Trade Truce Fuels S&P 500 Rally: Market Up Over 3%

Table of Contents

The Trade Truce and Its Impact on Market Sentiment

The recent trade truce between [Insert Countries Involved, e.g., the US and China] has significantly eased investor anxieties surrounding escalating trade wars and global economic instability. The agreement [briefly explain the key terms of the truce, e.g., a temporary halt to new tariffs and a commitment to further negotiations] removed a major source of uncertainty that had been weighing heavily on market performance. This development fostered a wave of optimism, impacting market sentiment in several key ways:

- Reduced uncertainty about tariffs and trade barriers: The truce alleviated fears of further tariff increases and trade restrictions, creating a more predictable environment for businesses.

- Improved investor confidence in global trade prospects: The agreement signaled a potential de-escalation of trade tensions, boosting investor confidence in the future of global trade.

- Positive impact on corporate earnings expectations: Companies previously burdened by uncertainty now have a clearer outlook, leading to revised upward projections for corporate earnings.

- Increased foreign investment inflows: The improved market sentiment attracted increased foreign investment, further fueling the S&P 500 rally. This influx of capital provided additional support to stock prices.

Sector-Specific Performance During the Rally

The S&P 500 rally wasn't uniform across all sectors. Some sectors benefited disproportionately from the trade truce, experiencing significantly higher gains.

- Technology sector gains: The tech sector saw substantial gains, largely due to reduced concerns about tariffs on technology products and increased demand for tech solutions globally.

- Industrial sector gains: The industrial sector also performed exceptionally well, benefiting from increased demand spurred by the easing of trade tensions and reduced input costs.

- Consumer discretionary sector gains: Consumer confidence increased, leading to higher consumer spending, which benefited companies in the consumer discretionary sector.

- Underperforming sectors: [Mention any sectors that underperformed and provide a brief explanation, e.g., certain energy sectors might have underperformed due to persistent global supply concerns, unrelated to the trade truce].

Other Contributing Factors to the S&P 500 Rally

While the trade truce was a significant catalyst, other factors contributed to the positive performance of the S&P 500:

- Stronger-than-expected economic data: Positive economic data releases, such as stronger-than-anticipated GDP growth and employment figures, bolstered investor confidence.

- Positive corporate earnings reports: Numerous companies released positive corporate earnings reports, further fueling the market's upward trajectory.

- Lower interest rates: Lower interest rates, implemented by central banks, made borrowing cheaper, encouraging investment and stimulating economic activity.

- Increased consumer confidence: Improved economic sentiment and the easing of trade tensions led to a rise in consumer confidence, supporting increased consumer spending.

Potential Risks and Future Outlook for the S&P 500

Despite the significant rally, it's crucial to acknowledge potential risks that could reverse the current positive trend:

- Potential for trade negotiations to falter: The trade truce is temporary, and the possibility of renewed trade tensions remains.

- Geopolitical instability: Unforeseen geopolitical events could negatively impact market sentiment and investor confidence.

- Economic slowdown in key markets: A slowdown in major economies could dampen global growth and negatively affect corporate earnings.

- Inflationary pressures: Rising inflation could erode corporate profits and trigger a market correction.

Considering these risks, a cautious approach to future S&P 500 performance is warranted. While the current market surge is impressive, sustained growth hinges on the continued success of trade negotiations and the stability of the global economic landscape.

Trade Truce Fuels Continued S&P 500 Growth?

In summary, the recent trade truce played a pivotal role in the significant S&P 500 rally, easing investor concerns and fostering a wave of positive economic sentiment. However, several other factors, including strong economic data and positive corporate earnings, also contributed to this market surge. While the outlook is currently positive, potential risks remain, highlighting the importance of continued monitoring of both positive and negative indicators impacting the market.

To make informed investment decisions regarding the S&P 500, stay informed about future developments in trade negotiations, the overall economic climate, and key market indicators. The volatility of the market demands ongoing analysis, and continued monitoring of the S&P 500 is crucial for navigating its unpredictable trajectory. Stay tuned for further updates on the S&P 500's trajectory.

Featured Posts

-

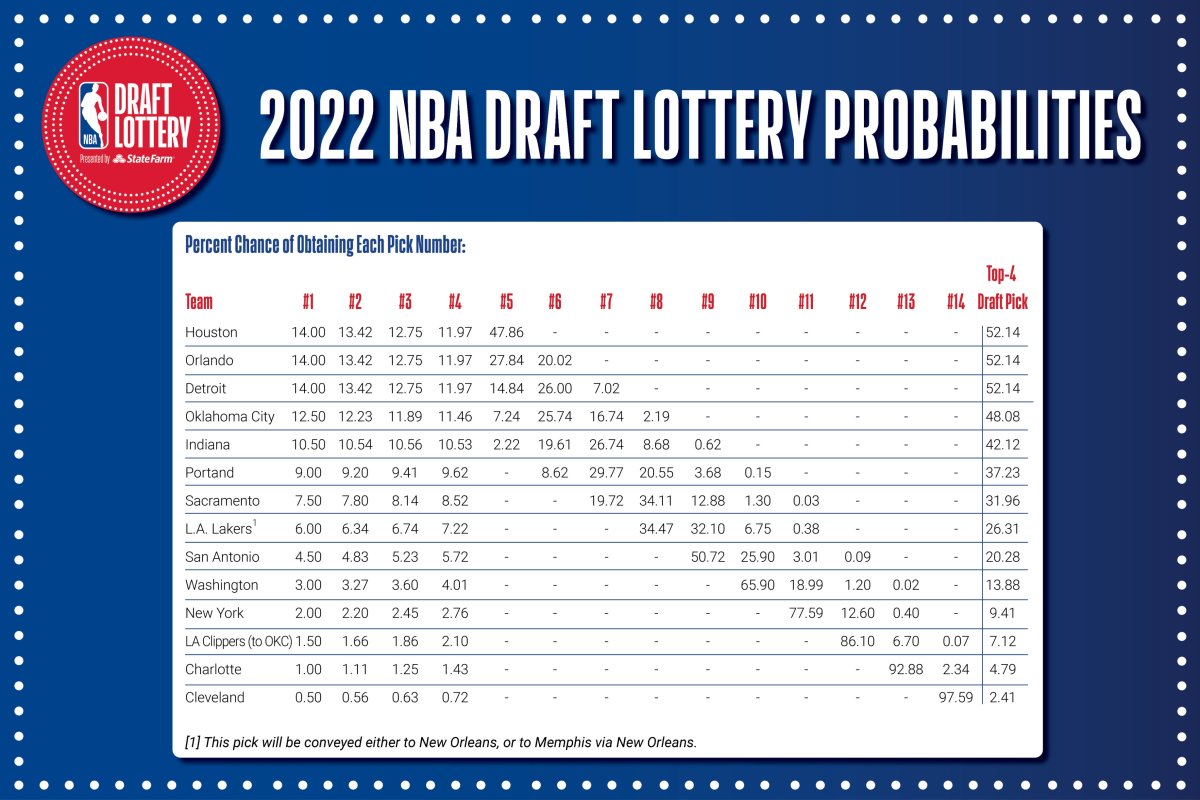

Nba Draft Lottery 2025 Predicting The No 1 Pick And Where To Watch

May 13, 2025

Nba Draft Lottery 2025 Predicting The No 1 Pick And Where To Watch

May 13, 2025 -

Landman Season 2 Filming Update Ali Larters Return Revealed In Bts Photos

May 13, 2025

Landman Season 2 Filming Update Ali Larters Return Revealed In Bts Photos

May 13, 2025 -

Investigating The Life And Work Of Angela Swartz

May 13, 2025

Investigating The Life And Work Of Angela Swartz

May 13, 2025 -

Cassidy Hutchinson Memoir Details On Her Jan 6 Testimony And Experiences

May 13, 2025

Cassidy Hutchinson Memoir Details On Her Jan 6 Testimony And Experiences

May 13, 2025 -

Sixers Nba Draft Lottery Odds How To Watch And What To Expect

May 13, 2025

Sixers Nba Draft Lottery Odds How To Watch And What To Expect

May 13, 2025