Trump Tax Plan Unveiled: Key Details From House Republicans

Table of Contents

Individual Income Tax Changes under the Trump Tax Plan

The Trump tax plan proposed significant changes to the individual income tax system, aiming to simplify the tax code and provide tax relief for many Americans. However, these changes also involved trade-offs, particularly regarding itemized deductions.

Proposed Tax Rate Reductions

The plan aimed to simplify the individual income tax brackets, reducing the number of brackets and lowering the overall tax rates. This was a central tenet of the proposed legislation.

- Significant cuts to the highest tax brackets: The highest earners saw the most dramatic reductions in their tax rates.

- Potential elimination of certain deductions: To offset the revenue loss from rate reductions, the plan considered eliminating or limiting several deductions.

- Increased standard deduction to offset some lost deductions: To mitigate the impact of lost itemized deductions, the standard deduction was significantly increased. This impacted many taxpayers who previously itemized.

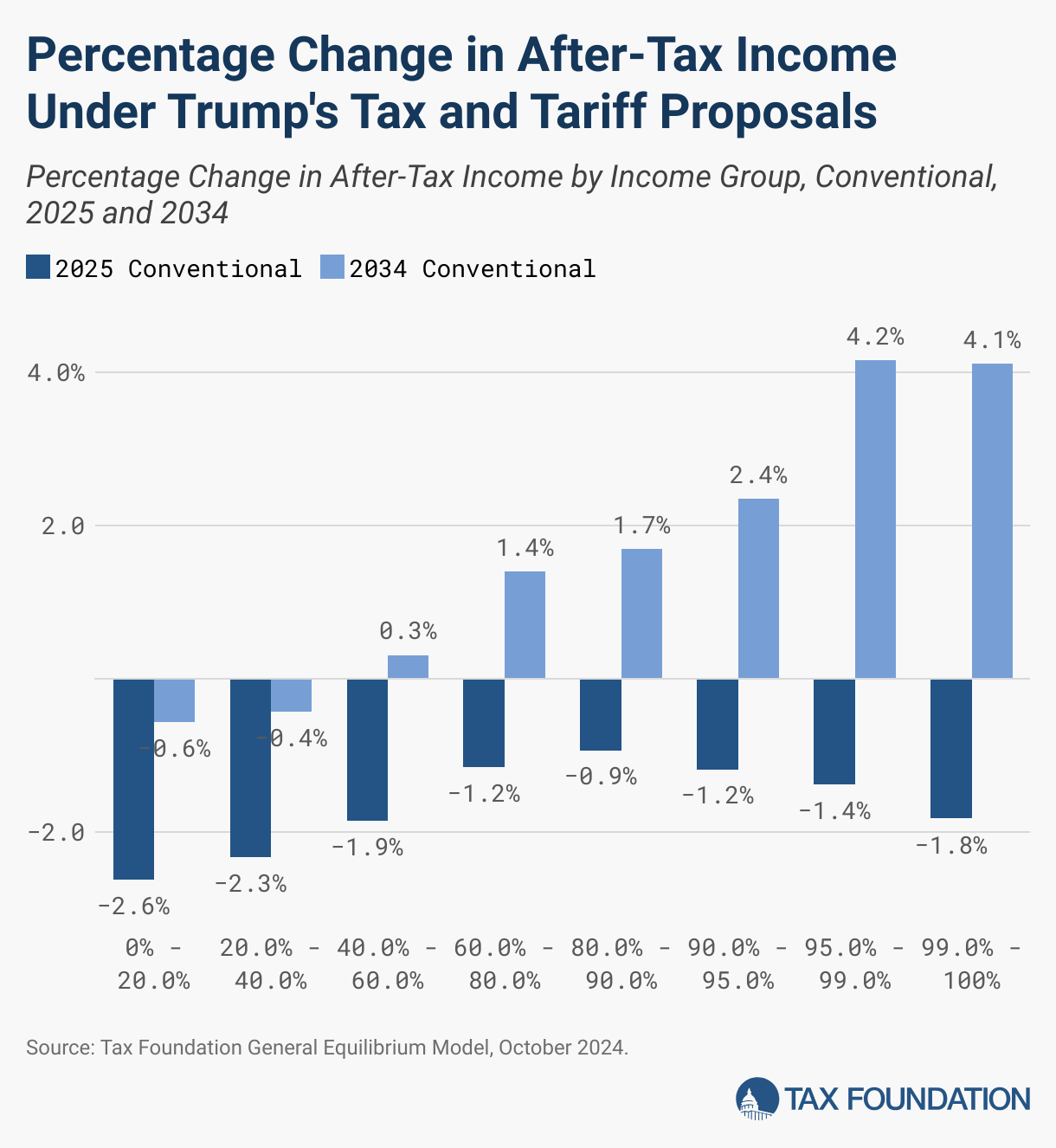

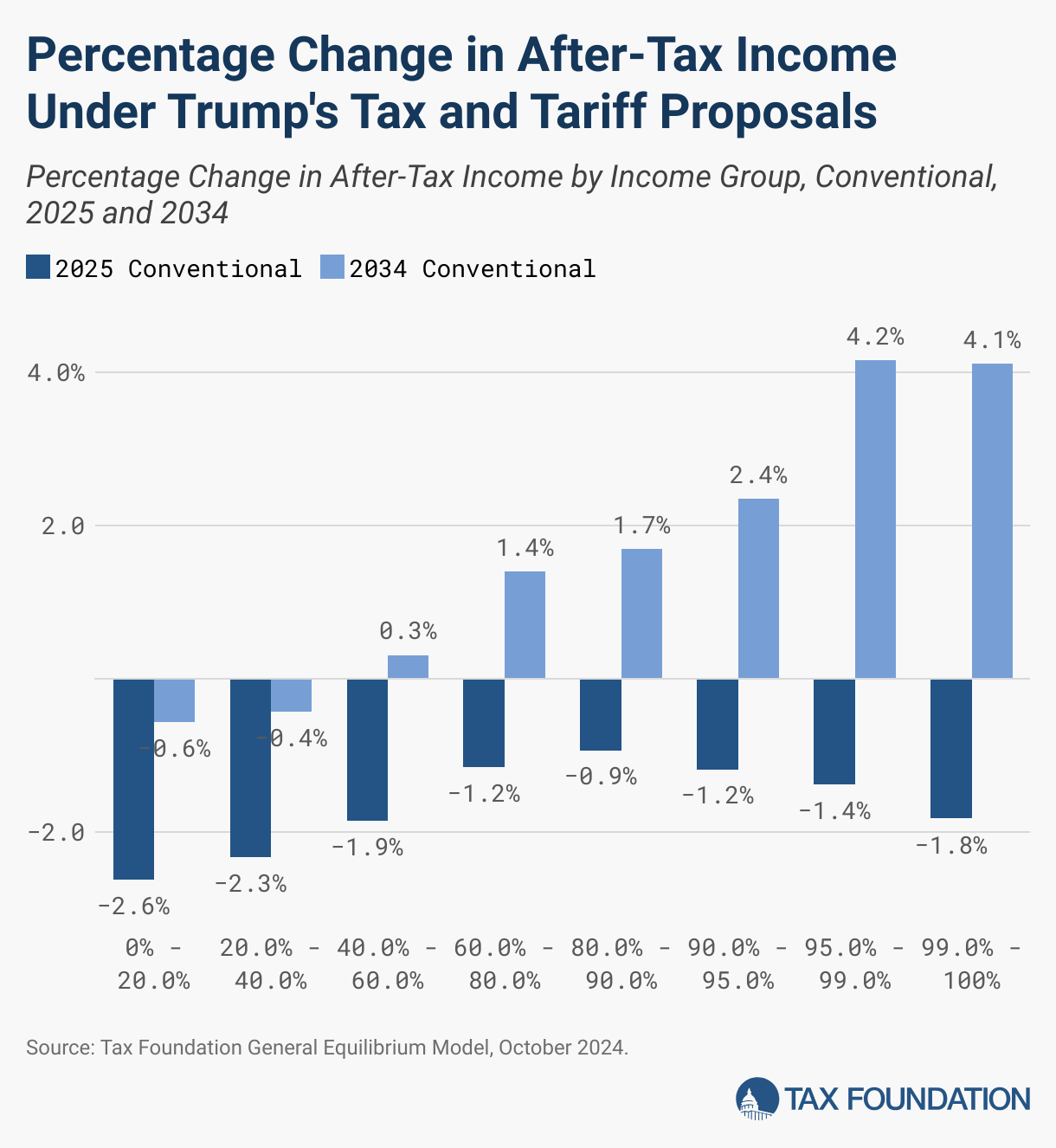

- Analysis of the impact on various income levels: The effects varied greatly depending on income level, filing status, and individual circumstances. Lower-income taxpayers experienced smaller benefits than higher-income individuals.

Changes to Itemized Deductions

The Trump tax plan proposed significant alterations to itemized deductions, impacting taxpayers' ability to reduce their tax liability. This was a controversial aspect of the plan.

- Limitations or elimination of state and local tax (SALT) deductions: The limitation or elimination of SALT deductions significantly affected taxpayers in high-tax states.

- Potential changes to mortgage interest deduction limits: Changes to the mortgage interest deduction could impact homeowners, especially those with large mortgages.

- Impact on charitable contributions deductions: The deductibility of charitable contributions remained, but the overall impact varied depending on the specifics of the plan.

- Discussion on the overall effect on taxpayers who itemize: Taxpayers who previously itemized saw a significant shift in their tax liability, with many moving to the standard deduction.

Child Tax Credit Expansion

The plan included provisions to expand the Child Tax Credit, offering potential tax relief for families. This was a popular aspect of the proposed changes.

- Increased credit amount per child: The proposed increase aimed to provide greater tax relief for families with children.

- Potential expansion of eligibility criteria: The plan potentially broadened the criteria for eligibility, making it accessible to more families.

- Impact on low- and middle-income families: This aspect of the plan offered the most substantial relief to lower and middle-income families.

- Comparison to previous Child Tax Credit legislation: The proposed changes represented a significant expansion compared to prior legislation.

Business Tax Provisions in the Trump Tax Plan

The Trump tax plan also included substantial changes to the business tax code, aiming to stimulate economic growth.

Corporate Tax Rate Cuts

A central aspect of the plan focused on significantly reducing the corporate tax rate, a key element for attracting investment.

- Proposed reduction from the previous rate: The proposed reduction was substantial, aiming to make the US more competitive globally.

- Potential impact on corporate profitability and investment: Supporters argued the reduction would boost profitability and encourage greater investment.

- Comparison to corporate tax rates in other developed countries: The proposed rate aimed to align the US more closely with rates in other developed nations.

- Discussion on the potential economic consequences of the rate cut: The potential consequences included increased economic activity and job creation, although this was subject to debate.

Pass-Through Business Tax Changes

The plan also addressed the taxation of pass-through businesses (like sole proprietorships and partnerships), impacting a significant portion of US businesses.

- Proposed changes to deductions and tax rates for pass-through entities: Changes to deductions and tax rates varied depending on the specifics of the business structure.

- Analysis of the impact on small business owners and entrepreneurs: Small business owners were expected to see significant benefits or drawbacks, depending on their individual circumstances.

- Comparison to previous tax treatments of pass-through businesses: The proposed changes represented a departure from previous approaches.

- Potential effects on job creation and economic growth: Similar to corporate tax cuts, this was expected to foster job growth and economic expansion, albeit subject to debate.

Economic and Budgetary Implications of the Trump Tax Plan

The Trump tax plan had significant economic and budgetary implications, raising concerns about the national debt.

Projected Impact on the National Debt

A key concern was the plan's potential impact on the national debt, a point of contention among critics.

- Estimates of increased deficits resulting from tax cuts: The tax cuts were projected to significantly increase the federal deficit.

- Potential long-term economic consequences of increased debt: Concerns were raised about the long-term implications of increased national debt.

- Debate surrounding the plan's fiscal responsibility: The plan's fiscal responsibility was a major topic of debate, with arguments for and against its sustainability.

- Consideration of alternative economic models and projections: Different economic models produced varying projections, highlighting the uncertainty surrounding the plan's economic effects.

Potential Economic Growth and Job Creation

Proponents argued the tax plan would stimulate economic growth and create jobs, but this remained a point of considerable debate.

- Predictions of increased investment and economic activity: Supporters predicted a surge in investment and overall economic activity.

- Analysis of potential job creation in various sectors: The projected impact on job creation varied across sectors.

- Counterarguments and alternative economic analyses: Critics pointed to potential downsides and presented alternative economic analyses.

- Comparison with other tax cut legislation and their economic impact: Comparisons were made with previous tax cuts and their outcomes.

Conclusion

The Trump Tax Plan, as proposed by House Republicans, presented a sweeping overhaul of the US tax system. While the plan aimed for significant tax cuts for both individuals and businesses, it also involved substantial changes to deductions and potential increases in the national debt. Understanding the intricacies of the Trump Tax Plan, including its potential effects on different income levels and business structures, is crucial for navigating the complexities of US tax law. To stay informed about future developments and potential impacts of this significant legislation, continue to research and analyze the latest updates on the Trump tax plan and its potential consequences. Understanding the specifics of the proposed changes is paramount for effective financial planning and investment strategies.

Featured Posts

-

Perviy Raund Pley Off N Kh L Vashington Monreal Ovechkin Demidov

May 16, 2025

Perviy Raund Pley Off N Kh L Vashington Monreal Ovechkin Demidov

May 16, 2025 -

Sycuan Casino Presents Padres Opening Series Details Revealed

May 16, 2025

Sycuan Casino Presents Padres Opening Series Details Revealed

May 16, 2025 -

Stanley Cup Playoffs Nhl Teams Up With Ndax In Canada

May 16, 2025

Stanley Cup Playoffs Nhl Teams Up With Ndax In Canada

May 16, 2025 -

Rekord Ovechkina Prevzoydeny Legendy Pley Off N Kh L

May 16, 2025

Rekord Ovechkina Prevzoydeny Legendy Pley Off N Kh L

May 16, 2025 -

Presidential Pardons In Trumps Second Term Legal And Ethical Considerations

May 16, 2025

Presidential Pardons In Trumps Second Term Legal And Ethical Considerations

May 16, 2025