Trump Administration's $3 Billion Loan Rejection: Sunnova Energy Faces Challenges

Table of Contents

The Trump Administration's Stance on Renewable Energy

Policy Shifts and Funding Priorities

The Trump administration's approach to renewable energy was markedly different from its predecessors. A clear preference for fossil fuels was evident throughout its tenure, impacting funding priorities and regulatory frameworks. This contrasted sharply with the Obama administration's push for clean energy initiatives.

- Reduced Funding for Renewable Energy Programs: Budgetary allocations for renewable energy research, development, and deployment were significantly curtailed. This contrasted with increased funding for fossil fuel subsidies and exploration.

- Relaxation of Environmental Regulations: Several environmental regulations aimed at curbing greenhouse gas emissions were weakened or rolled back, creating a less favorable environment for renewable energy investment.

- Statements from Administration Officials: Public statements from key administration officials often expressed skepticism towards the economic viability and environmental benefits of renewable energy sources like solar power, further dampening investor confidence.

The Loan Guarantee Program's Criteria and Application Process

Sunnova's application was likely assessed against stringent criteria within the Department of Energy's loan guarantee program. These criteria often focus on financial stability, project feasibility, and environmental impact.

- Rigorous Financial Due Diligence: Applicants were subject to extensive financial analysis to assess their creditworthiness and ability to repay the loan. This included scrutinizing balance sheets, cash flow projections, and risk assessments.

- Detailed Project Plans and Environmental Impact Assessments: Comprehensive project plans, including technical specifications, timelines, and cost estimates, were required. A thorough environmental impact assessment was also a necessary component.

- Competitive Application Process: Numerous companies compete for limited funding within these loan guarantee programs, leading to a highly selective process. Sunnova may not have met the program's stringent requirements, or another applicant may have been deemed a higher priority.

Sunnova Energy's Business Model and Financial Situation

The Company's Dependence on External Financing

Sunnova Energy, a leading residential solar energy provider, relies heavily on external financing for expansion and growth. Its business model involves significant upfront investment in solar panel installations and long-term contracts with homeowners.

- High Capital Expenditures: The installation of solar panels requires substantial upfront capital investment, making the company reliant on securing external funding to fuel its expansion.

- Debt Levels and Financial Health: Prior to the loan rejection, Sunnova's financial health would have been a critical factor in the loan application's assessment. High debt levels or other financial vulnerabilities could have hindered its chances of securing the $3 billion loan.

- Revenue Streams and Growth Projections: Sunnova's revenue streams are primarily derived from the sale and installation of solar systems and long-term service agreements. The loan rejection directly impacted its growth projections, necessitating adjustments to its business strategy.

Impact of the Rejection on Sunnova's Future Plans

The loan rejection had immediate and long-term implications for Sunnova's operations. The company likely had to reassess its expansion plans and explore alternative financing options.

- Project Delays and Cancellations: Several projects slated for development were likely postponed or canceled due to the unavailability of the anticipated funding.

- Impact on Investor Confidence: The rejection negatively impacted investor confidence, potentially leading to a decrease in the company's stock price and hindering its ability to secure alternative funding sources.

- Potential for Layoffs: To mitigate the financial fallout from the loan rejection, Sunnova may have had to implement cost-cutting measures, including potential layoffs or hiring freezes.

The Broader Implications for the Renewable Energy Industry

The Chill on Investment in Clean Energy

The rejection of Sunnova's loan application sent a ripple effect throughout the renewable energy industry. It highlighted the challenges in securing large-scale financing for clean energy projects, potentially chilling future investments.

- Decreased Investor Confidence: The rejection fostered a sense of uncertainty among investors regarding the viability of large-scale renewable energy projects, particularly those seeking government support.

- Increased Difficulty in Securing Funding: Other renewable energy companies seeking similar funding may find it more difficult to secure loans given the precedent set by Sunnova's rejection.

- Impact on Job Creation: Reduced investment in the renewable energy sector could lead to fewer jobs being created in this vital sector of the economy.

Political and Regulatory Uncertainty

The rejection underscored the critical role of political and regulatory stability in attracting investment in renewable energy. The lack of consistent and supportive policies creates uncertainty and deters investment.

- Policy Instability: Inconsistent government policies create a volatile environment for investors, making long-term investment planning difficult.

- Need for Stable and Supportive Policies: Clear and predictable government policies, including consistent funding for renewable energy initiatives, are crucial to stimulate investment and growth in the sector.

- Impact on Energy Transition: Uncertainty regarding government support could hamper the transition to cleaner energy sources, delaying progress towards climate change mitigation goals.

Conclusion

Sunnova Energy's $3 billion loan rejection under the Trump administration serves as a stark reminder of the challenges facing the renewable energy sector. The rejection stemmed from a confluence of factors: the administration's policy preferences, Sunnova's financial circumstances, and the inherently competitive nature of securing large-scale funding. This case highlights the crucial need for stable and supportive government policies to foster investment in clean energy projects. Understanding these complexities is vital for the future success of the sector. The Sunnova Energy case underscores the need for thorough due diligence, robust financial planning, and navigating the political landscape when pursuing large-scale financing for renewable energy ventures. Learn more about the complexities of securing funding for renewable energy projects to better understand the challenges and opportunities in this ever-evolving field.

Featured Posts

-

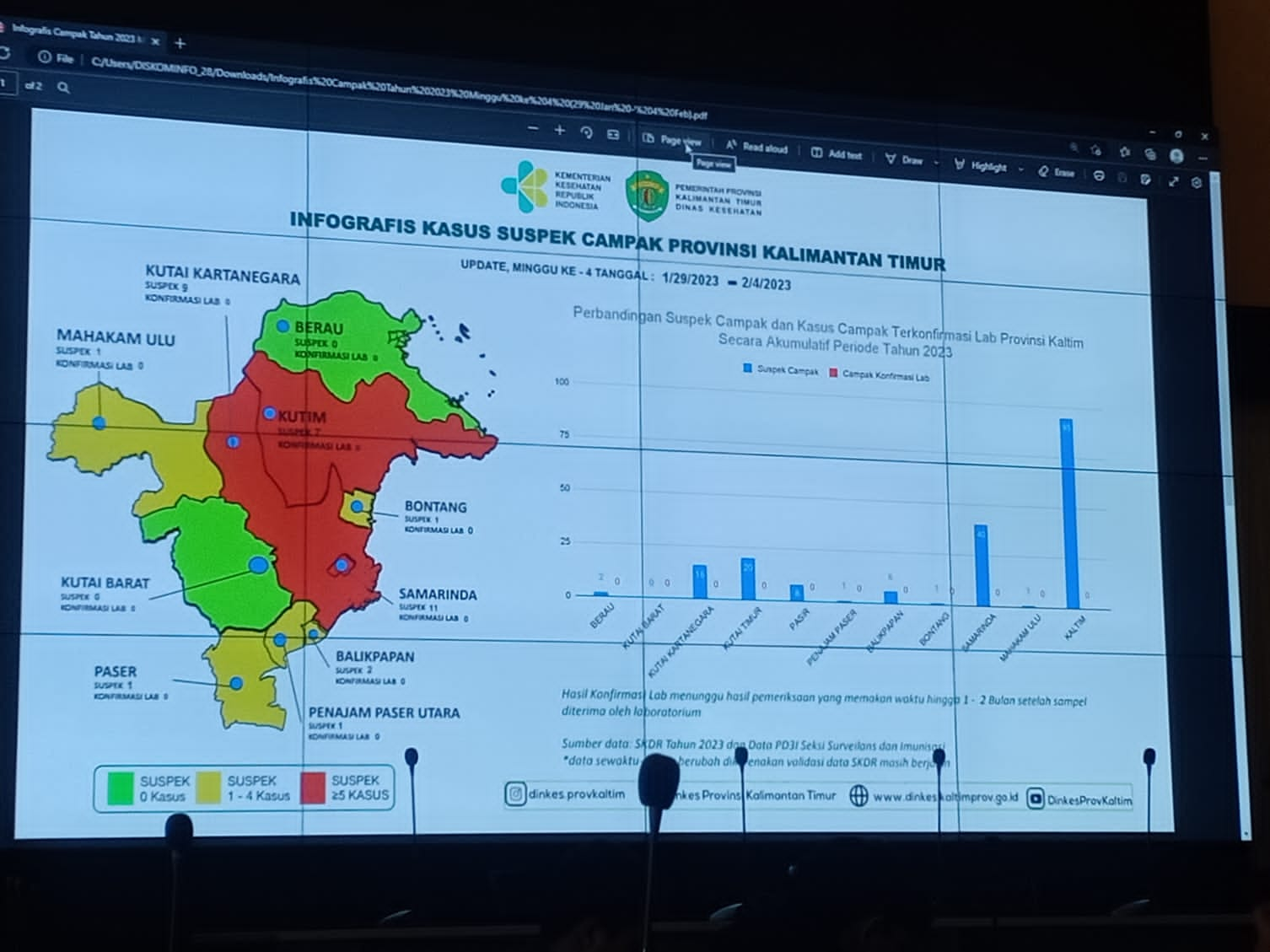

Imunisasi Anak Rendah Kasus Suspek Campak Di Pohuwato Melonjak Peringatan Dinkes Gorontalo

May 30, 2025

Imunisasi Anak Rendah Kasus Suspek Campak Di Pohuwato Melonjak Peringatan Dinkes Gorontalo

May 30, 2025 -

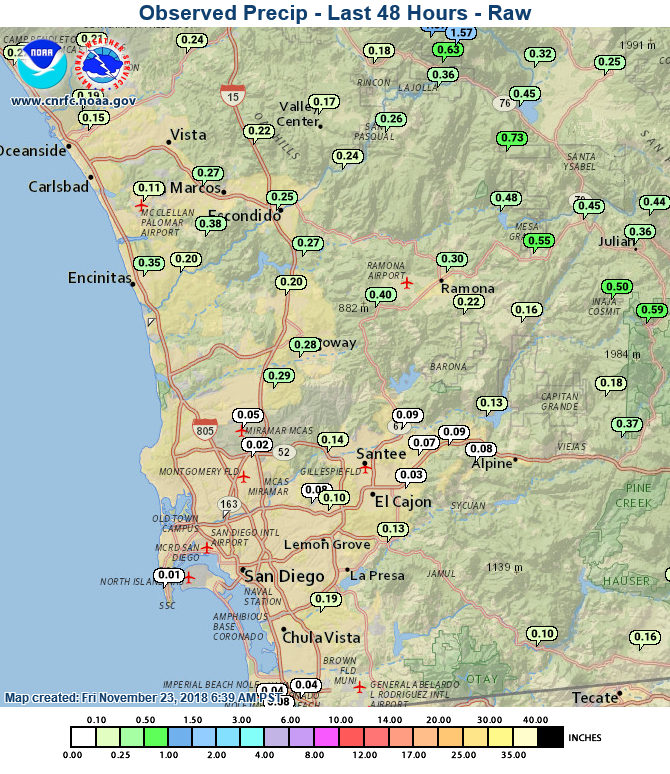

Cbs 8 Com Your Source For San Diego Rain Totals

May 30, 2025

Cbs 8 Com Your Source For San Diego Rain Totals

May 30, 2025 -

Indie Games On Nintendo Switch A Legacy Of Partnerships And Challenges

May 30, 2025

Indie Games On Nintendo Switch A Legacy Of Partnerships And Challenges

May 30, 2025 -

Vivian Jenna Wilson Modeling Career Launch Following Distance From Elon Musk

May 30, 2025

Vivian Jenna Wilson Modeling Career Launch Following Distance From Elon Musk

May 30, 2025 -

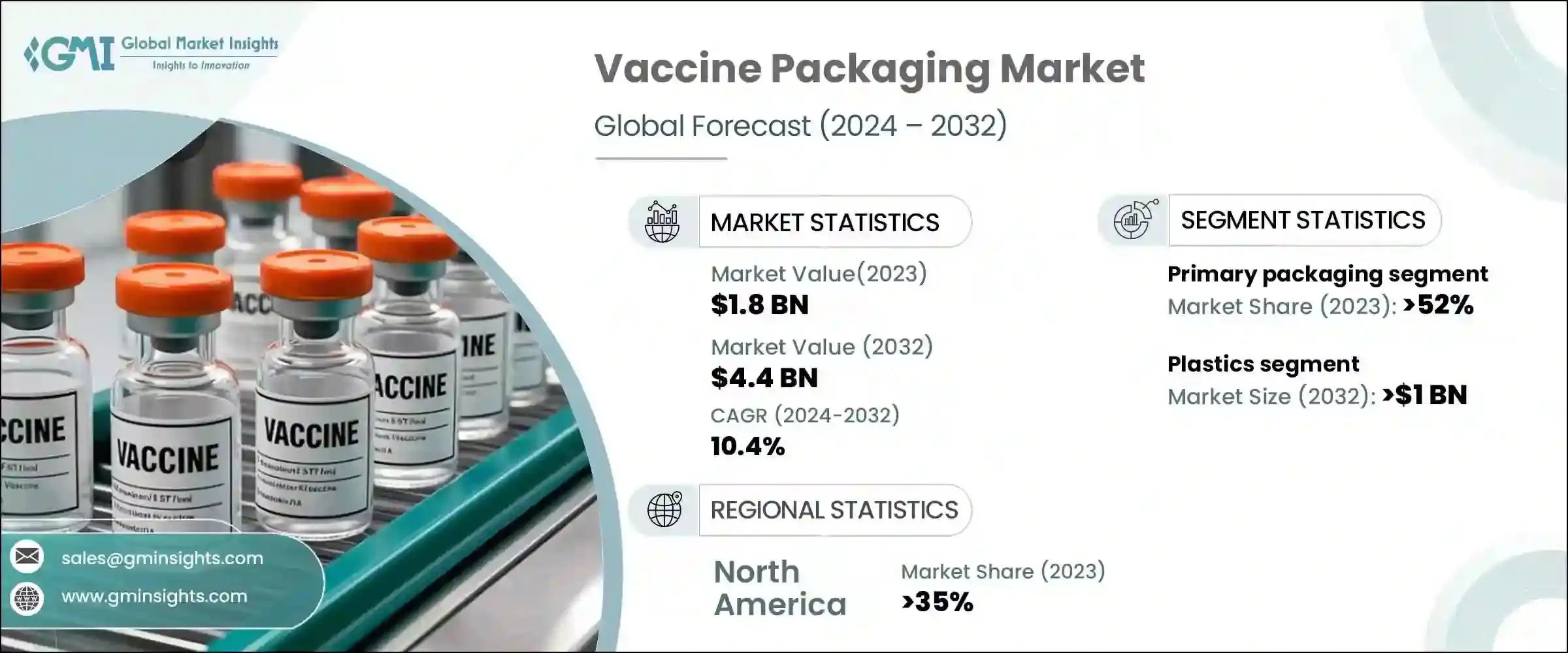

Explosive Growth In The Vaccine Packaging Market

May 30, 2025

Explosive Growth In The Vaccine Packaging Market

May 30, 2025