Traders Reduce BOE Rate Cut Expectations As Pound Rises Post-Inflation Data

Table of Contents

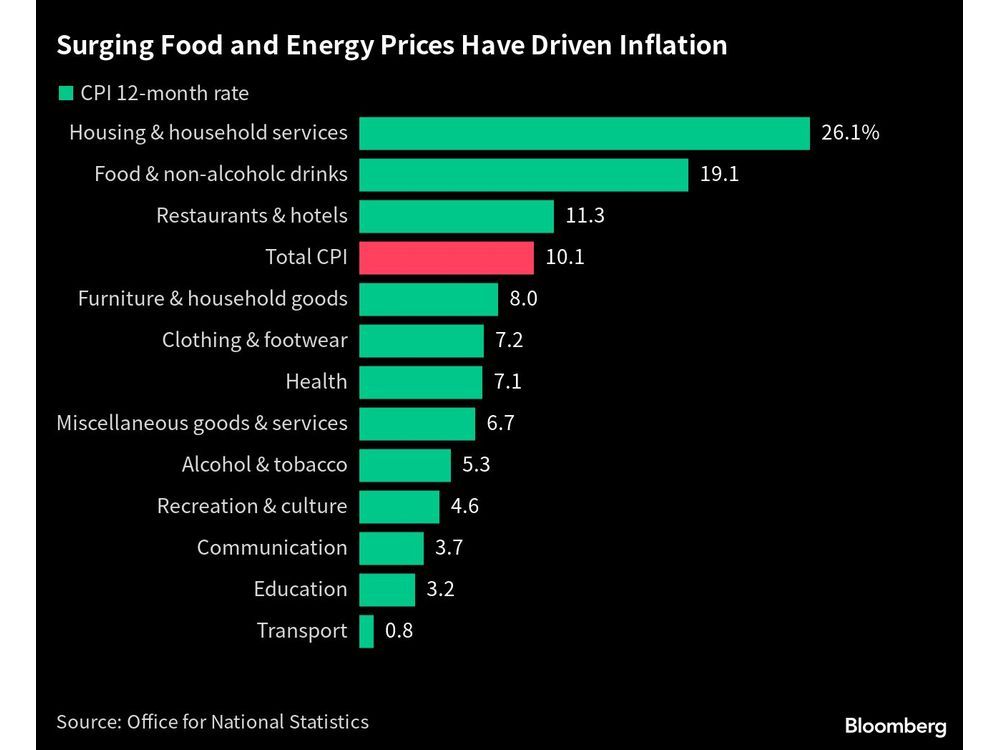

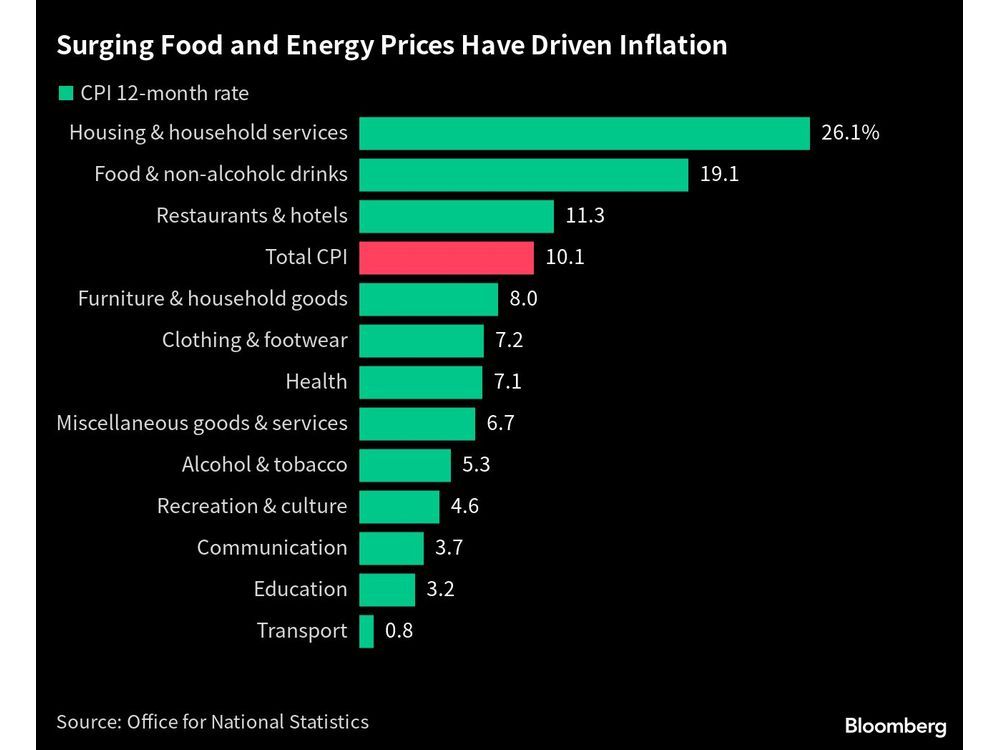

Inflation Data Surprises Markets

The recently released UK inflation data surprised markets, showing a more resilient picture than many analysts had predicted. While the precise figures vary depending on the index used (CPI and RPI), the overall trend was clear: inflation remained stubbornly high. This contrasts sharply with the expectations of many economists who anticipated a more significant decline. The key contributing factors to this unexpected resilience included persistently high energy prices, despite recent declines, and continued upward pressure on food costs. Wage growth also played a role, contributing to inflationary pressures.

- Detailed breakdown of CPI and RPI figures: The Consumer Price Index (CPI) registered a [insert actual figure]% increase, while the Retail Price Index (RPI) showed a [insert actual figure]% rise. These figures are [higher/lower] than predicted and [higher/lower] than the previous month/year.

- Comparison to market consensus forecasts: Market forecasts, on average, predicted a CPI of [insert forecast figure]% and an RPI of [insert forecast figure]%. The actual figures show a significant deviation from these expectations, influencing market sentiment.

- Analysis of contributing factors: Beyond energy and food price increases, factors such as supply chain disruptions and robust consumer demand continued to exert upward pressure on inflation, preventing a sharper decline.

Pound Strengthens on Inflation Data

The unexpectedly high inflation figures triggered an immediate and significant strengthening of the pound. The GBP/USD exchange rate experienced a sharp upward movement following the data release, reflecting the market's reassessment of the UK's economic outlook. This appreciation was not limited to the dollar; other major GBP currency pairs, such as GBP/EUR, also saw gains, indicating a broader strengthening of the British currency. Trading volumes increased substantially, highlighting the market's reaction to the unexpected data.

- GBP/USD exchange rate movement post-data release: The GBP/USD exchange rate jumped from [insert pre-release figure] to [insert post-release figure] within [timeframe] of the data release.

- Impact on other major GBP currency pairs: The GBP/EUR exchange rate also saw a notable increase, moving from [insert pre-release figure] to [insert post-release figure].

- Analysis of trading volume and volatility: Trading volume increased significantly in GBP pairs, indicating heightened market activity and volatility as traders reacted to the news.

Reduced Expectations for BOE Rate Cuts

The unexpectedly strong inflation data significantly dampened market expectations for a BOE rate cut. The prevailing market sentiment before the data release had priced in a high probability of a rate reduction at the next monetary policy meeting. However, the resilience of inflation suggests that the BOE might hold off on further easing, potentially even considering a rate hike if inflation continues its upward trajectory. This altered outlook reflects the central bank's mandate to control inflation.

- Shift in market probabilities for a BOE rate cut: Market probabilities for a BOE rate cut at the next meeting have decreased from [insert pre-data percentage]% to [insert post-data percentage]%, according to various financial models.

- Analysis of potential future BOE policy decisions: The BOE will likely carefully monitor upcoming economic indicators before making any further decisions regarding monetary policy.

- Quotes from financial experts on the implications for the UK economy: "[Insert quote from a financial expert regarding the implications of the data and future BOE policy]."

Implications for Traders and Investors

The shift in market sentiment presents both opportunities and risks for traders and investors. The strengthening pound creates opportunities for those with short GBP positions to profit from the currency's appreciation. Conversely, those holding long GBP positions may need to reassess their risk exposure. For investors, the implications extend to UK-based assets, whose valuations are influenced by currency fluctuations and interest rate expectations.

- Opportunities for currency trading (long or short GBP positions): Traders can adapt their strategies based on the changed outlook, potentially profiting from the increased volatility.

- Investment implications for UK-based assets: Investors need to consider the impact of the pound's appreciation and the reduced likelihood of a BOE rate cut on their portfolios.

- Importance of risk management in volatile market conditions: Given the volatility following the inflation data release, risk management strategies become even more crucial for navigating the market.

Conclusion

The unexpectedly high UK inflation data has triggered a significant market reaction, strengthening the pound and reducing expectations of a BOE rate cut. This interconnectedness of inflation data, currency markets, and central bank policy highlights the dynamic nature of economic forecasting and the importance of staying informed.

Stay ahead of the curve by continuously monitoring BOE rate cut expectations and their impact on the pound. Understanding these intricate relationships is key to successful trading and investment strategies related to BOE monetary policy and GBP exchange rate fluctuations.

Featured Posts

-

Zheng Qinwens Stunning Win Over Sabalenka In Rome Gauff Next

May 25, 2025

Zheng Qinwens Stunning Win Over Sabalenka In Rome Gauff Next

May 25, 2025 -

Urgent Flash Flood Warning For Bradford And Wyoming Counties Tuesday Evening

May 25, 2025

Urgent Flash Flood Warning For Bradford And Wyoming Counties Tuesday Evening

May 25, 2025 -

The Future Of Healthcare Analyzing The Philips Future Health Index 2025 And The Role Of Ai

May 25, 2025

The Future Of Healthcare Analyzing The Philips Future Health Index 2025 And The Role Of Ai

May 25, 2025 -

Myrtle Beach Newspaper Garners 59 Sc Press Association Awards For Local Coverage

May 25, 2025

Myrtle Beach Newspaper Garners 59 Sc Press Association Awards For Local Coverage

May 25, 2025 -

Monaco Nice L Equipe Selectionnee Pour La Reception

May 25, 2025

Monaco Nice L Equipe Selectionnee Pour La Reception

May 25, 2025