Trump's Tariffs Trigger 2% Drop In Amsterdam Stock Exchange

Table of Contents

The Immediate Impact on Key Sectors

The tariff announcement sent shockwaves through several key sectors listed on the Amsterdam Stock Exchange. The immediate impact was felt across various industries, highlighting the vulnerability of a globally integrated economy to protectionist measures.

Technology Sector Fallout

The technology sector, heavily reliant on global supply chains and US markets, suffered considerably.

- Decline in share prices of tech firms listed on AEX: Many technology companies saw their share prices plummet as investors reacted to the uncertainty created by the new tariffs. This uncertainty extended to the future profitability of these firms.

- Reduced investor confidence due to uncertainty surrounding future trade relations: The unpredictability of future trade policies dampened investor enthusiasm, leading to a significant sell-off in tech stocks. This uncertainty made future investments appear riskier.

- Potential for supply chain disruptions affecting Dutch tech companies: Dutch tech firms that depend on US components or export to the US market faced potential disruptions to their supply chains and sales. This created further pressure on share prices.

Agricultural Sector Vulnerability

The Dutch agricultural sector, a significant exporter of dairy products and horticultural goods, also felt the immediate sting of the tariffs.

- Impact on dairy and horticultural exports to the US: Increased tariffs on Dutch agricultural exports to the US immediately reduced their competitiveness in the American market.

- Increased competition from other agricultural exporters: Other countries not affected by the tariffs gained a competitive advantage, putting pressure on Dutch farmers and exporters.

- Potential for government intervention and support measures: The Dutch government may introduce support measures to help the agricultural sector weather the storm, including subsidies or aid packages.

Financial Sector Sensitivity

The financial sector, always sensitive to market volatility, also experienced the impact.

- Increased market volatility and investor risk aversion: The tariff announcement increased market uncertainty, leading to increased volatility and risk aversion among investors.

- Potential for decreased foreign investment in the Netherlands: The uncertainty surrounding trade relations could deter foreign investment in the Netherlands, impacting economic growth.

- Impact on lending and borrowing activities: The increased uncertainty could impact lending and borrowing activities within the financial sector, potentially leading to tighter credit conditions.

Underlying Causes and Contributing Factors

The 2% drop wasn't solely attributable to the tariff announcement; several underlying factors contributed.

Pre-existing Economic Conditions

The Dutch economy was not entirely immune to pre-existing vulnerabilities.

- Analysis of general market sentiment before the tariff announcement: Even before the tariff announcement, market sentiment was somewhat cautious due to other global economic uncertainties.

- Mention any existing economic slowdowns or uncertainties: Existing concerns about global economic growth likely exacerbated the impact of the tariff news.

- Consider the impact of global economic factors beyond US tariffs: The global economic landscape itself was already facing headwinds, making the Dutch market more susceptible to negative news.

Investor Sentiment and Market Reaction

The speed and intensity of the market's response were remarkable.

- Analysis of trading volumes and investor behavior: Trading volumes spiked, indicating a rapid and significant reaction from investors.

- Quotes from financial analysts and experts: Financial analysts highlighted the interconnectedness of global markets and the potential for further negative impacts.

- Comparison to market reactions in other European exchanges: The reaction in Amsterdam was relatively in line with other European exchanges, indicating a broad-based response to the tariff news.

Long-Term Implications and Potential Responses

The long-term consequences of these tariffs remain uncertain, depending on various factors.

Government Policy and Intervention

The Dutch government will play a crucial role in mitigating the long-term impact.

- Potential for economic stimulus packages or support programs: The government may implement economic stimulus measures to boost the economy and support affected sectors.

- Government efforts to diversify trade partnerships: Diversifying trade relationships will lessen dependence on the US market and mitigate future risks.

- Negotiations with the US government to ease trade tensions: The Dutch government may engage in diplomatic efforts to alleviate trade tensions with the US.

Adaptation and Restructuring

Businesses will need to adapt and restructure to navigate the new trade landscape.

- Potential for companies to relocate production or find alternative markets: Companies may explore relocating production facilities or finding new export markets.

- Innovation and development of new products and services: Innovation and diversification are crucial for businesses to remain competitive.

- Focus on strengthening domestic demand: Businesses may focus on bolstering domestic demand to offset the impact of reduced exports.

Conclusion

The 2% drop in the Amsterdam Stock Exchange following Trump's tariffs serves as a stark reminder of the interconnectedness of global financial markets and the significant impact of protectionist trade policies. While the immediate impact has been substantial, particularly on sectors like technology and agriculture, the long-term consequences will depend on several factors, including government responses and the ability of businesses to adapt. Understanding the implications of Trump's tariffs and their effect on the Amsterdam Stock Exchange is crucial for investors and businesses alike. Staying informed about the evolving trade landscape and understanding the ripple effects of these policies is vital for navigating future market fluctuations. Keep abreast of further developments regarding Trump's tariffs and their impact on the Amsterdam Stock Exchange to make informed investment decisions.

Featured Posts

-

Essen Ueberraschender Eis Favorit In Nrw

May 24, 2025

Essen Ueberraschender Eis Favorit In Nrw

May 24, 2025 -

Preserving History The Fight To Save Museum Programs After Trumps Cuts

May 24, 2025

Preserving History The Fight To Save Museum Programs After Trumps Cuts

May 24, 2025 -

New Ferrari Hot Wheels Sets A Mamma Mia Moment For Collectors

May 24, 2025

New Ferrari Hot Wheels Sets A Mamma Mia Moment For Collectors

May 24, 2025 -

11 Drop Amsterdam Stock Exchange Extends Losing Streak To Three Days

May 24, 2025

11 Drop Amsterdam Stock Exchange Extends Losing Streak To Three Days

May 24, 2025 -

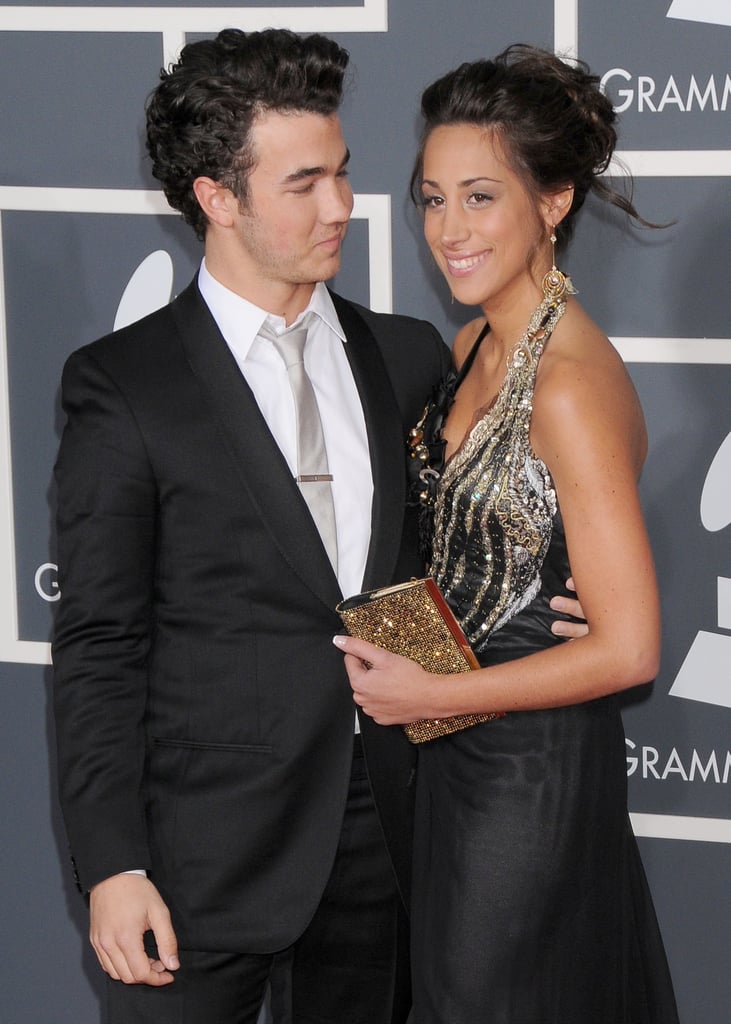

The Jonas Brothers A Married Couples Unexpected Dispute

May 24, 2025

The Jonas Brothers A Married Couples Unexpected Dispute

May 24, 2025