Trump Tax Cuts: Key Provisions Of The House GOP Plan

Table of Contents

Individual Income Tax Rate Reductions

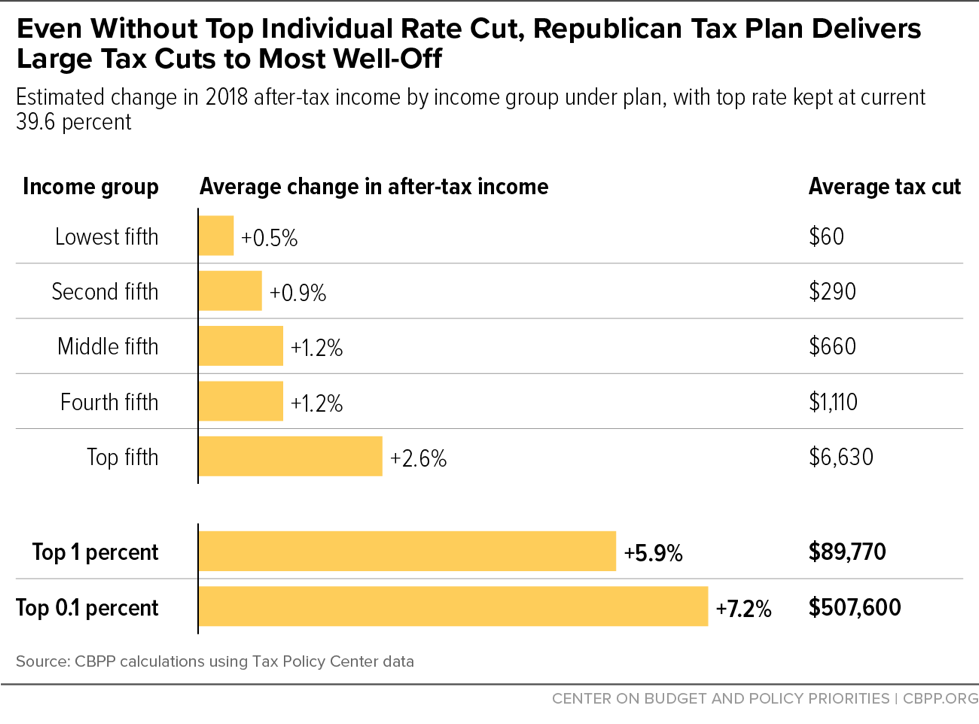

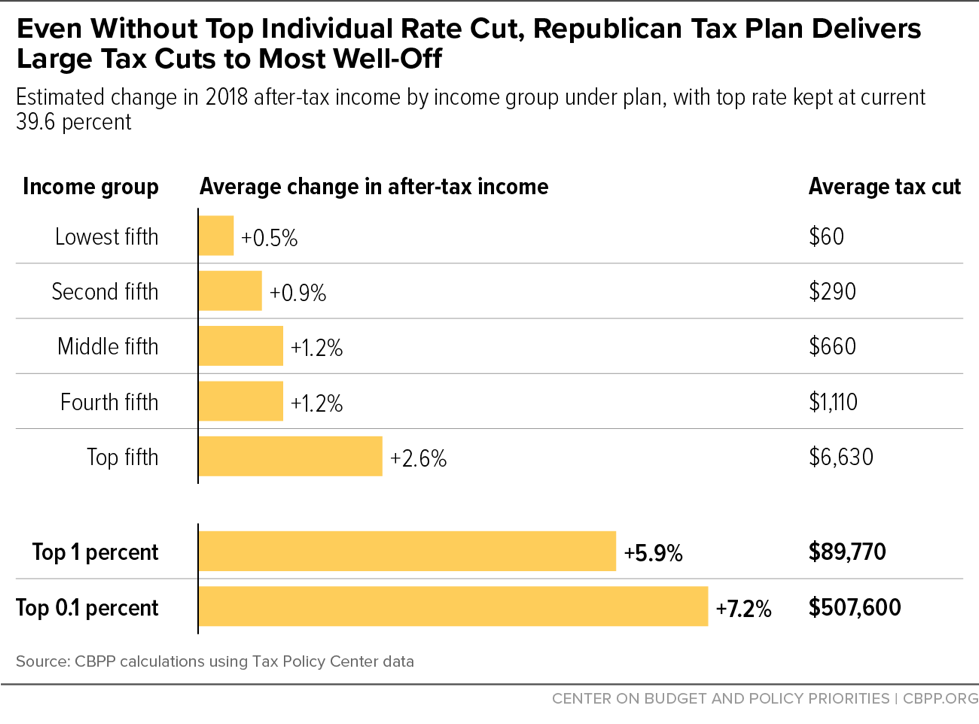

The Trump tax cuts implemented substantial changes to individual income tax rates. Understanding these changes is vital for anyone looking to analyze the impact on their personal finances.

Lowered Tax Brackets

The Tax Cuts and Jobs Act lowered the number of individual income tax brackets and reduced the rates within each bracket. Before the changes, there were seven brackets; the 2017 act reduced this to seven. The percentage reductions varied significantly across income levels.

- Significant tax reduction for high-income earners: The highest tax bracket saw a considerable decrease, leading to substantial savings for those in this income range.

- Moderate tax reduction for middle-income earners: While not as dramatic as for high-income earners, middle-income taxpayers also experienced a noticeable reduction in their tax liability.

- Minimal impact for low-income earners: Many low-income taxpayers saw little change in their tax burden, as the reductions were less pronounced at lower income levels. The standard deduction increase (discussed below) often had a larger impact on this group.

Standard Deduction Increases

The Trump tax cuts significantly increased the standard deduction for both single and married taxpayers. This meant that fewer individuals were required to itemize their deductions, simplifying the tax filing process for many.

- Increased ease of tax filing for many taxpayers: The higher standard deduction made itemizing less necessary, leading to simpler tax returns for a considerable portion of the population.

- Potential reduction in tax liability for some lower-income taxpayers: For lower-income taxpayers, the increased standard deduction often resulted in a lower tax liability than if they had itemized. This provided substantial relief for some.

- Fewer taxpayers itemizing deductions: Statistics showed a marked decrease in the number of taxpayers who chose to itemize deductions after the standard deduction increase.

Child Tax Credit Expansion

The Child Tax Credit (CTC) also underwent expansion under the Trump tax cuts. The maximum credit amount was increased, and the eligibility requirements were broadened, benefiting many families with children.

- Increased financial relief for families: The higher credit amount provided more substantial financial assistance to families, particularly those with multiple children.

- Potential for more families to claim the credit: The broadened eligibility criteria allowed more families to qualify for the CTC, expanding its reach and positive impact.

- Increased Refundability: A portion of the CTC became refundable, meaning that low-income families could receive a refund even if their tax liability was zero.

Corporate Tax Rate Cuts

The Trump tax cuts dramatically reduced the corporate tax rate, a significant change impacting businesses of all sizes.

Reduction in Corporate Tax Rate

The most notable change in the corporate tax structure was the reduction of the top corporate tax rate from 35% to 21%. This substantial decrease was intended to boost business investment and stimulate economic growth.

- Increased competitiveness for US businesses: The lower rate aimed to make American businesses more competitive globally, attracting investment and encouraging job creation.

- Potential for increased corporate profits: Lower tax burdens could translate into higher profits for companies, potentially leading to reinvestment and expansion.

- Potential for increased wages and job creation: Proponents argued that the tax cuts would incentivize companies to hire more workers and increase wages, benefiting the workforce. However, the extent to which this materialized is still debated. Some argue that increased profits primarily benefited shareholders rather than workers.

Impact on Business Investment

The lower corporate tax rate aimed to stimulate business investment and foster economic growth. While initial assessments indicated an increase in capital expenditures, the long-term impact remains a subject of ongoing economic analysis.

- Increased business investment: Some studies showed an uptick in business investment following the tax cuts, suggesting a positive, albeit short-term, effect.

- Stimulation of economic growth: The intention was to generate a ripple effect – increased investment leading to job creation, higher consumer spending, and overall economic expansion. Again, long-term results are still subject to interpretation.

Pass-Through Business Tax Changes

The Trump tax cuts also introduced changes to the taxation of pass-through businesses, such as partnerships and S corporations. These changes had significant implications for small business owners and the self-employed.

- Deduction limitations: Certain deductions were limited for pass-through businesses, affecting their overall tax liability.

- New tax provisions for pass-through entities: New tax provisions were introduced that aimed to simplify taxation, but they also introduced complexities for some businesses.

Conclusion

The Trump tax cuts, primarily enacted through the Tax Cuts and Jobs Act, brought significant changes to the US tax code. The key provisions, including individual income tax rate reductions, corporate tax rate cuts, and modifications to the Child Tax Credit and pass-through business taxation, aimed to stimulate economic growth and benefit businesses and individuals. While the long-term effects are still being debated and analyzed, understanding the specifics of these provisions remains vital for anyone navigating the US tax system. To learn more about how these Trump tax cuts affect your specific circumstances, consult with a qualified tax professional. Researching Trump tax cut implications and Trump tax reform will further help you understand these complex changes.

Featured Posts

-

Exploring The World Of Flushed Away An Analysis Of Its Animation And Story

May 13, 2025

Exploring The World Of Flushed Away An Analysis Of Its Animation And Story

May 13, 2025 -

Doom The Dark Ages What We Know So Far About The Release

May 13, 2025

Doom The Dark Ages What We Know So Far About The Release

May 13, 2025 -

Elsbeth And Family Business S02 E14 Preview

May 13, 2025

Elsbeth And Family Business S02 E14 Preview

May 13, 2025 -

Cassie And Alex Fine Red Carpet Debut While Expecting

May 13, 2025

Cassie And Alex Fine Red Carpet Debut While Expecting

May 13, 2025 -

India Pakistan Ceasefire Holds A Delicate Balance

May 13, 2025

India Pakistan Ceasefire Holds A Delicate Balance

May 13, 2025