Trump's Tariff Revenue: A Realistic Replacement For Income Tax?

Table of Contents

The Trump administration's imposition of significant tariffs on various imported goods sparked intense debate about their economic consequences. A particularly intriguing question emerged: could the revenue generated from these tariffs realistically replace income tax as a primary source of government funding? This article delves into the potential, limitations, and inherent complexities of such a proposition, examining the feasibility and economic ramifications of such a drastic shift in US fiscal policy.

Analyzing Tariff Revenue Generation

Sources of Tariff Revenue

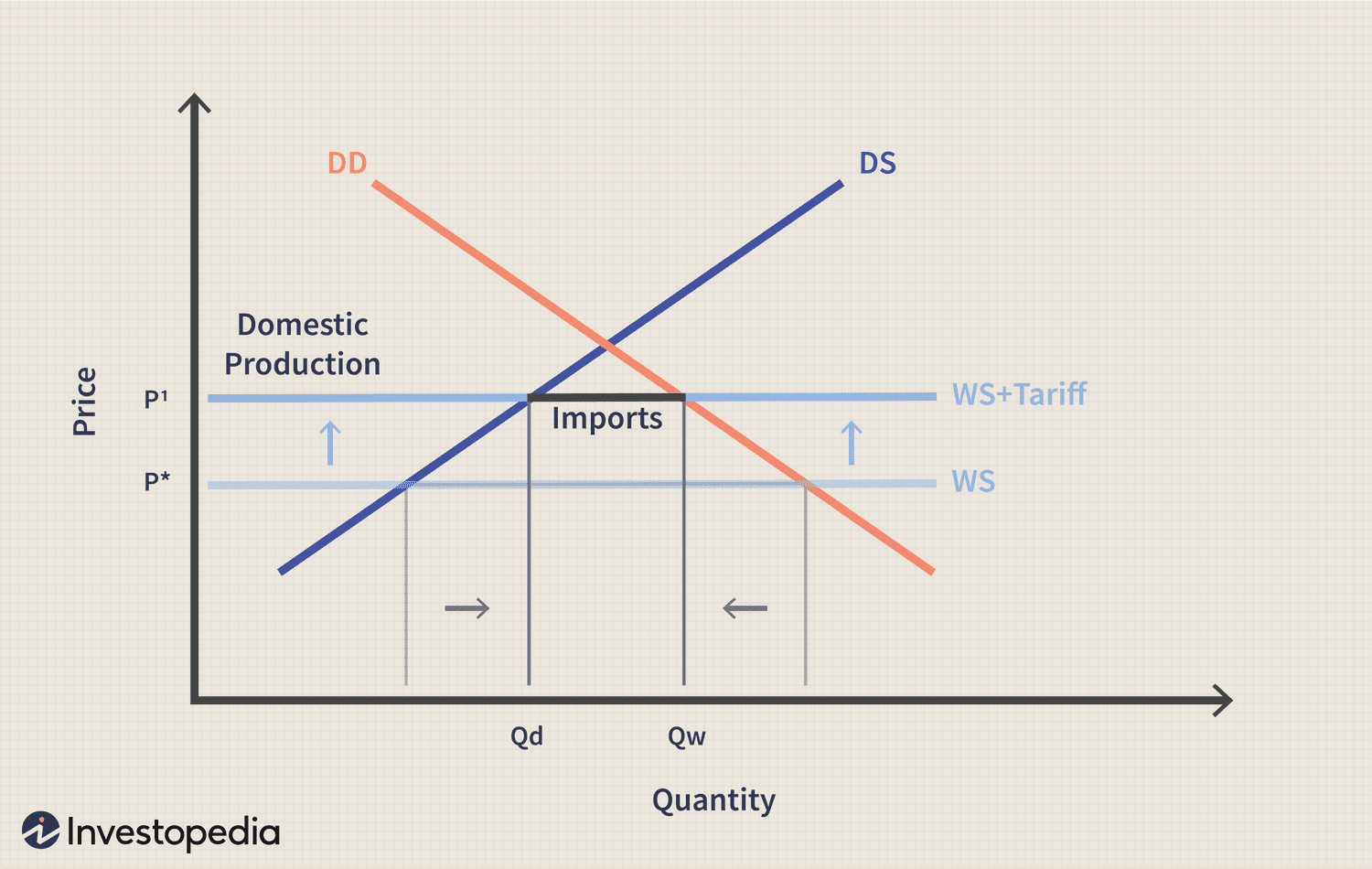

The Trump administration levied tariffs on a wide range of imported goods, including steel, aluminum, and numerous products from China. These tariffs, designed to protect domestic industries and potentially generate revenue, significantly impacted import volumes and, consequently, government coffers.

- Steel and Aluminum Tariffs: These tariffs, initially imposed at rates of 25% and 10%, respectively, generated billions of dollars in revenue. However, the impact on domestic steel and aluminum industries was debated, with some arguing that the tariffs led to higher prices for consumers and businesses.

- Tariffs on Chinese Goods: The extensive trade war with China involved tariffs on hundreds of billions of dollars worth of goods, leading to fluctuating revenue streams. The specific rates varied considerably depending on the product category.

- Revenue Figures: While precise figures fluctuate and are subject to ongoing analysis, reports from the US Treasury Department provide data on tariff revenue generated during this period. These figures should be carefully examined within the context of overall government expenditure.

Fluctuations and Unpredictability

Tariff revenue is inherently volatile. Unlike income tax, which provides a relatively stable and predictable revenue stream, tariff revenue is susceptible to numerous factors, making it an unreliable foundation for a national tax system.

- Trade Wars and Retaliation: Trade wars, such as the one with China, often lead to retaliatory tariffs from other countries, reducing import volumes and impacting revenue.

- Global Market Shifts: Changes in global supply chains, demand fluctuations, and economic downturns can all significantly affect the revenue generated from tariffs.

- Comparison to Income Tax: Income tax revenue, while not entirely static, exhibits far greater stability and predictability over time compared to the fluctuating nature of tariff revenue. This stability is crucial for effective government budgeting and long-term financial planning.

Distributional Effects of Tariff Revenue

The distributional effects of tariff revenue are complex and often uneven. While the government collects the revenue, the burden is often disproportionately borne by consumers and specific industries.

- Higher Prices for Consumers: Tariffs increase the price of imported goods, directly impacting consumers through higher costs for various products. This impact is felt more acutely by low-income households with a larger proportion of their income spent on necessities.

- Impact on Specific Industries: Certain industries, such as manufacturing and agriculture, can be heavily impacted by tariffs, either positively through protection or negatively through reduced exports and increased input costs. The distributional effects are not uniform across all sectors.

- Comparison to Income Tax: Income tax, while also having distributional implications, is designed with a broader tax base and progressive features, aiming for more equitable distribution compared to the targeted and often regressive nature of tariff revenue.

Comparing Tariff Revenue to Income Tax Revenue

Scale and Scope

The most significant difference between tariff revenue and income tax revenue lies in their scale. Income tax is the largest source of federal revenue in the US, dwarfing the revenue generated from tariffs by a considerable margin.

- Numerical Data: Official government data clearly demonstrates this vast disparity. Comparing annual income tax revenue figures to annual tariff revenue figures highlights the scale of the difference.

- Percentage Breakdowns: Analyzing the percentage contribution of each revenue source to the total government revenue further emphasizes the dominance of income tax.

Stability and Predictability

The inherent instability of tariff revenue compared to the relative predictability of income tax revenue poses a significant challenge to replacing the latter with the former.

- Historical Data: Examining historical data on both revenue streams clearly reveals the greater stability of income tax revenue, even during economic downturns. Tariff revenue fluctuates dramatically based on geopolitical factors and global economic conditions.

- Long-Term Revenue Projections: The volatility of tariff revenue makes it extremely difficult to produce reliable long-term revenue projections, making it an unsuitable base for stable government budgeting and long-term financial planning.

Economic Implications of a Shift

Replacing income tax with tariff revenue would have profound and potentially devastating macroeconomic consequences. The shift could distort market incentives, stifle economic growth, and lead to significant economic instability.

- Reduced Consumer Spending: Higher prices due to tariffs would likely reduce consumer spending, impacting overall economic activity.

- Impact on Investment and Business Activity: The uncertainty surrounding tariff revenue and the potential for sudden shifts in trade policies could discourage investment and hinder business activity.

- Ripple Effects on the Economy: The ripple effects of such a drastic change in the tax system could have far-reaching consequences, potentially leading to job losses, reduced economic growth, and increased inequality.

Alternative Policy Considerations

Tax Reform Alternatives

Replacing income tax with tariff revenue is not the only option for tax reform. Numerous alternative approaches offer potential solutions for improving the tax system while addressing its shortcomings.

- Progressive Consumption Tax: This tax focuses on consumption rather than income, with potential for greater fairness and efficiency.

- Value-Added Tax (VAT): A widespread tax on the value added at each stage of production could generate substantial revenue.

- Tax Code Simplification: Streamlining the complex tax code could increase compliance and reduce administrative costs.

Trade Policy Diversification

Reducing reliance on tariffs as a revenue source requires a diversified trade policy that fosters growth and competitiveness without relying on protectionist measures.

- Investment in Domestic Industries: Investing in domestic industries improves competitiveness and reduces dependence on imports.

- Diversification of Trade Partners: Reducing reliance on specific trade partners mitigates risk and improves economic resilience.

- Negotiation of More Balanced Trade Agreements: Fairer trade agreements reduce the need for protectionist tariffs.

Conclusion

In summary, while Trump's tariffs generated some revenue, their inherent volatility, limited scale, and negative economic consequences render them a highly unsuitable replacement for income tax. The unpredictable nature of tariff revenue makes it an unreliable foundation for a stable national tax system. A complete shift would likely trigger severe economic repercussions, including reduced consumer spending, stifled business investment, and increased economic instability. Instead of relying on tariffs, policymakers should explore alternative and more sustainable approaches to tax reform and trade policy that promote economic growth and stability. A more comprehensive and nuanced approach to revenue generation is necessary for the long-term health of the US economy. Let's discuss alternative approaches to generate sufficient revenue and strengthen the US economy. Learn more about the economic implications of Trump's tariffs and alternative tax policies.

Featured Posts

-

Kshmyr Tnaze Brtanwy Wzyr Aezm Kw Pysh Ky Gyy Drkhwast

May 01, 2025

Kshmyr Tnaze Brtanwy Wzyr Aezm Kw Pysh Ky Gyy Drkhwast

May 01, 2025 -

Louisville Storm Debris Pickup Requesting Your Assistance

May 01, 2025

Louisville Storm Debris Pickup Requesting Your Assistance

May 01, 2025 -

Frances Six Nations Triumph Mauvakas Mistakes And British And Irish Lions Implications

May 01, 2025

Frances Six Nations Triumph Mauvakas Mistakes And British And Irish Lions Implications

May 01, 2025 -

Canadian Election Results Poilievres Loss And Its Fallout

May 01, 2025

Canadian Election Results Poilievres Loss And Its Fallout

May 01, 2025 -

Enexis En Kampen In Juridisch Conflict Kort Geding Over Stroomnetaansluiting

May 01, 2025

Enexis En Kampen In Juridisch Conflict Kort Geding Over Stroomnetaansluiting

May 01, 2025