Trump's Latest Assault On Jerome Powell: Urges Immediate Termination

Table of Contents

Trump's Rationale for Powell's Dismissal

Trump's repeated calls for Powell's removal stem from fundamental disagreements about the Federal Reserve's monetary policy. These disagreements highlight a clash between the former president's short-term economic priorities and the Fed's long-term mandate.

Criticism of Interest Rate Hikes

Trump consistently criticized the Federal Reserve's interest rate hikes, arguing they stifled economic growth and negatively impacted the stock market. He viewed these increases as an obstacle to his administration's economic agenda.

- Example 1: Trump repeatedly tweeted his displeasure with rate increases, calling them "crazy" and detrimental to the economy. [Link to relevant tweet/news article]

- Example 2: He argued that higher interest rates hindered business investment and job creation, slowing down the economic expansion he claimed credit for. [Link to relevant news article]

- Example 3: Trump believed the Fed's actions were designed to undermine his presidency and hurt his chances of re-election. [Link to relevant news article/analysis]

Accusations of Mishandling the Economy

Beyond interest rate hikes, Trump accused Powell of general economic mismanagement, citing various economic indicators to support his claims. He often framed the Fed’s actions as incompetent and damaging to the US economy.

- Claim 1: Trump pointed to periods of slower economic growth as evidence of Powell's failings, often ignoring other contributing factors.

- Claim 2: He frequently criticized the unemployment rate, even when it remained historically low, suggesting the Fed could have done better.

- Claim 3: Trump cited inflation as a primary reason for his dissatisfaction, blaming Powell for not acting aggressively enough to curb rising prices, even when inflation was within the Fed's target range.

Powell's Response and the Federal Reserve's Position

Jerome Powell and the Federal Reserve have consistently maintained their independence from political pressure, emphasizing their commitment to price stability and maximum employment.

Powell's Independence and the Fed's Mandate

The Federal Reserve’s independence is a cornerstone of its effectiveness. Its structure is designed to shield monetary policy decisions from short-term political influences.

- Independence: The Federal Reserve governors serve long terms, minimizing the impact of changing administrations.

- Dual Mandate: The Fed's focus on price stability and maximum employment allows it to make decisions based on economic data, not political expediency.

- Accountability: While independent, the Fed is still accountable to Congress and regularly reports on its activities.

The Fed's Justification for its Monetary Policy Decisions

The Federal Reserve justifies its interest rate decisions based on a comprehensive analysis of economic data and its inflation targeting framework.

- Inflation Targeting: The Fed aims to keep inflation at a healthy level, typically around 2%.

- Economic Data: The Fed uses a wide range of indicators, including employment figures, inflation rates, and consumer spending, to inform its decisions. [Link to relevant Fed data sources]

- Quantitative Easing: The Fed may employ quantitative easing (QE) programs to stimulate the economy during times of crisis by injecting liquidity into the financial system.

Political and Economic Implications of Trump's Demand

Trump's continued attacks on Powell have significant political and economic implications, impacting market confidence and the Federal Reserve's credibility.

Impact on Market Volatility

Trump's public criticism of the Federal Reserve often led to increased market volatility. His pronouncements injected uncertainty into the financial markets.

- Stock Market Fluctuations: Stock markets often reacted negatively to Trump’s attacks on Powell, reflecting investor uncertainty about the future direction of monetary policy. [Link to relevant market data]

- Investor Confidence: Trump’s rhetoric undermined investor confidence in the Federal Reserve's ability to manage the economy effectively.

Potential Consequences for the Federal Reserve's Credibility

If Trump's demands were met and the Fed were to succumb to political pressure, its credibility and independence would be severely damaged.

- Erosion of Trust: Political interference in the Fed's decisions would erode public trust in its ability to make objective, data-driven decisions.

- Reduced Effectiveness: A politicized Fed would be less effective in managing the economy, potentially leading to higher inflation or economic instability.

- International Impact: The US Fed's independence is a global benchmark; compromising it would have negative implications for central banks worldwide.

Conclusion

Donald Trump's persistent assault on Jerome Powell and his calls for immediate termination represent a significant threat to the Federal Reserve's independence and the stability of the US economy. Trump's criticisms, while often politically motivated, overlook the complexities of monetary policy and the Fed’s crucial role in maintaining economic stability. The potential consequences of undermining the Fed's credibility are far-reaching and could have long-term repercussions for the US and the global financial system. Stay updated on the evolving situation with Trump’s ongoing assault on Jerome Powell and the future of the Federal Reserve’s economic policies.

Featured Posts

-

Milwaukee Brewers Win Walk Off Thriller Thanks To Brice Turangs Bunt

Apr 23, 2025

Milwaukee Brewers Win Walk Off Thriller Thanks To Brice Turangs Bunt

Apr 23, 2025 -

Yankees Historic Night 9 Home Runs Judges Trio Power 2025 Season Opener

Apr 23, 2025

Yankees Historic Night 9 Home Runs Judges Trio Power 2025 Season Opener

Apr 23, 2025 -

Week 1 Mlb Power Rankings According To Fan Graphs March 27 April 6

Apr 23, 2025

Week 1 Mlb Power Rankings According To Fan Graphs March 27 April 6

Apr 23, 2025 -

Yankees Smash Team Record With 9 Home Runs Judges 3 Blast Fuels Victory

Apr 23, 2025

Yankees Smash Team Record With 9 Home Runs Judges 3 Blast Fuels Victory

Apr 23, 2025 -

The Evolution Of Michael Lorenzen From Two Way Player To Specialist

Apr 23, 2025

The Evolution Of Michael Lorenzen From Two Way Player To Specialist

Apr 23, 2025

Latest Posts

-

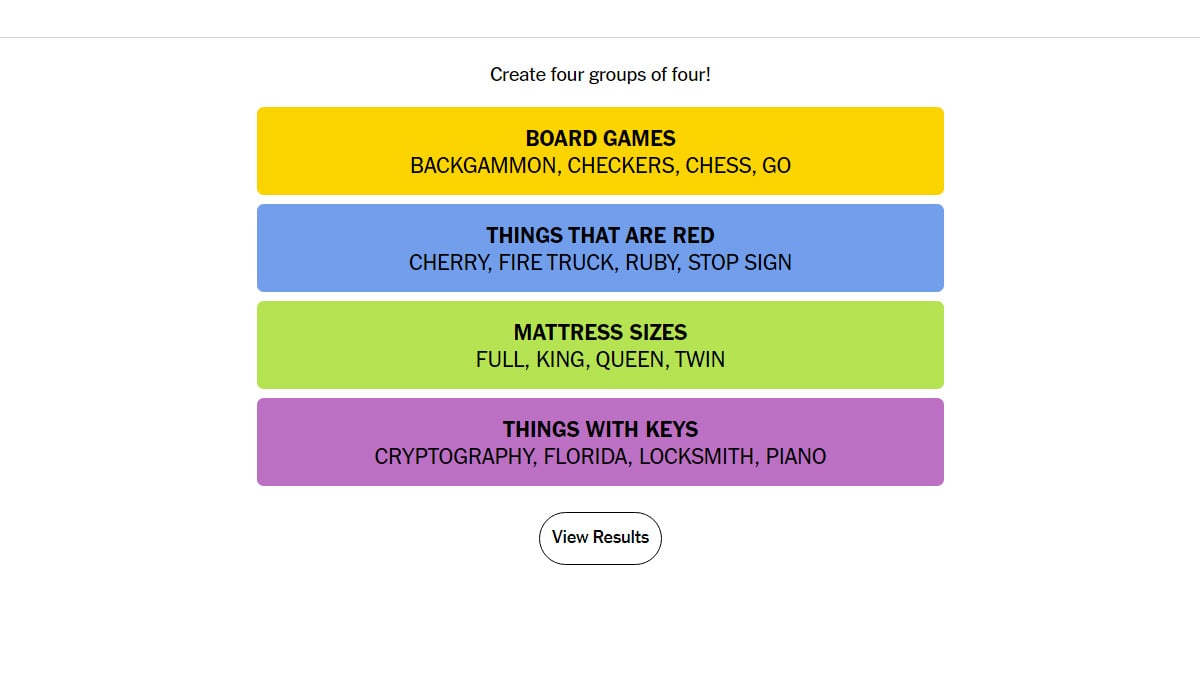

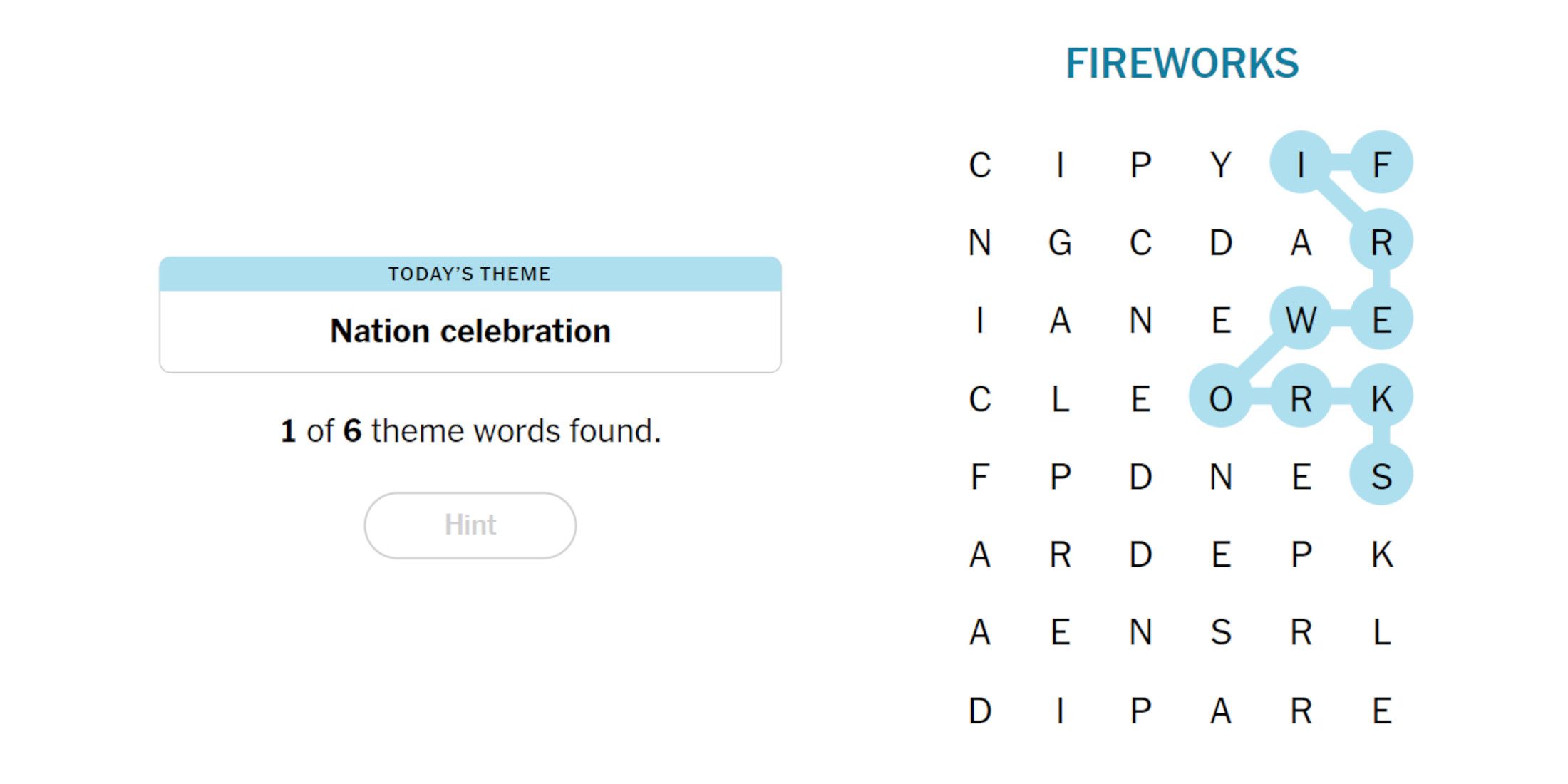

Nyt Strands Hints And Answers Saturday March 15 Game 377

May 09, 2025

Nyt Strands Hints And Answers Saturday March 15 Game 377

May 09, 2025 -

Complete Guide To Nyt Strands Game 405 April 12 2024

May 09, 2025

Complete Guide To Nyt Strands Game 405 April 12 2024

May 09, 2025 -

Crack The Nyt Spelling Bee April 4 2025 Tips And Tricks

May 09, 2025

Crack The Nyt Spelling Bee April 4 2025 Tips And Tricks

May 09, 2025 -

Solve Nyt Strands Hints And Answers For Thursday April 10 Game 403

May 09, 2025

Solve Nyt Strands Hints And Answers For Thursday April 10 Game 403

May 09, 2025 -

Nyt Strands April 12 2024 Solutions Game 405

May 09, 2025

Nyt Strands April 12 2024 Solutions Game 405

May 09, 2025