Trump Plays Down Economic Worries Amidst Trade Deal Cuts

Table of Contents

Trump's Optimism in the Face of Negative Economic Indicators

President Trump's response to negative economic indicators linked to trade deal cuts has been characterized by unwavering optimism, often contrasting sharply with expert analysis. This strategy involves two key approaches: minimizing the impact of trade disputes and emphasizing positive economic data.

Dismissal of Trade War Concerns

Throughout his presidency, President Trump has repeatedly minimized the impact of trade disputes on the American economy.

- Examples of statements: Numerous tweets and press conferences feature statements like, "The trade war is good for America" or claims that tariffs are easily absorbed by other countries. Specific examples should be cited here with links to verifiable sources (e.g., White House transcripts, reputable news archives).

- Details: These statements often contrast with data indicating job losses in specific sectors heavily impacted by tariffs, such as agriculture and manufacturing. For example, decreased exports in certain agricultural products and reports of factory closures in response to tariffs could be mentioned here, with links to supporting data from the Bureau of Labor Statistics or other reliable sources. Market fluctuations, particularly drops in the stock market following trade policy announcements, can further illustrate the real-world impact. A decrease in consumer confidence correlated with escalating trade tensions should also be considered.

Emphasis on Positive Economic Data

To counterbalance negative trends, President Trump frequently highlights positive economic indicators.

- Specific positive economic indicators: The President often cites low unemployment rates, GDP growth, and increases in business investment as evidence of a thriving economy, unaffected by trade disputes. Specific numbers and sources should be cited here to validate the claims.

- Comparison with negative impacts: While positive economic data exists, it’s crucial to compare this data with the potential negative impacts of trade deal cuts. For example, while unemployment might remain low, job growth in certain sectors might be significantly slowed or even reversed due to tariffs and trade disruptions. This section needs a detailed comparison, citing sources showing potential negative impacts from reputable economic institutions. Expert analysis contradicting the President's overly optimistic assessment needs to be included.

Expert Analysis and Contrasting Perspectives

While the Trump administration emphasizes positive economic aspects, independent economists hold significantly different perspectives on the impact of trade deal cuts.

Economists' Concerns Regarding Trade Deal Impacts

Numerous economic analyses highlight potential negative consequences of the trade deal cuts.

- Specific economic models, reports, and expert opinions: Cite reports from organizations like the Congressional Budget Office, the International Monetary Fund (IMF), and reputable economic think tanks. These reports often provide models projecting GDP losses, job displacement, and increased consumer prices due to tariffs.

- Sectors adversely impacted: Highlight sectors particularly vulnerable to trade deal cuts, such as agriculture, manufacturing, and potentially the technology sector depending on the specifics of the deals. Detailed explanation of the reasons for the impact on each sector is essential here, with supporting evidence.

Market Volatility and Investor Sentiment

Trade deal cuts have demonstrably impacted market volatility and investor sentiment.

- Data on stock market fluctuations, investor confidence indices: Cite data from reputable sources like the Dow Jones Industrial Average, S&P 500, and relevant investor confidence indices. Charting the market reaction to specific trade policy announcements would provide strong visual support.

- Correlation between Trump's statements and market reactions: Analyze how the markets react to President Trump's statements regarding trade deals. Do markets tend to respond negatively despite the President's optimism? Show a clear correlation between statements and market behavior. Discuss the role of uncertainty in influencing investment decisions.

The Political Implications of Downplaying Economic Worries

The President’s approach to communicating about the economy has significant political implications.

Impact on Public Opinion

President Trump’s messaging shapes public perception of the economy and trade policies.

- Polls, surveys, and news reports reflecting public sentiment: Cite relevant polling data and news analysis that reflects public opinion on the economy and trade. Are people as optimistic as the President, or are concerns more prevalent?

- Disconnect between public perception and reality: Discuss the potential for a disconnect between the President's optimistic portrayal of the economy and the actual economic experiences and anxieties of the American public.

Potential Electoral Consequences

The administration's handling of the economic situation could significantly influence future elections.

- Analysis of potential voter response to economic performance: Explore how economic performance, both real and perceived, could influence voting patterns in future elections. Will voters prioritize short-term economic gains over long-term risks?

- Potential political ramifications: Analyze the potential political ramifications for the current and upcoming elections, considering the possible influence of economic anxieties on voters’ choices.

Conclusion

President Trump's consistent downplaying of economic concerns related to trade deal cuts contrasts sharply with expert analysis and market reactions. While the administration highlights positive economic indicators, economists warn of potential negative consequences, including job losses, decreased economic growth, and increased market volatility. The discrepancy between the President's optimism and the anxieties of economists and investors raises concerns about the accuracy of the administration's economic messaging and its potential impact on public perception and future elections. To stay informed about the ongoing economic impacts of trade deal cuts under the Trump administration, continue following reliable news sources and economic analysis. Understanding the complex interplay between presidential statements, economic data, and expert opinions is crucial for navigating the evolving economic landscape. Further research on the effects of trade deal cuts and their impact on the US economy is encouraged.

Featured Posts

-

Greenock Or Vegas Martin Compston Weighs In

May 06, 2025

Greenock Or Vegas Martin Compston Weighs In

May 06, 2025 -

Ai Driven Podcast Creation Analyzing Scatological Documents For Meaningful Content

May 06, 2025

Ai Driven Podcast Creation Analyzing Scatological Documents For Meaningful Content

May 06, 2025 -

Tom Holland And Zendayas Surprise Baby Plans Revealed

May 06, 2025

Tom Holland And Zendayas Surprise Baby Plans Revealed

May 06, 2025 -

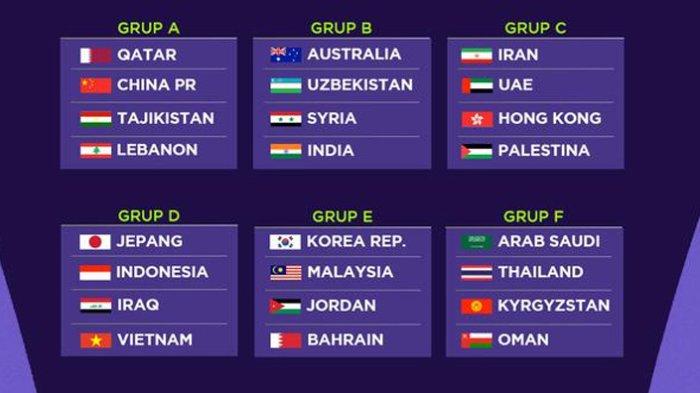

Hasil Pertandingan Piala Asia U 20 Iran Vs Yaman 6 0

May 06, 2025

Hasil Pertandingan Piala Asia U 20 Iran Vs Yaman 6 0

May 06, 2025 -

The Unpopularity Of 10 Year Mortgages A Canadian Perspective

May 06, 2025

The Unpopularity Of 10 Year Mortgages A Canadian Perspective

May 06, 2025