Trump's Trade Policies: A Threat To US Financial Leadership?

Table of Contents

The Impact of Tariffs on US and Global Markets

The core of Trump's trade strategy was the imposition of tariffs – taxes on imported goods. The stated rationale was twofold: protectionism (shielding domestic industries from foreign competition) and national security (reducing reliance on foreign suppliers for critical goods). However, the economic consequences were far-reaching and complex.

- Increased Prices for Consumers: Tariffs directly increased the cost of imported goods, leading to higher prices for consumers and potentially fueling inflation. This burden disproportionately affected low-income households, who spend a larger percentage of their income on essential goods.

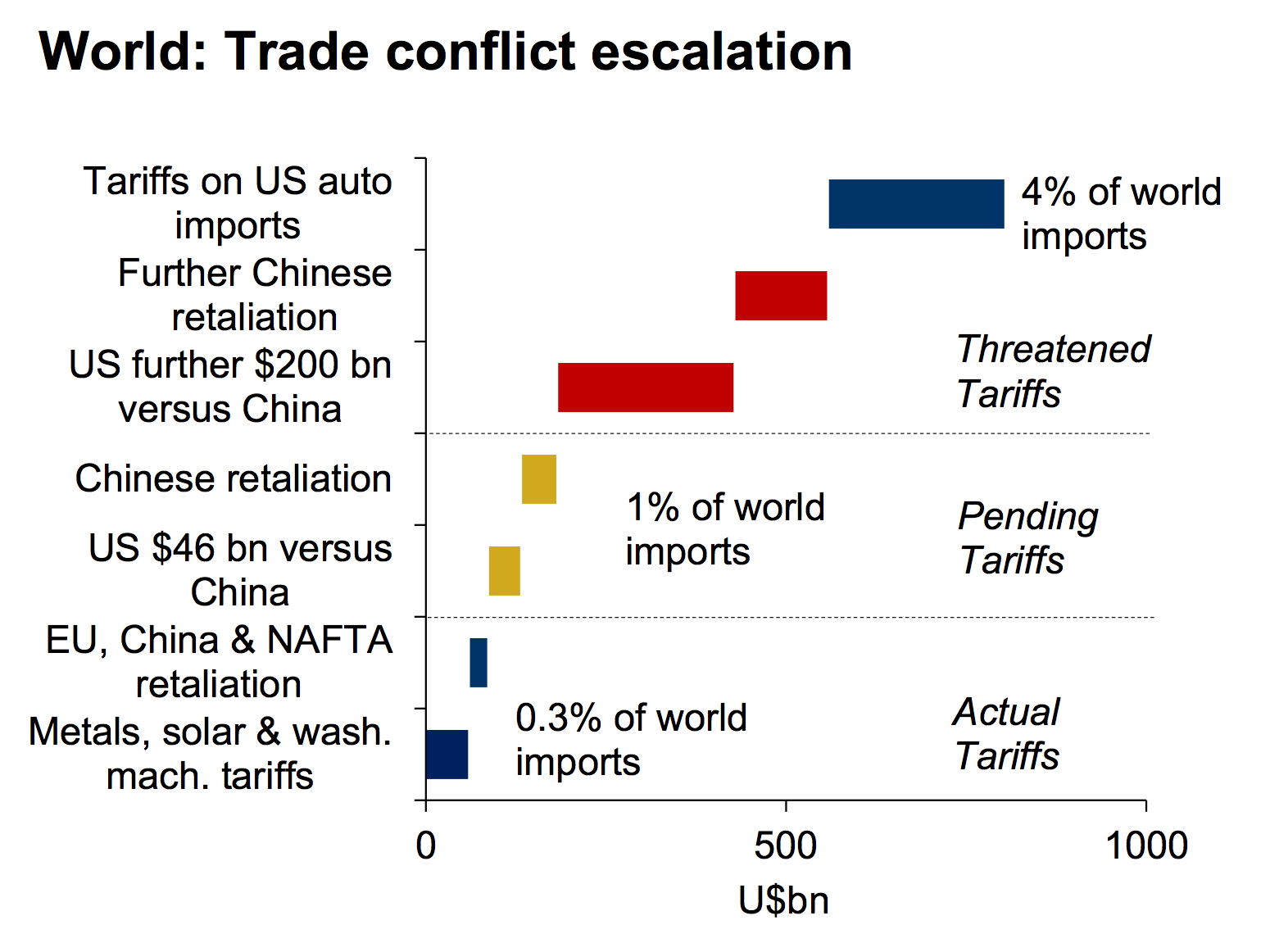

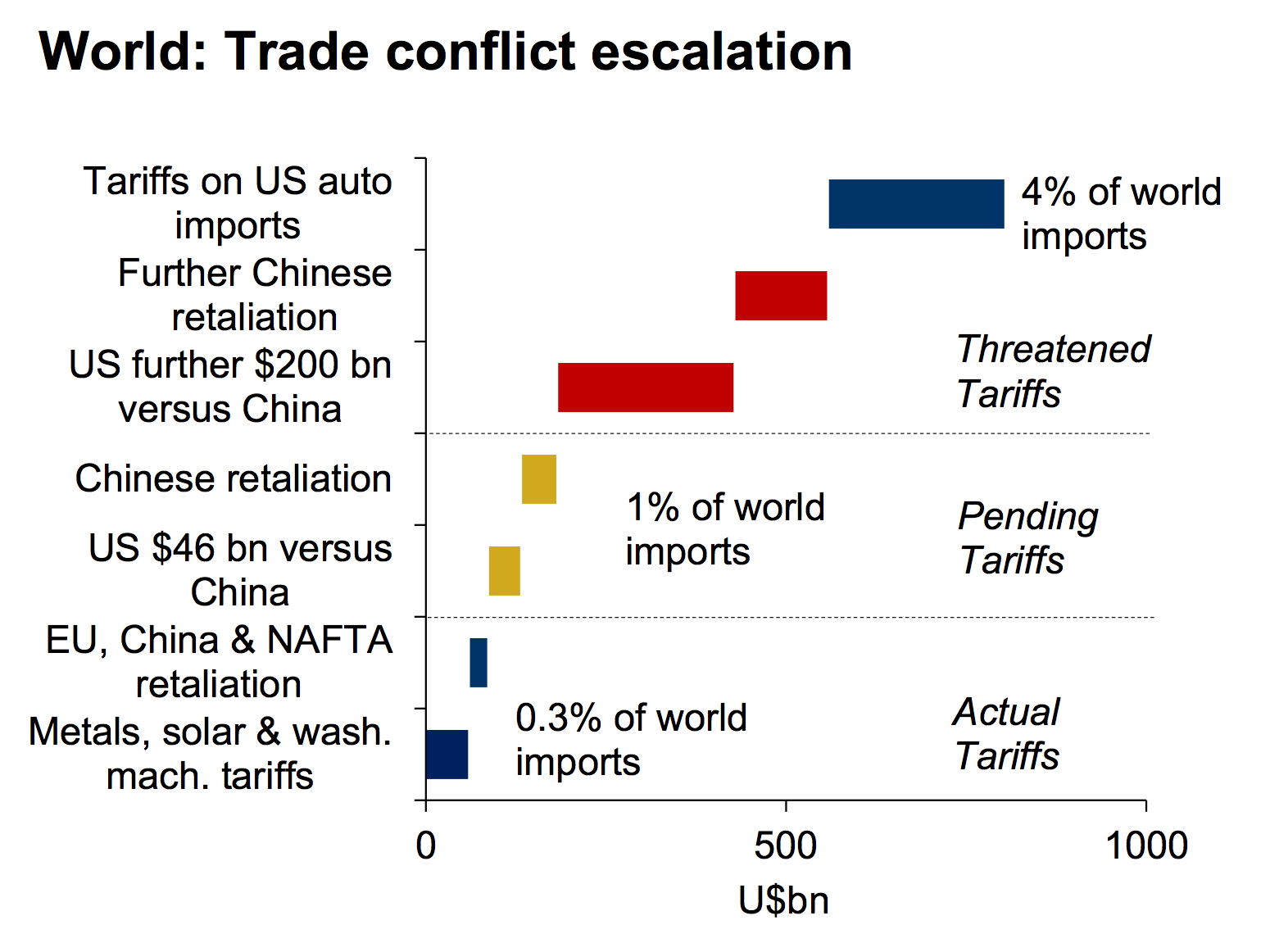

- Retaliatory Tariffs: Other countries responded to US tariffs with their own retaliatory measures, creating a cycle of escalating trade tensions and harming US exporters. This led to reduced sales and job losses in affected industries.

- Disruption of Global Supply Chains: The imposition of tariffs disrupted established global supply chains, forcing companies to re-evaluate sourcing strategies and potentially increasing production costs. This complexity further fueled inflation and uncertainty within markets.

- Impact on Specific Industries: Certain sectors, such as agriculture and manufacturing, were particularly hard hit by trade wars. Farmers faced reduced exports, while manufacturers struggled with increased input costs and reduced competitiveness.

Trade Wars and Their Consequences

The Trump administration initiated several high-profile trade wars, most notably with China. These conflicts involved imposing substantial tariffs on billions of dollars worth of goods, triggering retaliatory measures from the affected countries.

- Winners and Losers: While some domestic industries might have benefited from increased protection, many others suffered from reduced export markets and increased input costs. The overall economic impact was complex and difficult to quantify precisely, with substantial debate amongst economists.

- Long-Term Effects on US-China Relations: The trade war significantly strained US-China relations, exacerbating existing geopolitical tensions and creating uncertainty in global markets. The long-term consequences of this deteriorated relationship continue to be felt.

- Impact on Global Trade Stability: The trade wars undermined the stability of the global trading system, raising concerns about the future of multilateral trade agreements and the role of international organizations in resolving trade disputes.

Damage to International Alliances and Institutions

Trump's "America First" approach to trade significantly damaged relationships with key US allies, impacting both bilateral and multilateral trade relationships.

- Strained Alliances: The imposition of tariffs on goods from Canada, the European Union, and Mexico damaged trust and created friction amongst traditional allies. These trade disputes strained diplomatic relationships and hampered cooperation on other global issues.

- Impact on the WTO: The Trump administration's frequent criticism of the World Trade Organization (WTO) and its reluctance to engage in multilateral dispute resolution weakened the institution's effectiveness and undermined its authority.

- Weakening of Multilateral Trade Agreements: The withdrawal from the Trans-Pacific Partnership (TPP) trade agreement further signaled a retreat from multilateralism and a preference for bilateral deals, potentially harming US influence in shaping global trade rules.

The Long-Term Effects on US Financial Leadership

The consequences of Trump's trade policies on US financial leadership are complex and still unfolding.

- US Dollar's Reserve Currency Status: While the US dollar remains the dominant global reserve currency, the trade wars and associated uncertainty have raised questions about its long-term stability and dominance. The shift towards greater use of alternative currencies could challenge the US's global financial influence.

- Foreign Investment in the US: The increased trade tensions and policy uncertainty might have discouraged foreign investment in the US, potentially slowing economic growth and reducing long-term competitiveness.

- Implications for US Economic Growth and Global Competitiveness: The net effect of Trump's trade policies on US economic growth and global competitiveness remains a subject of ongoing debate among economists. The disruption to global supply chains and increased trade barriers likely created significant headwinds, hindering growth and competitiveness in the longer term.

- Alternative Perspectives: It's important to acknowledge that some argue that Trump's trade policies were necessary to address trade imbalances and protect US industries. However, the overwhelming consensus amongst economists is that the negative consequences outweighed any potential short-term gains.

Conclusion: Trump's Trade Policies: A Lasting Threat to US Financial Leadership?

Trump's trade policies, marked by aggressive tariffs and trade wars, undeniably had a significant and multifaceted impact on the US economy and its global standing. While the immediate effects were complex and varied, the long-term consequences raise serious questions about the sustainability of US financial leadership. The damage to international alliances, the weakening of multilateral institutions, and the increased uncertainty in global markets all pose potential threats to the US dollar's dominance and the nation's overall economic competitiveness.

While some may argue that certain protectionist measures were beneficial to specific sectors, the overall cost – in terms of disrupted supply chains, escalating prices, and strained international relations – appears to have outweighed any perceived gains. It is crucial to continue researching Trump's trade policies and their lingering effects on US financial leadership to better understand the implications for the future of the global economy. Further research into the impact of these policies on specific industries and international relationships is encouraged. For a more in-depth analysis, consider exploring resources from reputable organizations like the Peterson Institute for International Economics.

Featured Posts

-

Tik Toks Influence On Businesses Avoiding Trump Tariffs

Apr 22, 2025

Tik Toks Influence On Businesses Avoiding Trump Tariffs

Apr 22, 2025 -

A Compassionate Shepherd Reflecting On The Life Of Pope Francis

Apr 22, 2025

A Compassionate Shepherd Reflecting On The Life Of Pope Francis

Apr 22, 2025 -

Zuckerberg And The Trump Administration A New Era For Meta

Apr 22, 2025

Zuckerberg And The Trump Administration A New Era For Meta

Apr 22, 2025 -

500 Million Settlement Looms Major Canadian Bread Price Fixing Case Heads To Court

Apr 22, 2025

500 Million Settlement Looms Major Canadian Bread Price Fixing Case Heads To Court

Apr 22, 2025 -

Lab Owners Guilty Plea Faking Covid Test Results During Pandemic

Apr 22, 2025

Lab Owners Guilty Plea Faking Covid Test Results During Pandemic

Apr 22, 2025