sources:

- Major Financial News Websites: Sites like Yahoo Finance, Google Finance, and Bloomberg provide up-to-the-minute data.

- Trading Platforms: Reputable online brokerage platforms offer access to real-time futures data, along with charting tools.

The Impact of Corporate Earnings on Stock Market Performance

Understanding Earnings Reports

Corporate earnings reports are crucial for gauging a company's financial health and future prospects. Key components include:

- Earnings Per Share (EPS): A company's profit divided by the number of outstanding shares.

- Revenue: The total income generated by a company during a specific period.

- Guidance: A company's forecast for future performance.

Earnings announcements significantly influence stock prices. A beat (exceeding analyst expectations) often results in a price increase, while a miss (falling short) typically leads to a decline. Comparing reported earnings to analyst expectations is essential for evaluating market reaction.

Analyzing Earnings for Investment Decisions

Fundamental analysis plays a critical role in evaluating earnings reports. This involves examining a company's financial statements, business model, and competitive landscape to assess its intrinsic value.

Market reactions to earnings surprises are frequently dramatic:

- Positive Earnings Surprise: Often triggers a sharp price increase, reflecting investor optimism.

- Negative Earnings Surprise: Can lead to significant price drops, indicating investor disappointment.

Beyond EPS, consider these factors:

- Revenue Growth

- Debt Levels

- Profit Margins

- Cash Flow

Earnings Calendar and its Significance

Tracking the earnings calendar is crucial for staying ahead of market movements. Knowing when major companies are releasing their reports allows investors to anticipate potential volatility and adjust their portfolios accordingly. Many financial websites provide comprehensive earnings calendars.

Identifying and Interpreting Current Market Trends

Macroeconomic Factors and Their Influence

Broad economic conditions significantly impact stock market performance. Key factors include:

- Interest Rates: Higher rates can curb economic growth and dampen stock prices.

- Inflation: High inflation erodes purchasing power and can negatively affect corporate profits.

- Economic Growth: Strong GDP growth generally supports a positive market outlook.

- Geopolitical Events: Unexpected global events can trigger significant market fluctuations.

Keep an eye on these economic indicators:

- GDP (Gross Domestic Product)

- CPI (Consumer Price Index)

- Unemployment Rate

Technical Analysis Techniques

Technical analysis uses historical price and volume data to identify patterns and predict future price movements. Common tools include:

- Moving Averages: Smoothen price data to identify trends.

- Chart Patterns: Recognizing recurring patterns (e.g., head and shoulders, double tops/bottoms) can signal potential reversals or continuations of trends.

Fundamental Analysis for Long-Term Trends

Fundamental analysis is crucial for long-term investment decisions. This involves evaluating a company's intrinsic value based on its financial health, competitive advantage, and future growth potential. By identifying undervalued or overvalued stocks, investors can position themselves for long-term gains.

Stay Ahead in the Market: Continuous Tracking of Dow Futures, Earnings, and Trends

Successfully navigating the stock market hinges on understanding and actively tracking Dow Futures, corporate Earnings, and prevailing Current Market Trends. This article has provided a framework for analyzing these crucial indicators. Remember that consistently monitoring these factors, coupled with sound investment strategies and risk management, is vital for long-term success. To deepen your understanding, explore additional resources such as reputable financial books, online courses, and professional investment advice. Stay informed about Dow Futures, Earnings, and Current Market Trends – your financial future depends on it!

Featured Posts

-

De Bio Based Basisschool En De Noodzaak Van Noodstroom Generatoren Op Schoolpleinen

May 01, 2025

De Bio Based Basisschool En De Noodzaak Van Noodstroom Generatoren Op Schoolpleinen

May 01, 2025 -

Addio A Mario Nanni Un Maestro Del Giornalismo Parlamentare Ci Lascia

May 01, 2025

Addio A Mario Nanni Un Maestro Del Giornalismo Parlamentare Ci Lascia

May 01, 2025 -

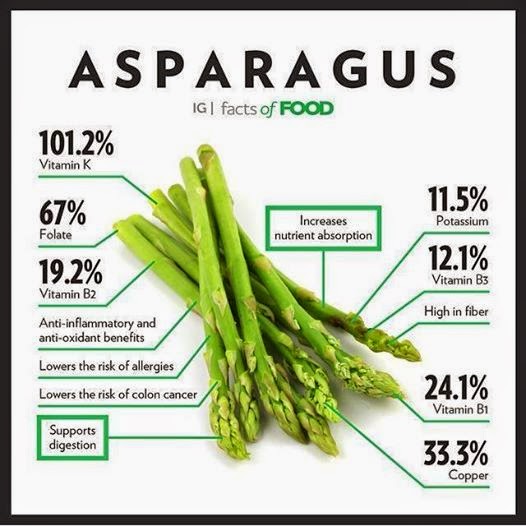

How Healthy Is Asparagus Unveiling The Nutritional Benefits

May 01, 2025

How Healthy Is Asparagus Unveiling The Nutritional Benefits

May 01, 2025 -

Daily Horoscope For April 17 2025 Your Zodiac Signs Predictions

May 01, 2025

Daily Horoscope For April 17 2025 Your Zodiac Signs Predictions

May 01, 2025 -

Dragon Den Repeat Viewers Baffled By Outdated Episode

May 01, 2025

Dragon Den Repeat Viewers Baffled By Outdated Episode

May 01, 2025