Trump's Tariff Revenue: A Realistic Replacement For Income Taxes?

Table of Contents

The Promise and Reality of Tariff Revenue

The theoretical potential of tariffs to generate revenue is simple: a tax on imported goods increases government coffers. However, the reality is far more complex. While the Trump administration did see an increase in tariff revenue compared to previous years, it fell significantly short of replacing, even partially, income tax revenue.

Let's analyze the historical data:

- Comparison to Previous Administrations: While specific figures vary depending on the goods and the year, a comparison reveals that the increase in tariff revenue under Trump, while noticeable, was dwarfed by the overall income tax revenue generated.

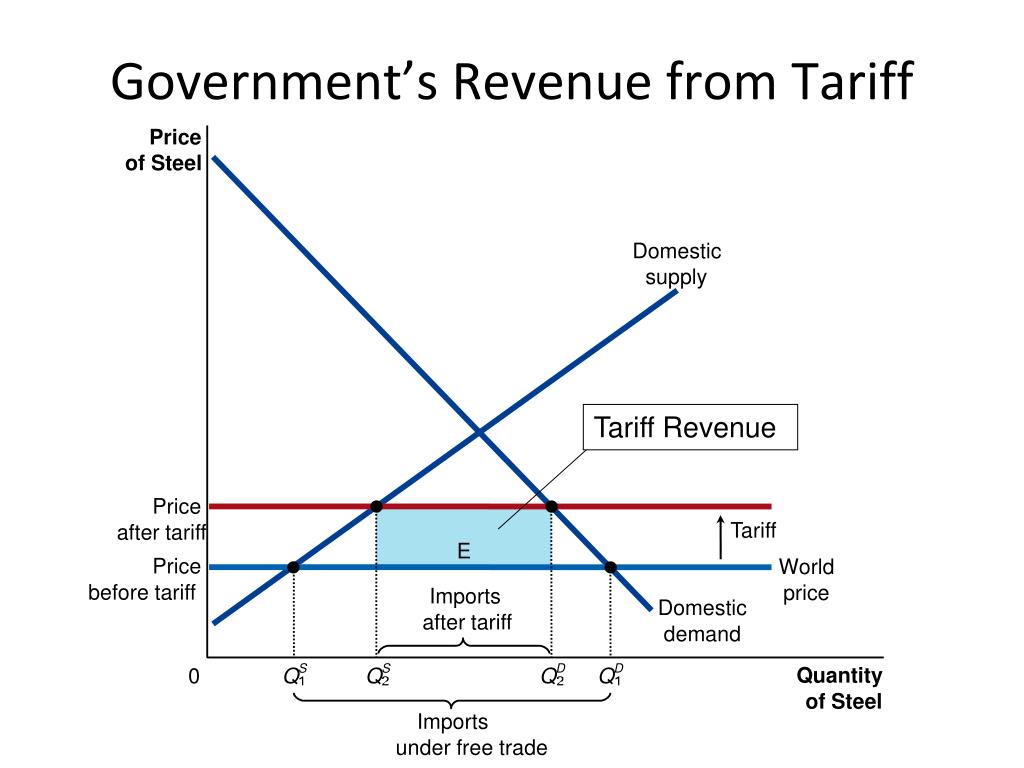

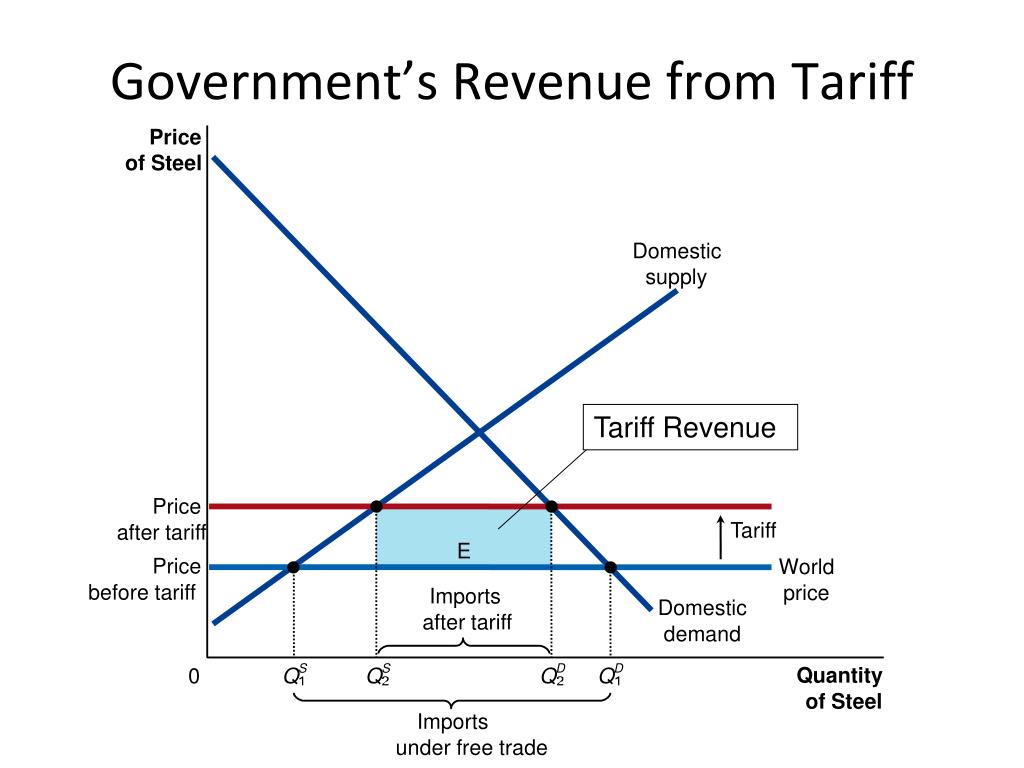

- Quantifying Revenue from Specific Tariffs: Tariffs imposed on steel and aluminum, for instance, generated a certain amount of revenue. However, this was a small fraction of overall government expenditure. Precise figures require detailed analysis from government financial reports.

- Limitations of Historical Data: Using past tariff revenue to predict future revenue is unreliable. Trade patterns, global economic conditions, and retaliatory tariffs significantly influence the actual revenue generated. Moreover, the revenue collected from a specific tariff can be volatile and hard to accurately predict.

The potential for increased revenue through new or increased tariffs exists, but it’s crucial to acknowledge the inherent limitations and potential for negative economic consequences.

Economic Impacts and Trade Wars

High tariffs, while potentially boosting revenue in the short term, often lead to significant negative economic consequences. These consequences undermine the very goal of increased revenue:

- Retaliatory Tariffs: Other countries frequently retaliate with their own tariffs, leading to trade wars and harming both exporting and importing nations.

- Increased Prices for Consumers: Tariffs increase the cost of imported goods, leading to higher prices for consumers and reducing purchasing power.

- Harm to Specific Industries: Industries reliant on imported goods or exports face significant challenges, potentially leading to job losses and economic hardship.

Let's examine some examples:

- Trade Wars Initiated/Escalated Under Trump: The trade disputes with China, the EU, and other countries exemplify the negative impacts of escalating trade tensions.

- Economic Costs of Trade Wars: Studies by various organizations have quantified the substantial economic costs resulting from these trade conflicts, demonstrating lost output and reduced trade.

- Impact on Specific Sectors: The agricultural sector and manufacturing industries, for instance, were particularly affected by retaliatory tariffs imposed by trading partners.

These trade wars dramatically impacted international trade relationships, undermining the stability and predictability crucial for long-term economic growth and making the revenue stream from tariffs even more unreliable.

Comparing Tariff Revenue to Income Tax Revenue

A direct comparison reveals the vast difference in scale between income tax revenue and the potential from tariffs.

- Total Annual Income Tax Revenue: The annual income tax revenue in the United States is in the trillions of dollars.

- Highest Possible Realistic Estimate of Tariff Revenue: Even under the most optimistic scenarios, the maximum possible tariff revenue collected would remain a fraction of total income tax revenue.

- Volatility of Tariff Revenue: Tariff revenue is inherently volatile and dependent on unpredictable global economic conditions and trade relationships, unlike the more stable, albeit progressive, income tax system.

Relying solely on tariffs for government funding would be incredibly risky and would likely lead to unstable government finances and unpredictable budgetary shortfalls.

Alternative Revenue Generation Strategies

Exploring alternative revenue streams is crucial for ensuring stable government finances. Several options exist, each with its own advantages and drawbacks:

- Examples: Corporate tax reform (closing loopholes and potentially raising rates), a value-added tax (VAT), a carbon tax to address climate change, and closing existing tax loopholes are all possibilities.

- Revenue Potential: Each alternative holds varying potential for revenue generation; detailed economic modeling is necessary to accurately assess their potential.

- Political Feasibility: The political landscape significantly impacts the feasibility of implementing these alternatives.

A diversified approach to revenue generation, rather than sole reliance on tariffs, is a far more prudent and stable strategy for government finance.

Conclusion: Trump's Tariff Revenue: An Unrealistic Income Tax Replacement?

Our analysis clearly demonstrates that using tariff revenue as a replacement for income taxes is unrealistic. The potential revenue generated by tariffs, even under the most optimistic projections, falls drastically short of the substantial income tax revenue needed to fund government operations. Furthermore, the inherent volatility of tariff revenue, coupled with the significant potential for negative economic consequences like trade wars and reduced consumer purchasing power, renders it an unreliable and risky foundation for government finances. The importance of considering the broad economic consequences of tariff policies cannot be overstated.

We encourage you to further research the topic of tariff revenue and its role in government finance, and to consider the broader implications of trade policy on the US economy and global markets. Further reading on income tax reform and alternative revenue generation methods is highly recommended to gain a more comprehensive understanding of this crucial issue.

Featured Posts

-

Ohio River Flooding Forces Cancellation Of Thunder Over Louisville Fireworks Show

Apr 30, 2025

Ohio River Flooding Forces Cancellation Of Thunder Over Louisville Fireworks Show

Apr 30, 2025 -

Il Caso Becciu Papa Francesco Parla Di Voci Premature Sulle Dimissioni

Apr 30, 2025

Il Caso Becciu Papa Francesco Parla Di Voci Premature Sulle Dimissioni

Apr 30, 2025 -

Eurovision 2023 Manchester Your Complete Guide

Apr 30, 2025

Eurovision 2023 Manchester Your Complete Guide

Apr 30, 2025 -

Garcias Homer Witts Rbi Double Power Royals Past Guardians

Apr 30, 2025

Garcias Homer Witts Rbi Double Power Royals Past Guardians

Apr 30, 2025 -

Inmates Hour Long Plea For Help Ignored Before Death San Diego Jail

Apr 30, 2025

Inmates Hour Long Plea For Help Ignored Before Death San Diego Jail

Apr 30, 2025