Trump Denies Intentions To Fire Federal Reserve Chair Jerome Powell

Table of Contents

Trump's Denials and Their Context

Keywords: Trump denial, Powell firing, White House statement, political pressure, economic criticism

Trump's repeated denials of any intention to fire Jerome Powell, while seemingly straightforward, warrant closer examination. His statements, often made via social media or interviews, must be viewed within the context of recent economic indicators and the ongoing market volatility.

- Public Statements: Trump has consistently denied actively seeking to dismiss Powell, often framing his previous criticisms as merely expressing concern over economic policy. However, the tone and frequency of these denials themselves suggest underlying political pressure.

- Timing and Context: The timing of these denials is significant. They frequently follow periods of market turbulence or criticism of the Fed's handling of inflation and interest rates. This suggests a strategic attempt to mitigate potential backlash and calm market anxieties.

- Political Motivations: Analyzing Trump's pronouncements requires considering his broader political agenda. His criticism of Powell, particularly regarding interest rate hikes, could be interpreted as an attempt to influence economic conditions ahead of potential future elections.

- Past Criticisms: Trump's history of publicly criticizing Powell's decisions, including labeling him as an "enemy" and expressing dissatisfaction with interest rate increases, casts a shadow on the sincerity of his recent denials.

The Power Struggle Between the President and the Federal Reserve

Keywords: presidential power, Fed independence, central bank independence, monetary policy, political interference

The relationship between the President and the Federal Reserve is inherently complex, fraught with potential conflict. Understanding this dynamic requires examining the historical context and legal frameworks governing their interaction.

- Historical Context: Throughout US history, the relationship between the executive branch and the central bank has been characterized by periods of both cooperation and tension. Presidents have often sought to influence monetary policy to achieve their political goals, while the Fed has strived to maintain its independence to effectively manage the economy.

- Legal Framework: While the President appoints the Fed Chair, the Chair's term is relatively long, offering some insulation from direct political pressure. The process for removing a Fed Chair is complex, requiring significant justification and potentially facing legal challenges.

- Consequences of Interference: Political interference in the Fed's decision-making process undermines the central bank's credibility and can lead to unpredictable economic outcomes. Market confidence is easily eroded when monetary policy decisions appear influenced by political considerations rather than purely economic factors.

- Arguments for and Against Presidential Influence: Some argue that greater presidential influence is necessary to ensure that monetary policy aligns with the government's overall economic goals. Others maintain that the Fed's independence is crucial to prevent short-sighted political interventions from destabilizing the economy.

The Economic Implications of the Dispute

Keywords: inflation, interest rates, economic uncertainty, market volatility, investor confidence, economic growth

The uncertainty surrounding the Trump-Powell dynamic has significant economic implications, impacting investor confidence and potentially affecting key economic indicators.

- Investor Confidence: The perception of political interference in the Federal Reserve's operations can significantly undermine investor confidence, leading to market volatility and potentially impacting investment decisions.

- Inflation and Interest Rates: Uncertainty about the future direction of monetary policy can influence inflation expectations and interest rate movements. This uncertainty itself can contribute to instability.

- Economic Growth and Stability: The combination of reduced investor confidence and uncertainty surrounding interest rate policy can negatively impact economic growth and overall stability. A climate of uncertainty inhibits investment and discourages long-term economic planning.

- Expert Opinions: Numerous economists have warned about the potential for negative economic consequences stemming from the ongoing tension between the executive branch and the Federal Reserve. The consensus is that maintaining central bank independence is crucial for long-term economic health.

Powell's Response and the Future of the Federal Reserve

Keywords: Powell response, Fed statement, monetary policy outlook, future of the Fed, central bank credibility

Jerome Powell and the Federal Reserve have responded to the ongoing situation with measured statements emphasizing the importance of the Fed's independence.

- Official Responses: The Fed has consistently reiterated its commitment to its mandate of price stability and maximum employment, regardless of political pressure. Powell's public statements have generally avoided direct confrontation with Trump's criticisms.

- Maintaining Independence and Credibility: This situation tests the Fed's ability to maintain its independence and credibility as a non-political institution. Continued political pressure could erode public trust in the central bank’s ability to make objective, data-driven decisions.

- Long-Term Consequences: The long-term consequences of this power struggle could extend beyond the US, potentially affecting global economic stability and the credibility of other central banks around the world.

Conclusion

The ongoing dynamic between Donald Trump and Jerome Powell highlights a critical tension between the executive branch and the Federal Reserve. Trump's denials of intentions to dismiss Powell, while seemingly reassuring, cannot fully alleviate concerns about the potential for political interference in monetary policy. The inherent power struggle, the economic uncertainties it creates, and the potential impact on investor confidence all underscore the vital importance of maintaining the Federal Reserve's independence. The potential long-term economic ramifications for the US and the global economy are considerable. Stay informed about the ongoing developments regarding the Trump-Powell dynamic. Further understanding of the dynamics between the President and the Federal Reserve is crucial for anyone interested in economic policy and the future direction of the US economy. Continue to follow reputable news sources for updates on the Trump-Powell relationship.

Featured Posts

-

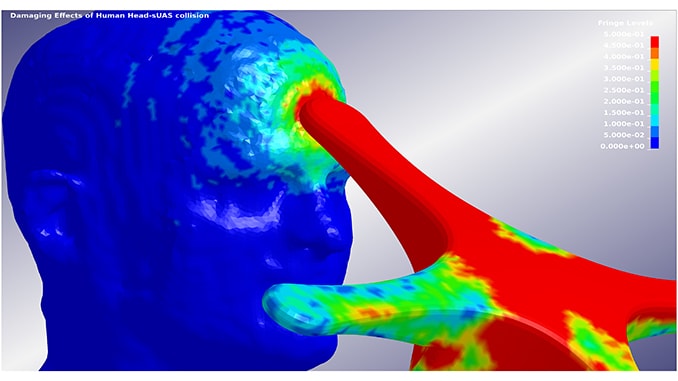

Faa Study Collision Risks At Las Vegas Airport

Apr 24, 2025

Faa Study Collision Risks At Las Vegas Airport

Apr 24, 2025 -

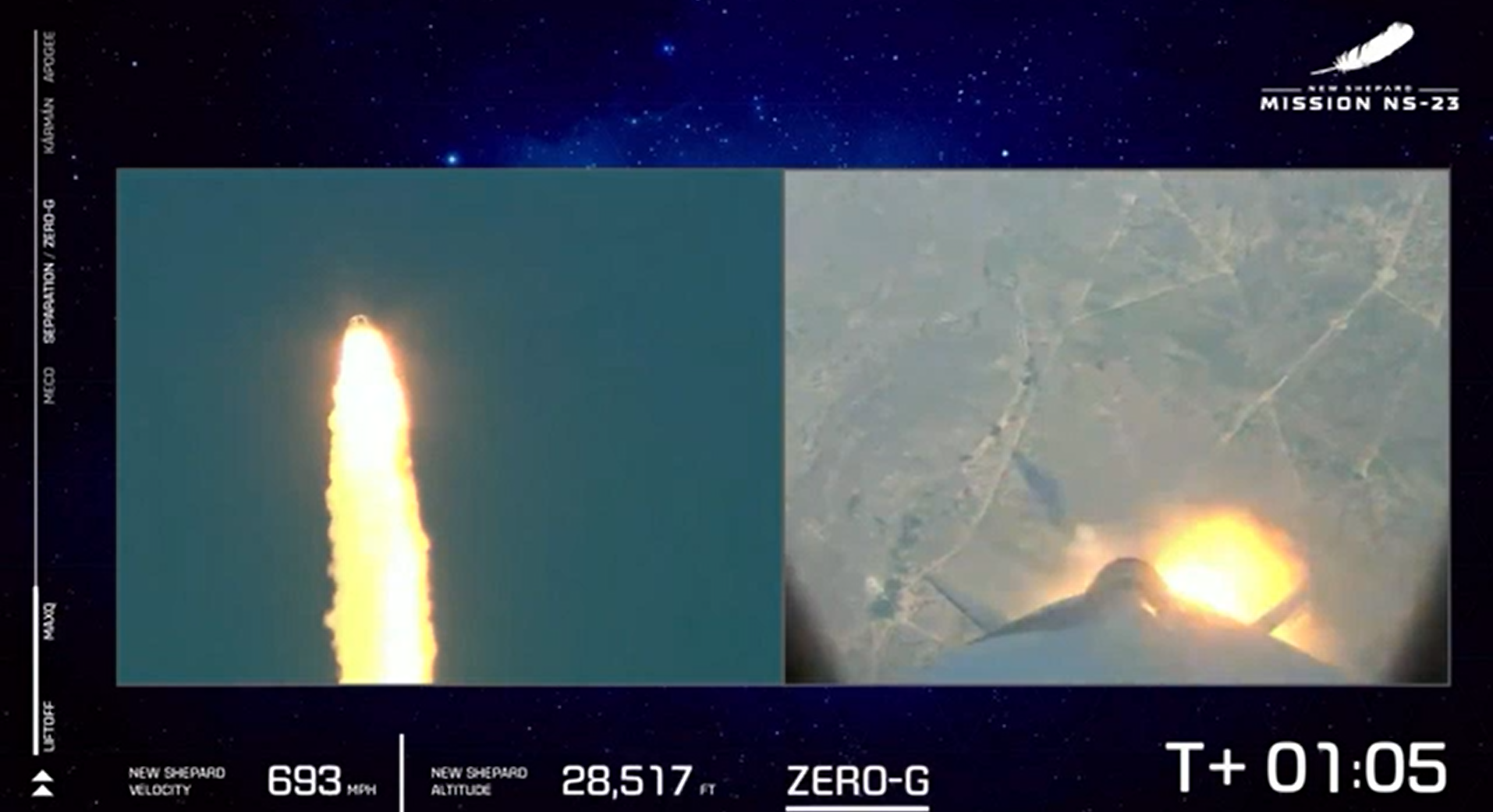

Blue Origins Launch Abort Details On The Subsystem Failure

Apr 24, 2025

Blue Origins Launch Abort Details On The Subsystem Failure

Apr 24, 2025 -

Zuckerberg And The Trump Era A New Phase For Meta

Apr 24, 2025

Zuckerberg And The Trump Era A New Phase For Meta

Apr 24, 2025 -

Nba All Star Game Additions Draymond Green Moses Moody And Buddy Hield

Apr 24, 2025

Nba All Star Game Additions Draymond Green Moses Moody And Buddy Hield

Apr 24, 2025 -

Blue Origin Cancels Launch Vehicle Subsystem Malfunction

Apr 24, 2025

Blue Origin Cancels Launch Vehicle Subsystem Malfunction

Apr 24, 2025