Trump Tariffs And Apple: Assessing The Risk To Buffett's Portfolio

Table of Contents

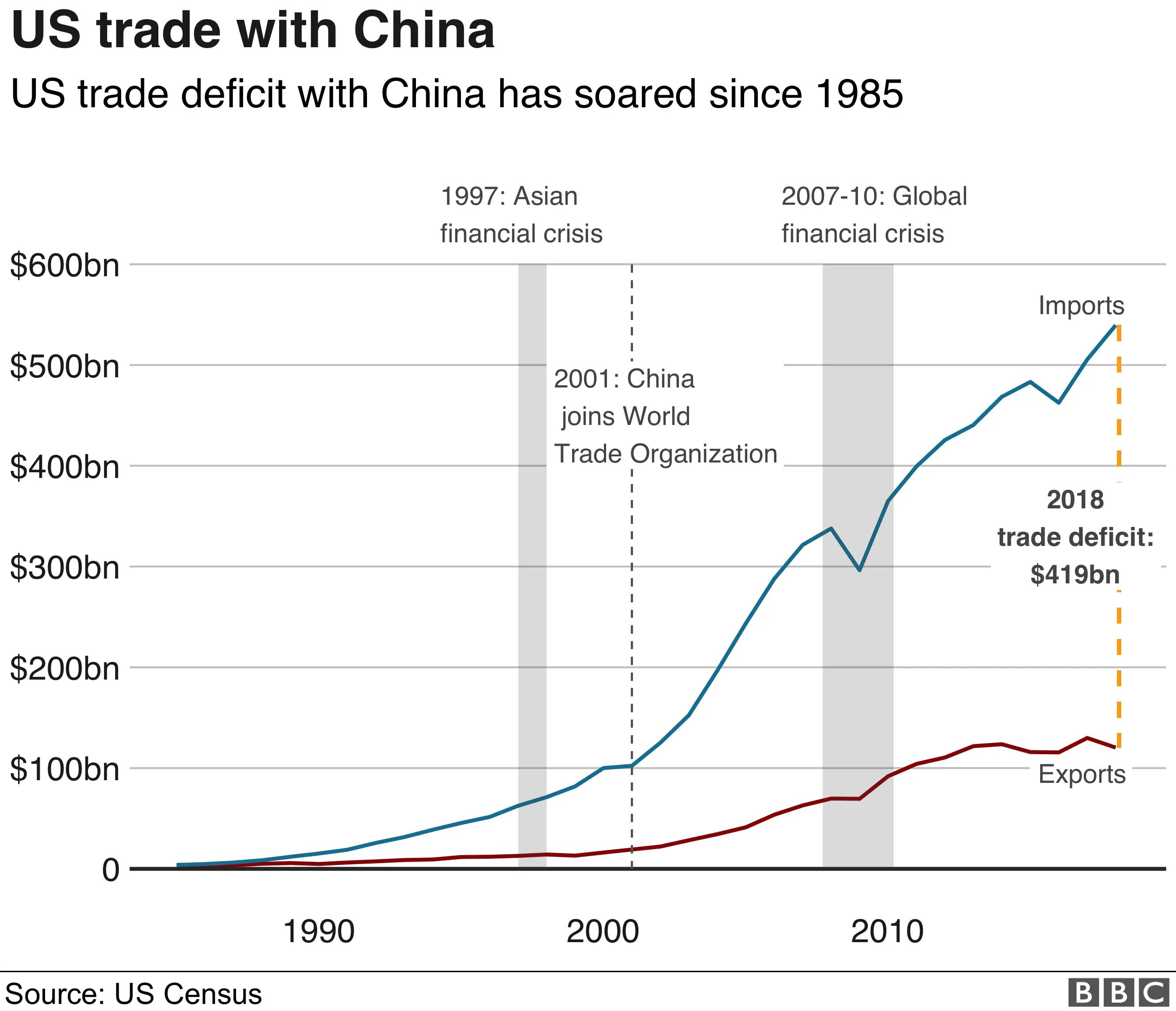

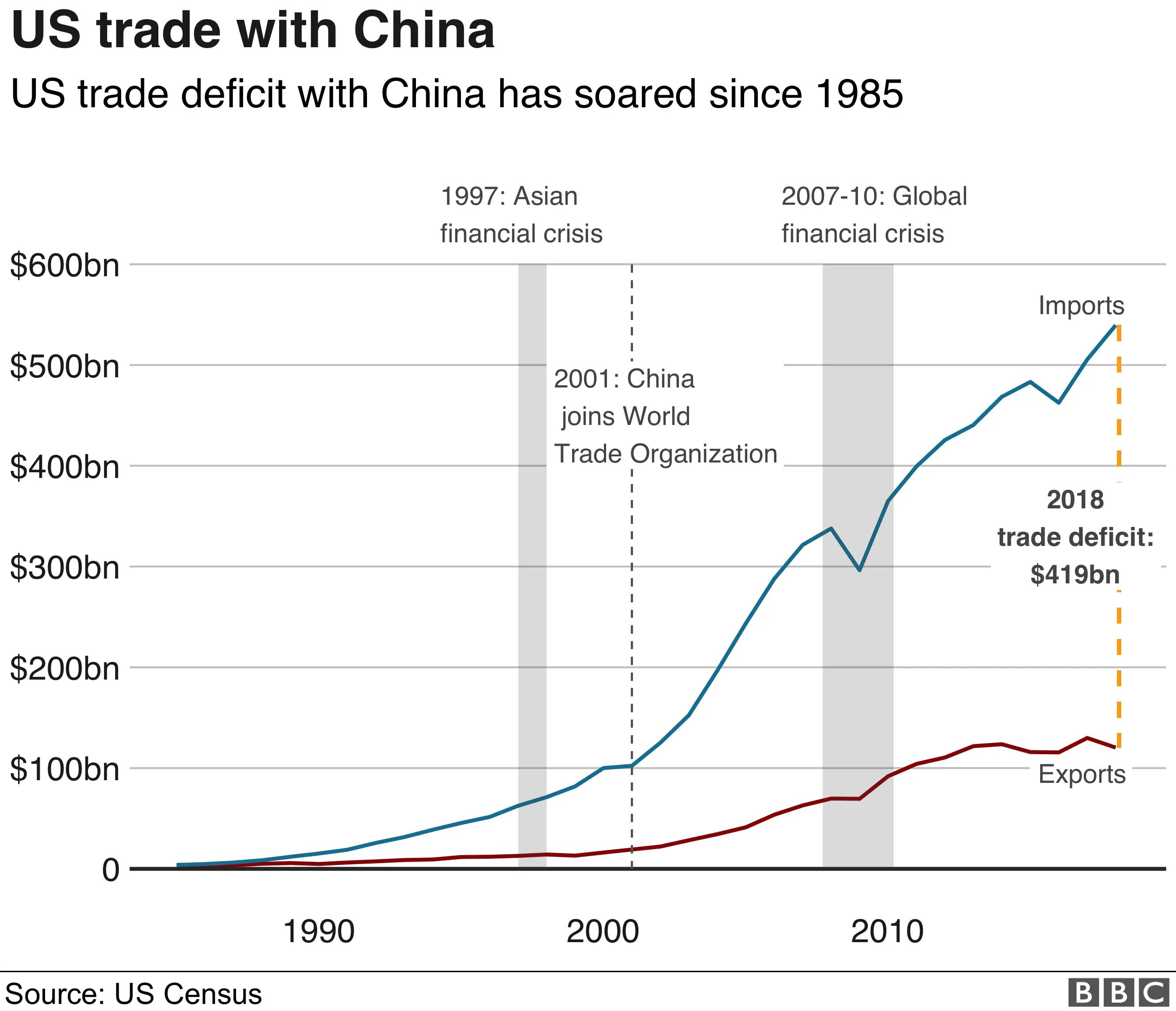

The Impact of Trump Tariffs on Apple's Supply Chain

The Trump administration's imposition of tariffs on goods imported from China, a key manufacturing hub for Apple, directly increased Apple's production costs. These tariffs, implemented in stages, targeted various components used in Apple's flagship products, including iPhones, iPads, and Macs.

- Increased manufacturing costs for iPhones, iPads, and Macs: Tariffs added a substantial percentage to the cost of importing crucial components like processors, displays, and other sophisticated electronics from China. This directly impacted Apple's manufacturing costs, squeezing profit margins.

- Potential impact on Apple's pricing strategy and consumer demand: To offset the increased costs, Apple faced a difficult choice: absorb the added expense, reducing profit margins, or pass the costs onto consumers, potentially impacting sales. The latter risked a decline in consumer demand, especially in price-sensitive markets.

- Examination of Apple's efforts to diversify its manufacturing base to mitigate tariff risks: Faced with these challenges, Apple actively sought to diversify its manufacturing base, exploring opportunities in other countries such as Vietnam and India. This diversification strategy, while long-term, was costly and time-consuming, offering no immediate solution to the immediate tariff impacts.

- Discussion of alternative sourcing strategies implemented by Apple: Apple also explored alternative sourcing strategies, including working with more suppliers to reduce reliance on single sources in China and developing some components in-house to minimize tariff exposure. These strategies, while effective in the long run, involved significant investment and logistical hurdles.

Apple's Financial Performance During the Tariff Period

Analyzing Apple's financial reports during the period of Trump's tariffs reveals a complex picture. While Apple remained profitable, the impact of the tariffs was undeniable.

- Changes in Apple's profit margins: Apple's profit margins experienced some compression as the increased manufacturing costs impacted their bottom line. While the company managed to maintain profitability, the margins were thinner than they would have been without the tariffs.

- Impact on revenue growth: Revenue growth slowed slightly during this period, partly attributed to the increased prices and potential dampening of consumer demand caused by the tariff-induced price increases.

- Stock performance during this period and its correlation to tariff announcements: Apple's stock performance was, predictably, somewhat volatile during this period, showing some correlation with announcements of new or adjusted tariffs. Negative news regarding trade disputes naturally impacted investor sentiment.

- Comparison of Apple's performance to competitors less affected by tariffs: A comparison with competitors less reliant on Chinese manufacturing revealed that Apple faced a more pronounced impact from the tariffs than some of its rivals. This underscored the concentration of Apple's supply chain in China prior to the imposition of tariffs.

Berkshire Hathaway's Investment Strategy and Risk Mitigation

Buffett's investment philosophy centers around long-term value investing and a focus on companies with strong fundamentals. His approach to managing risks associated with political and economic uncertainties is characterized by diversification and a long-term perspective.

- Berkshire Hathaway's diversification strategy and its role in reducing the impact of any single investment’s downturn: Berkshire Hathaway’s famously diversified portfolio helped mitigate the impact of the Trump tariffs on Apple. The losses in Apple were offset by gains in other sectors of the portfolio, limiting the overall impact on Berkshire Hathaway's performance.

- Analysis of Buffett’s long-term perspective on Apple and the potential resilience of the company despite short-term market fluctuations: Buffett's faith in Apple's long-term prospects likely influenced his decision to maintain his substantial investment despite the short-term challenges posed by the tariffs. He likely viewed the tariffs as a temporary setback rather than a fundamental threat to Apple's overall success.

- Potential adjustments made to Berkshire Hathaway's portfolio in response to the tariff-related risks: While significant portfolio adjustments are unlikely, given Buffett's long-term outlook, subtle shifts in investment strategy within other sectors could have occurred in response to the increased risk profile of the global trade environment.

The Long-Term Implications for Buffett's Apple Investment

The Trump-era tariffs left a lasting impact, shaping Apple's global supply chain strategies and influencing its long-term growth prospects.

- Potential for ongoing adjustments in global supply chains: The experience of the tariffs has accelerated Apple’s efforts to diversify its manufacturing base, leading to a more geographically distributed supply chain – a long-term shift designed to minimize future risks from trade disputes.

- Long-term impacts on Apple’s competitive position: While the tariffs presented a short-term challenge, they also forced Apple to improve its supply chain resilience, ultimately strengthening its long-term competitive position.

- The likelihood of future trade disputes influencing Apple's profitability: The ongoing potential for future trade disputes highlights the importance of Apple's diversification efforts and the need for ongoing vigilance in managing geopolitical risk.

Conclusion

The Trump tariffs presented a significant challenge to Apple, impacting its supply chain, financial performance, and consequently, Berkshire Hathaway's investment. However, Apple's resilience, coupled with Berkshire Hathaway's diversified portfolio and long-term investment strategy, mitigated the overall risk. The key findings emphasize the importance of supply chain diversification, the interplay between trade policies and corporate profitability, and the role of long-term investment strategies in navigating geopolitical uncertainty. To stay informed on the ongoing impact of trade policies on major investments, continue to follow analyses of Trump Tariffs Apple Buffett and other similar investment scenarios. Understanding the complexities of global trade and their influence on your portfolio is crucial for informed investment decisions.

Featured Posts

-

Artfae Daks 30 Tjawz Dhrwt Mars Welamat Ela Astmrar Alnmw

May 24, 2025

Artfae Daks 30 Tjawz Dhrwt Mars Welamat Ela Astmrar Alnmw

May 24, 2025 -

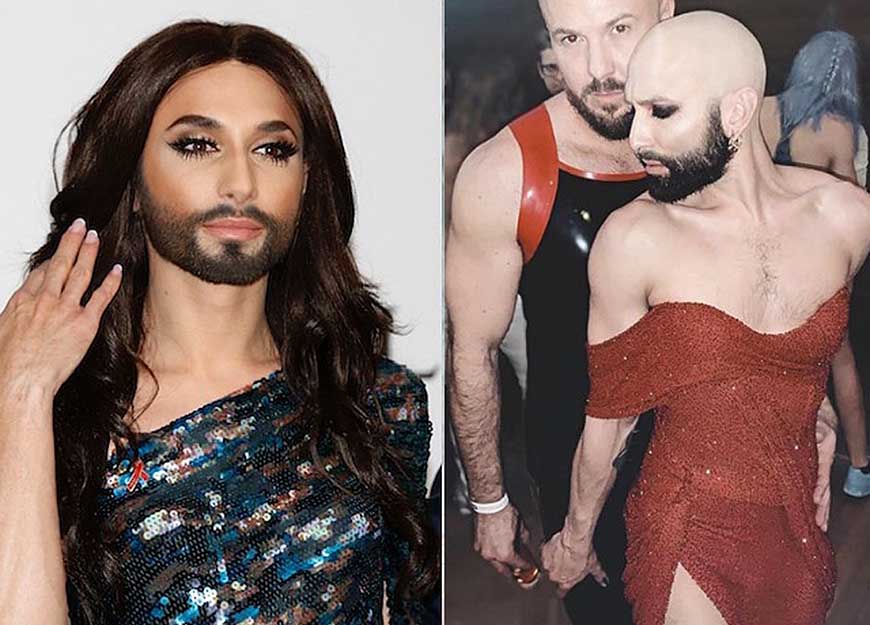

Konchita Vurst Kak Se Promeni Pevitsata Sled Evroviziya

May 24, 2025

Konchita Vurst Kak Se Promeni Pevitsata Sled Evroviziya

May 24, 2025 -

The Dark Side Of Disaster Examining The Market For Los Angeles Wildfire Bets

May 24, 2025

The Dark Side Of Disaster Examining The Market For Los Angeles Wildfire Bets

May 24, 2025 -

Umd Commencement 2025 Kermit The Frog To Address Graduates

May 24, 2025

Umd Commencement 2025 Kermit The Frog To Address Graduates

May 24, 2025 -

Usa Film Festival Brings Free Films And Celebrities To Dallas

May 24, 2025

Usa Film Festival Brings Free Films And Celebrities To Dallas

May 24, 2025