Trump's Oil Price Preference: Goldman Sachs Analysis Of Social Media Posts

Table of Contents

Methodology: How Goldman Sachs Analyzed Social Media Data Related to Trump and Oil Prices

Goldman Sachs' analysis employed a sophisticated methodology to uncover potential correlations between former President Trump's public statements and sentiment towards oil prices. Their approach combined quantitative and qualitative analysis techniques, offering a robust, albeit nuanced, perspective. The firm leveraged a vast dataset encompassing several social media platforms, enabling a comprehensive examination of public discourse.

- Specific social media platforms analyzed: Twitter, Facebook, and potentially Reddit, considering their relevance to political discourse and public opinion.

- Timeframe of the data collection: The timeframe likely encompassed Trump's presidency (2017-2021), possibly extending to include relevant periods before and after.

- Keywords and phrases tracked: The analysis likely focused on keywords like "oil price," "gas prices," "energy policy," and phrases directly referencing Trump's stance on energy matters. Sentiment surrounding these terms would have been crucial.

- Specific algorithms used for sentiment analysis: Sophisticated natural language processing (NLP) algorithms were likely used to gauge the emotional tone surrounding oil price discussions and Trump's statements. These algorithms often incorporate techniques like lexicon-based approaches and machine learning models.

The limitations inherent in any social media analysis must be acknowledged. The data might not be entirely representative of the broader population, and there's always the risk of biased algorithms or the manipulation of online sentiment. Goldman Sachs likely addressed these potential biases in their report.

Key Findings: What Goldman Sachs Discovered About Trump's Stated or Implied Oil Price Preferences

Goldman Sachs' analysis arguably revealed a preference for a relatively lower oil price range. The study likely identified a correlation between Trump's public pronouncements and periods of lower oil prices, suggesting a potential preference for a certain price band that would benefit the American consumer and the economy.

- Specific oil price ranges identified as preferred by Trump (based on the analysis): The specific range would be detailed in the original Goldman Sachs report, but it's likely to be a price band that reflects a balance between economic growth and energy independence.

- Examples of Trump's public statements supporting the findings: The analysis likely cited instances where Trump publicly expressed concern about high gas prices or praised periods of lower oil costs. These statements would have been analyzed for their sentiment and impact.

- Potential economic consequences of Trump's preferred oil prices: Lower oil prices generally boost economic activity by reducing transportation costs and influencing inflation. However, they could also harm oil-producing states and companies.

- Potential political ramifications of Trump's preferred oil prices: Low oil prices are often seen as positive by voters, potentially enhancing a president’s popularity, whereas high prices can be politically damaging.

Implications for Energy Markets and Policy: The Broader Context of Goldman Sachs' Findings

The Goldman Sachs analysis has significant implications for the energy sector and policy-making. The perceived preference for a certain price range could have influenced market volatility, investment decisions, and international relations.

- Impact on investment decisions in the energy sector: Uncertainty about future oil prices, potentially fueled by Trump's rhetoric, can impact investment decisions in oil exploration, production, and renewable energy.

- Effect on international relations and energy diplomacy: Trump's approach to energy policy and oil prices likely influenced the US's standing in global energy markets and relationships with oil-producing nations.

- Potential for future policy changes based on these findings: The findings could inform future policy debates on energy independence, regulation, and the role of government intervention in the energy sector.

- The broader implications for energy market forecasting: The study highlights the need to consider political factors, and social media sentiment, when forecasting oil prices.

Criticisms and Alternative Perspectives: Assessing the Validity and Limitations of the Goldman Sachs Study

While insightful, the Goldman Sachs study is not without its potential limitations and criticisms. Alternative interpretations of the data and counterarguments exist.

- Potential flaws in the methodology: Critics might question the sample size, the algorithms used for sentiment analysis, or the potential for bias in the social media data itself.

- Alternative explanations for observed correlations: Other factors beyond Trump's statements, such as global supply and demand, could have influenced oil price fluctuations.

- Views from opposing political viewpoints: Those with differing political perspectives on energy policy may offer contrasting interpretations of the findings.

- Critique from independent energy analysts: Independent energy analysts may have differing opinions on the significance or validity of Goldman Sachs' conclusions.

Conclusion: Understanding Trump's Oil Price Preference: A Call to Further Research

Goldman Sachs' social media analysis provides a unique perspective on the potential influence of political statements on oil prices. The study suggests a correlation between former President Trump's rhetoric and perceived preferences for a specific oil price range, potentially impacting energy markets and policy. However, the limitations inherent in using social media data for such analysis must be acknowledged. Further research is essential to fully understand the complex interplay between political discourse, public perception, and energy market dynamics. We encourage readers to explore the full Goldman Sachs report and engage in further discussions about Trump's oil policy, Goldman Sachs' analytical approach, and the broader implications of using energy market analysis tools like this. Understanding these factors is crucial for informed decision-making in the volatile world of energy markets.

Featured Posts

-

Township Water Supply Contaminated Residents Face Health Risks

May 15, 2025

Township Water Supply Contaminated Residents Face Health Risks

May 15, 2025 -

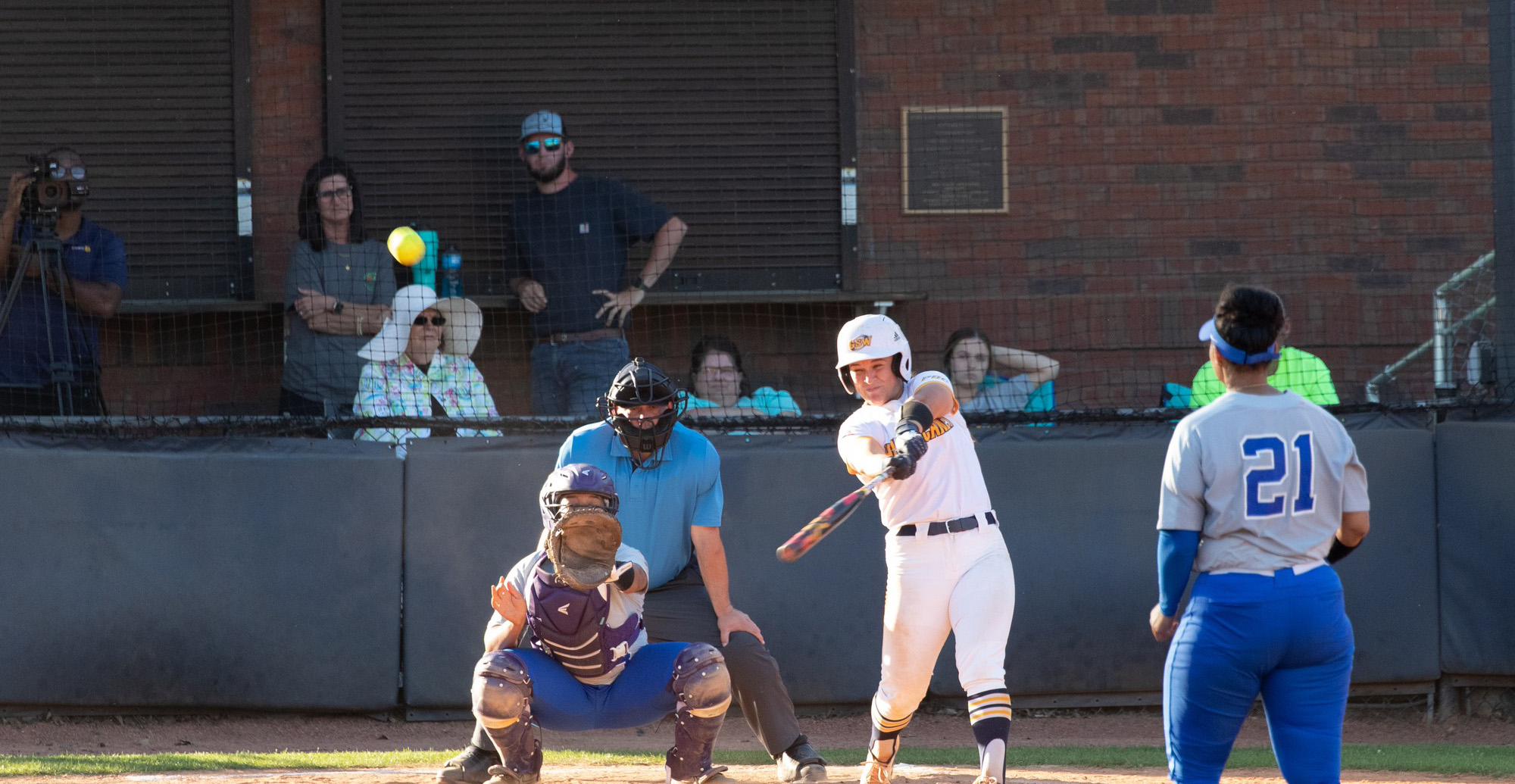

School Record Falls As Ndukwe Claims Pbc Tournament Mvp

May 15, 2025

School Record Falls As Ndukwe Claims Pbc Tournament Mvp

May 15, 2025 -

Watch Miss Joe And Jill Bidens Full The View Interview

May 15, 2025

Watch Miss Joe And Jill Bidens Full The View Interview

May 15, 2025 -

Private Equity Buys Boston Celtics For 6 1 Billion Impact On The Franchise And Fans

May 15, 2025

Private Equity Buys Boston Celtics For 6 1 Billion Impact On The Franchise And Fans

May 15, 2025 -

Renos Boxing Future A Heavyweight Champions Vision

May 15, 2025

Renos Boxing Future A Heavyweight Champions Vision

May 15, 2025