Trump's Houthi Truce: Shippers Remain Doubtful

Table of Contents

Security Concerns Remain Paramount

The primary obstacle to a swift return to normalcy in Yemeni waters remains the persistent threat of attacks on shipping vessels. Even under the Trump's Houthi Truce, the risk of encountering Houthi aggression remains a significant factor for shipping companies.

Continued Risk of Attacks

Despite the ceasefire, the Houthi rebels retain considerable military capability, including the potential to launch attacks on ships transiting the Red Sea.

- Past Attacks: Numerous attacks on commercial vessels have occurred in recent years, highlighting the vulnerability of ships navigating these waters. These incidents resulted in significant losses, both in terms of material damage and human lives.

- Houthi Capabilities: The Houthis possess a range of weaponry, including sophisticated anti-ship missiles and smaller, faster attack craft, posing a considerable threat to even larger vessels.

- Vulnerability of Commercial Ships: Many commercial ships lack robust defensive systems, making them easy targets for attacks. This vulnerability is exacerbated by the sheer volume of traffic in the Red Sea.

- Insurance Premiums and Delays: The risk of attacks translates directly into higher insurance premiums for shipping companies, adding to the already considerable cost of transporting goods through this crucial waterway. Furthermore, concerns about security often lead to delays as ships adjust their routes or wait for improved security guarantees.

Lack of Enforcement Mechanisms

A crucial weakness of the Trump's Houthi Truce lies in the lack of a robust international monitoring and enforcement mechanism. The agreement's success relies heavily on the goodwill and cooperation of all parties involved, a tenuous foundation in the volatile Yemeni context.

- Insufficient International Monitoring: The absence of a strong international force to monitor compliance creates a significant vulnerability. Without credible, independent verification, breaches of the ceasefire are likely to go unpunished.

- Verification Difficulties: Verifying compliance is incredibly challenging given the complex political landscape and the decentralized nature of the Houthi movement. Any verification efforts are hindered by the lack of access to key areas and a reluctance from all parties to fully cooperate.

- Reliance on Self-Reporting: The reliance on self-reporting by various parties involved severely limits the effectiveness of monitoring. It is highly likely that violations will go unreported or downplayed.

Economic Uncertainty and Impact on Trade Routes

The ongoing conflict and even the tenuous Trump's Houthi Truce significantly disrupt trade routes through the strategically vital Red Sea. This critical waterway carries a massive volume of goods, impacting global supply chains and the world economy.

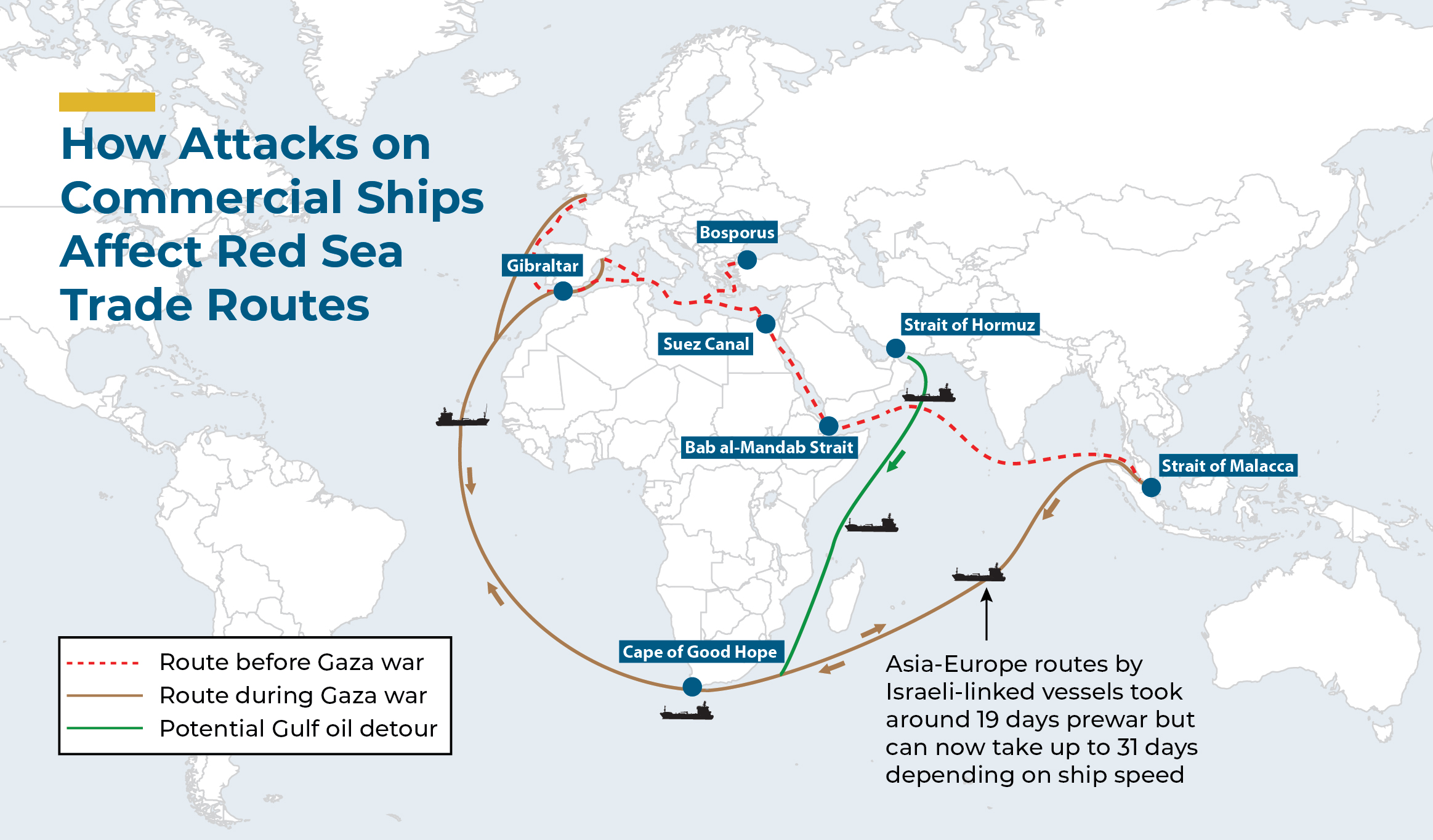

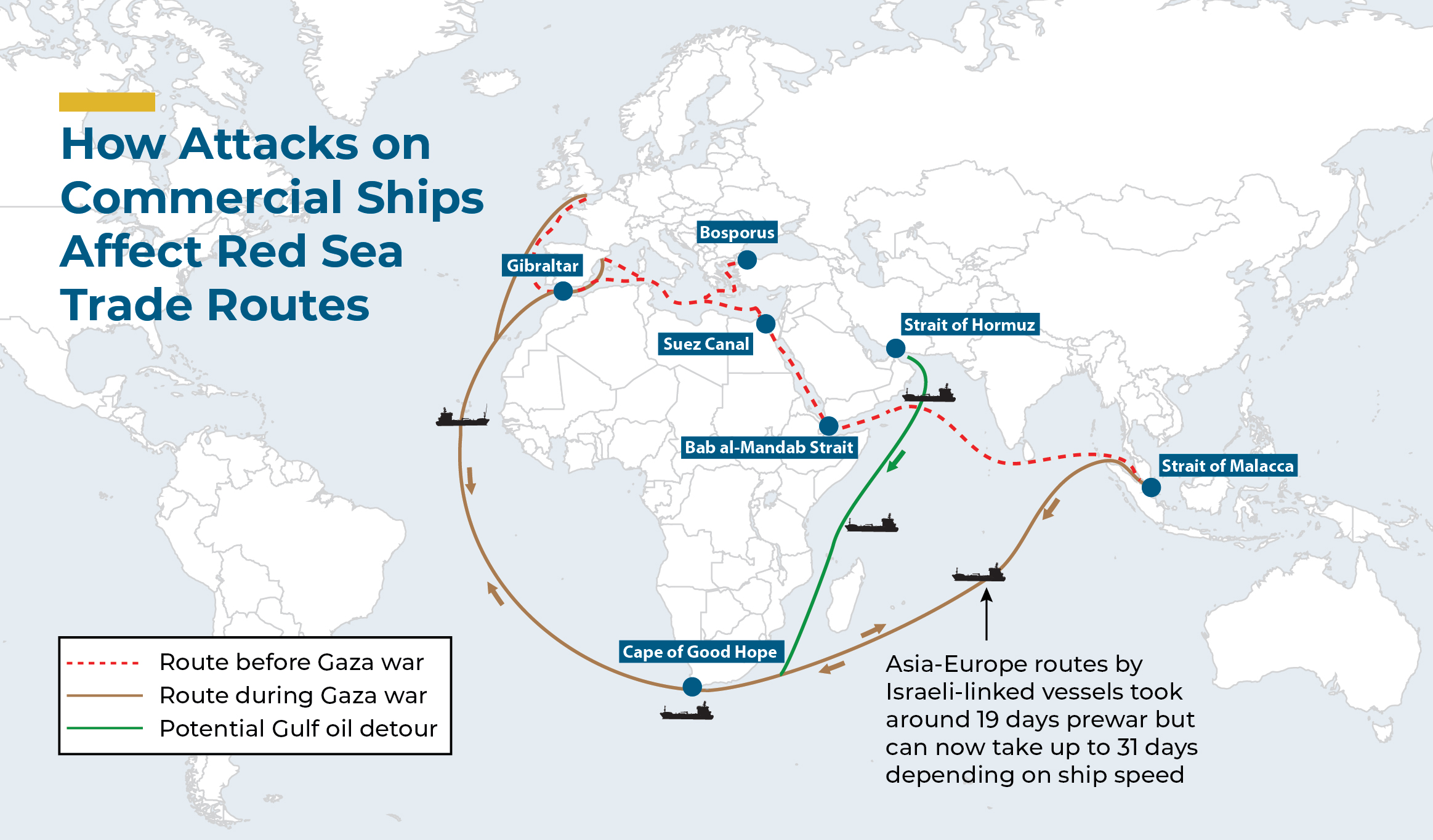

Disruption to Red Sea Trade

The Red Sea is a major artery for global trade, connecting Asia, Africa, and Europe. Any disruption significantly impacts global supply chains and increases costs for businesses.

- Trade Volume: The Red Sea carries an enormous volume of goods, making it a critical link in global trade. Disruptions to this traffic flow have major consequences for businesses worldwide.

- Delays and Increased Costs: Security concerns, port closures, and logistical challenges associated with the conflict result in delays and increased costs for shippers. This translates into higher prices for consumers globally.

- Impact on Global Supply Chains: Disruptions in the Red Sea affect multiple industries and countries worldwide, impacting the availability and cost of goods in various markets. This disruption to global supply chains can have serious economic consequences.

Port Functionality and Operational Challenges

Yemeni ports have suffered significant damage due to the conflict, further hampering shipping operations. The combination of damaged infrastructure, sanctions, bureaucratic hurdles, and the inconsistent application of the Trump's Houthi Truce creates a volatile and unreliable operating environment.

- Port Infrastructure Damage: Years of conflict have severely damaged port infrastructure in Yemen, reducing their capacity and efficiency.

- Impact of Sanctions: International sanctions have further complicated operations in Yemeni ports, impacting the flow of goods and creating additional bureaucratic hurdles.

- Bureaucratic Hurdles: Navigating the complex regulatory environment in Yemen adds significant delays and costs for shipping companies. Inconsistent application of the truce agreement only exacerbates these difficulties.

Shippers' Perspectives and Reactions

The shipping industry views the Trump's Houthi Truce with a mixture of cautious optimism and considerable skepticism. Major players remain wary of the risks, reflecting their concerns in their operational decisions and risk assessments.

Statements from Key Players

Major shipping companies and industry associations have expressed concerns about the ongoing security risks and the limitations of the ceasefire. While some cautiously welcome the truce as a potential step toward stability, many emphasize the need for stronger enforcement mechanisms and improved security guarantees before committing to significant increases in traffic through the Red Sea.

Insurance and Risk Assessment

The perceived risk associated with shipping in Yemeni waters is directly reflected in insurance premiums. The uncertainty surrounding the truce's effectiveness makes it challenging for insurers to accurately assess the risk, resulting in increased costs for shippers.

- Impact on Shipping Costs: Higher insurance premiums significantly increase the overall cost of shipping goods through the Red Sea, making it less competitive compared to alternative routes.

- Challenges in Obtaining Insurance Coverage: The heightened risk makes obtaining adequate insurance coverage increasingly challenging for shipping companies. Some insurers may even refuse coverage altogether, further limiting options for businesses.

Conclusion

Trump's Houthi Truce, while offering a glimmer of hope for peace in Yemen, has not fully alleviated the considerable concerns within the shipping industry. The persistent security risks, the lack of robust enforcement mechanisms, and the continued economic uncertainty paint a complex picture for maritime trade in the Red Sea. The truce's long-term success remains questionable, and shippers continue to face significant challenges navigating this volatile environment. It's crucial to continue monitoring the situation closely to understand the evolving dynamics of Trump's Houthi truce and its impact on the future of shipping in the region. Stay informed about developments affecting maritime trade in the Red Sea and delve deeper into research on the long-term viability of the truce and its effects on Trump's Houthi Truce to make informed decisions.

Featured Posts

-

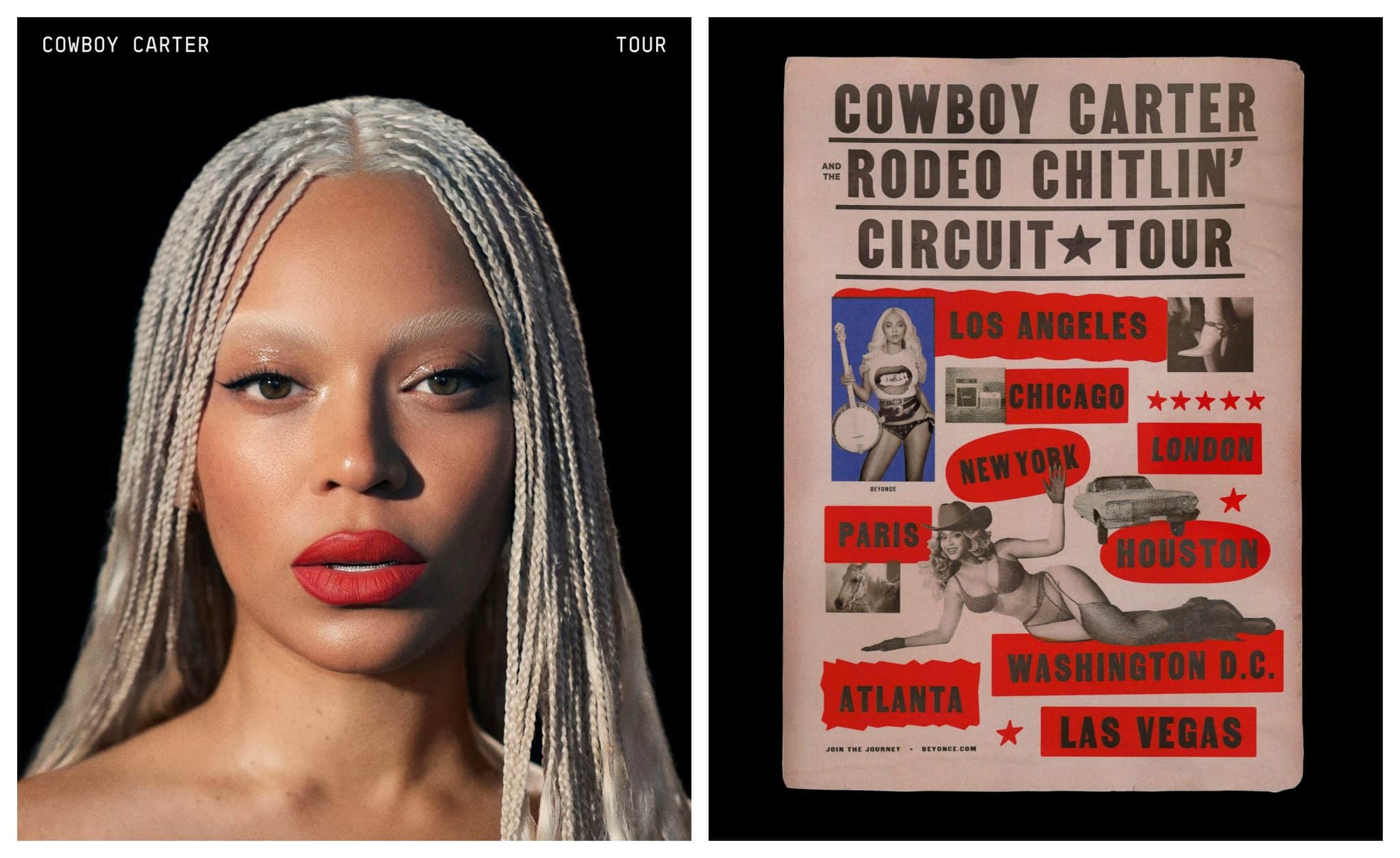

Post Tour Surge Beyonces Impact On Cowboy Carters Streaming Numbers

May 09, 2025

Post Tour Surge Beyonces Impact On Cowboy Carters Streaming Numbers

May 09, 2025 -

F1 World Mourns Colapinto And Perez Lead Tributes Following Devastating Loss

May 09, 2025

F1 World Mourns Colapinto And Perez Lead Tributes Following Devastating Loss

May 09, 2025 -

Is The Monkey The Worst Stephen King Movie Of 2025 A Look Ahead

May 09, 2025

Is The Monkey The Worst Stephen King Movie Of 2025 A Look Ahead

May 09, 2025 -

Warming Weather Hinders Anchorage Fin Whale Skeleton Recovery

May 09, 2025

Warming Weather Hinders Anchorage Fin Whale Skeleton Recovery

May 09, 2025 -

10 Adn Pas Selangor Bantu Mangsa Tragedi Putra Heights Bantuan And Sokongan Diberikan

May 09, 2025

10 Adn Pas Selangor Bantu Mangsa Tragedi Putra Heights Bantuan And Sokongan Diberikan

May 09, 2025

Latest Posts

-

Draisaitls Stellar Year Edmonton Oilers Star A Hart Trophy Finalist

May 09, 2025

Draisaitls Stellar Year Edmonton Oilers Star A Hart Trophy Finalist

May 09, 2025 -

Oilers Defeat Kings In Overtime Thriller Series Even At 1 1

May 09, 2025

Oilers Defeat Kings In Overtime Thriller Series Even At 1 1

May 09, 2025 -

Analyzing The Impact Of The 2025 Nhl Trade Deadline On Playoff Races

May 09, 2025

Analyzing The Impact Of The 2025 Nhl Trade Deadline On Playoff Races

May 09, 2025 -

Leon Draisaitls Hart Trophy Nomination A Historic Season For The Edmonton Oilers

May 09, 2025

Leon Draisaitls Hart Trophy Nomination A Historic Season For The Edmonton Oilers

May 09, 2025 -

Edmonton Oilers Leon Draisaitl A Hart Trophy Finalists Banner Season

May 09, 2025

Edmonton Oilers Leon Draisaitl A Hart Trophy Finalists Banner Season

May 09, 2025