Trump Team Targets Tariff Cuts And Rare Earth Access In China Negotiations

Table of Contents

The Push for Tariff Reductions: A Key Negotiation Point

The Trump administration's imposition of tariffs on Chinese goods significantly impacted both the US and Chinese economies, triggering a trade war with far-reaching consequences.

Existing Tariffs and Their Impact

The tariffs, implemented in stages, targeted various sectors, leading to substantial disruptions.

- Agriculture: American farmers faced reduced exports of soybeans and other agricultural products to China, resulting in significant economic hardship for many.

- Manufacturing: US manufacturers faced increased costs for imported components and materials, impacting production and competitiveness.

- Consumer Goods: Higher tariffs translated into increased prices for consumers, affecting purchasing power and overall economic sentiment.

Data from the US Census Bureau showed a sharp decline in bilateral trade volume between the US and China following the implementation of tariffs. While precise figures fluctuate, the overall trend points to a negative impact on trade flows.

Potential Benefits of Tariff Cuts

Lowering tariffs offers several potential economic benefits:

- Increased Trade: Reduced barriers would stimulate trade flows in both directions, boosting economic activity.

- Lower Consumer Prices: Consumers would benefit from lower prices for imported goods, enhancing their purchasing power.

- Enhanced Economic Growth: Increased trade and lower prices contribute to overall economic growth and job creation.

However, concerns remain. A sudden, drastic reduction in tariffs could negatively impact domestic industries, potentially leading to job losses in specific sectors. A phased approach, carefully calibrated to minimize disruption, is crucial for mitigating these potential downsides.

Negotiating Leverage

The negotiating leverage of both sides regarding tariff reductions is complex and constantly shifting. The US holds significant leverage due to its substantial consumer market and its ability to impose tariffs on a wide range of Chinese goods. Conversely, China holds significant leverage due to its control over various global supply chains and its massive production capacity. Successful negotiations require compromises and concessions on both sides.

Securing Access to Rare Earth Minerals: A Strategic Imperative

Rare earth minerals are crucial for numerous high-tech applications, making securing access a strategic imperative for the US.

The Importance of Rare Earths

Rare earth elements are essential components in various technologies:

- Smartphones: Used in screens, magnets, and other components.

- Electric Vehicles: Critical for electric motors and batteries.

- Military Equipment: Essential for guided missiles, radar systems, and other defense technologies.

China currently dominates the global supply chain for rare earth minerals, raising concerns about potential disruptions and geopolitical leverage.

Concerns Regarding China's Monopoly

The US's heavy reliance on China for rare earths poses significant risks:

- Supply Disruptions: China could restrict exports, disrupting the US supply chain and harming various industries.

- Geopolitical Leverage: China could use its control over rare earth supplies as a tool for political leverage in international relations.

- National Security Implications: Disruptions to the rare earth supply chain could severely impact US national security, particularly in defense-related technologies.

To mitigate these risks, the US is exploring alternative sourcing strategies and investing in domestic production of rare earth minerals.

Negotiating Rare Earth Access

The US could pursue several strategies to negotiate better access to rare earth minerals:

- Diversification of Supply Chains: Developing partnerships with other rare earth producers to reduce dependence on China.

- Joint Ventures: Collaborating with Chinese companies on rare earth mining and processing operations.

- Technology Transfer Agreements: Seeking agreements for the transfer of advanced technologies related to rare earth processing.

The Overall Impact of the Negotiations on US-China Relations

The success or failure of these negotiations will significantly impact US-China relations. A successful outcome could lead to improved trade relations, increased economic cooperation, and a more stable geopolitical environment. Conversely, a failure could further escalate tensions, harming global economic stability. The long-term implications for the global economy are significant, influencing investment decisions, supply chains, and international trade patterns.

Conclusion: The Future of Trump's China Trade Strategy: Tariff Cuts and Rare Earth Access

The Trump administration's strategy, focusing on tariff cuts and securing rare earth access, aimed to address critical trade imbalances and national security concerns. Both tariff reductions and access to rare earth minerals are strategically vital for the US economy and its national security. The long-term consequences of these negotiations will shape the global economic landscape for years to come. Stay informed about the ongoing developments in US-China trade negotiations to better understand the evolving dynamics of this crucial relationship and the impact of tariff reductions and access to rare earth minerals on the global stage. The future of US-China trade hinges on the success of these complex negotiations.

Featured Posts

-

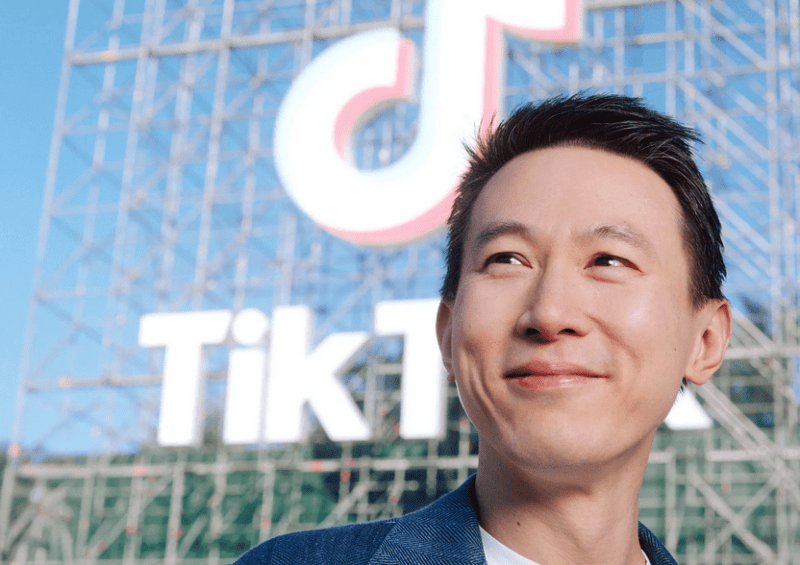

Instagram Ceo On Tik Tok Competition A Battle For User Engagement

May 11, 2025

Instagram Ceo On Tik Tok Competition A Battle For User Engagement

May 11, 2025 -

Shevchenko Fiorot Ufc 315 A Closer Look At The May Showdown

May 11, 2025

Shevchenko Fiorot Ufc 315 A Closer Look At The May Showdown

May 11, 2025 -

Next Pope Analyzing The Leading Candidates For The Papacy

May 11, 2025

Next Pope Analyzing The Leading Candidates For The Papacy

May 11, 2025 -

John Wick Chapter 5 Production Status And Potential Storylines

May 11, 2025

John Wick Chapter 5 Production Status And Potential Storylines

May 11, 2025 -

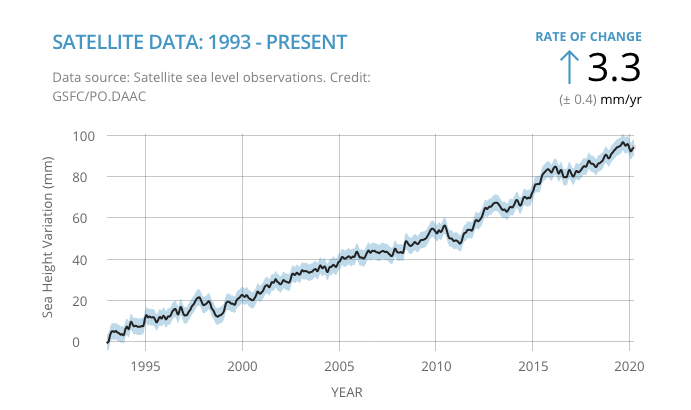

The Increasing Danger Of Rising Global Sea Levels

May 11, 2025

The Increasing Danger Of Rising Global Sea Levels

May 11, 2025