Trump Tax Bill: What The House Republican Plan Means For You

Table of Contents

Individual Income Tax Changes

The Trump Tax Bill brought substantial changes to the individual income tax system, affecting taxpayers across various income brackets.

Changes to Tax Brackets

The bill revised the income tax brackets, resulting in changes to both tax rates and thresholds. For example, the highest tax bracket was reduced from 39.6% to 37%, while several lower brackets also saw rate reductions. These changes impacted taxpayers differently depending on their income level.

- Example 1: A single filer earning $50,000 annually experienced a modest tax reduction.

- Example 2: A high-income earner making $500,000 annually saw a more significant decrease in their tax liability due to the reduction in the highest tax bracket.

- Example 3: Lower income individuals may have seen less of a change, or even no change, depending on their specific income level and deductions.

This tax reform aimed to simplify the income tax system, but the tax rates and tax brackets remained complex, particularly for high-income earners. The effects varied widely based on the individual's specific circumstances and deductions.

Standard Deduction and Personal Exemptions

A key element of the Trump Tax Bill was the increase in the standard deduction and the elimination of personal exemptions. This simplification aimed to make tax filing easier for many taxpayers.

- Pre-Bill Standard Deduction (Single): $6,350

- Post-Bill Standard Deduction (Single): $12,000

- Pre-Bill Standard Deduction (Married Filing Jointly): $12,700

- Post-Bill Standard Deduction (Married Filing Jointly): $24,000

This change significantly benefited many taxpayers, particularly those with lower incomes. However, the elimination of personal exemptions could negatively affect families with multiple dependents, offsetting some of the benefits of the increased standard deduction. The impact varied based on filing status (married couples filing jointly vs. single filers) and the number of dependents. This tax simplification measure had mixed consequences.

Child Tax Credit

The Trump Tax Bill expanded the Child Tax Credit, significantly boosting its value and making it partially refundable. This change provided substantial relief to families with children.

- Credit Amount: Increased significantly.

- Eligibility Requirements: Remained largely unchanged, though the expanded credit benefited more families.

- Refundability: A portion of the credit became refundable, offering financial assistance to low-income families.

This expansion of the child tax credit directly benefited low- and middle-income families with children, offering greater tax credits for families and enhancing family tax benefits. The increased refundability made a meaningful difference for those who previously couldn't fully utilize the credit.

Corporate Tax Rate Reduction

A cornerstone of the Trump Tax Bill was the dramatic reduction in the corporate tax rate. This had far-reaching implications for businesses, investment, and the broader economy.

Impact on Businesses

The corporate tax rate was slashed from 35% to 21%. Proponents argued this would stimulate economic growth and job creation by encouraging businesses to invest more.

- Before: 35% corporate tax rate

- After: 21% corporate tax rate

This significant reduction in business tax cuts was intended to boost competitiveness and attract more investment. However, the actual impact on business investment and job creation remains a subject of ongoing debate.

Trickle-Down Economics & its Effectiveness

The corporate tax cut was largely based on the theory of trickle-down economics, where tax cuts for businesses eventually translate into benefits for workers and the broader economy.

- Arguments for: Increased business investment leads to job creation and higher wages.

- Arguments against: Tax cuts disproportionately benefit shareholders and executives, leading to increased income inequality without significant benefits for workers.

Empirical evidence supporting the effectiveness of trickle-down economics in this context is mixed. Many studies have shown limited or no discernible positive impact on wage growth or job creation as a direct result of this particular tax cut. Further analysis is needed to fully understand its long-term effects. The debate continues on the economic impact of this tax policy and the true effect on business investment.

Long-Term Effects and Criticisms of the Trump Tax Bill

While the Trump Tax Bill aimed to boost the economy, it also generated significant criticism and concern regarding its long-term effects.

National Debt

One major criticism centers on the bill's contribution to the national debt. The significant tax cuts reduced government revenue, leading to an increase in the budget deficit and the overall national debt.

- Statistics: The national debt increased significantly in the years following the bill's passage (specific figures should be added here from reliable sources).

The long-term implications of a larger national debt include higher interest payments, potentially hindering future government spending on vital programs. This fiscal policy decision has been a subject of intense debate.

Income Inequality

Critics also argue that the Trump Tax Bill exacerbated income inequality. The tax cuts were perceived as disproportionately benefiting high-income individuals and corporations, widening the gap between the rich and the poor.

- Arguments: The lower corporate tax rate and reduced top individual income tax rates primarily aided the wealthiest, further concentrating wealth at the top.

This concern about wealth distribution and tax fairness highlights a key point of contention regarding the bill's social impact. The effects on social equity are a significant area of ongoing research and debate.

Conclusion

The Trump Tax Bill, enacted in 2017, implemented significant changes to both individual and corporate tax rates. While the bill aimed to stimulate economic growth through tax cuts, its long-term effects remain a subject of debate, with concerns surrounding the national debt and income inequality persisting. Understanding the intricacies of the Trump Tax Bill is crucial for making informed financial decisions. Further research and consultation with a tax professional can help you navigate this complex legislation and optimize your tax strategy.

Featured Posts

-

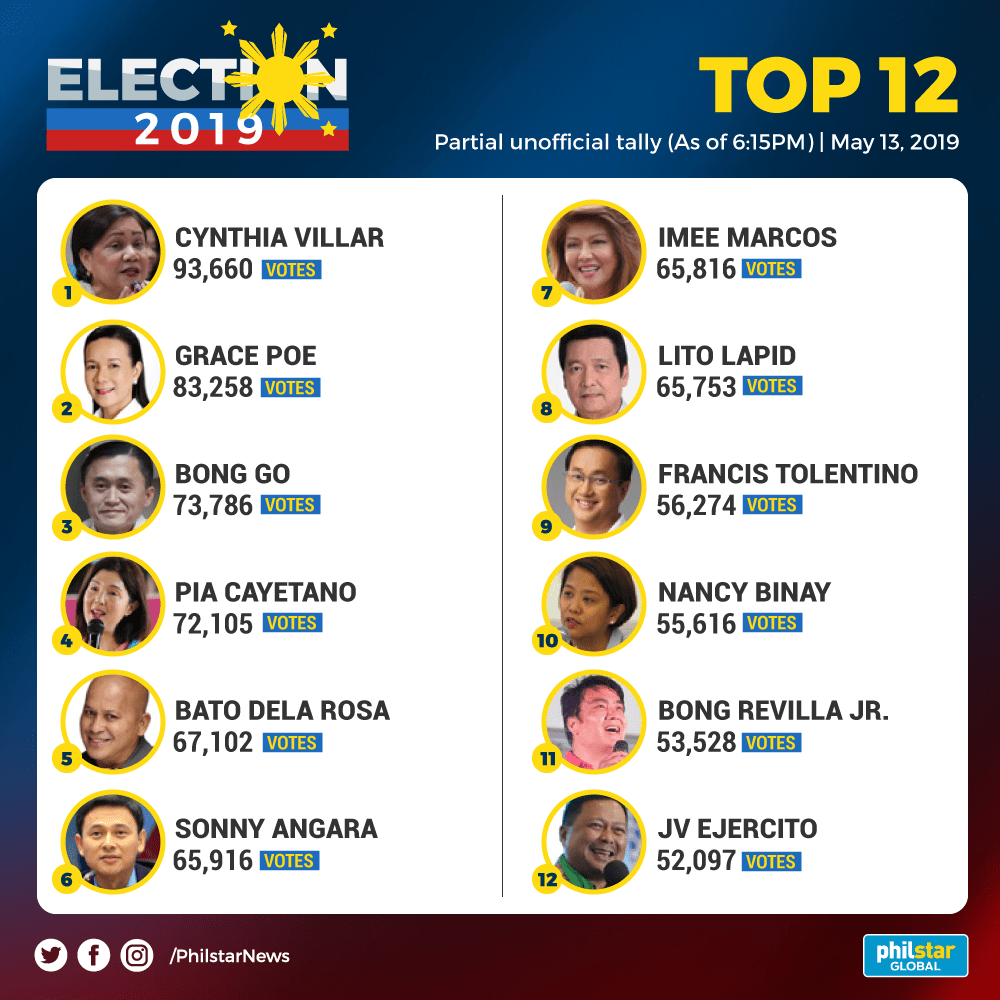

Duterte Allies Triumph In Philippine Midterm Elections A Setback For Marcos

May 13, 2025

Duterte Allies Triumph In Philippine Midterm Elections A Setback For Marcos

May 13, 2025 -

Heatwave Alert Indore Reaches 40 Celsius

May 13, 2025

Heatwave Alert Indore Reaches 40 Celsius

May 13, 2025 -

Hostages In Gaza The Protracted Nightmare For Their Families

May 13, 2025

Hostages In Gaza The Protracted Nightmare For Their Families

May 13, 2025 -

11

May 13, 2025

11

May 13, 2025 -

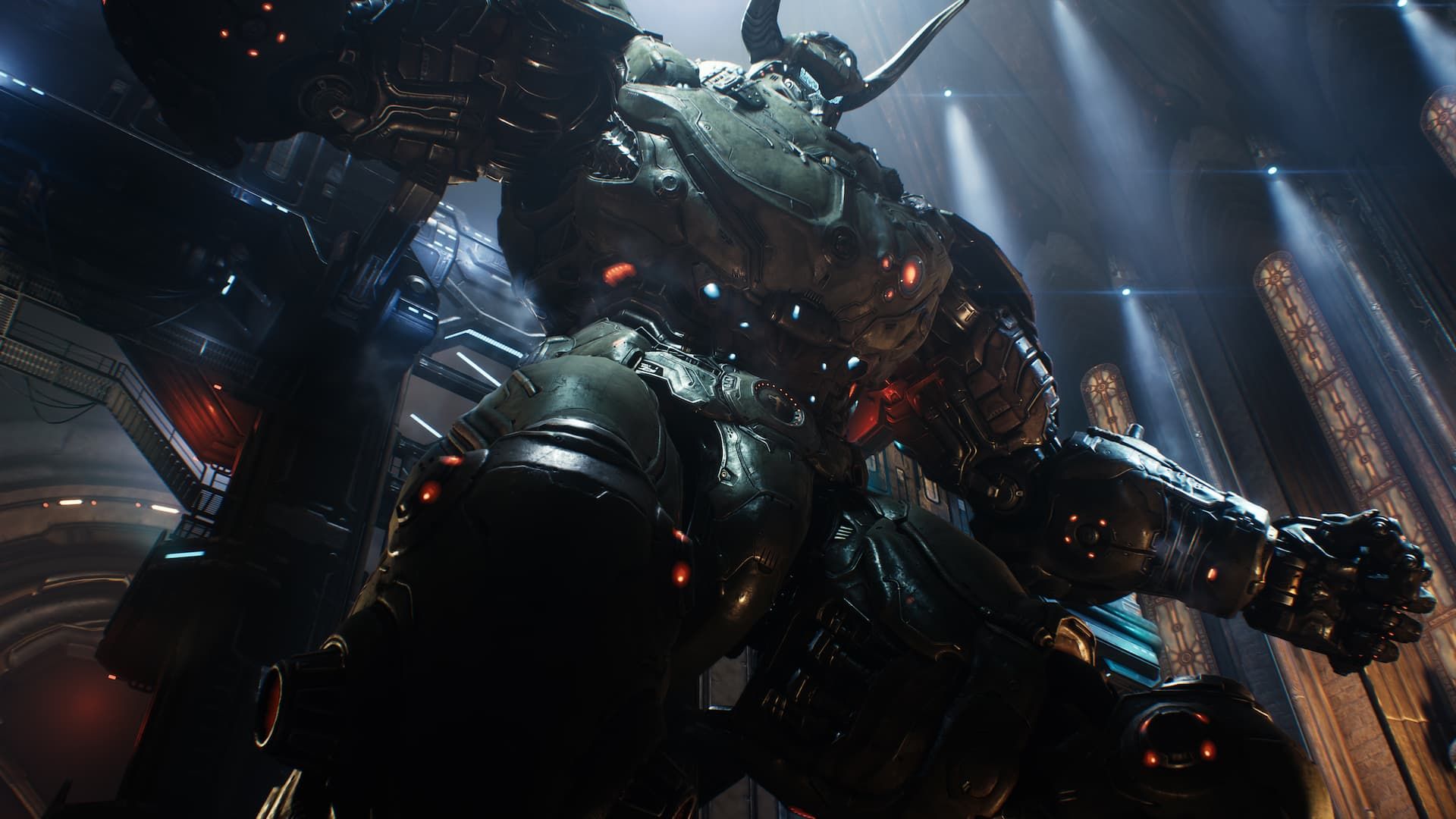

Doom The Dark Ages What We Know So Far About The Release

May 13, 2025

Doom The Dark Ages What We Know So Far About The Release

May 13, 2025